Selected stock price target news of the day - October 22nd, 2024

By: Matthew Otto

Crown Holdings Reports Q3 EPS Beat and Provides Upward Revised FY2024 Guidance

Crown Holdings reported its financial results for the third quarter with net sales of $3.07 billion, in line with the consensus estimate of $3.07 billion. Reported earnings per share (EPS) of $1.99 for the quarter, exceeding the analyst estimate of $1.81 by $0.18.

This performance was supported by higher shipments of global beverage and food cans in North America, despite lower volumes in other businesses and a $9 million unfavorable impact from foreign currency translation. Income from operations rose to $444 million, up from $374 million in the third quarter of 2023, while segment income increased 10% year-over-year to $472 million.

Looking ahead, Crown Holdings provided updated guidance for fiscal year 2024, projecting adjusted diluted EPS in the range of $6.25 to $6.35, above the consensus estimate of $6.15. For the fourth quarter of 2024, Crown Holdings expects EPS between $1.45 and $1.55, compared to the consensus of $1.51. Also reported a net loss of $175 million for the third quarter, largely due to pension settlement charges of $517 million, compared to net income of $159 million in Q3 2023. Adjusted diluted EPS for Q3 was $1.99, an improvement from $1.73 in the prior year.

Crown Holdings generated $897 million in cash from operating activities during the first nine months of 2024, with adjusted free cash flow of $668 million, and ended the quarter with a net leverage ratio of 3.0 times adjusted EBITDA.

Analysts Raise Price Targets Following Strong Q3 Results

- Loop Capital analyst Alton Stump maintained a Buy rating and raised the price target from $120 to $129.

- Wells Fargo analyst Gabe Hajde kept an Equal-Weight rating and increased the price target from $97 to $105.

- Barclays analyst Michael Leithead continued with an Overweight rating and lifted the price target from $100 to $112.

- Morgan Stanley analyst Pamela Kaufman maintained an Equal-Weight rating while raising the price target from $105 to $109.

- Baird analyst Ghansham Panjabi upheld an Outperform rating and adjusted the price target from $100 to $110.

Which Analyst has the best track record to show on CCK?

Analyst Jeffrey Zekauskas (JPMORGAN) currently has the highest performing score on CCK with 6/6 (100%) price target fulfillment ratio. His price targets carry an average of $6.94 (8.36%) potential upside. Crown Holdings stock price reaches these price targets on average within 97 days.

Procter & Gamble Beats Q1 EPS Estimates, Misses on Revenue; Reaffirms 2025 Outlook

Procter & Gamble reported first-quarter fiscal year 2025 net sales of $21.7 billion, a 1% decline compared to the prior year, falling slightly short of the consensus estimate of $22.02 billion. Organic sales, which exclude foreign exchange, acquisitions, and divestitures, increased by 2%.

Procter & Gamble reported diluted net earnings per share (EPS) of $1.61, down 12% from the previous year, mainly due to restructuring charges. However, core EPS, excluding certain items, rose 5% to $1.93, surpassing analyst expectations of $1.90 by $0.03. Operating cash flow for the quarter was $4.3 billion, and net earnings totaled $4.0 billion. P&G maintained adjusted free cash flow productivity at 82%, in line with expectations.

Segment performance was mixed, with organic sales increasing in Grooming (+3%), Health Care (+4%), and Fabric & Home Care (+3%), while Beauty saw a 2% decline, driven by a 20% drop in SK-II sales in Greater China. P&G’s organic sales in Greater China, its second-largest market, fell 15% as demand weakened, a trend expected to continue for several quarters.

Procter & Gamble reiterated its fiscal 2025 guidance, projecting all-in sales growth of 2% to 4%, with headwinds from foreign exchange and divestitures potentially reducing growth by one percentage point. P&G also maintained its core EPS growth outlook of 5% to 7%, targeting $6.91 to $7.05 per share for the full year, with a midpoint estimate of $6.98.

Analyst Positive Outlook with Price Target Increases

- Morgan Stanley analyst Dara Mohsenian maintained an Overweight rating while raising the price target from $174 to $191.

- Evercore ISI Group analyst Robert Ottenstein kept an Outperform rating and raised the price target from $180 to $183.

- RBC Capital analyst Nik Modi reiterated a Sector Perform rating and the price target at $164.

- DA Davidson analyst Linda Bolton Weiser maintains a Neutral rating yet increases the price target from $159 to $160.

Which Analyst has the best track record to show on PG?

Analyst Nik Modi (RBC) currently has the highest performing score on PG with 10/10 (100%) price target fulfillment ratio. His price targets carry an average of $3.24 (2.02%) potential upside. Procter & Gamble stock price reaches these price targets on average within 211 days.

Regions Financial Q3 2024 Earnings Per Share Decline and Revenue Miss, Yet Strong Performance in Key Areas

Regions Financial reported a net income of $446 million for the third quarter results. This translates to earnings per diluted share of $0.49, which was $0.04 below the analyst estimate of $0.53. Total revenues for the quarter amounted to $1.79 billion, missing the consensus estimate of $1.8 billion.

