Selected stock price target news of the day - June 08, 2023

By: Matthew Otto

Academy Sports Outdoors Reports Earnings Decline; Revises Down Fiscal 2023 Guidance

Academy Sports and Outdoors released its financial results yesterday for Q1 2023 ending April 29, showing a decline in sales and profits compared to the same period last year. Net sales fell by 5.7% from $1.47 billion to $1.38 billion, while comparable sales declined by 7.3%. Income before income tax was down by 39.2% to $118.7 million, while net income dropped by 37.3% to $94 million.

The company attributed the underwhelming results to macroeconomic pressures, unfavorable weather, and stronger sales in the hunting business during the same period in 2022. However, Academy’s leadership remains confident in its business model and the new long-range plan to drive growth.

During Q1, Academy opened one new store and plans to open between 13 to 15 stores during 2023, with a five-year plan of opening between 120 to 140 stores. The company’s cash and cash equivalents have fallen by 37.4% to $295.5 million, while net merchandise inventories rose by 4.7% to $1.39 billion. Long-term debt reduced by 14.5% to $584.1 million.

In light of the Q1 results and ongoing macroeconomic challenges, Academy has revised its 2023 fiscal guidance. Net sales are now projected to be between $6.18 billion and $6.37 billion, down from the previous estimate of between $6.5 billion and $6.7 billion. The company also expects GAAP net income to be between $520 million and $575 million, and GAAP earnings per common share, diluted, to be between $6.50 and $7.20.

Wall Street Action

- Morgan Stanley analyst Simeon Gutman has maintained an Equal-Weight rating and lowered the price target from $70 to $55.

- Evercore ISI Group analyst Greg Melich maintains an Outperform rating and has lowered the price target from $80 to $70.

- UBS analyst Michael Lasser has kept a Buy rating and lowered the price target from $78 to $65.

- Wedbush analyst Seth Basham maintains an Outperform rating and has reduced the price target from $75 to $60.

- Baird analyst Justin Kleber keeps an Outperform rating and has lowered the price target from $75 to $70.

- Oppenheimer analyst Brian Nagel reiterated an Outperform rating for Academy Sports, maintaining a price target of $85.

- BofA Securities analyst Robert Ohmes has lowered the price target to $75.

The stock had quadrupled in value in the last two years with all analysts having their price target above the stock price despite the last few months’ withdrawal. However as mentioned earlier Simeon Gurman has changed his rating which might be a cautionary signal.

Analyst Christopher Horvers of JP Morgan has currently the highest performing score on AOS with 5/6 (83.33%) price target fulfillment ratio. His price targets carry on average an $10.01 (25.42%) potential upside and are fulfilled within an average of 195 days.

Rent the Runway Exceeds on Revenue Increase, disappoints on outlook

Rent the Runway has announced its Q1 2023 financial results. The company reported a Q1 EPS of ($0.46), which was $0.02 better than the analyst estimate of ($0.48). Revenue for the quarter came in at $74.2 million, surpassing the consensus estimate of $72.99 million.

The company’s active subscriber count reached a record high of 145,220, indicating a 15% quarter-over-quarter growth. This growth was accompanied by a reduction in net loss, from $42.5 million in Q1 2022 to $30.1 million in Q1 2023. Adjusted EBITDA also showed a significant improvement, going from a loss of $8.8 million in Q1 2022 to a positive $4.5 million in Q1 2023.

Looking forward, Rent the Runway provided guidance for Q2 2024, expecting revenues in the range of $77-79 million, compared to the consensus estimate of $81 million. For the full fiscal year 2024, the company anticipates revenues between $320-330 million, closely aligning with the consensus estimate of $325 million.

Wall Street adjusts but not much

- Raymond James analyst Rick Paterson maintains an Outperform rating, but lowers the price target from $8 to $5.

- Telsey Advisory analyst Dana Telsey reiterates an Outperform rating and a $4 price target.

The stock had lost over 85% since its IPO at the end of 2021, some analysts such as Morgan Stanley Lauren Schenk and Michael Binetti of Credit Suisse have downgraded to a Hold rating last year. The rest still carry a Buy with potential upside in their price targets.

Analyst Ross Sandler Barclays has currently the highest performing score on RENT with 1/6 (16.67%) price target fulfillment ratio. His price targets carry on average an $4.75 (85.17%) potential upside and are fulfilled within average of 4 days.

HashiCorp Disappoints on Guidance Expectations:

HashiCorp has released financial results for the first quarter of fiscal 2024, ending April 30, 2023. The company reported a Q1 FY2024 EPS of ($0.07), which is an improvement over the analyst consensus estimate of ($0.14). The company’s revenue of $138 million did exceed the consensus estimate of $133.13 million.

Looking forward, HashiCorp’s guidance for Q2 FY2024 paints a less rosy picture. It predicts an EPS of ($0.16)-($0.14), which is worse than the consensus estimate of ($0.12). Also, the projected Q2 FY2024 revenue of $137-139 million is lower than the consensus estimate of $141 million, indicating a potential slowdown in sales.

For the full fiscal year 2024, HashiCorp’s projections are also lower than analyst expectations. They foresee an EPS of ($0.27)-($0.24), compared to the consensus estimate of ($0.39). Similarly, the expected revenue of $564-570 million falls short of the consensus estimate of $593 million.

