Selected stock price target news of the day - October 28th, 2024

By: Matthew Otto

Deckers Exceeds Q2 Expectations with 20% Revenue Growth, Raises FY 2025 Guidance

Deckers Brands reported its second fiscal quarter for FY 2025, with a 20% year-over-year revenue increase to $1.31 billion, outperforming Wall Street’s expectations of $1.20 billion. Diluted earnings per share (EPS) rose 39% to $1.59, exceeding analyst estimates of $1.23. This performance was driven by demand for its HOKA and UGG brands, with HOKA brand sales up 34.7% to $570.9 million and UGG brand sales up 13% to $689.9 million.

Deckers experienced growth across both its direct-to-consumer (DTC) and wholesale channels, with DTC net sales increasing 19.9% to $397.7 million, and wholesale sales rising 20.2% to $913.7 million. Gross margin expanded to 55.9%, up from 53.4% the previous year, while operating income grew to $305.1 million from $224.6 million.

Looking ahead, Deckers raised its FY 2025 revenue guidance to approximately $4.8 billion, reflecting an anticipated 12% increase, up from prior projections of $4.7 billion. EPS guidance was also revised upward to a range of $5.15 to $5.25. Deckers ended the quarter with strong liquidity, holding $1.226 billion in cash and cash equivalents and reporting no outstanding debt.

Analyst Ratings Reflect Confidence in Growth as Price Targets Raises

- UBS analyst Jay Sole maintained a Buy rating and increased the price target from $226 to $232.

- Telsey Advisory Group analyst Dana Telsey held an Outperform rating and raised the price target from $183 to $190.

- TD Cowen analyst John Kernan continued with a Buy rating while boosting the price target from $178 to $185.

- Evercore ISI Group analyst Jesalyn Wong reaffirmed an Outperform rating and increased the price target from $185 to $195.

- Barclays analyst Adrienne Yih maintained an Overweight rating and raised the target from $180 to $190.

- Keybanc analyst Ashley Owens kept an Overweight rating and lifted the price target from $180 to $190.

- Stifel analyst Jim Duffy held a Hold rating yet raised the price target from $147.83 to $181.

- BofA Securities analyst Christopher Nardone maintained a Neutral rating and raised the target from $170 to $182.

- Wells Fargo analyst Ike Boruchow kept an Equal-Weight rating and raised the target from $165 to $170.

- Baird analyst Jonathan Komp upheld an Outperform rating and raised the target from $180 to $195.

Which Analyst has the best track record to show on DECK?

Analyst Janine Stichter (BTIG) currently has the highest performing score on DECK with 19/21 (90.48%) price target fulfillment ratio. Her price targets carry an average of $37.45 (23.04%) potential upside. Deckers Outdoors stock price reaches these price targets on average within 161 days.

Texas Roadhouse Reports Q3 2024 Financials with 13.5% Revenue Growth and 32.5% EPS Increase

Texas Roadhouse reported its financial results with total revenue for the 13-week period increased by 13.5% year-over-year to $1.27 billion, with a comparable rise in revenue for the 39-week period, reaching $3.94 billion. Income from operations showed a gain of 38.1% for the 13-week period, totaling $102 million, while net income rose by 32.3% to $84.4 million.

Diluted earnings per share increased by 32.5%, reaching $1.26, driven by higher restaurant margins that rose 24.1% year-over-year, primarily due to increased sales and improved labor productivity. For the longer 39-week period, diluted earnings per share grew 37.0% to $4.74, supported by a 26.7% increase in restaurant margin dollars.

Texas Roadhouse experienced an 8.5% growth in comparable restaurant sales at company-operated locations for the 13-week period, alongside a 7.2% increase at domestic franchise restaurants. Weekly average sales at restaurants reached $149,176, including $18,914 in to-go sales, marking an increase from the previous year’s average of $138,668 with $17,058 in to-go sales.

Analysts Lift Price Targets Amid Strong Q3 Earnings

- UBS analyst Dennis Geiger maintained a Buy rating and raised the price target from $200 to $210.

- RBC Capital analyst Logan Reich held a Sector Perform rating but lifted the price target from $175 to $185.

- Wedbush analyst Nick Setyan kept an Outperform rating and elevated the price target from $190 to $200.

- Barclays analyst Jeffrey Bernstein maintained an Equal-Weight rating while increasing the price target from $160 to $175.

- Stifel analyst Chris O’Cull reaffirmed a Hold rating and raised the price target from $180 to $195.

- Truist Securities analyst Jake Bartlett continued with a Buy rating and boosted the price target from $202 to $207.

- BMO Capital analyst Andrew Strelzik maintained a Market Perform rating and moved the price target up from $155 to $162.

- Baird analyst David Tarantino held an Outperform rating and lifted the price target from $190 to $205.

- Morgan Stanley analyst John Glass maintained an Equal-Weight rating and adjusted the price target from $200 to $205.

Which Analyst has the best track record to show on TXRH?

Analyst John Ivankoe (JPMORGAN) currently has the highest performing score on TXRH with 9/12 (75%) price target fulfillment ratio. His price targets carry an average of $7.56 (4.38%) potential upside. Texas Roadhouse stock price reaches these price targets on average within 108 days.

Union Pacific Reports Third Quarter Earnings with Mixed Results and Analyst Shortfalls

Union Pacific reported third-quarter 2024 net income of $1.7 billion, or $2.75 per diluted share. A 9% increase from last year’s $1.5 billion and $2.51 per share but fell short of analysts’ expectations of $2.78.

