Selected stock price target news of the day - September 01, 2023

By: Matthew Otto

MongoDB’s Q2 FY2024 Financial Performance Highlights Growth

In the second quarter of fiscal year 2024, MongoDB showcased financial performance across various key metrics. The company reported a total revenue of $423.8 million, marking a substantial 40% year-over-year increase. This growth was driven in large part by MongoDB’s cloud-native database service, Atlas, which experienced a 38% year-over-year growth. Atlas now represents a significant portion of MongoDB’s revenue, accounting for 63% and boasting a revenue run rate exceeding $1 billion.

MongoDB’s customer acquisition efforts also paid off during the quarter, with the addition of 1,900 new customers, bringing the total customer count to over 45,000. The direct sales team played a pivotal role in this growth, adding more than 1,900 new customers and increasing the count of direct sales customers to over 6,800, reflecting a year-over-year increase. Strong retention rates further highlighted the platform’s mission-critical nature.

Furthermore, MongoDB’s financial strength was evident in its gross profit of $329 million, a gross margin of 78%, a significant improvement from the previous year. The company also has a net income of $76.7 million, or $0.93 per share, compared to a net loss in the same period the previous year.

Analysts Bullish on MongoDB as Price Targets Get Lifted

- JMP Securities analyst Patrick Walravens maintained a Market Outperform rating and increased the price target from $425 to $440.

- Needham analyst Mike Cikos reiterated a Buy rating and raised the price target from $430 to $445.

- Piper Sandler analyst Brent Bracelin maintained an Overweight rating and lifted the price target from $400 to $425.

Analyst Brent Bracelin (PIPER SANDLER) currently has the highest performing score on MDB with 23/25 (92%) price target fulfillment ratio. His price targets carry an average of $44.76 (19.92%) potential upside. MongoDB stock price reaches these price targets on average within 92 days.

Dollar General Q2 2023 Financial Highlights

In the second quarter of 2023, Dollar General reported a gross profit margin of 31.1%, reflecting a 1.26% decrease compared to the same period in the previous year. This decline was primarily attributed to lower markups, increased shrink, markdowns, and inventory damages, exacerbated by a larger proportion of sales coming from consumable products. Despite these challenges, Dollar General noted decreased LIFO (Last In, First Out) provision and lower transportation costs as partially offsetting factors.

On the operating expense front, Dollar General reported SG&A (Selling, General, and Administrative) expenses as a percentage of sales to be 24%. This represented an increase of 1.36% compared to the previous year’s second quarter. This uptick was primarily driven by investments in retail labor, including a $40 million targeted labor investment, as well as costs related to utilities, depreciation, and amortization, and rent.

Dollar General’s operating profit for the second quarter of 2023 was $692 million, marking a 24.2% decrease from the same quarter in the previous year. As a percentage of sales, the operating profit margin stood at 7.1%, reflecting a 2.62% decrease year-over-year. The company also noted increased interest expenses, which rose to $84 million from $43 million in the previous year’s second quarter, driven by higher average borrowings and interest rates.

Analyst Ratings and Price Target Adjustments

- Goldman Sachs analyst Kate McShane maintained a Buy rating but lowered the price target from $216 to $160.

- BMO Capital analyst Kelly Bania reiterated a Market Perform rating but lowered the price target from $175 to $135.

- Evercore ISI Group analyst Michael Montani downgraded from Outperform to Neutral and the price target from $185 to $150.

- Loop Capital analyst Anthony Chukumba downgraded from Buy to Hold and the price target from $200 to $140.

- Raymond James analyst Bobby Griffin lowered from Strong Buy to Outperform and the price target from $200 to $160.

- Telsey Advisory Group analyst Joseph Feldman lowered from Outperform to Market Perform and the price target from $185 to $145.

Analyst Kelly Bania (BMO) currently has the highest performing score on DG with 11/16 (68.75%) price target fulfillment ratio. Her price targets carry an average of $16.7 (11.23%) potential upside. Dollar General stock price reaches these price targets on average within 223 days.

Lululemon Reports Q2 2023 Performance, Demonstrating Growth

Lululemon Athletica announced its financial results for the second quarter of 2023, reporting an 18% increase in net revenue, reaching $2.2 billion versus the consensus estimate of $2.17 billion, with growth figures both in North America (11%) and internationally (52%). The company’s direct-to-consumer net revenue accounted for 40% of the total, slightly down from the previous year.

The company’s gross profit for the quarter surged by 23% to $1.3 billion, with a notable gross margin increase of 230 basis points to 58.8%. Lululemon’s income from operations increased by 19% to $479.3 million, with an operating margin of 21.7%, up 20 basis points. Despite the increase in income tax expense by 30% to $145 million, the effective tax rate for the second quarter was 29.8%, reflecting the dynamic operating environment. These financials led to diluted earnings per share of $2.68, compared to $2.26 in the second quarter of 2022, and it is $0.15 better than the analyst estimate of $2.53.

