Selected stock price target news of the day - October 26th, 2023

By: Matthew Otto

Fortive’s Q3 2023: Growth and Acquisitions

Fortive Corporation’s Third Quarter 2023 Earnings Results reported a 2.5% core revenue growth, marked by a 160 basis points increase in adjusted gross margins to a record 59.7%. The Intelligent Operating Solutions segment demonstrated a 4% core revenue growth. This is driven by performance in Environmental, Health, and Safety and Facility and Asset Life Cycle solutions. Precision Technologies reported 1% core revenue growth with Tektronix’s exceptional execution in power and digital test solutions contributing to low single-digit core growth and operating margin expansion. The Advanced Healthcare Solutions segment saw a 2% core revenue increase, led by improved sterilization demand.

The acquisition of EA Elektro-Automatik, enhancing Fortive’s position in advanced electronic test and measurement solutions. EA Elektro-Automatik, with an estimated revenue of $175 million and operating margins in the low 40s in 2023, is expected to be accretive to Fortive’s growth and margins.

Analyst Mixed Ratings and Price Target Adjustments on Fortive

- Wells Fargo’s Joseph O’Dea maintained an Equal-Weight rating and lowered the price target from $75 to $70.

- BofA Securities’ Andrew Obin downgraded from Buy to Neutral and set a $70 price target.

- Barclays’ Julian Mitchell maintained an Overweight and lowered the price target from $83 to $76.

Which Analyst has the best track record to show on FTV?

Analyst Brett Linzey (MIZUHO) currently has the highest performing score on FTV with 3/3 (100%) price target fulfillment ratio. His price targets carry an average of $-1.5 (-1.13%) potential downside. Fortive Corporation stock price reaches these price targets on average within 68 days.

Spotify’s 2022 Triumph: Reshaping Music Revenue

In 2022, according to the International Confederation of Societies of Authors and Composers report, Spotify platform reported a 26% increase in monthly active users during the third quarter, reaching 574 million. This surpassed both the company’s own guidance and analysts’ forecasts, showcasing the platform’s sustained growth and influence in the music industry. The report underscored the impact of streaming on the music landscape, revealing that streaming collections have doubled since the pre-COVID era and now constitute 35% of total collections for music creators. Spotify’s success is particularly noteworthy, given its role in driving the surge in digital royalty collections, which rose by 34% to 4.43 billion USD in 2022.

Analysts Raise Price Targets for Spotify

- JP Morgan’s Doug Anmuth maintained an Overweight rating and increased the price target from $190 to $205.

- Truist Securities’ Matthew Thornton stayed on a Buy rating and raised the price target from $176 to $190.

- Barclays’ Mario Lu maintained an Overweight rating and pushed the price target from $182 to $186.

- Benchmark’s Mark Zgutowicz kept a Buy rating and lifted the price target from $195 to $202.

Which Analyst has the best track record to show on SPOT?

Analyst Matthew Thornton (TRUIST) currently has the highest performing score on SPOT with 13/18 (72.22%) price target fulfillment ratio. His price targets carry an average of $33.19 (23.59%) potential upside. Spotify stock price reaches these price targets on average within 104 days.

Norfolk Southern’s Q3 2023 Financial Overview

Norfolk Southern Corporation recently disclosed its Third Quarter 2023 Earnings, reporting a decline in revenues by 11%. This is largely attributed to a reduction in fuel surcharge revenue. Despite a 2% decrease in overall volume, the decline in revenue outpaced volume due to lower fuel surcharge and intermediate storage revenue compared to the previous period. Norfolk Southern’s adjusted operating ratio for Q3 stood at 69.1%, reflecting a year-over-year deterioration and sequential decline, impacted by fuel price fluctuations and increased labor costs resulting from a historic wage increase in the preceding year.

The company disclosed that it had accrued $118 million in Q3. This is for the soil removal from the site and anticipates ongoing testing efforts for safety assurance until April 2024. The costs associated with this incident, totaling $966 million thus far, have impacted Norfolk Southern’s financials, contributing to a 28% decline in adjusted operating income year-over-year.