The reported pre-tax pre-provision income was $721 million, while the adjusted pre-tax pre-provision income reached $799 million. The earnings per diluted share were negatively impacted by strategic securities repositioning and costs associated with the redemption of Series B Preferred Stock, reducing reported earnings by $0.08.

Total revenue increased by 3% on a reported basis and 5% on an adjusted basis compared to Q2 2024. Net interest income rose 3% to over $1.2 billion, benefiting from easing deposit cost pressures and the replacement of lower-yielding loans and securities with higher-yielding options. The total net interest margin increased by 3 basis points to 3.54%. Non-interest income increased by 5% on a reported basis and 9% on an adjusted basis, with capital markets income surging 35% to $92 million.

Non-interest expenses rose by 6% on a reported basis and 4% on an adjusted basis, leading to an efficiency ratio of 59.3%. Average loans and leases remained stable, with net charge-offs reported at $117 million, representing 48 basis points of average loans. The allowance for credit loss ratio increased to 1.79%, with an allowance covering 210% of nonperforming loans.

The Common Equity Tier 1 and Tier 1 ratios were estimated at 10.6% and 11.9%, respectively, while tangible common book value per share ended at $12.26, reflecting a 16% increase quarter-over-quarter and a 34% increase year-over-year.

Analyst Ratings Maintained with Increased Price Targets

- DA Davidson analyst Peter Winter maintained a Buy rating and raised the price target from $27 to $29.

- Wedbush analyst David Chiaverini retained an Outperform rating, while also increasing the price target from $28 to $30.

- Truist Securities’ Brandon King continued a Hold rating, and raised the price target from $25 to $26.

- Wells Fargo analyst Whit Mayo kept an Equal-Weight rating and increased the price target from $22 to $24.

- Barclays analyst Jason Goldberg maintained an Underweight rating but increased the price target from $22 to $25.

Which Analyst has the best track record to show on RF?

Analyst Ken Usdin (JEFFERIES) currently has the highest performing score on RF with 11/13 (84.62%) price target fulfillment ratio. His price targets carry an average of $4.11 (20.66%) potential upside. Regions Financial stock price reaches these price targets on average within 213 days.

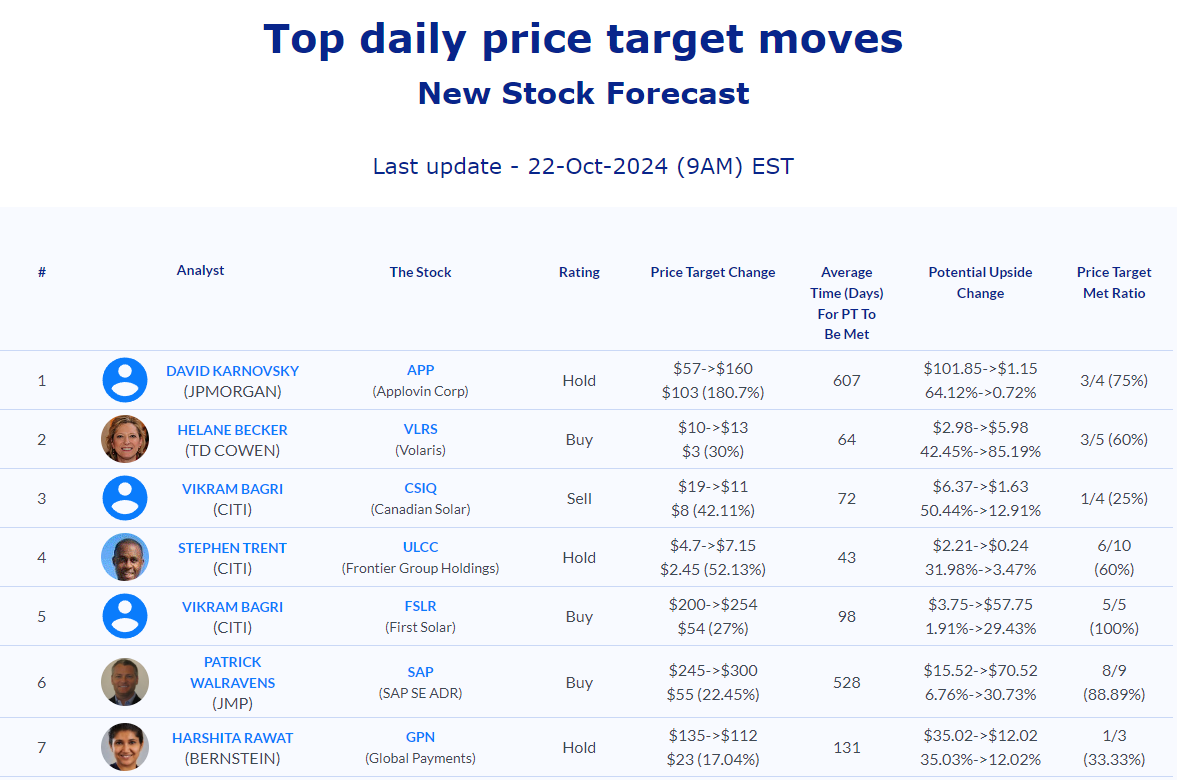

Daily stock Analysts Top Price Moves Snapshot