Selected stock price target news of the day - October 03, 2023

By: Matthew Otto

Nvidia’s Resilience: Growth Potential in the AI Market

Analyst Pierre Ferragu from New Street Research reiterated a Buy rating on Nvidia and maintained a price target of $635. Ferragu pointed out that Nvidia’s revenue is up about seven times, and the shares have a valuation of 27 times forward earnings and 14 times sales. In contrast to historical cases like Cisco during the dot-com boom, Ferragu argued that Nvidia does not face a similar “bubble valuation” risk, with its more advanced multilayered infrastructure in AI.

Ferragu estimated that Nvidia’s stock could experience a potential 20% decline if its revenue in 2025 disappoints Wall Street. This assumption is based on expectations for profits being cut by 33%, resulting in a valuation decline to 30 times forward earnings. Currently, investors appear to be factoring in a significant risk of pullback, mixed with a likely deceleration beyond 2024. Despite this, Ferragu highlighted that if concerns about 2025 recede, Nvidia’s stock has significant appreciation potential.

Analyst Optimism Soars for Nvidia as Price Targets Get a Boost

- KeyBanc Analyst John Vinh Maintained an Overweight rating and raised the price target from $670 to $750.

- New Street Research Analyst Pierre Ferragu Reiterated a Buy rating and a price target of $635.

Which Analyst has the best track record to show on NVDA?

Analyst Richard Shannon (CRAIG HALLUM) currently has the highest performing score on NVDA with 11/15 (73.33%) price target fulfillment ratio. His price targets carry an average of $205.98 (235.08%) potential upside. NVIDIA stock price reaches these price targets on average within 561 days.

Eli Lilly’s Acquisition of Point Biopharma: A Strategic Leap in Cancer Therapies

Eli Lilly has committed to an acquisition, agreeing to purchase Point Biopharma Global for $1.4 billion. This transaction is part of Lilly’s broader strategy to strengthen its pharmaceutical pipeline, particularly in the face of increased competition for its cancer therapy Alimta. The acquisition comes on the heels of other notable deals this year, including the $2.4 billion buyout of Dice Therapeutics and the $1.93 billion acquisition of privately held Versanis.

Point Biopharma is currently conducting late-stage studies on two radioligand therapy candidates, PNT2002 and PNT2003. PNT2002, in collaboration with Lantheus Holdings, is being tested in patients with advanced prostate cancer, with late-stage data expected this quarter. The acquisition will also include Point Biopharma’s experimental candidate, PNT2003, targeted at an ultra-rare type of digestive tract cancer.

The deal also includes access to Point Biopharma’s Indianapolis manufacturing plant for radiopharmaceuticals, a crucial element in the production of these cutting-edge therapies. Additionally, Lilly will acquire a research and development center in Toronto, enhancing its global capabilities in cancer research.

Analyst Maintains Bullish Stance on Eli Lilly

- Cantor Fitzgerald Analyst Louise Chen Reiterated an Overweight rating and a $630 price target.

Which Analyst has the best track record to show on LLY?

Analyst Mohit Bansal (WELLS FARGO) currently has the highest performing score on LLY with 7/7 (100%) price target fulfillment ratio. His price targets carry an average of $34.57 (10.04%) potential upside. Eli Lilly stock price reaches these price targets on average within 47 days.

Florence Italy Bans Airbnb in Historic Center

Florence, one of Italy’s renowned tourist destinations, has implemented a ban on new short-term residential rentals through platforms like Airbnb within its historic center. Tuscan city approves the decision to address the escalating housing crisis that has seen a significant surge in Airbnb listings. In addition to the ban, the city has introduced a three-year tax break incentive for landlords who switch from short-term to long-term leases, a move designed to alleviate the strain on local housing and prioritize the needs of its residents over the influx of tourists.

Florence’s mayor, Dario Nardella, expressed dissatisfaction with national government plans to regulate the short-term rental sector, prompting the city to take autonomous action. Nardella highlighted the substantial increase in Airbnb listings from approximately 6,000 in 2016 to almost 14,378, contributing to a 42% rise in ordinary monthly residential rents. The move is not without controversy, as opposition figures, such as Marco Stella of the Forza Italia party, have announced plans to appeal to the administrative court against Florence’s decision, emphasizing concerns about market liberalism.