Analysts Mixed Outlook Reflected in Price Target Revisions

- Wells Fargo’s Allison Poliniak Maintained Overweight rating and lowered price target from $245 to $220.

- Morgan Stanley’s Ravi Shanker Reiterated an Equal-Weight rating and reduced the price target from $174 to $170.

- Barclays’ Brandon Oglenski Kept an Equal-Weight rating and adjusted the price target down from $215 to $205.

Which Analyst has the best track record to show on NSC?

Analyst Brian Ossenbeck (JPMORGAN) currently has the highest performing score on NSC with 10/16 (62.5%) price target fulfillment ratio. His price targets carry an average of $40.84 (23.33%) potential upside. Norfolk Southern stock price reaches these price targets on average within 272 days.

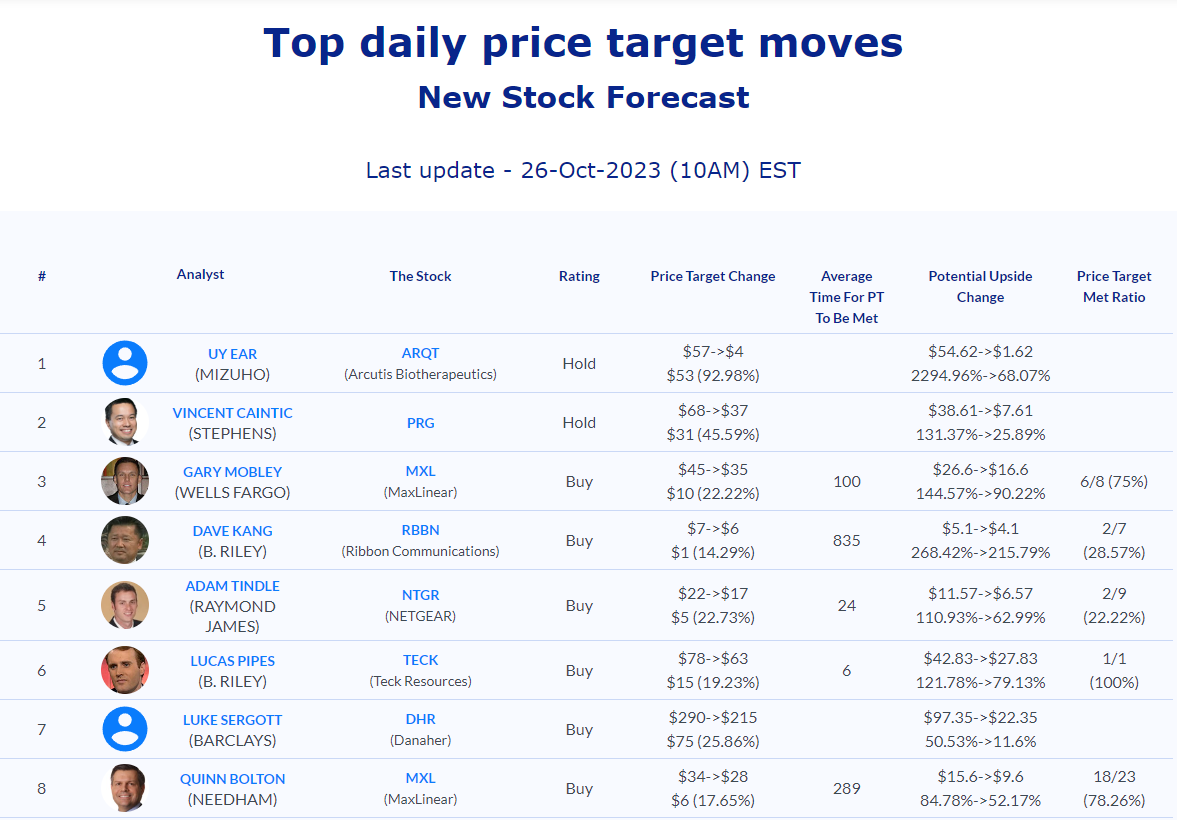

Daily stock Analysts Top Price Moves Snapshot