Lululemon anticipates continued growth in the range of 17% to 18% for both net revenue and diluted earnings per share in the third quarter. For the full year, the company projects net revenue growth in the same range, with diluted earnings per share expected to be between $12.02 and $12.17.

Analysts Maintain Positive Outlook for Lululemon Athletica

- Guggenheim analyst Gregory Francfort reiterated a Buy rating and a $440 price target.

- Stifel analyst Jim Duffy maintained a Buy rating and raised the price target from $460 to $463.

- Wells Fargo analyst Ike Boruchow maintained an Overweight rating and increased the price target from $425 to $445.

- Oppenheimer analyst Brian Nagel reiterated an Outperform rating and raised the price target from $400 to $450.

- BMO Capital analyst Simeon Siegel kept a Market Perform rating and upgraded the price target from $355 to $376.

- Raymond James analyst Rick Patel kept a Strong Buy rating and raised the price target from $438 to $440.

- Telsey Advisory Group analyst Dana Telsey maintained an Outperform rating and increased the price target from $430 to $450.

- Keybanc analyst Noah Zatzkin reiterated an Overweight rating and raised the price target from $425 to $450.

Analyst Abbie Zvejnieks (PIPER SANDLER) currently has the highest performing score on LULU with 6/8 (75%) price target fulfillment ratio. Her price targets carry an average of 6/8 (75%) potential upside. Lululemon Athletica stock price reaches these price targets on average within 79 days.

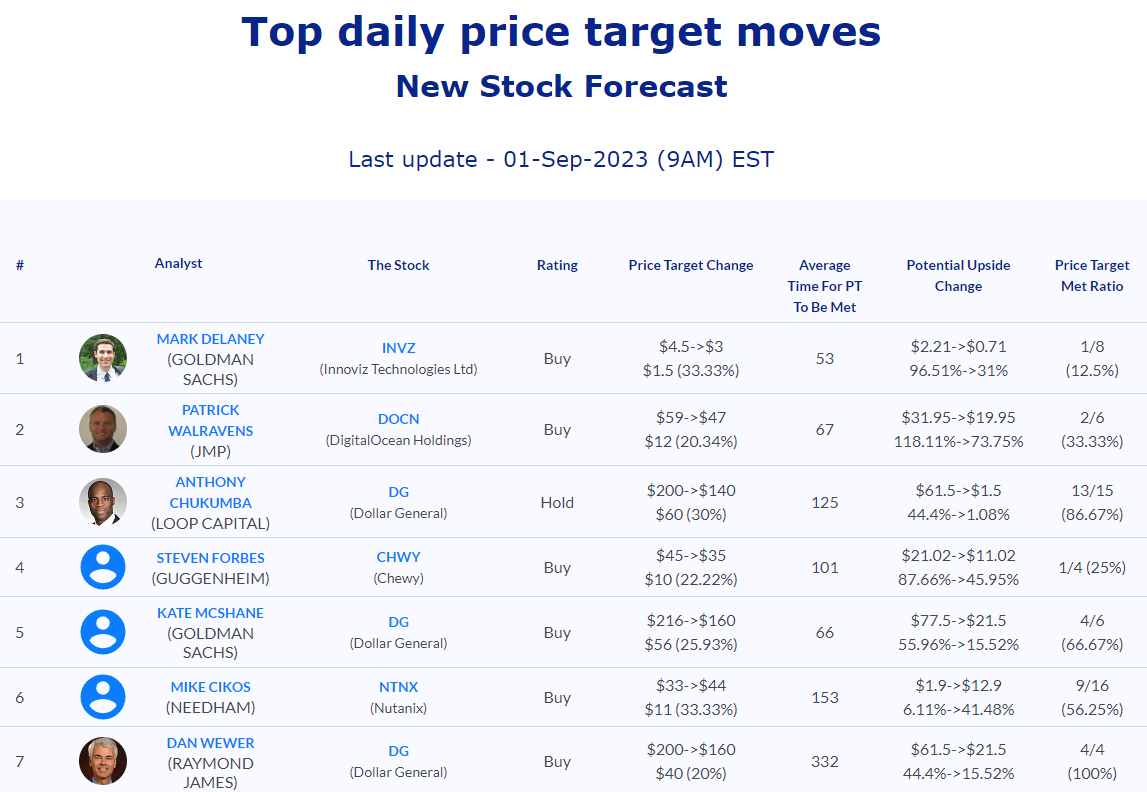

Daily stock Analysts Top Price Moves Snapshot