Selected stock price target news of the day - November 9th, 2023

By: Matthew Otto

Toast Revenue Guidance Narrowing

Toast adjusted its full-year 2023 revenue projection to $3.83 billion to $3.86 billion, compared to the previous range of $3.81 billion to $3.87 billion. Despite the revision, Toast reported annualized recurring revenue run rate of $1.22 billion for the third quarter, marking a 40% year-over-year increase, while its loss per share narrowed to 9 cents from the 19 cents reported in the same quarter the previous year.

BTIG analysts Andrew Harte and Thomas Smith highlighted a same-store sales headwind affecting revenue, attributing it to a macro factor beyond management’s control. They noted the company’s pullback in the forecast for fourth-quarter software-as-a-service average revenue per user growth from 10% to mid-to-high single digits. Conversely, William Blair analysts led by Stephen Sheldon expressed optimism, emphasizing Toast’s strong growth despite softening top-line trends.

Analyst Adjusted Price Targets Reflect Varied Perspectives

- Piper Sandler’s Brent Bracelin downgraded from Overweight to Neutral and the price target from $27 to $17.

- Needham’s Mayank Tandon maintained a Buy rating and adjusted the price target downward from $31 to $20.

- Morgan Stanley’s Josh Baer reiterated an Overweight rating and revised the price target down from $28 to $22.

- JP Morgan’s Tien-Tsin Huang kept a Neutral stance and reduced the price target from $26 to $19.

- Wells Fargo’s Jeff Cantwell maintained an Underweight rating and lowered the price target from $16 to $15.

Which Analyst has the best track record to show on TOST?

Analyst Timothy Chiodo (CREDIT SUISSE) currently has the highest performing score on TOST with 4/6 (66.67%) price target fulfillment ratio. His price targets carry an average of $2.88 (15.02%) potential upside. Toast stock price reaches these price targets on average within 39 days.

Uber’s Q3 Profit and Share Buyback Buzz

Uber reported a free cash flow of $905 million for Q3, with unrestricted cash, cash equivalents, and short-term investments totaling $5.2 billion at the quarter’s end. Analysts, such as Wedbush’s Scott Devitt, are pointing to the improving free cash flow profile as a driver for Uber to consider instituting a share repurchase program to address dilution caused by stock-based compensation.

Devitt emphasizes the potential for capital returns, suggesting that a share repurchase program could be on the horizon for Uber. Meanwhile, CFRA analyst Angelo Zino highlights growth opportunities in underpenetrated markets, such as Spain and Germany, projecting further expansion for the ride-hailing giant. Additionally, D.A. Davidson analyst Tom Forte underscores the significance of the Uber One membership plan, pointing out that members spend four times as much with the company, representing a lucrative avenue for sustained revenue.

Analysts Bullish on Uber as Price Targets Surge

- Morgan Stanley’s Brian Nowak maintained an Overweight rating and raised the price target from $60 to $62.

- Roth MKM’s Rohit Kulkarni reiterated a Buy rating and increased the price target from $61 to $62.

- Truist Securities analyst Youssef Squali kept a Buy rating and lowered the price target.

- JP Morgan’s Doug Anmuth maintained an Overweight rating and raised the price target from $56 to $62.

- Wedbush analyst Scott Devitt reiterated an Outperform rating and increased the price target from $55 to $57.

- D.A. Davidson’s Tom Forte maintained a Buy rating with a target price of $64.

Which Analyst has the best track record to show on UBER?

Analyst Rohit Kulkarni (MKM) currently has the highest performing score on UBER with 5/11 (45.45%) price target fulfillment ratio. His price targets carry an average of $14.29 (37.41%) potential upside. Uber Technologies stock price reaches these price targets on average within 154 days.

Array Technologies Revenue Outlook Revision Amidst Challenges

Array Technologies revised its full-year revenue outlook, anticipating figures between $1.525 billion and $1.575 billion, down from the initial forecast of $1.650 billion to $1.725 billion. This adjustment fell short of Wall Street’s estimate of $1.622 billion, according to FactSet. Despite Array’s third-quarter adjusted earnings of 21 cents per share exceeding analysts’ expectations of 14 cents, the revenue of $350.4 million fell short of estimates, which stood at $375.1 million.

