Selected stock price target news of the day - June 16, 2023

By Matthew Otto

Kroger Shares Fall Despite Beating Q1 Estimates; Analysts Give Mixed Reviews on Performance and Outlook

Kroger, the supermarket chain, has maintained its annual forecasts despite surpassing Wall Street estimates for first-quarter profit and same-store sales. This is a result of consistent demand for essentials and easing supply chain costs.

However, this conservative outlook led to a 4.5% drop in the company’s shares to $45.07, as investors were expecting an upgraded forecast. Telsey Advisory Group analyst, Joseph Feldman, noted that the market hoped Kroger would have shown stronger performance given the robust grocery sales at its competitors. Last month, Walmart, for instance, raised its annual forecasts as more Americans shopped for its lower-priced groceries and essentials.

Rodney McMullen, Kroger’s CEO, attributed the decision not to upgrade the forecast to the economic environment, which is significantly impacting its budget-conscious shoppers. McMullen pointed out that the least loyal customers were primarily focusing on the price at the shelf, over personalized offers, convenience, and quality.

In the first quarter, Kroger, which plans to acquire its smaller competitor Albertsons in a $25 billion deal, saw a 1.3% increase in net sales to $45.17 billion. However, this was slightly below the estimated $45.24 billion.

Despite not reaching top and bottom-line estimates this quarter, Kroger’s gross margins increased by 21 basis points, benefiting from lower supply chain costs and sourcing some products closer to its distribution centers. The company also profited from shoppers, including those with higher incomes seeking economical options amidst ongoing inflation, who preferred its store-label brands over more expensive national brands.

Wall Street Action

- Morgan Stanley analyst Simeon Gutman has maintained an Equal-Weight ratingand lowered the price target from $49 to $48.

- Telsey Advisory Group analyst Joseph Feldman has reiterated an Outperform rating on Kroger, maintaining a $55 price target.

- Evercore ISI analyst Michael Montani has lowered the price target to $54.

- Roth/MKM analyst Bill Kirk has lowered the price target to $48.

- UBS analyst Michael Lasser has lowered the price target to $48.

Analyst Scott Mushkin (R5 CAPITAL) has currently the highest performing score on KR with 1/2 (50%) price target fulfillment ratio. His price targets carry on average an $-0.59 (1.97%) potential downside and are fulfilled within an average of 53 days.

Jabil Exceeds Q3 Expectations, Raises Outlook for FY 2023 Amid Strong Performance

Jabil reported Q3 EPS (Earnings Per Share) of $1.99, surpassing the analyst estimate of $1.88. This better-than-expected EPS performance suggests that Jabil’s profitability was higher than what analysts predicted, adding to the company’s positive earnings surprise.

Furthermore, Jabil’s Q3 revenue was $8.5 billion, which also outpaced the consensus estimate of $8.19 billion. This indicates that the company’s sales performance was stronger than what was forecasted by the market analysts.

Looking ahead, Jabil’s guidance for Q4 2023 is projecting an EPS of between $2.14 and $2.50, in comparison to the consensus estimate of $2.30. Also, Jabil expects Q4 2023 revenue of $8.2 to $8.8 billion, compared to the consensus estimate of $8.57 billion. It will be interesting to watch whether Jabil can continue to outperform market expectations in the next quarter.

Wall Street Action

- Credit Suisse analyst Shannon Cross keeps Jabil with an Outperform rating and lifts the price target from $110 to $125.

- Raymond James analyst Melissa Fairbanks maintains Jabil with a Strong Buy rating and raises the price target from $100 to $120.

- Stifel analyst Matthew Sheerin raised Jabil’s price target to $115.

- BofA Securities analyst Ruplu Bhattacharya raised the price target for Jabil to $108.

Analyst Mark Delaney (GOLDMAN) has currently the highest performing score on JBL with 14/14 (100%) price target fulfillment ratio. His price targets carry on average an $3.27 (7.23%) potential upside and are fulfilled within average of 89 days.

American Express gets Warning From Citi of Slowing Credit Card Spending

Citigroup warned about decelerating American Express credit card spending trends. The downward movement came as Citigroup initiated a negative catalyst watch on the credit card company, citing a sharper than expected slowdown in travel and entertainment categories.

Analysts Maintain Cautious Outlook on American Express Amid Slowing Spending Trends

- Citigroup analyst Arren Cyganovich has maintained a Sell rating on American Express and lowered the price target from $150 to $148.

