Selected stock price target news of the day - November 7th, 2024

By: Matthew Otto

Exact Sciences Misses Q3 Revenue and EPS Estimates, Lowers Full-Year Guidance Despite Product Advances

Exact Sciences posted third-quarter revenue of $709 million, a 13% year-over-year increase, though below the analyst consensus of $716.8 million. Earnings per share (EPS) for Q3 came in at ($0.21), missing the analyst estimate by $0.01.

Screening revenue reached $545 million, up 15%, and Precision Oncology revenue totaled $164 million, marking a 5% increase. Adjusted EBITDA rose by $42 million to $99 million, with a 500 basis point increase in adjusted EBITDA margin to 14%. Additionally, Exact Sciences generated $139 million in operating cash flow and $113 million in free cash flow. Gross margin, inclusive of amortization, was 69%, while non-GAAP gross margin reached 72%.

Exact Sciences adjusted its full-year guidance, now expecting FY 2024 revenue between $2.73 billion and $2.75 billion, below the previous range of $2.81 billion to $2.85 billion and the consensus estimate of $2.83 billion.

This revision includes updated expectations for Screening revenue, now projected at $2.08 billion to $2.095 billion, and Precision Oncology revenue, now anticipated at $650 million to $655 million. Adjusted EBITDA guidance has also been revised, with the company now targeting $310 million to $320 million, down from the prior range of $335 million to $355 million.

Analysts Maintain Ratings but Cut Price Targets Following Q3 Revenue Miss

- Citigroup analyst Patrick Donnelly maintained a Buy rating but lowered the price target from $80 to $75.

- Jefferies analyst Brandon Couillard maintained a Buy rating while raising the price target from $84 to $85.

- BTIG analyst Mark Massaro kept a Buy rating yet adjusted the target from $82 to $65.

- Stifel analyst Daniel Arias held a Buy rating and lowered the target price from $82 to $67.

- Canaccord Genuity analyst Kyle Mikson retained a Buy rating and reduced the price target from $95 to $75.

- TD Cowen analyst Dan Brennan reaffirmed a Buy rating and adjusted the target down from $90 to $82.

- Goldman Sachs analyst Matthew Sykes kept a Buy rating but revised the price target from $75 to $65.

- Evercore ISI analyst Vijay Kumar maintained an Outperform rating and lowered the target from $80 to $60.

- Craig-Hallum analyst Alex Nowark upheld a Buy rating and decreased the target from $82 to $65.

- Benchmark analyst Bruce Jackson maintained a Buy rating and lowered the price target from $67 to $65.

- Baird analyst Catherine Schulte kept an Outperform rating and adjusted the price target from $70 down to $67.

Which Analyst has the best track record to show on EXAS?

Analyst Mark Massaro (BTIG) currently has the highest performing score on EXAS with 37/43 (86.05%) price target fulfillment ratio. His price targets carry an average of $25.84 (58.51%) potential upside. Exact Sciences stock price reaches these price targets on average within 163 days.

NXP Reports 5% Revenue Decline Amid Weak Industrial and IoT Demand; Issues Cautious Q4 Outlook

NXP Semiconductors posted third-quarter revenue of $3.25 billion, which met guidance but reflected a 5% year-over-year decrease. Industrial and IoT revenue fell 7% year-over-year, underscoring weak demand in this market. Automotive revenue also declined 3% to $1.83 billion, while mobile saw an 8% increase.

NXP reported a GAAP gross margin of 57.4% and a GAAP operating margin of 30.5%, while non-GAAP metrics showed a slightly improved gross margin of 58.2% and operating margin of 35.5%.

In light of this difficult environment, NXP also issued a cautious fourth-quarter forecast, with projected revenue between $3.05 billion and $3.15 billion, missing analysts’ average expectation of $3.36 billion, according to LSEG data.

NXP returned $259 million in dividends and repurchased $305 million in shares, totaling 95% of its non-GAAP free cash flow of $593 million for the quarter. In addition to these returns, the board authorized an additional $2 billion in repurchase capital, resulting in a balance of $2.64 billion at quarter-end.

Analysts Adjust Price Targets Following Q3 Results and Cautious Q4 Outlook

- UBS analyst Francois-Xavier Bouvignies maintained a Buy rating but lowered the price target from $285 to $275.

- Evercore ISI Group analyst Mark Lipacis reiterated an Outperform rating and reduced the price target from $370 to $315.

- Truist Securities analyst William Stein kept a Buy rating, while lowering the price target from $287 to $252.

- Susquehanna analyst Christopher Rolland maintained a Neutral rating and trimmed the price target from $260 to $250.

- Oppenheimer analyst Rick Schafer held an Outperform rating, yet cut the price target from $330 to $300.

- Needham analyst Quinn Bolton upheld a Buy rating, though decreased the price target from $300 to $250.

- Morgan Stanley analyst Joseph Moore kept an Equal-Weight rating but reduced the price target from $250 to $235.

- Barclays analyst Blayne Curtis maintained an Overweight rating, though lowered the price target from $330 to $280.

- Cantor Fitzgerald analyst C.J. Muse reiterated an Overweight rating and the price target steady at $270.

Which Analyst has the best track record to show on NXPI?

Analyst Tore Svanberg (STIFEL) currently has the highest performing score on NXPI with 19/20 (95%) price target fulfillment ratio. His price targets carry an average of $27.72 (11.93%) potential upside. NXP Semiconductors stock price reaches these price targets on average within 43 days.