Guggenheim analysts Joseph Osha and Hilary Cauley, while maintaining a Buy rating on Array stock, lowered their earnings and revenue estimates for this year and the next. Their Wednesday report included a reduced price target, emphasizing the challenges facing Array Technologies in the current market landscape.

Analysts Adjust Ratings and Price Targets Amid Industry Headwinds

- Guggenheim analyst Joseph Osha maintained a Buy rating and lowered the price target from $36 to $30.

- JP Morgan analyst Mark Strouse reiterated an Overweight rating and adjusted the price target downward from $32 to $30.

- Goldman Sachs analyst Brian Lee kept a Buy rating and reduced the price target from $36 to $31.

Which Analyst has the best track record to show on ARRY?

Analyst Christine Cho (BARCLAYS) currently has the highest performing score on ARRY with 2/5 (40%) price target fulfillment ratio. Her price targets carry an average of $5.2 (26.25%) potential upside. Array Technologies stock price reaches these price targets on average within 4 days.

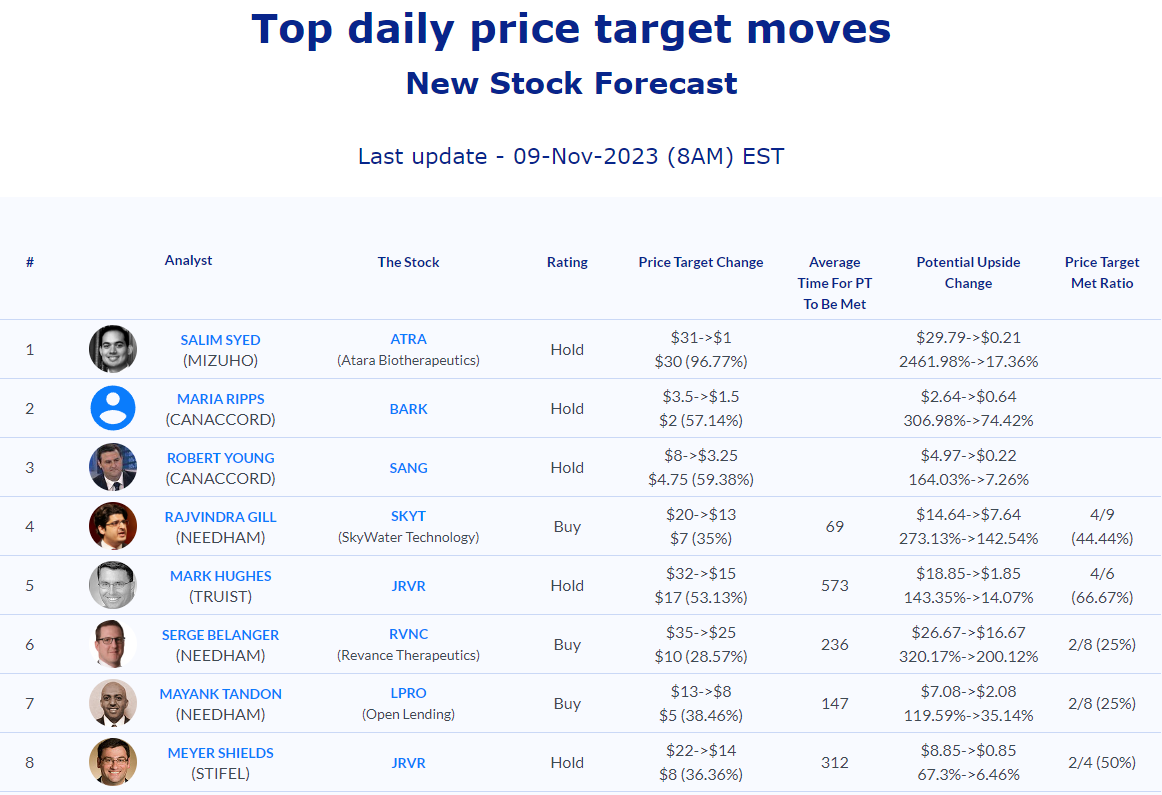

Daily stock Analysts Top Price Moves Snapshot