Selected stock price target news of the day - May 26, 2023

By Matthew Otto

Workday Reports Strong Fiscal 2024 Q1 Results: Subscription Revenues Surge 20%

Workday, Inc.announced its fiscal 2024 first quarter financial results, showing significant growth. Total revenues were $1.68 billion versus an anticipated $1.67 billion, a 17.4% increase compared to the same period last year. Subscription revenues stood at $1.53 billion, up 20.1% from last year. Workday’s Q1 adjusted earnings per share came in at $1.31, outperforming the $1.12 forecast by Refinitiv analysts

The operating loss decreased from $72.8 million, or -5.1% of revenues, in the first quarter of fiscal 2023, to $19.8 million, or -1.2% of revenues. This was countered by a non-GAAP operating income of $395.9 million, a significant increase from $288.6 million the previous year.

Workday executives expressed a strong commitment to continued innovation and incorporation of artificial intelligence and machine learning across their entire product portfolio. The company’s first quarter results exceeded the company’s forecast, with revenue up 16%, and subscription revenue up 19%. The company also announced the appointment of Zane Rowe as chief financial officer.

For the full year ending in January 2024, Workday forecasts subscription revenue of $6.55 billion to $6.575 billion, lifting the bottom end of the forecast range slightly from the previous quarter, with a growth rate of 18%. The company’s 24-month subscription revenue backlog was reported at $9.79 billion, up 23% and beating the guidance of a 20% gain.

Workday Sees Bullish Analyst Forecast Following Strong Q1 Earnings, New CFO Announcement

- Morgan Stanley analyst Keith Weiss maintains an Overweight rating, increasing the price target from $230 to $250.

- BMO Capital analyst Daniel Jester sustains an Outperform rating, lifting the price target from $205 to $240.

- Wells Fargo analyst Michael Turrin holds an Overweight rating, revising the price target upwards from $250 to $260.

- TD Cowen analyst J. Derrick Wood continues an Outperform rating, raising the price target from $230 to $250.

- B of A Securities analyst Brad Sills sticks to a Buy rating, adjusting the price target from $220 to $250.

- Stifel analyst Brad Reback maintains a Hold rating, edging up the price target from $200 to $205.

- Mizuho analyst Siti Panigrahi upholds a Buy rating, bumping the price target from $225 to $250.

- Baird analyst Mark Marcon preserves an Outperform rating, escalating the price target from $220 to $245.

- Needham analyst Scott Berg reiterates a Buy rating, sustaining the $220 price target.

- Citigroup analyst Steven Enders holds a Neutral rating, advancing the price target from $203 to $220.

- JMP Securities analyst Patrick Walravens sustains a Market Outperform rating, moving the price target from $210 to $252.

- Jefferies analyst Brent Thill keeps a Buy rating, elevating the price target from $235 to $250.

- Barclays analyst Raimo Lenschow retains an Overweight rating, boosting the price target from $216 to $243.

- Piper Sandler analyst Brent Bracelin continues an Overweight rating, upping the price target from $215 to $247.

- Morgan Stanley analyst Keith Weiss elevates the price target to $240.

- DA Davidson analyst Robert Simmons increases Workday’s price target to $240.

- Mizuho Securities analyst Siti Panigrahi lifts the price target to $250.

- Oppenheimer analyst Ken Wong raises the price target to $240.

Looking at AnaChart we see that the stock is rebounding steadily from the lows of last year with most analysts bullish. Noticeable more conservative views belong to Guggenheim analyst John DiFucci at$142 and Loop Capital analyst Yun Ki at $180.

Marvell Projects Doubling of AI Revenue

Marvell Technology Group delivered a strong earnings report and offered an optimistic guidance that exceeded Wall Street’s expectations. The company reported adjusted earnings per share of 31 cents for the quarter ending in April, outperforming the consensus estimate of 29 cents from Wall Street analysts, as tracked by FactSet. Moreover, the firm’s revenue of $1.32 billion surpassed analysts’ expectations of $1.3 billion.

The company anticipates a range of possible revenue for the current quarter, with a midpoint estimate of $1.33 billion. This figure is notably higher than the consensus estimate of $1.31 billion.

Marvell CEO Matt Murphy emphasized the crucial role of Artificial Intelligence (AI) in driving the company’s growth. “AI has emerged as a key growth driver for Marvell, which we are enabling with our leading network connectivity products and emerging cloud-optimized silicon platform,” Murphy stated. The company expects its AI revenue in fiscal 2024 to at least double from the previous year and foresees rapid growth in subsequent years.

