Selected stock price target news of the day - November 30th, 2023

By: Matthew Otto

Snowflake Q3 Revenue and 2024 Forecasts Amidst AI Adoption Boom

Snowflake has reported third-quarter results, with revenue soaring by 32% to reach $734.2 million, surpassing analysts’ expectations of $713.1 million. The company’s product revenue, derived from the consumption of compute, storage, and data transfer resources, stood at $698.5 million for the quarter ending October 31.

Snowflake’s financials are underpinned by the expanding influence of artificial intelligence (AI), driving increased demand for its data cloud offerings. Looking ahead, Snowflake forecasts its fourth-quarter product revenue to range between $716 million and $721 million, outshining analysts’ average estimate of $700.3 million. Furthermore, the company has adjusted its 2024 product revenue forecast to $2.65 billion, up from the previous estimate of $2.60 billion.

Analysts Rally Behind as Price Targets Soar, Predicting a Bright Future

- JP Morgan analyst Mark Murphy maintained an Overweight rating and raised the price target from $170 to $200.

- Morgan Stanley analyst Keith Weiss reiterated an Overweight rating and increased the price target from $215 to $230.

- Needham analyst Mike Cikos kept a Buy rating and raised the price target from $216 to $225.

- Piper Sandler analyst Brent Bracelin maintained an Overweight rating and boosted the price target from $195 to $220.

- JMP Securities analyst Joe Goodwin reiterated a Market Outperform rating and a $200 price target.

- Stifel analyst Brad Reback raised the price target to $235.

- Evercore ISI analyst Kirk Materne increased the price target to $235.

- Canaccord Genuity analyst David Hynes upgraded the price target to $215.

- Truist Securities analyst Joel Fishbein raised the price target to $210.

Which Analyst has the best track record to show on SNOW?

Analyst Simon Leopold (RAYMOND JAMES) currently has the highest performing score on SNOW with 6/6 (100%) price target fulfillment ratio. His price targets carry an average of $24.31 (17.39%) potential upside. Snowflake stock price reaches these price targets on average within 57 days.

Salesforce Q3 Report Reveals Revenue Growth and Optimistic Outlook

Salesforce has reported financial results for its fiscal third quarter, ending October 31. The company’s revenue reached $8.72 billion, marking an 11% year-over-year increase and surpassing both management’s forecast and the Wall Street consensus. Adjusted profits stood at $2.11 per share, exceeding the company’s own projection of $2.05 to $2.06 and beating the Street consensus by six cents.

Looking ahead, Salesforce projects an outlook for the January quarter, forecasting revenue between $9.18 billion and $9.23 billion, with non-GAAP profits expected to be between $2.25 and $2.26 per share. For the full fiscal year, the company anticipates revenue ranging from $34.75 billion to $34.8 billion, with adjusted profits between $8.18 and $8.19 per share, reflecting an upward revision from the previous forecast. Additionally, Salesforce foresees operating cash flow growth of 30% to 33% for the full year, surpassing its earlier estimate of 22% to 23%.

Analysts Price Targets Raised Amidst Strong Performance

- BofA Securities analyst Brad Sills maintained a Buy rating and raised the price target from $280 to $300.

- Needham analyst Scott Berg reiterated a Buy rating and increased the price target from $250 to $275.

- Piper Sandler analyst Brent Bracelin maintained a Neutral rating and raised the price target from $232 to $266.

- UBS analyst Karl Keirstead raised the price target to $260.

- Baird analyst Rob Oliver increased the price target to $240.

- Mizuho Securities analyst Gregg Moskowitz raised the price target to $280.

- Loop Capital analyst Yun Kim elevated the price target to $245.

Which Analyst has the best track record to show on CRM?

Analyst Raimo Lenschow (BARCLAYS) currently has the highest performing score on CRM with 18/23 (78.26%) price target fulfillment ratio. His price targets carry an average of $33.42 (18.82%) potential upside. Salesforce stock price reaches these price targets on average within 183 days.

Okta’s Q3 Fiscal Year 2024 and Future Projections

Okta’s Q3 Fiscal Year 2024 saw a 21% total revenue growth, primarily fueled by a 22% surge in subscription revenue. Large customers with $1 million-plus Annual Contract Value experienced over 40% growth. The company achieved non-GAAP operating profit and a free cash flow of $150 million, with a free cash flow margin of 26%. Okta opportunistically repurchased $150 million of its 2026 convertible debt notes, contributing to a total of $900 million in debt repurchases over three quarters.

