Selected stock price target news of the day - September 11, 2023

By: Matthew Otto

Smartsheet Q2 2024 Performance Signals Path to $1 Billion ARR Milestone

Smartsheet has reported financial results for the second quarter of fiscal year 2024. The company’s revenue soared to $235.6 million, reflecting a 26% year-over-year growth. Equally notable, billings surged by 18%, reaching a total of $243.1 million during this quarter. Notably, annual recurring revenue (ARR) is now at a $933 million, putting Smartsheet on a trajectory to surpass $1 billion in ARR by the end of the fiscal year.

The company’s customer base grew with over 9,400 enterprise customers, which are organizations with more than 2,000 employees. These enterprise customers contribute to Smartsheet’s ARR, accounting for over 50% of their recurring revenue. Moreover, Smartsheet experienced expansions, with 75 customers increasing their Smartsheet investment by over $100,000 in Q2, while 232 companies expanded by more than $50,000. Additionally, Smartsheet successfully closed three transactions exceeding $1 million each, solidifying its position with 51 customers boasting ARR over $1 million.

Smartsheet increased the cell links limit from 30,000 to an impressive 0.5 million per sheet. Moreover, they have plans to achieve another 10x increase in scale next year, aiming for a staggering 5 million cell links per sheet.

Analysts Raise Price Targets Expressing Confidence in Growth

- Barclays analyst Ryan Macwilliams maintained an Equal-Weight rating and raised the price target from $45 to $50.

- Citigroup analyst Tyler Radke reiterated a Neutral rating and increased the price target from $49 to $52.

- Canaccord Genuity analyst David Hynes kept a Buy rating and raised the price target from $50 to $53.

- BMO Capital analyst Keith Bachman maintained an Outperform rating and upgraded the price target from $44 to $50.

- Morgan Stanley analyst Josh Baer maintained an Overweight rating and raised the price target from $55 to $56.

Analyst Tyler Radke (CITI) currently has the highest performing score on SMAR with 6/11 (54.55%) price target fulfillment ratio. His price targets carry an average of $8.82 (15.75%) potential upside. Smartsheet stock price reaches these price targets on average within 38 days.

Restoration Hardware Faces Challenges as Slower Sales and Revenue Warning Emerge

RH announced a third-quarter revenue forecast of $740 million to $760 million, falling short of the average Wall Street analyst estimate of $772.87 million. This outlook comes on the heels of RH’s second-quarter performance, which saw a 19% drop in net revenue to $800 million and a 37% slump in net income to $76.5 million, primarily due to weakened demand for luxury furniture items.

Restoration Hardware Chairman and CEO Gary Friedman expressed concerns about the luxury housing market and the broader economy, expecting them to remain challenging throughout fiscal 2023 and into the following year. One significant factor contributing to these challenges is the continuation of high mortgage rates, with expectations for rates to remain unchanged until the second quarter of 2024. While analysts reacted differently to RH’s report, with some lowering price targets and others raising them, the company remains cautiously optimistic as it prepares to invest $50 million in increased advertising costs, anticipating the launch of its product catalog across homes in the United States and the UK.

Analysts React with Price Target Adjustments

- Citigroup analyst Steven Zaccone maintained a Buy rating and lowered the price target from $460 to $440.

- UBS analyst Michael Lasser reiterated a Neutral rating and lowered the price target from $350 to $340.

- Wells Fargo analyst Zachary Fadem maintained an Overweight rating and raised the price target from $300 to $375.

Analyst Zachary Fadem (WELLS FARGO) currently has the highest performing score on RH with 17/20 (85%) price target fulfillment ratio. His price targets carry an average of $47.17 (22.08%) potential upside. RH stock price reaches these price targets on average within 85 days.

Lantronix Q4 2023 Financial Performance: Insights and Projections

Lantronix has unveiled its financial results for the fourth quarter of fiscal year 2023. During this period, the company reported $34.9 million in revenue, exhibiting a 6% uptick compared to the previous quarter, albeit a 3% decline year-over-year. This increase was largely attributed to the sales in their Embedded Solutions division, especially a $3.4 million deal with an in-flight infotainment customer. In contrast, System Solutions remained relatively stable, while Software and Services revenues experienced a dip due to decreased design services revenue.

