Selected stock price target news of the day - September 12, 2023

By: Matthew Otto

Oracle’s Q1 2024 Cloud Revenue Spurs Analyst Debate on Future Prospects

Oracle Corporation has reported financial results for Q1 2024, with growth in cloud-related revenue. Total cloud revenue, including Software as a Service (SaaS) and Infrastructure as a Service (IaaS), reached $4.6 billion, marking a 29% increase compared to the previous year. Excluding Cerner, cloud revenue still demonstrated a growth at 29%, amounting to $4 billion. The growth in Oracle’s cloud services and license support revenue also stood out, reaching $9.5 billion, up by 12% year-over-year.

Oracle’s cloud infrastructure business has been a key driver of growth, with IaaS revenue surging by 64% to $1.5 billion. SaaS revenue reached $3.1 billion, showcasing a 17% increase. Moreover, Oracle’s strategic back-office SaaS applications, which encompass a range of services, including product support, reported annualized revenue of $6.9 billion, with a growth rate of 20%.

Analysts have offered varying perspectives on Oracle’s performance and outlook. Global Equities Research, led by Trip Chowdry, sees a promising opportunity in Oracle’s cloud infrastructure revenue growth and its ability to charge premium prices compared to competitors. They have set a price target of $140 for Oracle shares.

Guggenheim analysts, led by John DiFucci, remain bullish on Oracle’s growth story, despite the disappointing guidance, assigning a price target of $150 to the stock. However, D.A. Davidson analyst Gil Luria is more cautious, lowering their price target for Oracle shares from $115 to $105, expressing concerns about the long-term growth drivers.

Analysts Offer Varied Perspectives on Outlook and Price Targets

- Piper Sandler analyst Brent Bracelin reaffirmed an Overweight rating and a $130 price target.

- Citigroup analyst Tyler Radke maintained a Neutral rating and increased the price target from $121 to $138.

Analyst Kirk Materne (EVERCORE) currently has the highest performing score on ORCL with 7/8 (87.5%) price target fulfillment ratio. His price targets carry an average of $4.95 (10.36%) potential upside. Oracle Corporation stock price reaches these price targets on average within 137 days.

RTX Faces Aircraft Grounding as Quality Concerns Prompt Engine Inspections

RTX has found itself in the midst of a challenging situation, as it recently announced that it would need to remove and inspect 600 to 700 geared turbofan engines (GTF). This move comes as a result of quality concerns surrounding these engines, leading to inevitable disruptions in its operations. The inspections are expected to be thorough and time-consuming, potentially grounding some of the company’s aircraft.

This development underscores the critical importance of safety and quality assurance in the aerospace industry. While such inspections may cause short-term setbacks, they are crucial to maintaining the integrity and reliability of aircraft.

As the aviation industry continues to recover from the impacts of the COVID-19 pandemic, suppliers like RTX are tasked with navigating unexpected challenges while upholding stringent safety protocols.

Analyst Downgrades with Lowered Price Targets

- RBC Capital analyst Ken Herbert downgraded from Outperform to Sector Perform and the price target from $105 to $82.

- Barclays analyst David Strauss downgraded from Overweight to Equal-Weight and the price target from $100 to $75.

Analyst Matthew Akers (WELLS FARGO) currently has the highest performing score on RTX with 4/7 (57.14%) price target fulfillment ratio. His price targets carry an average of $9 (10.10%) potential upside. RTX stock price reaches these price targets on average within 81 days.

Casey’s Q1 2023 Results, Eyes Expansion Amidst Performance

Casey’s General Stores has announced financial results for the first quarter ending July 31, 2023. The company reported an 11% increase in diluted earnings per share (EPS), with EPS reaching $4.52 compared to the same period in the previous year. This growth is attributed to higher profitability inside the store, driven by inside same-store sales, which increased by 5.4% and reflected a 12.1% improvement on a two-year stacked basis. Casey’s inside margin stood at 40.6%.

One of the performers for Casey’s during this quarter was its inside sales, which surged to $1,369.7 million, marking an 8.1% increase primarily driven by prepared food and dispensed beverages, including whole pizza pies, hot sandwiches, and donuts. The company’s inside margin also improved by 80 basis points compared to the same quarter last year.

