Selected stock price target news of the day - June 06, 2023

By Matthew Otto

EPAM Lowers Outlook, Falling Short of Analyst Expectations

EPAM Systems has announced a reduction in its financial outlook for the second quarter and full year 2023, attributing the decision to a deterioration in near-term demand. The company noted a more cautious spending pattern in the build segment of the global IT services market, leading to slower pipeline conversions and an overall reduction in the total pipeline.

For the full year, the company now projects revenues between $4.65 billion to $4.8 billion, indicating a 2% decrease year-over-year at the midpoint of the range. GAAP income from operations is expected to fall within 11% to 12% range, and non-GAAP income from operations within 15% to 16%. GAAP diluted EPS is now projected to range from $7.28 to $7.68 and non-GAAP diluted EPS between $9.80 to $10.20.

For the second quarter, revenues are expected to range from $1.160 billion to $1.170 billion ($2.33 and $2.40 was slightly below the FactSet estimate of $2.43), a 2.5% decrease year-over-year at the midpoint of the range. GAAP income from operations should remain within the 10% to 11% range, while non-GAAP income from operations within the 14% to 15% range. The GAAP effective tax rate should be around 20% and non-GAAP tax rate approximately 23%. GAAP diluted EPS is expected to fall within $1.75 to $1.82 and non-GAAP diluted EPS between $2.33 to $2.40.

Wall Street Switches to Hold

- Stifel analyst David Grossman has maintained a Buy rating but reduced the price target from $320 to $240.

- Barclays analyst Ramsey El-Assal downgraded from Overweight to Equal-Weight and lowered the price target from $310 to $220.

- Piper Sandler analyst Arvind Ramnani also downgraded from Overweight to Neutral and lowered the price target from $289 to $215.

- Keybanc analyst Thomas Blakey dropped EPAM from Overweight to Sector Weight.

This sort of shift from Buy to Hold ratings accompanied by more than one analyst usually is not a common occurrence and is a rare indicator of how Wall Street loses faith in a stock’s prospects. The

Analyst Mayank Tandon of Needham has currently the highest performing score on EPAM with 26/33 (78.79%) price target fulfillment ratio. His price targets carry on average an $71.75 (35.30%) potential upside and are fulfilled within average of 93 days

GitLab demonstrates strength along demand for AI

GitLab announced its first quarter fiscal year 2024 financial results and surpassed analyst estimates on key metrics.

Key Financial Highlights:

- GitLab reported a Q1 non-GAAP EPS of ($0.06), which was $0.08 better than the analyst estimate of ($0.14).

- The total revenue for the quarter was $126.9 million, exceeding the consensus estimate of $117.84 million.

GitLab’s CEO, Sid Sijbrandij, emphasized the company’s positioning as a leading AI-powered DevSecOps platform, offering unique capabilities to their customers.

CFO Brian Robins noted the organic growth of the company, emphasizing the 45% YoY increase in revenue and the significant improvement in non-GAAP operating margin.

The company also provided its financial outlook for the second quarter and fiscal year 2024, outperforming consensus estimates:

- For Q2 FY 2024, GitLab expects EPS of ($0.03)-($0.02), better than the consensus estimate of ($0.08). The company anticipates revenue to be between $129 million and $130 million, higher than the consensus of $127 million.

- For FY 2024, GitLab forecasts EPS of ($0.18)-($0.14), again better than the consensus of ($0.26). The company also expects its revenue to be between $541 million and $543 million, exceeding the consensus of $533 million.