Amidst these results and forecasts, HashiCorp has also announced a workforce reduction of approximately 8%. The company’s expressed commitment to breakeven by the second half of fiscal year 2025.

Wall Street Action

- Morgan Stanley analyst Sanjit Singh maintained an Equal-Weight rating, but reduced the price target from $37 to $30.

- Oppenheimer analyst Ittai Kidron reiterated an Outperform rating, maintaining a $42 price target.

- Needham analyst Alex Henderson continued to rate HashiCorp as a Buy, but lowered the price target from $39 to $34.

- BTIG analyst Gray Powell lowered the price target to $32.

- Wolfe Research analyst Alex Zukin reduced the price target to $30, down from $33.

- JPMorgan analyst Mark Murphy reduced his price target to $26.

- Goldman Sachs analyst Kash Rangan adjusted the price target to $30.

- Stifel analyst Brad Reback maintained a Buy rating, but lowered the price target from $38 to $31.

The stock has lost a bit more than half of its value since going public last year. Most analysts keep adjusting their price targets lower as the stock continues with its trend down with half keeping their Buy rating.

Analyst Sanjit Singh of Morgan Stanley has currently the highest performing score on HCP with 2/5 (40%) price target fulfillment ratio. His price targets carry on average an $13.69 (42.34%) potential upside and are fulfilled within average of 27 days.

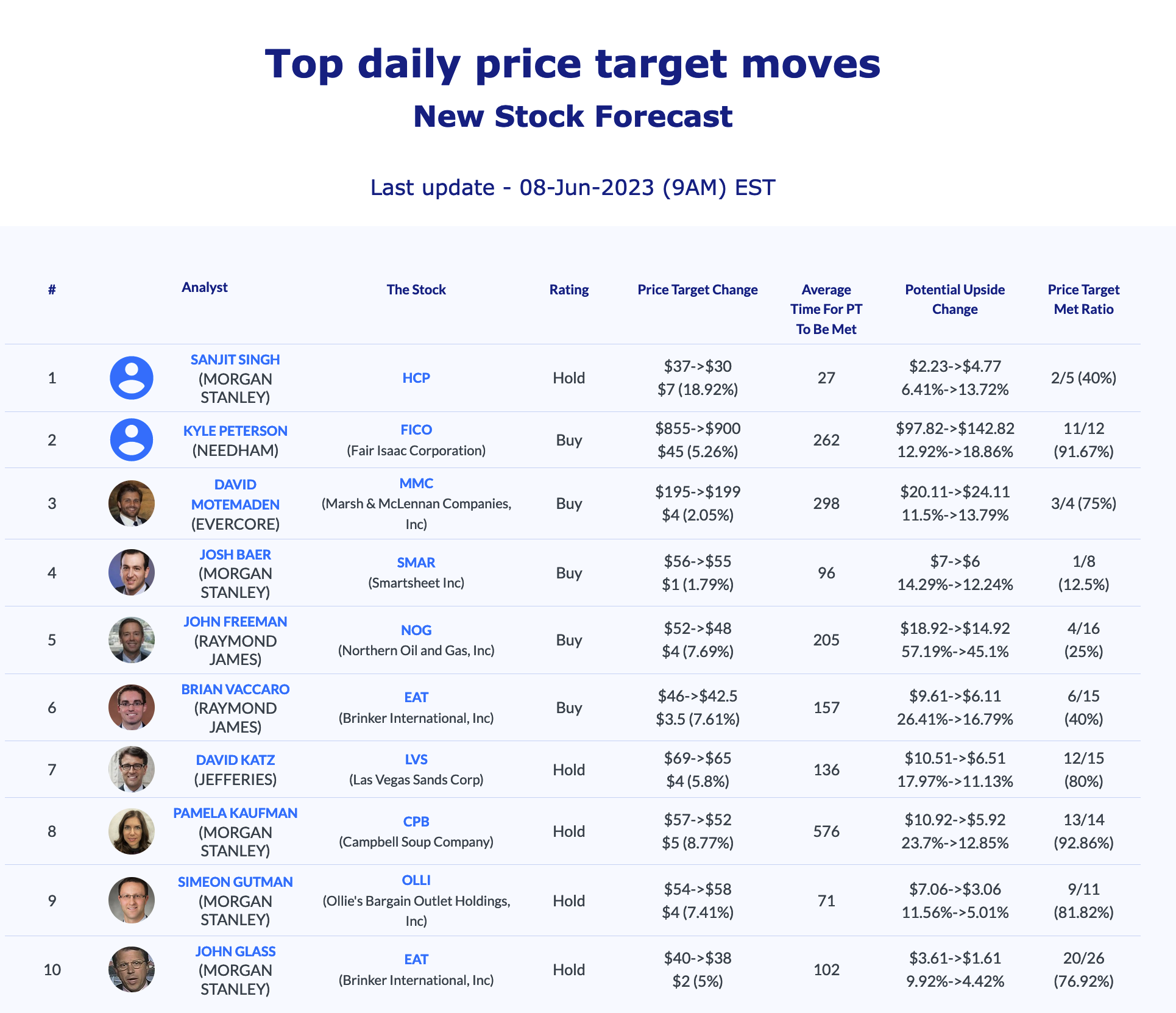

Daily stock Analysts Top Price Moves Snapshot