Qualys Reports Q3 2024 Results, Beats Earnings and Revenue Estimates; Raises Full-Year Guidance

Qualys reported financial results for Q3 2024, with revenues rising 8% year-over-year to $153.9 million, exceeding the consensus estimate of $150.73 million. Net income was $58.0 million, or $1.56 per diluted share, beating the analyst estimate of $1.34 by $0.22, up from $56.7 million, or $1.51 per diluted share in Q3 2023.

Adjusted EBITDA for the quarter rose 1% to $69.7 million, with an Adjusted EBITDA margin of 45%, compared to 48% in the same period last year. Operating cash flow decreased by 34%, totaling $61.0 million, down from $92.4 million in Q3 2023.

Qualys delivered guidance for the full year, expecting 2024 EPS to range from $5.81 to $5.91, surpassing the consensus estimate of $5.57. Full-year revenue guidance was raised to between $602.9 million and $605.9 million, compared to the consensus estimate of $559.4 million. For Q4 2024, Qualys expects revenues to range between $154.5 million and $157.5 million, reflecting a 7% to 9% year-over-year growth.

Analysts Mixed Sentiment with Price Increases Across the Board

- UBS analyst Roger Boyd maintained a Neutral rating and raised the price target from $140 to $160.

- WestPark Capital analyst Casey Ryan reiterated a Hold rating.

- Jefferies analyst Joseph Gallo kept a Hold rating and increased the price target from $135 to $155.

- DA Davidson analyst Rudy Kessinger maintained a Neutral rating, while raising the price target from $120 to $147.

- Canaccord Genuity analyst Michael Walkley maintained a Buy rating and raised the price target from $160 to $170.

- RBC Capital analyst Matthew Hedberg kept a Sector Perform rating and lifted the price target from $150 to $162.

- Truist Securities analyst Joel Fishbein maintained a Hold rating and increased the price target from $120 to $145.

- TD Cowen analyst Nick Yako reiterated a Hold rating and raised the price target from $130 to $150.

- Morgan Stanley analyst Hamza Fodderwala maintained an Underweight rating, with a price target increase from $123 to $126.

Which Analyst has the best track record to show on QLYS?

Analyst Hamza Fodderwala (MORGAN STANLEY) currently has the highest performing score on QLYS with 7/11 (63.64%) price target fulfillment ratio. His price targets carry an average of $1.5 (1.23%) potential upside. Qualys stock price reaches these price targets on average within 62 days.

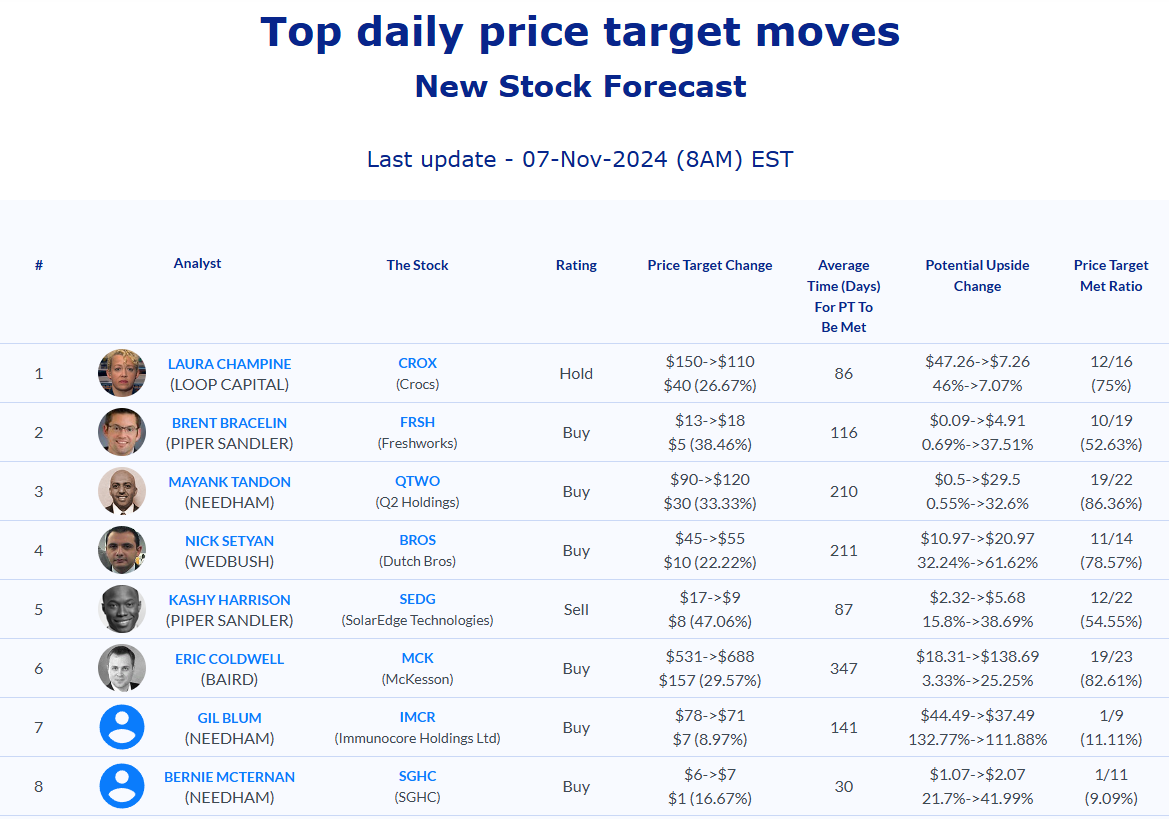

Daily stock Analysts Top Price Moves Snapshot