Marvell is a key player in the semiconductor industry, offering a diverse portfolio of chips and hardware products that cater to data centers, 5G infrastructure, networking, and storage markets.

Wall Street Action

- Srini Pajjuri of Raymond James maintains an Outperform rating and has raised the price target from $50 to $64.

- Morgan Stanley’s Joseph Moore keeps an Equal-Weight rating, increasing the price target from $45 to $55.

- Christopher Rolland from Susquehanna reiterates a Positive rating and adjusts the price target from $53 to $60.

- Wells Fargo analyst Gary Mobley maintains an Overweight rating and elevates the price target from $54 to $65.

- Matthew Ramsay of TD Cowen holds onto an Outperform rating and hikes the price target from $50 to $65.

- Tore Svanberg from Stifel keeps a Buy rating and raises the price target from $56 to $65.

- Vivek Arya of B of A Securities maintains a Buy rating and boosts the price target from $51 to $70.

- Needham’s Quinn Bolton reiterates a Buy rating and enhances the price target from $50 to $65.

- Barclays analyst Blayne Curtis holds an Overweight rating, lifting the price target from $45 to $55.

- Atif Malik from Citigroup keeps a Buy rating, raising the price target from $58 to $61.

- Deutsche Bank’s Ross Seymore maintains a Buy rating, increasing the price target from $50 to $65.

- John Vinh of Keybanc keeps an Overweight rating and boosts the price target from $60 to $70.

- Toshiya Hari of Goldman Sachs raised the price target to $60.

Looking at AnaChart we see that all analysts had been bullish on Marvell while it lost half of its value in 2021 (see snapshot below), Noticeable bull is Hans Mosesmann of Rosenblatt

Ulta Beauty Cuts Annual Operating Margin Forecast Amid Rising Costs

Cosmetics retailer, Ulta Beauty, has revised its annual operating margin forecast downward, suggesting increasing pressure from higher inventory shrink and supply chain costs.

Despite hiking prices in the second half of 2022 to protect its margin, Ulta Beauty found the benefits overshadowed by escalating store expenses and wage pressures. Moreover, concerns about inflation and a potential recession have led consumers to curtail their spending on discretionary items, such as cosmetics and fragrances.

Ulta Beauty CEO David Kimbell acknowledged these market pressures, noting that “inflation concerns remain high and consumers are spending more selectively.” The company’s CFO, Scott Settersten, also mentioned the expectation of moderation in beauty category growth and an increase in promotional environments as the company entered 2023.

Ulta now projects an annual operating margin between 14.5% and 14.8%, a reduction from its earlier forecast of 14.7% to 15.0%. Despite this, the company increased its annual sales forecast.

Like other retailers such as Target Corp and Foot Locker Inc, Ulta Beauty also highlighted growing concerns over theft and organized crime that have contributed to an inventory shrink or loss.

Ulta Beauty, which sells its own range of products in addition to high-end beauty brands like Bobbi Brown and Hourglass, and celebrity-led cosmetic lines from stars like Ariana Grande and Kylie Jenner, reported a 12.3% rise in revenue to $2.63 billion in the first quarter ending April 29, slightly beating analysts’ average estimate of $2.62 billion.

Wall Street Action

- Oppenheimer analyst Rupesh Parikh maintains an “Outperform” rating on Ulta Beauty, but lowered the price target from $575 to $540.

- Canaccord Genuity’s Susan Anderson also maintains a “Buy” rating, revising her price target down from $622 to $606 and taking over as street high.

- DA Davidson’s Michael Baker is in line with Oppenheimer, maintaining a “Buy” rating while dropping the price target from $620 to $540.

- BMO Capital’s Simeon Siegel held his “Market Perform” rating, but adjusted his price target downwards from $510 to $485.

- Morgan Stanley’s Simeon Gutman kept an “Equal-Weight” rating, decreasing his price target from $535 to $520.

- Raymond James analyst Olivia Tong holds a “Strong Buy” stance on Ulta Beauty, with a revised price target of $600, down from $615.

- Wells Fargo’s Ike Boruchow is maintaining an “Underweight” rating on Ulta Beauty, significantly dropping his price target from $400 to $350.

- B of A Securities analyst Lorraine Hutchinson continues with a “Neutral” rating, lowering her price target from $540 to $490.

- Stifel’s Mark Astrachan also maintains a “Hold” rating, with a reduced price target of $475, down from $525.

- Baird’s Mark Altschwager is keeping an “Outperform” rating, lowering his price target from $580 to $560.

