Selected stock price target news of the day - October 31st, 2024

By: Matthew Otto

Alphabet Exceeds Q3 Expectations with Strong Cloud and Ad Revenue Growth, Driven by AI Advancements

Alphabet reported stronger-than-expected third-quarter earnings, with revenue reaching $88.27 billion, surpassing the consensus estimate of $86.37 billion. Earnings per share climbed to $2.12, outperforming analysts’ expectations by $0.28, compared to an estimated $1.84.

Google Cloud generated $11.35 billion in revenue, exceeding the $10.79 billion estimate and marking a nearly 35% increase from the previous year’s $8.41 billion. Alphabet attributes this growth to its AI-driven offerings tailored for enterprise clients.

Alphabet’s advertising business showed resilience, with total ad revenue at $65.85 billion, an increase from last year’s $59.65 billion, although growth moderated compared to the prior quarter. Alphabet’s YouTube ad revenue also surpassed expectations, posting $8.92 billion.

Meanwhile, Google’s search business generated $49.4 billion, up 12.3% year-over-year and remaining the largest revenue driver. Additionally, the Google Workspace and Google Cloud Platform units posted a 30% year-over-year revenue growth. Alphabet’s Other Bets segment, which includes Waymo and Verily, reported revenue of $388 million, up from $297 million a year earlier.

Analyst Ratings Update: Price Targets Raised Across the Board

- Bernstein analyst Mark Shmulik maintained a Market Perform rating, yet raised the price target from $180 to $185.

- JMP Securities analyst Andrew Boone kept an Outperform rating and raised the price target from $200 to $220.

- Cantor Fitzgerald analyst Deepak Mathivanan reiterated a Neutral rating and the price target at $190.

- Roth MKM analyst Rohit Kulkarni maintained a Buy, and boosted the price target from $206 to $212.

- Keybanc analyst Justin Patterson retained an Overweight rating while increasing the price target from $200 to $215.

- Oppenheimer analyst Jason Helfstein kept at Outperform and raised the price target from $185 to $215.

- RBC Capital analyst Brad Erickson maintained an Outperform rating and lifted the price target from $204 to $210.

- Truist Securities analyst Youssef Squali continued with a Buy rating and raised the price target from $220 to $225.

- BMO Capital analyst Brian Pitz reiterated an Outperform rating, and upgraded the price target from $215 to $217.

- Pivotal Research analyst Jeffrey Wlodarczak maintained a Buy rating and boosted the price target from $215 to $225.

Which Analyst has the best track record to show on GOOGL?

Analyst Scott Devitt (WEDBUSH) currently has the highest performing score on GOOGL with 21/27 (77.78%) price target fulfillment ratio. His price targets carry an average of $42.28 (25.98%) potential upside. Alphabet stock price reaches these price targets on average within 281 days.

PayPal’s Q3 Earnings Beat EPS Estimates, But Lower Revenue and Soft Q4 Outlook Weigh on Shares

PayPal Holdings released its third-quarter earnings posting an adjusted earnings per share (EPS) of $1.20, which exceeded analysts’ expectations of $1.07 according to FactSet. However, revenue fell slightly short at $7.85 billion, below the $7.88 billion consensus estimate. PayPal’s total payment volume rose 9% year-over-year to $422.6 billion, while transaction margin dollars increased by 8% to $3.7 billion.

Looking ahead, PayPal revised its full-year EPS growth forecast to the high teens, up from its previous low- to mid-teens estimate. For the fourth quarter, PayPal anticipates low single-digit revenue growth and an adjusted EPS range of $1.07 to $1.11, representing a slight decrease due to increased marketing investments supporting new products.

Analysts from Mizuho, Dan Dolev, maintained their Outperform rating on PayPal with a price target of $100, noting that while soft fourth-quarter guidance may pressure the stock, optimism around 2025 growth could potentially improve market sentiment.

Analysts Raise Price Targets Amid Mixed Q3 Performance

- Canaccord Genuity analyst Joseph Vafi maintained a Buy rating and raised the price target from $80 to $96.

- Macquarie analyst Paul Golding maintained an Outperform rating and lifted the price target from $90 to $95.

- Goldman Sachs analyst Will Nance kept a Neutral rating but increased the price target from $79 to $87.

- RBC Capital analyst Daniel Perlin upheld an Outperform rating and adjusted the price target from $84 to $89.

- JP Morgan analyst Tien-Tsin Huang maintained an Overweight rating and revised the price target from $80 to $90.

- UBS analyst Timothy Chiodo retained a Neutral rating while raising the price target from $72 to $85.

- BMO Capital analyst Rufus Hone held a Market Perform rating and moved the price target up from $73 to $82.

- Susquehanna analyst James Friedman kept a Positive rating and boosted the price target from $83 to $94.

Which Analyst has the best track record to show on PYPL?

Analyst Andrew Bauch (WELLS FARGO) currently has the highest performing score on PYPL with 10/12 (83.33%) price target fulfillment ratio. His price targets carry an average of $-4.82 (-6.04%) potential downside. PayPal Holdings stock price reaches these price targets on average within 11 days.

