Selected stock price target news of the day - September 10th, 2024

By: Matthew Otto

Oracle Surpasses Earnings Expectations, and Secures Key AWS Partnership

Oracle Corporation reported its fiscal first-quarter 2025 earnings, posting adjusted earnings per share (EPS) of $1.39, beating the consensus estimate of $1.33. Total revenue for the quarter was $13.3 billion, slightly ahead of expectations at $13.2 billion.

Oracle’s cloud infrastructure business experienced growth, with revenue rising 45% to $2.2 billion. Additionally, Oracle saw a 10% increase in cloud application revenue, reaching $3.5 billion. These results were driven by AI training capacity on Oracle Cloud Infrastructure (OCI), which grew 49% compared to the previous year. Oracle’s recent multi-cloud partnership with Amazon Web Services is expected to further bolster its cloud offerings.

The results have been favorable by Analysts, with D.A. Davidson’s Gil Luria raising the price target from $105 to $140 while maintaining a neutral rating, and Morgan Stanley’s Keith Weiss highlighting Oracle’s outperformance compared to software peers, particularly due to the scarcity in AI hardware.

Looking ahead, the company anticipates total revenue growth of 7% to 9% for the next quarter, with cloud revenue expected to increase by 23% to 25%.

Analysts Boost Price Targets After Strong Q1 Performance

- TD Cowen analyst Derrick Wood maintained a Buy rating and raised the price target from $165 to $180.

- KeyBanc analyst Jason Ader maintained an Overweight rating and lifted the price target from $165 to $175.

- BMO Capital analyst Keith Bachman kept a Market Perform rating while increasing the price target from $160 to $173.

- Morgan Stanley analyst Keith Weiss reiterated an Equal-Weight rating but raised the price target from $125 to $145.

- BofA Securities analyst Brad Sills maintained a Neutral rating and pushed the price target up from $155 to $175.

- JMP Securities analyst Patrick Walravens upgraded from Market Perform to Market Outperform and set a new price target at $175.

- Piper Sandler analyst Brent Bracelin held an Overweight rating while raising the price target from $150 to $175.

Which Analyst has the best track record to show on ORCL?

Analyst Tyler Radke (CITI) currently has the highest performing score on ORCL with 10/10 (100%) price target fulfillment ratio. His price targets carry an average of $-0.38 (-0.27%) potential downside. Oracle Corporation stock price reaches these price targets on average within 104 days.

ABM Industries Exceeds Q3 Earnings Expectations and Raises 2024 Outlook

ABM Industries reported third-quarter 2024 earnings, with an EPS of $0.94, beating the analyst estimate of $0.86 by $0.08. Generated $2.1 billion in revenue for the quarter, surpassing the consensus estimate of $2.04 billion.

The Aviation segment saw a 13% revenue boost, while Technical Solutions grew by 25%, supported by microgrid project activity.Despite a slight decline in its Business & Industry (B&I) segment, ABM’s diversified portfolio and geographical spread helped maintain its resilience.

Following these results, ABM raised its outlook for fiscal year 2024 adjusted EPS to a range of $3.48 to $3.55, up from its previous guidance of $3.40 to $3.50. Anticipates maintaining adjusted EBITDA margins around 6.3% for the year and expects free cash flow to approach the higher end of its forecasted range of $240 million to $270 million.

Analysts Adjust Price Targets Amid Q3 Results and Upgraded Outlook

- UBS analyst Joshua Chan maintained a Neutral rating and raised the price target from $51 to $55.

- Truist Securities analyst Jasper Bibb Kept a Hold rating but increased the price target from $49 to $55.

- Baird analyst Andrew Wittmann kept a Neutral stance while raising the price target from $49 to $56.

- Deutsche Bank analyst Fawne Alwy set a new price target of $55.

Which Analyst has the best track record to show on ABM?

Analyst Andrew Wittmann (BAIRD) currently has the highest performing score on ABM with 19/20 (95%) price target fulfillment ratio. His price targets carry an average of $-1.09 (-2.18%) potential downside. ABM Industries stock price reaches these price targets on average within 573 days.

BRP Sees Revenue Plunge 33.7% in Q2 FY 2025 Amid Inventory Cutbacks

BRP reported its second-quarter results for fiscal year 2025, with revenues dropping by 33.7% to $1,841.9 million from $2,778.0 million in Q2 2023. Gross profit for the quarter decreased by 46.0% to $376.5 million, with the gross profit margin falling to 20.4% from 25.1% year-over-year.

Normalized EBITDA dropped 58.0% to $198.5 million, and net income fell by $331.5 million to $7.2 million. Normalized diluted earnings per share (EPS) were $0.61, down from $3.21, and diluted EPS was $0.09, down from $4.26.