- Citigroup’s Kelly Crago maintains a “Neutral” rating on Ulta Beauty, reducing her price target from $510 to $460.

- Finally, Telsey Advisory Group’s Dana Telsey reiterates an “Outperform” rating and maintains her $600 price target.

- Oppenheimer analyst Rupesh Parikh has revised his price target to $540.

Looking at AnaChart we see that ULTA is traded at near all time high. Loop Capital analyst Anthony Chukumb is has a reserved look with $500 stock forecast and a Hold rating along with the above mentioned Wells Fargo’s Ike Boruchow

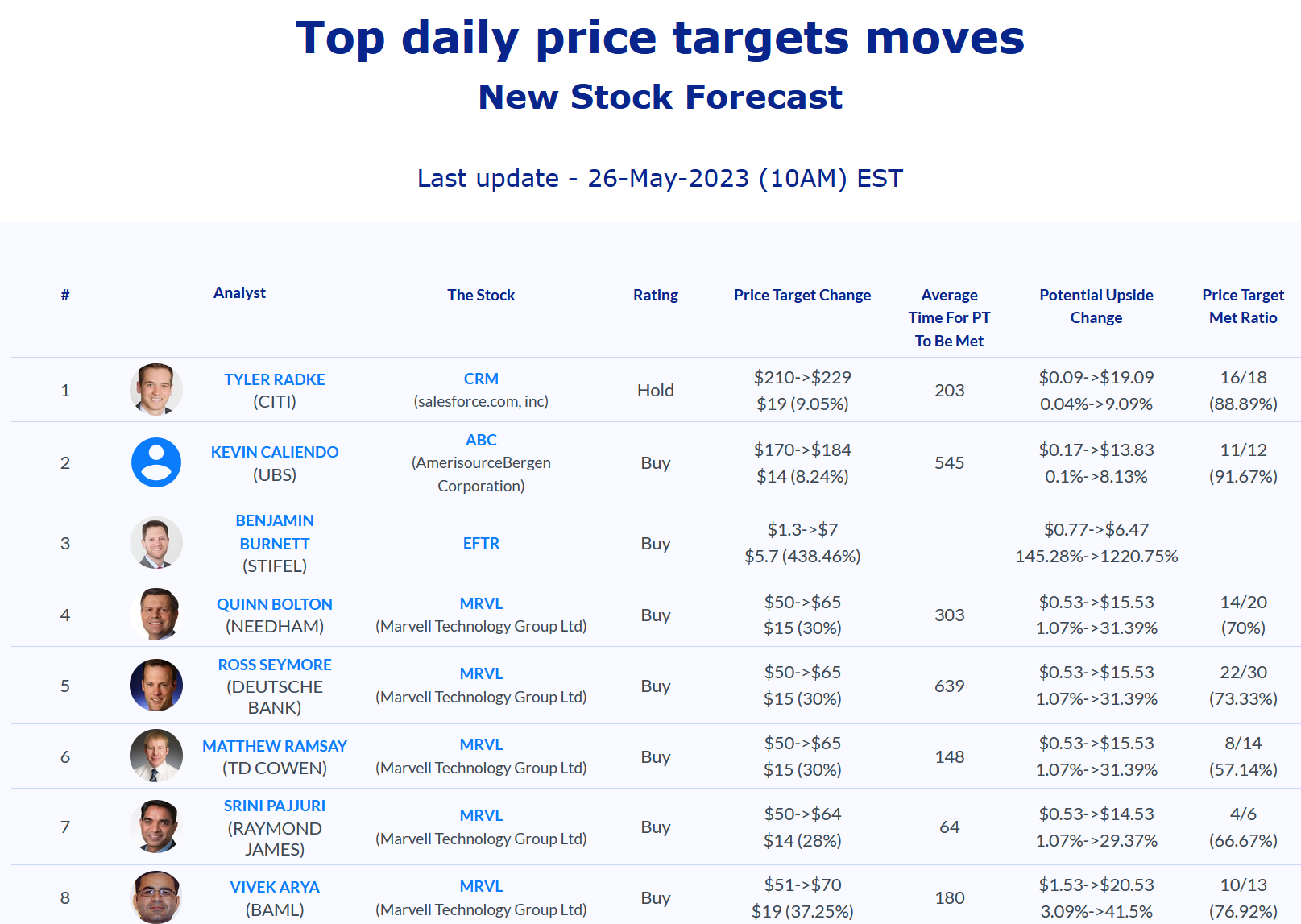

Daily stock Analysts Top Price Moves Snapshot