Selected stock price target news of the day - October 24th, 2023

By: Matthew Otto

EngageSmart: $4B Vista Equity Acquisition

EngageSmart is set to undergo a significant transformation as it enters into a definitive agreement to be acquired by private-equity giant Vista Equity Partners for a $4 billion. Upon completion of the acquisition, affiliates of Vista Equity Partners will hold a majority stake of about 65% in EngageSmart, while affiliates of global investor General Atlantic will retain approximately 35% of outstanding equity. The deal is expected to conclude in the first quarter of 2024, with EngageSmart having a 30-day go-shop period to explore alternative acquisition offers. This acquisition by Vista Equity Partners comes against the backdrop of a slower mergers and acquisitions period in 2023, with a 29% decline in global deal volume, attributed in part to expectations of enduring higher interest rates, impacting financing costs.

Analyst Downgrades Hit EngageSmart as Market Sentiment Shifts

- Raymond James analyst John Davis Downgraded from Strong Buy to Market Perform.

- Needham analyst Scott Berg Lowered from Buy to Hold.

- Keybanc analyst Alex Markgraff Downgraded from Overweight to Sector Weight.

Which Analyst has the best track record to show on ESMT?

Analyst Will Nance (GOLDMAN SACHS) currently has the highest performing score on ESMT with 1/8 (12.5%) price target fulfillment ratio. His price targets carry an average of $6.22 (28.59%) potential upside. EngageSmart stock price reaches these price targets on average within 35 days.

Agilysys Fiscal Year 2024 Q2 Records $58.6M Revenue

Agilysys has reported financial results for the second quarter of fiscal year 2024. The company achieved a revenue of $58.6 million, marking the seventh consecutive quarter of revenue growth and a 22.8% increase from the same period in the prior year. Notably, the fiscal year 2024 Q2 saw a surge in net annual contract value for sales agreements. The growth was widespread across various verticals, including gaming casinos, resorts, cruise ships, hotels, and managed foodservice providers, showcasing the versatility and demand for Agilysys’ solutions. The fiscal year 2023 set a record for Agilysys in terms of full-year sales. The first half of fiscal year 2024 has already outperformed the same period last year. The company’s raised full-year revenue guidance, now ranging from $235 million to $238 million.

Analyst Showed Favorable Ratings and Price Targets

- Needham analyst Mayank Tandon reiterated with a Buy rating and a $92 price target.

Which Analyst has the best track record to show on AGYS?

Analyst George Sutton (CRAIG HALLUM) currently has the highest performing score on AGYS with 10/12 (83.33%) price target fulfillment ratio. His price targets carry an average of $7.47 (19.16%) potential upside. Agilysys stock price reaches these price targets on average within 134 days.

Cybersecurity Concerns Mount as Okta Faces Major Breach

Okta faced a blow to its market valuation, witnessing a plummet of over $2 billion following the revelation of a hack on its support systems. The breach allowed an unidentified hacking group to exploit the support system and access client files. This raise concerns about the potential compromise of sensitive information. The lack of detailed information from Okta regarding the breach has fueled speculation and underscored the challenges in securing critical data.

This incident adds to a series of cybersecurity challenges faced by Okta, including high-profile attacks on major corporations like Caesars and MGM earlier this year. Both companies experienced direct and indirect losses surpassing $100 million due to sophisticated social engineering attacks that targeted their Okta installations. Notably, Caesars reportedly paid a substantial ransom to the hacking group responsible.

Okta’s security practices have faced scrutiny before, with a hacking group called Lapsus$. The group attempts to access numerous Okta systems in March. This group has been linked to cyber attacks on Uber and Rockstar Games, highlighting the interconnected and far-reaching consequences of cybersecurity vulnerabilities. The frequency and sophistication of these incidents underscore the urgent need for organizations to prioritize cybersecurity measures and collaborate on industry-wide initiatives to enhance digital resilience.