Despite a slight 0.4% increase in same-store fuel gallons sold compared to the prior year, Casey’s managed to maintain a fuel margin of 41.6 cents per gallon. While total fuel gross profit decreased by 3.6% due to the comparison with record high fuel margins from the previous year, the company sold $20.2 million in renewable fuel credits (RINs) during the quarter, an increase of $2.5 million from the same quarter in the prior year. Casey’s also continued its expansion efforts, adding stores to its portfolio, and maintaining liquidity with approximately $1.3 billion available as of July 31, 2023.

Casey’s is poised for continued growth, with plans to add at least 150 stores in fiscal 2024. The company remains confident in its outlook, expecting inside same-store sales to increase by 3% to 5% and inside margin to improve further.

Analysts Maintain Positive Outlook with High Price Targets

- Stephens & Co. analyst Ben Bienvenu reiterated an Overweight rating and a $280 price target.

- Benchmark analyst John Lawrence maintained a Buy rating and a $275 price target.

Analyst Irene Nattel (RBC) currently has the highest performing score on CASY with 21/28 (75%) price target fulfillment ratio. Her price targets carry an average of $26.84 (13.98%) potential upside. Casey’s General Stores stock price reaches these price targets on average within 222 days.

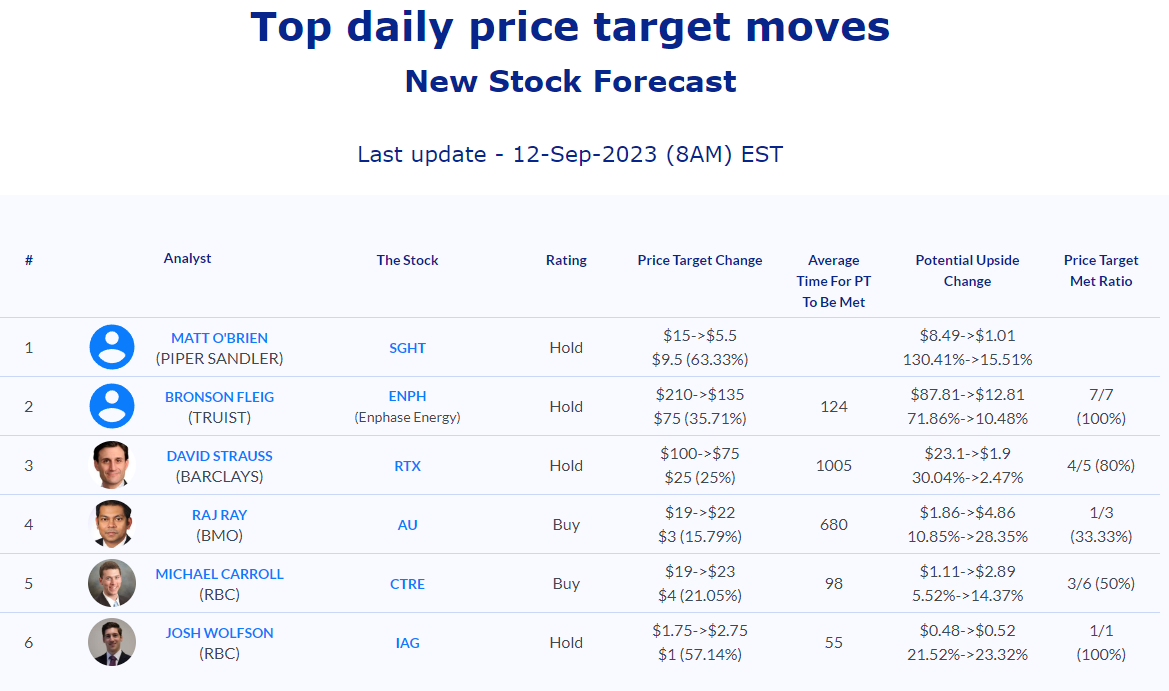

Daily stock Analysts Top Price Moves Snapshot