Selected stock price target news of the day - November 3rd, 2023

By: Matthew Otto

Confluent Reports Increased Q3 Revenue to $200 Million

Confluent reported its financial outcomes for the third quarter of 2023, ending September 30, 2023. The reported third quarter revenue was $200 million, marking a 32% increase compared to the same period the previous year. Revenue from Confluent Cloud was reported at $92 million, which is a 61% rise year over year. The company’s remaining performance obligations are reported to be $824 million, increasing by 24% from the prior year. There are now 1,185 customers with an annual recurring revenue of $100,000 or greater, which is a 25% increase year over year.

Jay Kreps, the CEO, mentioned that the company’s growth was due to the critical role of data streaming and customer demand for their platform. The company also reported an improvement in GAAP EPS (Earnings Per Share) and a non-GAAP EPS, with the subscription revenue growing by 36% year over year.

The financial details show a year-over-year decrease in GAAP Operating Loss from $(118.9) million to $(108.6) million and a non-GAAP Operating Loss reduction from $(42.1) million to $(10.9) million. This translates to operating margins improving by 24.1 percentage points on a GAAP basis and 22.3 percentage points on a non-GAAP basis. Net cash used in operating activities decreased significantly, as did the free cash flow deficit.

For the upcoming quarter and the full fiscal year 2023, Confluent projects total revenue to be in the range of $204-$205 million for the fourth quarter and $768-$769 million for the fiscal year. The non-GAAP operating margin is expected to be between 0% and 1%, and the non-GAAP net income (loss) per share is forecasted to be $0.05 for the fourth quarter and between $(0.01) and $0.00 for the fiscal year.

Analysts carry mostly a positive note

- Wolfe Research analyst Verkhovski upgrades to Outperform with a new price target of $21.

- Guggenheim analyst Ma upgrades to Buy with a new price target of $23.

- Piper Sandler analyst Owens maintains Overweight on, reduces price target from $40 to $30.

- Truist Securities analyst Fishbein maintains Buy on, cuts price target from $42 to $27.

- Goldman Sachs analyst Kash Rangan lowers Confluent’s price target to $24.

- Wolfe Research analyst Allan Verkhovski upgrades Confluent from Peerperform to Outperform, sets $21 target.

- Guggenheim analyst Howard Ma upgrades Confluent from Neutral to Buy, sets $23 target.

Which Analyst has the best track record to show on CFLT?

Analyst Raimo Lenschow (BARCLAYS) has currently the highest performing score on CFLT with 7/11 (63.64%) price target fulfillment ratio. His price targets carry on average an $5.17 (21.60%) potential upside. Confluent stock price reaches these price targets on average within 58 days.

Fortinet Announces Revenue Increase and Earnings Beat

Fortinet reported a third-quarter earnings per share (EPS) of $0.41, which was $0.05 higher than the expected $0.36. However, the company’s revenue of $1.33 billion was slightly below the projected $1.35 billion. Looking ahead to the fourth quarter of 2023, Fortinet has provided an EPS guidance of $0.42 to $0.44, aligning with the lower end of market expectations. Revenue is anticipated to be between $1.38 and $1.44 billion, which falls short of the predicted $1.5 billion. For the entire fiscal year 2023, Fortinet’s EPS forecast ranges from $1.54 to $1.56, compared to the consensus estimate of $1.51, and it expects revenue to reach between $5.27 billion and $5.33 billion, which is slightly below the consensus forecast of $5.4 billion.

The company provided guidance for Q4 2023, expecting revenue between $1.380 billion and $1.440 billion, and billings ranging from $1.560 billion to $1.700 billion. Quoted on Barron’s, Analysts from Wedbush and RBC Capital Markets maintained favorable ratings, highlighting a positive long-term outlook despite a short-term billings trajectory concern. Guggenheim analysts maintained a neutral position, citing questions about near to medium-term demand. Adjusted earnings surpassed expectations, while revenue was slightly below estimates.

Wall Street Loses faith of Future Growth

- Ittai Kidron of Oppenheimer adjusts Fortinet’s rating to Perform.

- Amit Daryanani of Evercore ISI revises Fortinet’s status from Outperform to In-Line, decreasing the price target to $51 from $78.

- Jonathan Ruykhaver of Cantor Fitzgerald shifts Fortinet’s classification from Overweight to Neutral and trims the price target to $50 from $75.

- Brian Essex of JP Morgan reclassifies Fortinet from Overweight to Neutral, with a revised price target of $52, down from $67.

- BMO Capital analyst Keith Bachman has revised the price target for Fortinet (FTNT) to $56. In a separate assessment.

- Cantor Fitzgerald analyst Jonathan Ruykhaver downgraded Fortinet to Neutral.

Which Analyst has the best track record to show on FTNT?

Analyst Daniel Ives (WEDBUSH) has currently the highest performing score on FTNT with 10/11 (90.91%) price target fulfillment ratio. His price targets carry on average an $8.22 (20.96%) potential upside. Fortinet stock price reaches these price targets on average within XXX days.

DTE Energy Q3 EPS Falls Short of Estimates, Lowers Guidance

DTE Energy has disclosed its financial outcomes for the third quarter, revealing an EPS of $1.44, which falls short of the analyst estimate by $0.24, as the estimate was $1.68. The company’s reported earnings have decreased when compared to the same quarter in the previous year, where the EPS stood at $1.99.

