Selected stock price target news of the day - June 01, 2023

By Matthew Otto

Salesforce Beats Analysts’ Expectations; Faces Increased Challenges

Salesforce has reported an 11% rise in its Q1 FY24 revenue, which marks its slowest pace of growth in 13 years due to an uncertain economy that led companies to reduce spending on cloud-based software. Despite the positive earnings report, Salesforce’s shares fell nearly 5% after-hours, following a significant surge in the company’s stock this year.

Amy Weaver, Salesforce’s CFO, mentioned the company faced ongoing macroeconomic pressures in the U.S., with demand from financial services and technology companies slowing in the quarter.

Salesforce’s capital expenditure saw a 36% increase to $243 million due to investments in AI-related tools to power its software products. Despite the challenges, Salesforce’s revenue of $8.25 billion for the quarter ended April 30 beat analysts’ expectations of $8.18 billion.

Salesforce is facing stiff competition in the crowded cloud-computing market from well-financed traditional vendors such as Oracle (ORCL.N). The company has also been a target of activist investors like ValueAct, Inclusive Capital, and Starboard Value, which have all separately advocated for better cost control initiatives and improved efficiencies.

Salesforce has forecasted a revenue range of $8.51 billion to $8.53 billion for the current quarter, representing approximately a 10% growth from last year. Analysts were expecting revenue of $8.49 billion. On an adjusted basis, Salesforce earned $1.69 per share, surpassing the estimate of $1.61 per share.

Wall Street Raises Price Target on Sales Force

- JMP Securities analyst Patrick Walravens has maintained a Market Outperform rating and raised the price target from $250 to $275, a new street high.

- Citigroup analyst Tyler Radke has kept a Neutral rating and increased the price target from $229 to $230.

- Oppenheimer analyst Brian Schwartz has maintained an Outperform rating and raised the price target from $225 to $235.

- Bernstein analyst Mark Moerdler has maintained an Underperform rating but increased the price target from $145 to $153.

- Baird analyst Rob Oliver has kept a Neutral rating and raised the price target from $200 to $210.

- Mizuho analyst Gregg Moskowitz has maintained a Buy rating and increased the price target from $225 to $240.

- Piper Sandler analyst Brent Bracelin has maintained an Overweight rating and raised the price target from $230 to $248.

- Raymond James analyst Brian Peterson has raised the price target for Salesforce to $260.

The stock had regained half of its losses made in the last two years with not all analysts are full on board, although all have been adjusting up consistently since March this year. For example Derrick Wood from TD Cowen although having a Buy rating set his price target at $200 which is below the Salesforce stock price.

Advance Auto Parts Sees Q1 Shortfall; Misses Expectations, Slashes Full-Year Guidance

Advance Auto Parts‘ first-quarter earnings for 2023 were significantly below Wall Street expectations, The company reported an EPS of 72 cents, lower than the expected $2.57 per share, according to average analyst estimates compiled by Refinitiv. This difference of $1.85 per share indicates a significant gap between expectations and actual results.

Also, quarterly revenue was $3.42 billion, slightly missing expectations of $3.43 billion.

Furthermore, Advance Auto Parts had to revise their full-year guidance downwards, which also indicates that the company’s performance did not meet initial expectations. The revised EPS guidance for the full year 2023 now stands at between $6 and $6.50, down from a previously stated range of $10.20 to $11.20

Net sales increased by a small margin, just 1.3%, primarily driven by new store openings. However, comparable store sales saw a decline of 0.4%. Operating income was also below expectations at $90 million, amounting to an operating income margin of 2.6%, well below expectations.

On the financial front, gross profit decreased by 2.4% to $1.5 billion, primarily due to inflationary product costs that were not fully absorbed by pricing actions. The company’s effective tax rate increased, and its diluted EPS was at $0.72, a stark contrast to $2.26 in the first quarter of 2022.

Analysts Adjust Price Targets

- Truist Securities’ Scot Ciccarelli maintains Hold, lowers price target to $67

- Barclays’ Seth Sigman maintains Equal-Weight, lowers price target to $69

- Citigroup’s Steven Zaccone maintains Neutral, lowers price target to $76

- Morgan Stanley’s Simeon Gutman maintains Equal-Weight, lowers price target to $80

- Goldman Sachs’ Kate McShane downgrades Advance Auto Parts to Neutral, lowers price target to $82

- JP Morgan’s Christopher Horvers downgrades to Neutral, lowers price target to $84

- Raymond James’ Bobby Griffin downgrades Advance Auto Parts from Strong Buy to Market Perform.

The last two years have not been kind to the retail stock while it lost 60%, however today’s adjustment marks that Wall Street doesn’t forecast a rebound in the near time horizon.

Okta Beats Q1 2024 Expectations: Revenue Up 25%; Forecasts Optimistic Despite Macroeconomic Concerns

Okta announced its first quarter fiscal year 2024 financial results:

- Q1 revenue grew 25% year-over-year to $518 million, and subscription revenue increased 26% year-over-year to $503 million.

- Current remaining performance obligations (cRPO) rose 20% year-over-year to $1.70 billion.

- The company reported a record operating cash flow of $129 million and free cash flow of $124 million.

- GAAP operating loss stood at $160 million, a significant reduction from the loss of $240 million in the same period the previous year.

- Non-GAAP operating income was $37 million, compared to a non-GAAP operating loss of $41 million in Q1 2023.

- GAAP net loss was $119 million, a decrease from $243 million in the first quarter of fiscal 2023.

