Selected stock price target news of the day - October 29th, 2024

By: Matthew Otto

Amkor Technology Q3 Results Miss EPS Estimate, Q4 Guidance Falls Short of Expectations

Amkor Technology reported third-quarter 2024 results, with net sales for the quarter rose to $1.86 billion, exceeding the consensus estimate of $1.84 billion and representing a 27% sequential increase from Q2’s $1.46 billion. However, earnings per diluted share (EPS) of $0.49 came in below analyst expectations of $0.50.

Amkor achieved a gross profit of $272 million, an operating income of $149 million, and a net income of $123 million. The gross margin reached 14.6%, up slightly from Q2’s 14.5% but below the 15.5% in Q3 2023. EBITDA totaled $309 million, rising from $247 million in the prior quarter, though it fell short of the $333 million achieved in Q3 2023.

For the fourth quarter, Amkor projected net sales between $1.60 billion and $1.70 billion compared to a consensus of $1.84 billion. EPS is expected to range from $0.28 to $0.44, below the analyst estimate of $0.57, with net income projected at $70 million to $110 million. Full-year capital expenditures are estimated at approximately $750 million. Amkor held cash and short-term investments totaling $1.5 billion, with total debt standing at $1.1 billion.

Analysts Lower Price Targets Amid Q3 Results and Q4 Guidance

- KeyBanc analyst Steve Barger maintained an Overweight rating but lowered the price target from $38 to $34.

- Morgan Stanley analyst Joseph Moore kept an Equal-Weight rating and decreased the price target from $35 to $26.

- Needham analyst Charles Shi held a Buy rating while reducing the price target from $45 to $34.

- B. Riley analyst Craig Ellis adjusted the price target to $38.

- Goldman Sachs analyst Toshiya Hari reiterated a Neutral rating with a $32 price target.

Which Analyst has the best track record to show on AMKR?

Analyst Thomas Diffely (D.A. DAVIDSON) currently has the highest performing score on AMKR with 2/3 (66.67%) price target fulfillment ratio. His price targets carry an average of $6.52 (22.12%) potential upside. Amkor Technology stock price reaches these price targets on average within 212 days.

Harmonic Beats Q3 Revenue and EPS Expectations Amid Video Segment Weakness and Cash Decline

Harmonic reported its financial results for the third quarter of 2024, with total revenue of $195.8 million, exceeding analyst expectations of $181.76 million and marking a 54% increase compared to $127.2 million in the same quarter last year.

The Broadband segment generated $145.3 million, up from $75.8 million, while the Video segment saw a decrease from $51.4 million to $50.4 million. Gross margins also improved, with GAAP gross margin reaching 53.5% and non-GAAP gross margin at 53.7%, both higher than the previous year’s 48.5% and 49.5%, respectively.

Harmonic reported GAAP operating income of $35.4 million, contrasting with a GAAP loss of $8.6 million in Q3 2023, while non-GAAP operating income rose to $44.5 million from $0.1 million. Net income on a GAAP basis was $21.7 million, translating to a GAAP earnings per share (EPS) of $0.19, an improvement from last year’s net loss of $6.5 million or a GAAP loss per share of $0.06. Non-GAAP EPS reached $0.26, outperforming the analyst estimate of $0.22.

In operational highlights, Harmonic’s cOS™ platform was commercially deployed with 121 customers, collectively serving 32 million cable modems. Harmonic ended the quarter with $58.2 million in cash and a backlog and deferred revenue totaling $584.7 million.

Mixed Analyst Outlooks and Lowered Price Targets

- Barclays analyst Tim Long maintained an Overweight rating yet reduced the price target from $20 to $17.

- Northland Capital Markets analyst Tim Savageaux held an Outperform rating but lowered the price target from $16 to $14.

- Raymond James analyst Simon Leopold downgraded from Strong Buy to Outperform and the price target from $17 to $14.

- Needham analyst Ryan Koontz reiterated a Buy rating and the price target at $18.

Which Analyst has the best track record to show on HLIT?

Analyst Tim Long (BARCLAYS) currently has the highest performing score on HLIT with 9/13 (69.23%) price target fulfillment ratio. His price targets carry an average of $5.76 (40.45%) potential upside. Harmonic stock price reaches these price targets on average within 96 days.

Inari Medical Reports Q3 2024: Revenue Rises 21.4%; EPS Misses Analyst Estimates

Inari Medical announced its financial results for the third quarter generating a revenue of $153.4 million, reflecting a 21.4% increase compared to $126.4 million in the same quarter of the previous year. Revenue surpassed the consensus estimate of $150.69 million.