The corporation has revised its full-year 2023 EPS guidance, lowering the forecast to a range between $5.65 and $5.85. This revised projection is a decrease from the previous guidance midpoint of $6.25 and is also lower than the market consensus of $6.18. The reduction in the EPS outlook is primarily due to the operational challenges posed by considerable storm activity and cooler than expected summer temperatures, which have affected the company’s financial performance.

Despite these setbacks, DTE Energy has outlined a series of measures and initiatives aimed at bolstering its infrastructure and service delivery. The company has embarked on a Distribution Grid Plan for DTE Electric, a strategic five-year, $9 billion investment aimed at enhancing grid reliability by 60% over the next five years. This plan includes upgrading infrastructure and transitioning to a fully automated smart grid. Moreover, DTE has initiated an undergrounding pilot project in Detroit, which is expected to demonstrate significant reliability improvements for customers.

Wall Street Keeps positive Ratings but Adjusts Price Targets Lower

- Guggenheim’s Shahriar Pourreza maintains a Buy rating but reduces the price target from $110 to $103.

- Anthony Crowdell from Mizuho also maintains a Buy rating but decreases the price target from $121 to $106.

- BMO Capital’s James Thalacker maintains a Market Perform rating, with the price target lowered from $109 to $107.

- Barclays’ Nicholas Campanella sets the price target to $106, reduced from $109.

- Neil Kalton from Wells Fargo maintains an Overweight rating but cuts the price target from $133 to $110.

Which Analyst has the best track record to show on DTE?

Analyst Christopher Turnure (JPMORGAN) has currently the highest performing score on DTE with 3/4 (75%) price target fulfillment ratio. His price targets carry on average an $19.82 (19.80%) potential upside. DTE Energy stock price reaches these price targets on average within 566 days.

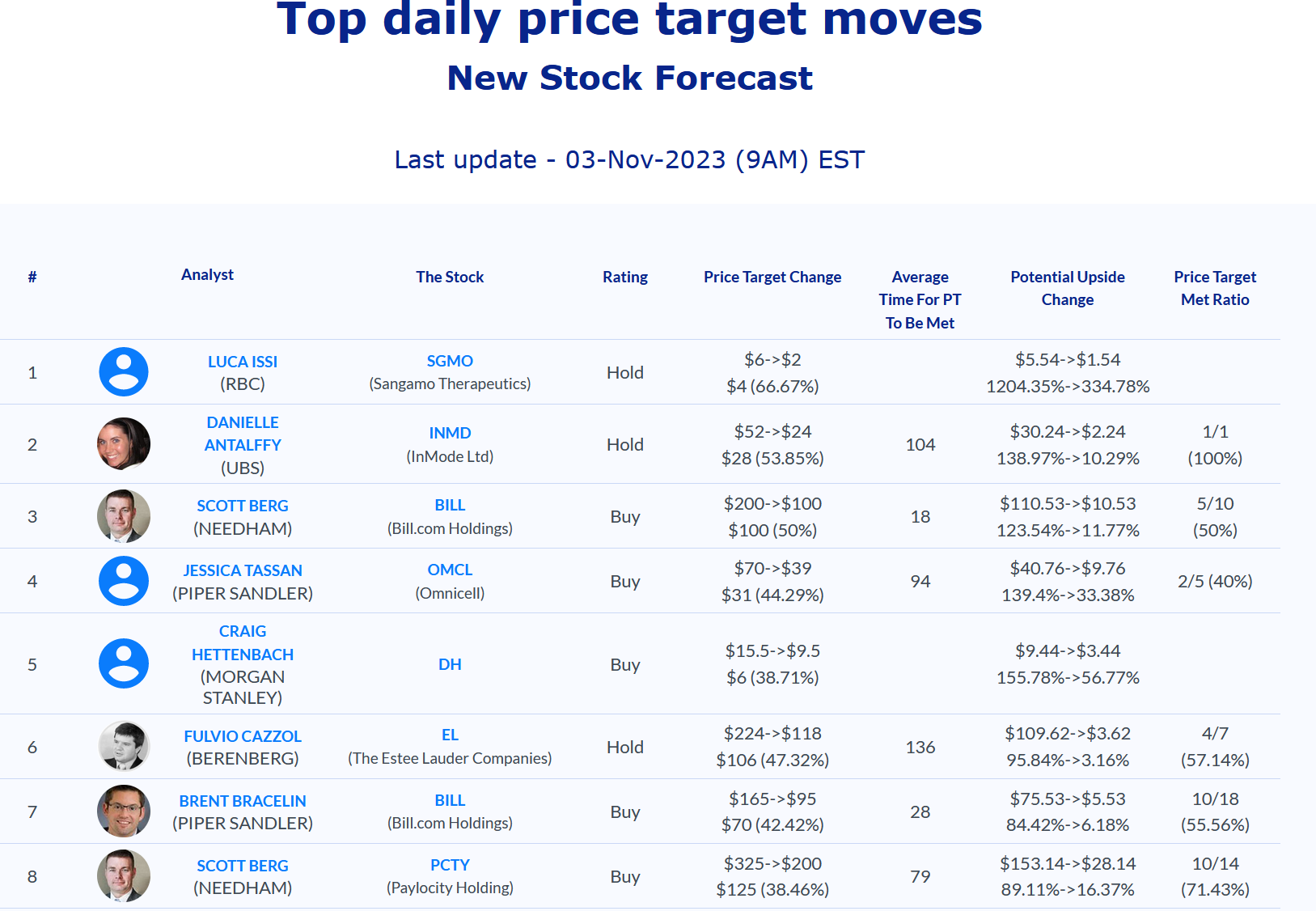

Daily stock Analysts Top Price Moves Snapshot