The central government in Italy is concurrently working on legislation that may impose a minimum stay requirement for properties in historic city centers and tourist-dense municipalities. The proposed bill also suggests the need for a national identification code for each residential property rented to tourists to regulate and track such lettings, with potential penalties for non-compliance reaching up to $5,500.

Analyst Downgrades Airbnb Rating

- KeyBanc analyst Justin Patterson downgraded from Overweight to Sector Weight.

Which Analyst has the best track record to show on ABNB?

Analyst Lloyd Walmsley (UBS) currently has the highest performing score on ABNB with 5/6 (83.33%) price target fulfillment ratio. His price targets carry an average of $3.96 (2.57%) potential upside. Airbnb stock price reaches these price targets on average within 101 days.

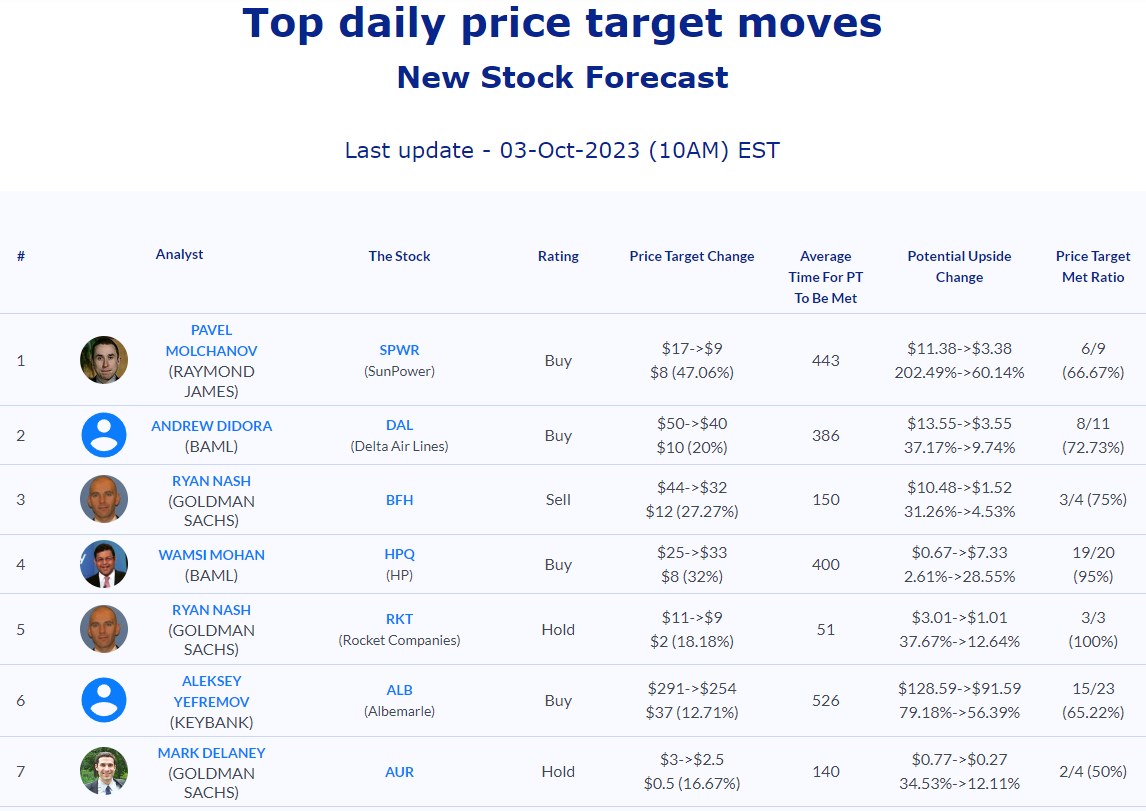

Daily stock Analysts Top Price Moves Snapshot