Notably, Lantronix’s gross margin for Q4 2023 was 39.5%, down from 44.4% in the previous quarter and 41.9% for the same period in the previous year. This dip primarily resulted from shifts in product mix, with increased sales in embedded computing and decreased sales in the out-of-band products category. The company anticipates a return to mid-40s gross margins in the upcoming quarters. Lantronix’s CEO and CFO, Jeremy Whitaker, expressed optimism regarding fiscal year 2024, citing a strong backlog, steady demand, and promising compute solutions in areas such as smart grids, intelligent vehicles, and enterprise video, projecting over 30% growth for the year and revenue in the range of $175 million to $185 million.

Analysts Express Confidence with Buy Ratings and Price Target Adjustments

- Roth Capital analyst Scott Searle reiterated a Buy rating and a $12 price target.

- Canaccord Genuity analyst Michael Walkley maintained a Buy rating and raised the price target from $9 to $10.

Analyst Scott Searle (ROTH) currently has the highest performing score on LTRX with 6/11 (54.55%) price target fulfillment ratio. His price targets carry an average of $39.19 (11.81%) potential upside. Lantronix stock price reaches these price targets on average within 350 days.

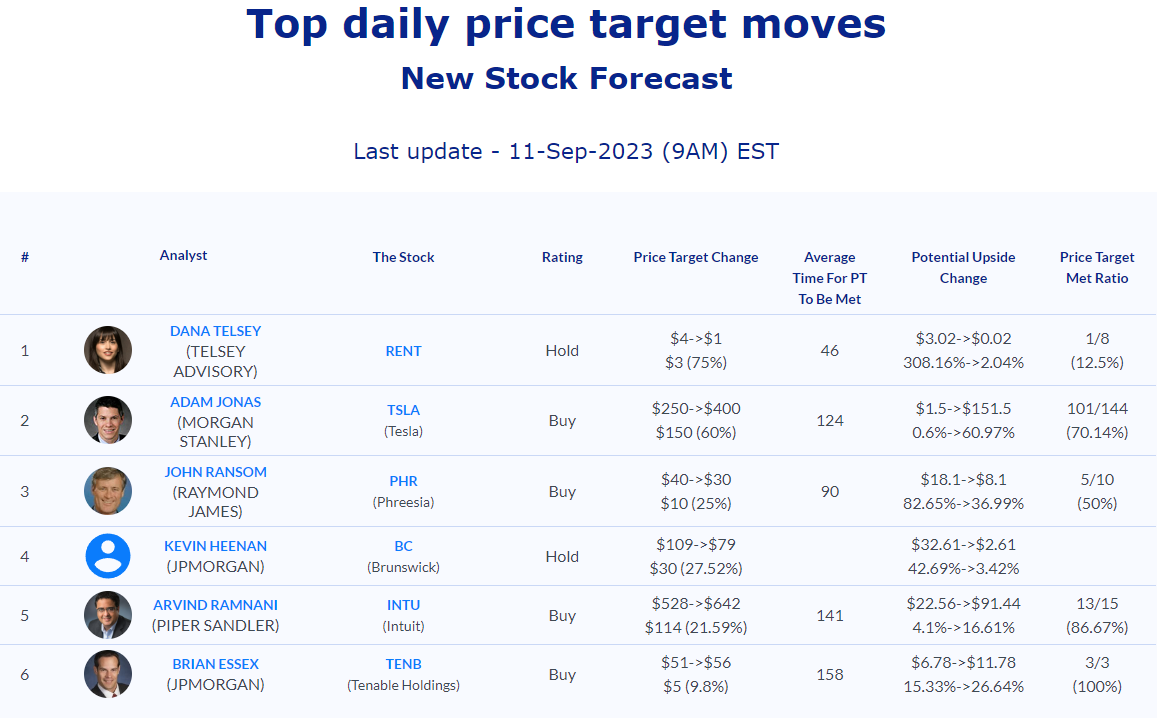

Daily stock Analysts Top Price Moves Snapshot