Gross profit for the quarter was $133.5 million, yielding a gross margin of 87.1%, slightly down from 88.5% in Q3 2023. Operating expenses rose to $147.1 million, compared to $109.8 million in the prior year. The GAAP operating loss for the quarter was $13.6 million, a decrease from an operating income of $2.1 million in Q3 2023.

Inari reported a net loss of $18.4 million, translating to a net loss per share of $0.31, which was $0.19 worse than the analyst estimate of a loss of $0.12, contrasting with a net income of $3.2 million and earnings per share of $0.06 in the prior year.

Looking ahead, Inari raised its full-year 2024 revenue guidance to between $601.5 million and $604.5 million, versus the consensus of $600 million. This reflects an increase of $3.5 million at the midpoint from the previous guidance range of $594.5 million to $604.5 million. This guidance indicates expected growth of approximately 21.9% to 22.5% over 2023.

Analysts Show Confidence Following Q3 2024: Price Targets Increased

- Canaccord Genuity analyst William Plovanic maintained a Buy rating and raised the price target from $71 to $74.

- Baird analyst David Rescott kept an Outperform rating while increasing the price target from $66 to $67.

- Piper Sandler analyst Adam Maeder held a Neutral rating and raised the price target from $50 to $52.

- Needham analyst Mike Matson reiterated a Hold rating.

Which Analyst has the best track record to show on NARI?

Analyst Richard Newitter (TRUIST) currently has the highest performing score on NARI with 6/13 (46.15%) price target fulfillment ratio. His price targets carry an average of $3.8 (9.00%) potential upside. Inari Medical stock price reaches these price targets on average within 29 days.

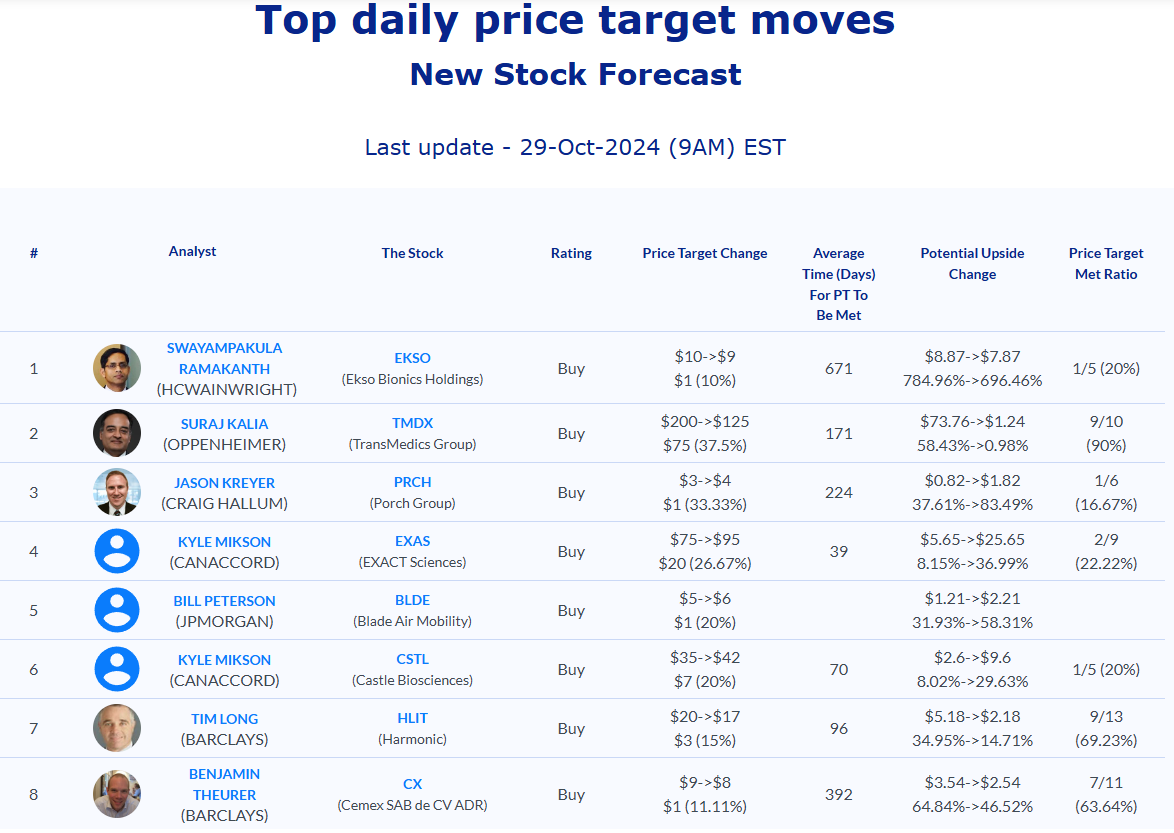

Daily stock Analysts Top Price Moves Snapshot