Despite a security incident, Okta anticipates a 15% total revenue growth in Q4, ranging between $585 million and $587 million. For Fiscal Year 2024, the revenue outlook was raised by $30 million at the high end, now forecasting between $2.243 billion and $2.245 billion, a growth of 21%. Preliminary Fiscal Year 2025 estimates include a total revenue range of $2.460 billion to $2.470 billion, with a targeted non-GAAP operating margin of approximately 17% and a minimum free cash flow margin of 19%. The company’s cash, cash equivalents, and short-term investments stand at $2.13 billion, supporting its strategic initiatives.

Analyst Ratings Reflect Mixed Sentiment

- Scotiabank’s Patrick Colville downgraded from Sector Outperform to Sector Perform.

- TD Cowen’s Shaul Eyal lowered from Outperform to Market Perform and the price target from $100 to $74.

- Wells Fargo’s Andrew Nowinski downgraded from Overweight to Equal-Weight and the price target from $80 to $70.

- Keybanc’s Michael Turits shifted from Overweight to Sector Weight.

- Needham’s Alex Henderson maintained a Buy rating and a $100 price target.

- Stifel’s Adam Borg reiterated a Buy rating and a $100 price target.

Which Analyst has the best track record to show on OKTA?

Analyst Brian Colley (STEPHENS) currently has the highest performing score on OKTA with 6/6 (100%) price target fulfillment ratio. His price targets carry an average of $3.01 (4.92%) potential upside. Okta stock price reaches these price targets on average within 23 days.

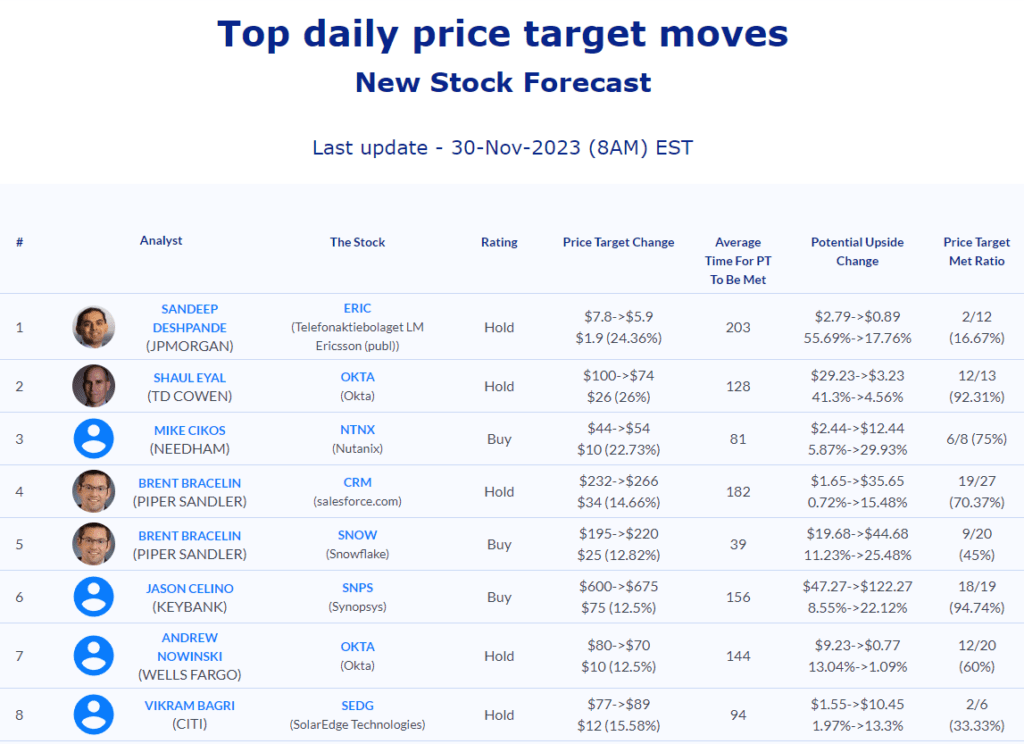

Daily stock Analysts Top Price Moves Snapshot