Operating income rose 11% to $2.4 billion, driven by a 3% increase in operating revenue, which reached $6.1 billion but fell short of the consensus estimate of $6.14 billion. Freight revenue, excluding fuel surcharges, increased 5%, with revenue carloads growing by 6%. The operating ratio improved by 310 basis points to 60.3%, benefiting from lower quarterly fuel prices that contributed 120 basis points to this metric.

Operational performance indicators reflected improved efficiency, with quarterly freight car velocity up 5% to 210 daily miles per car and locomotive productivity also improving by 5% to 135 gross ton-miles (GTMs) per horsepower day. Workforce productivity increased by 12%, achieving 1,102 car miles per employee. Union Pacific reported a fuel consumption rate of 1.058 gallons per thousand GTMs, marking a 1% increase.

Looking ahead, Union Pacific anticipates fourth-quarter results to be consistent with third-quarter performance while expecting year-over-year improvement compared to the fourth quarter of 2023. The capital plan for 2024 remains at $3.4 billion, and share repurchases are projected at approximately $1.5 billion.

Analyst Adjusts Price Targets Amid Maintained Ratings

- TD Cowen analyst Jason Seidl maintained a Buy rating while lowering the price target from $255 to $252.

- Barclays analyst Brandon Oglenski held an Overweight rating, but reduced the price target from $280 to $275.

- RBC Capital analyst Walter Spracklin continued with an Outperform rating and decreased the price target from $288 to $283.

- JP Morgan analyst Brian Ossenbeck maintained a Neutral stance and lowered the price target from $263 to $252.

- Stifel analyst Benjamin Nolan kept a Buy rating while adjusting the price target from $265 to $262.

- Susquehanna analyst Bascome Majors maintained a Neutral rating and reduced the price target from $260 to $255.

- Benchmark analyst Nathan Martin reiterated a Buy rating and the price target at $266.

- Wells Fargo analyst Christian Wetherbee maintained an Overweight rating while lowering the price target from $270 to $255.

- Baird analyst Benjamin Hartford kept an Outperform rating but reduced the price target from $270 to $260.

Which Analyst has the best track record to show on UNP?

Analyst Benjamin Nolan (STIFEL) currently has the highest performing score on UNP with 10/13 (76.92%) price target fulfillment ratio. His price targets carry an average of $31.7 (13.76%) potential upside. Union Pacific stock price reaches these price targets on average within 141 days.

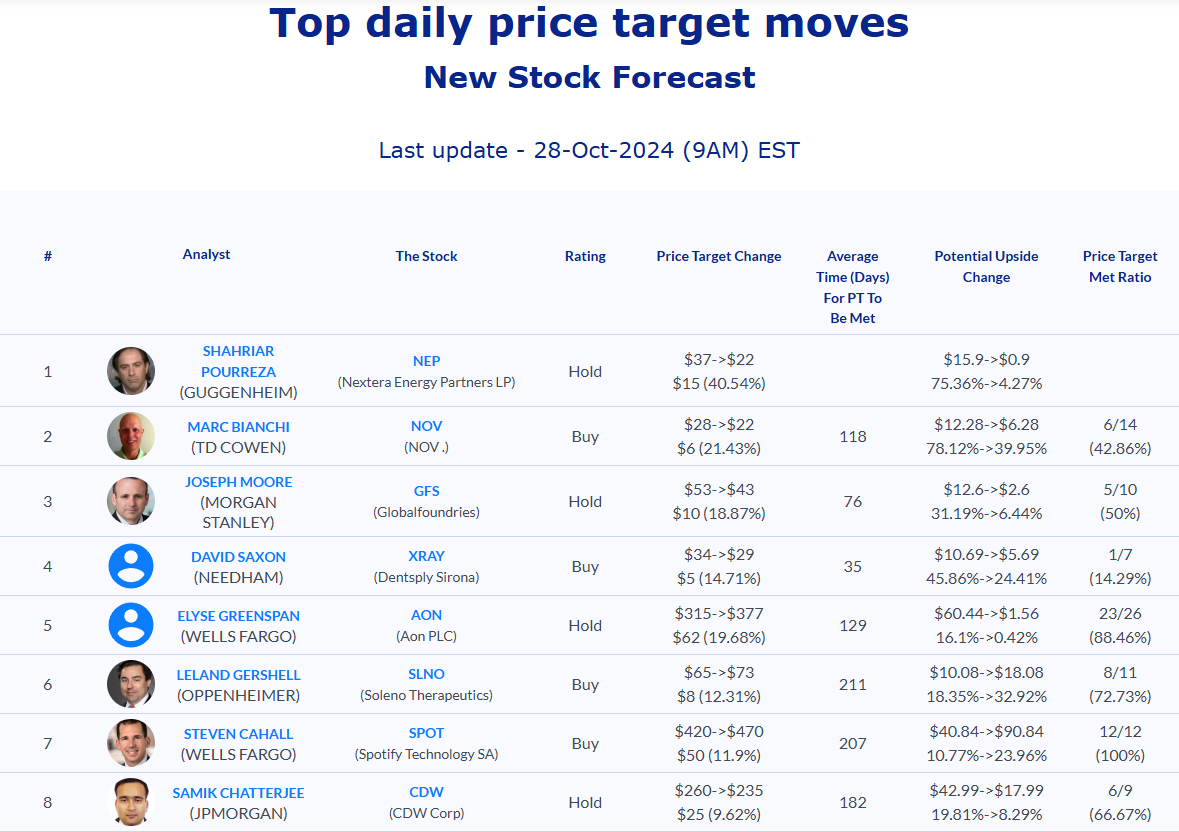

Daily stock Analysts Top Price Moves Snapshot