In terms of retail performance, BRP’s North American Powersports sales declined by 18% from the previous year. BRP experienced mixed results across its markets, with Latin America showing an 18% increase in retail sales, while other regions like North America, EMEA, and Asia Pacific saw declines. Additionally, BRP has reduced its network inventory by 13% so far this year, working towards a target reduction of 15% to 20% by the end of fiscal 2025.

Looking ahead, BRP revised guidance for the remainder of the year anticipates revenues between $7.8 billion and $8 billion, with normalized EBITDA expected to be between $890 million and $940 million.

Analysts Downgrade and Adjust Price Targets Amid Q2 Results

- CIBC analyst Mark Petrie downgraded from Outperformer to Neutral and the price target from $100 to $92.

- Citigroup analyst James Hardiman maintained a Buy rating but lowered the price target from $80 to $75.

- RBC Capital analyst Sabahat Khan kept an Outperform rating and decreased the price target from $108 to $99.

- BMO Capital analyst Tristan Thomas-Martin lowered the price target to $100 from $115.

- Baird analyst Craig Kennison reduced the price target to $68.

- Desjardins analyst Benoit Poirier downgraded from Buy to Hold and set a price target of $94.

- Scotiabank analyst Jonathan Goldman downgraded to Sector Perform.

Which Analyst has the best track record to show on DOOO?

Analyst James Hardiman (CITI) currently has the highest performing score on DOOO with 2/4 (50%) price target fulfillment ratio. His price targets carry an average of $9.11 (12.85%) potential upside. BRP stock price reaches these price targets on average within 151 days.

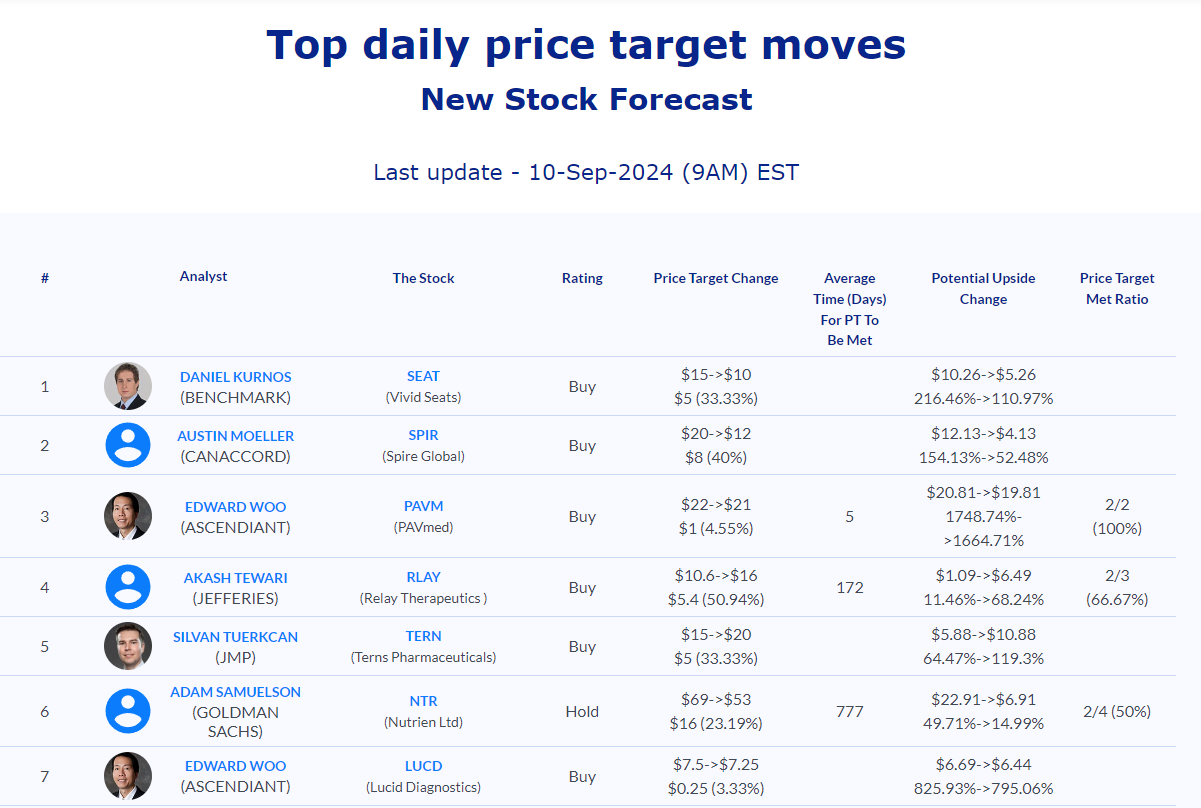

Daily stock Analysts Top Price Moves Snapshot