Analysts Bullish with Raised Price Targets

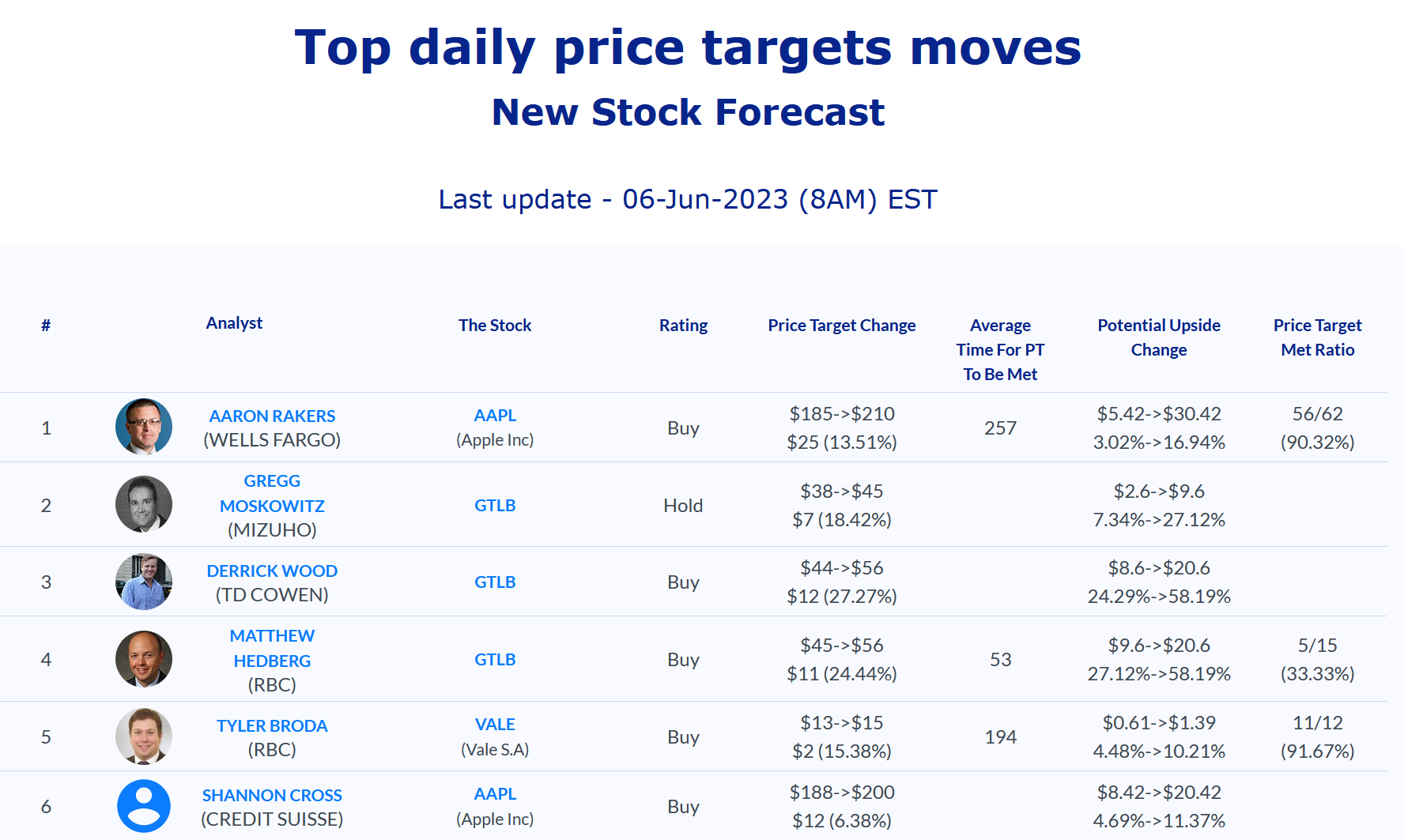

- RBC Capital’s Matthew Hedberg kept his Outperform rating, but upped the price target from $45 to $56.

- TD Cowen’s J. Derrick Wood also stood by his Outperform rating, boosting the price target from $44 to $56.

- BofA Securities’ Koji Ikeda held his Buy rating, increasing the price target from $50 to $55.

- Mizuho’s Gregg Moskowitz retained a Neutral rating and lifted the price target from $38 to $45.

- UBS’s Karl Keirstead raised the price target from $35.00 to $50.00, while maintaining a Buy rating.

- Scotiabank’s Nick Altmann increased the price target to $50.

Since going public the stock lost more than two thirds of its value while all analysts kept an optimistic look.

Analyst Matthew Hedberg of RBS has currently the highest performing score on GTLB with 5/15 (33.33%) price target fulfillment ratio. His price targets carry on average an $18.19 (33.05%) potential upside and are fulfilled within an average of 53 days.

Sprinklr Surpasses Q1 EPS Estimates, Forecasts Strong Growth for FY2024

Sprinklr reported Q1 EPS of $0.06, significantly beating the analyst estimate of $0.01 by $0.05. Total revenue for the quarter came in at $173.4 million, exceeding the consensus estimate of $169 million.

The first quarter saw Sprinklr continue its growth trajectory, with total revenue and subscription revenue up 20% and 24% year-over-year, respectively. Ragy Thomas,

For Q2 2024, Sprinklr is forecasting EPS in the range of $0.04-$0.05, surpassing the consensus estimate of $0.03. It also expects revenue to be between $172-174 million, in line with the consensus estimate of $173.2 million.

Looking ahead to FY 2024, Sprinklr forecasts an EPS of $0.19-$0.21, greatly exceeding the consensus estimate of $0.14. Revenue for FY 2024 is projected to be between $711-715 million, slightly below the consensus estimate of $712.3 million.

Analysts Raise Price Targets on Strong Fiscal 2024 Outlook

- JP Morgan analyst Pinjalim Bora maintains an Overweight stance, boosting the price target from $14 to $16.

- BTIG analyst Matt VanVliet retains a Buy rating, hiking the price target from $16 to $17.

- Stifel analyst Parker Lane holds steady, uplifting the price target from $13 to $15.

- JMP Securities analyst Patrick Walravens preserves a Market Outperform rating, amplifying the price target from $20 to $24.

- Cantor Fitzgerald analyst Brett Knoblauch lifts his price target to $17.

- BTIG analyst Matt VanVliet elevates his price target to $17.

- Citi Analyst Tyler Radke ups the price target to $15 while maintaining a Neutral rating.

The stock is currently at two thirds of its market value when it had its IPO last year. Nearly half of analysts carry a Hold rating on the stock.

Analyst Michael Turrin of Wells Fargo has currently the highest performing score on CXM with 5/7 (71.43%) price target fulfillment ratio. His price targets carry on average an $-0.04 (-0.11%) potential downside and are fulfilled within average of 29 days.

Daily stock Analysts Top Price Moves Snapshot