- Stephens & Co. analyst Vincent Caintic has reiterated an Underweight rating on American Express and maintained a $146 price target.

Analyst Moshe Orenbuch (CREDIT SUISSE) has currently the highest performing score on AXP with 22/24 (91.67%) price target fulfillment ratio. His price targets carry on average an $-0.38 (5.45%) potential downside and are fulfilled within average of 169 days.

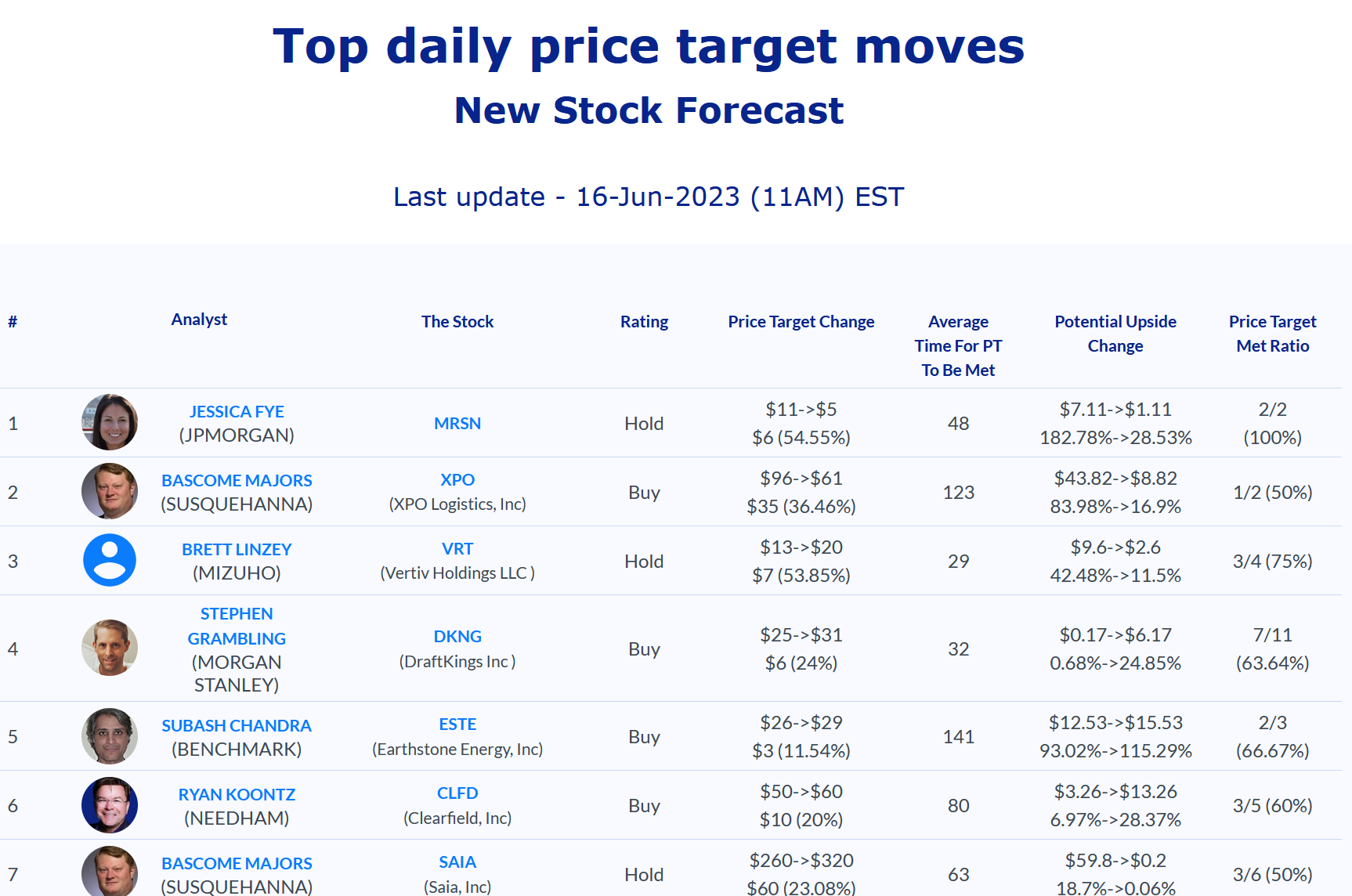

Daily stock Analysts Top Price Moves Snapshot