Analysts Adjust Ratings and Price Targets Amidst Cybersecurity Breach

- Jefferies analyst Joseph Gallo maintained a Buy rating and lowered the price target from $105 to $95.

- Piper Sandler analyst Rob Owens kept an Overweight rating and adjusted the price target down from $100 to $95.

- BTIG analyst Gray Powerll reiterated a Buy rating and lowered the price target to $95 from $98.

- Canaccord Genuity analyst Richard Davis lowered the price target to $77.

Which Analyst has the best track record to show on OKTA?

Analyst Brian Colley (STEPHENS) currently has the highest performing score on OKTA with 6/6 (100%) price target fulfillment ratio. His price targets carry an average of $3.01 (4.92%) potential upside. Okta stock price reaches these price targets on average within 23 days.

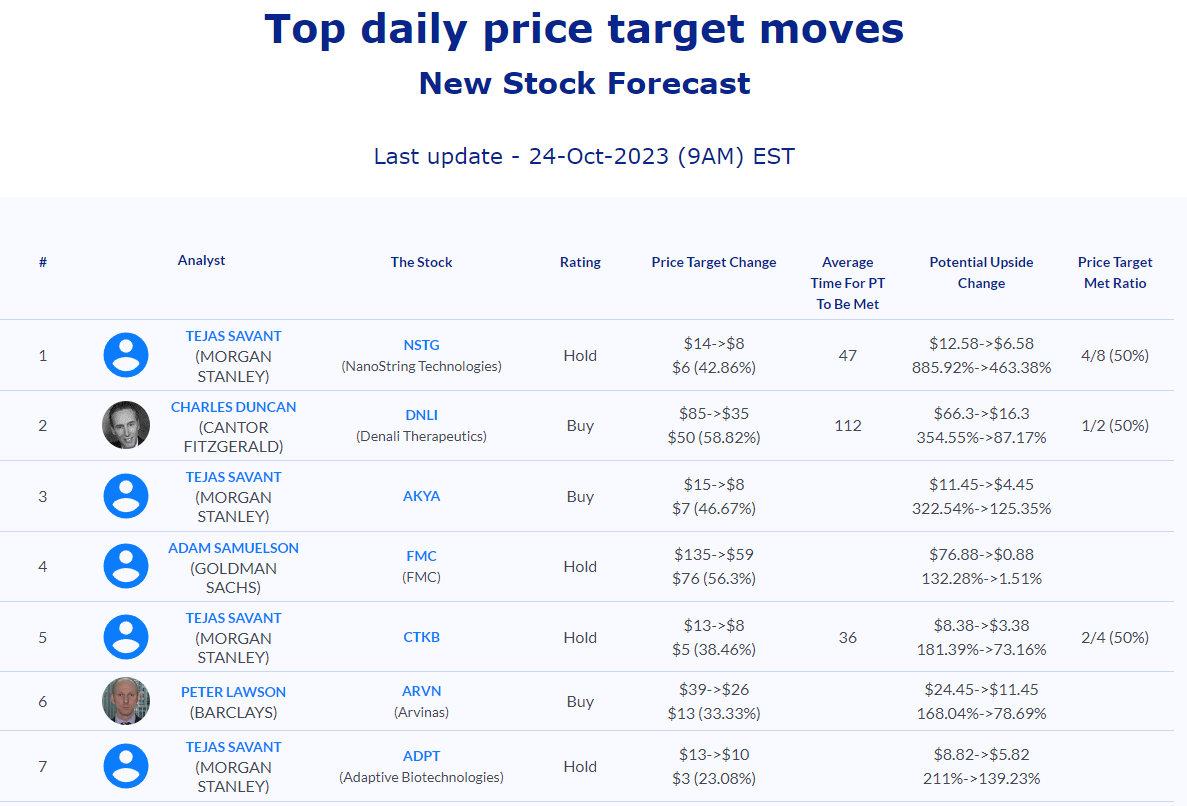

Daily stock Analysts Top Price Moves Snapshot