- Non-GAAP net income came in at $38 million, compared to a Non-GAAP net loss of $43 million in Q1 2023.

- Okta repurchased $366 million principal amount of the convertible senior notes due in 2025, resulting in a gain on early extinguishment of debt of $31 million.

For the second quarter of fiscal 2024, Okta expects total revenue of $533 million to $535 million and a non-GAAP operating income of $36 million to $38 million. For the full fiscal year 2024, Okta now anticipates total revenue of $2.175 billion to $2.185 billion and a non-GAAP operating income of $161 million to $170 million.

Wall Street Action

- Trevor Walsh from JMP Securities stands by his Market Outperform rating on Okta, preserving a price target of $110.

- Brian Colley from Stephens & Co. reaffirms an Equal-Weight stance on Okta, keeping a price target of $84.

- Keith Bachman at BMO Capital shifts Okta from Outperform to Market Perform, dropping the price target to $85.

- Ittai Kidron from Oppenheimer maintains his Outperform outlook on Okta, holding a price target of $110.

- Peter Weed of Bernstein keeps a Market Perform position on Okta, adjusting the price target down to $84.

- Alex Henderson from Needham reasserts a Buy recommendation on Okta, keeping the price target at $100.

- Brian Essex at JP Morgan downgrades Okta from Overweight to Neutral, lowering his price target to $85.

Half of the analysts covering the stock are well reserved despite unanimously increasing their price targets three months ago. Joel Fishbein of Truist is the most bearish at $75.

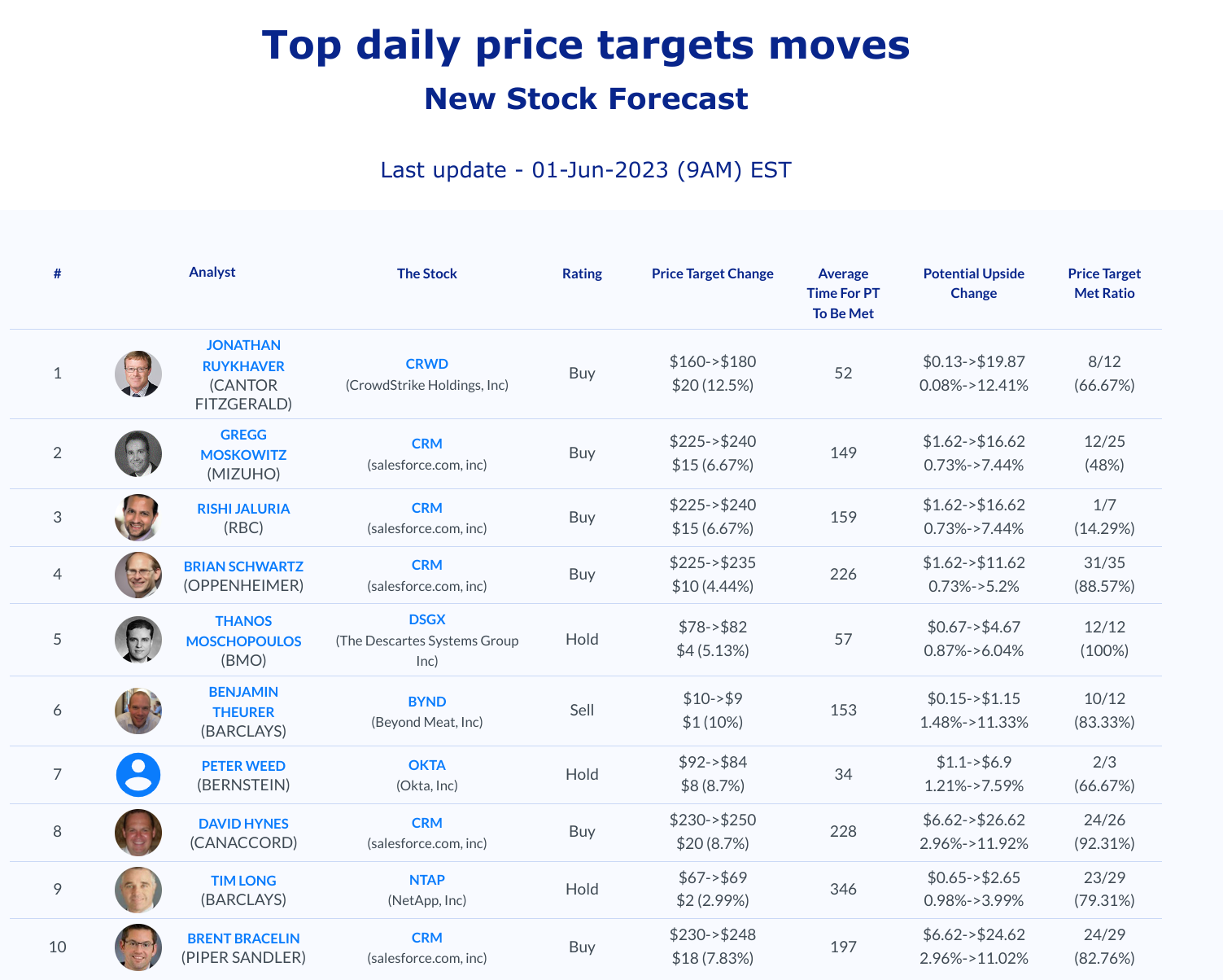

Daily stock Analysts Top Price Moves Snapshot