Qorvo Reports Q2 Fiscal 2025 Results: Revenue and Profit Forecasts Below Expectations Amid Market Challenges

Qorvo reported financial results for its fiscal 2025 second quarter posting a revenue of $1.047 billion, with a gross margin of 42.6%, operating income of $9.7 million, and a net loss of $0.18 per share. Gross margin reached 47.0%, operating income was $212.2 million, and diluted earnings per share came in at $1.88, exceeding analyst expectations of $1.85.

Looking ahead, Qorvo anticipates third-quarter revenue of approximately $900 million, plus or minus $25 million, which is below Wall Street’s projected $1.06 billion. Non-GAAP gross margin is forecasted around 45%, with adjusted earnings per share between $1.10 and $1.30—well below analysts’ expectations of $1.92 per share.

Additionally, full-year fiscal 2025 revenue and gross margin are projected to decline slightly from fiscal 2024 levels, partly influenced by a 2.8% year-over-year reduction in shipments from Samsung Electronics, which contributes 12% of Qorvo’s revenue.

Analyst Ratings Downgraded and Price Targets Reduced

- TD Cowen analyst Matthew Ramsay maintained a Hold rating, while lowering the price target from $125 to $85.

- Raymond James analyst Srini Pajjuri downgraded from Outperform to Market Perform.

- Barclays analyst Tom O’Malley kept an Equal-Weight rating, yet lowered the price target from $120 to $90.

- JP Morgan analyst Peter Peng maintained an Underweight rating and reduced the price target from $115 to $95.

- Piper Sandler analyst Harsh Kumar reiterated a Neutral rating and lowered the price target from $100 to $85.

- UBS analyst Timothy Arcuri maintained a Neutral rating, but lowered the price target from $115 to $90.

- Susquehanna analyst Christopher Rolland retained a Neutral rating, and lowered the price target from $115 to $90.

Which Analyst has the best track record to show on QRVO?

Analyst Toshiya Hari (GOLDMAN SACHS) currently has the highest performing score on QRVO with 10/11 (90.91%) price target fulfillment ratio. His price targets carry an average of $-1.8 (-1.50%) potential downside. Qorvo stock price reaches these price targets on average within 63 days.

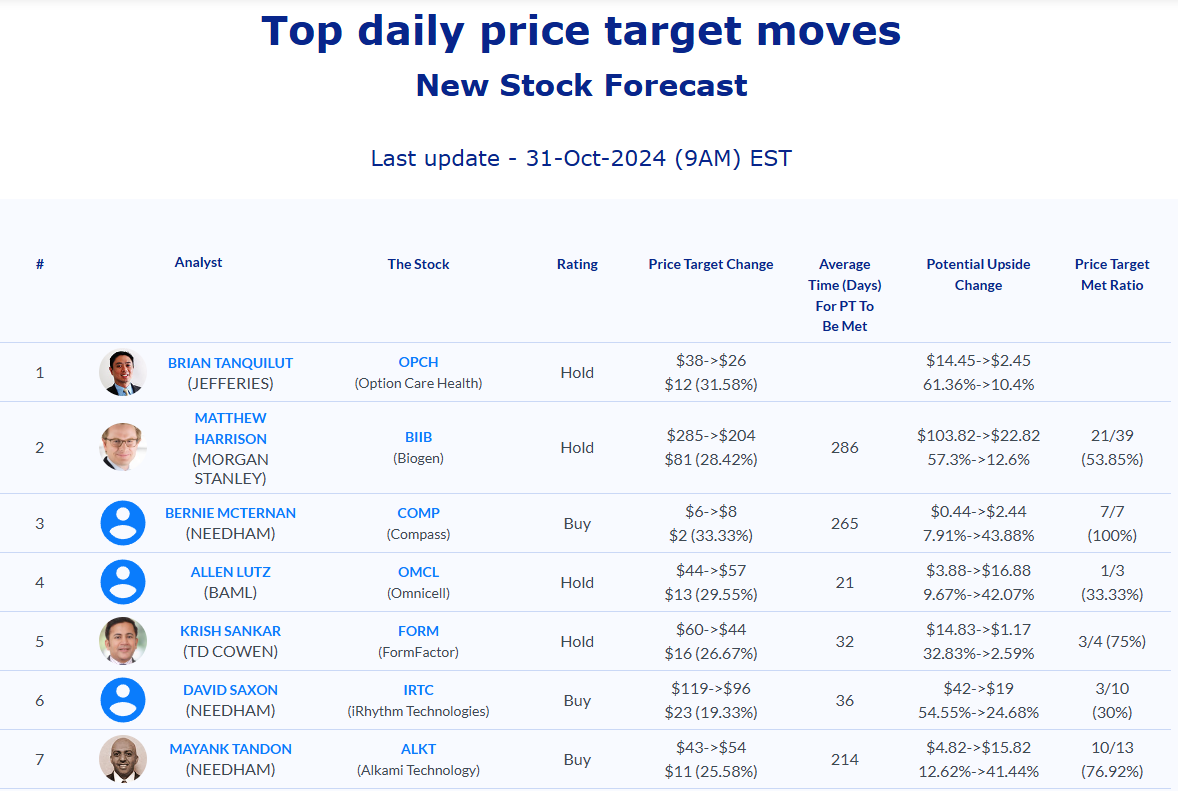

Daily stock Analysts Top Price Moves Snapshot