Selected stock price target news of the day - September 13th, 2024

By: Matthew Otto

Petco Reports In-Line Q2 2024 Earnings, Sets Focus on Profitability and Growth for Q3 2025

Petco Health and Wellness reported its second-quarter 2024 earnings, delivering an earnings per share (EPS) of ($0.02), which was in line with analyst estimates. Revenue for the quarter stood at $1.52 billion, meeting the consensus estimate of $1.52 billion.

Despite a slight year-over-year decline in net revenue by 50 basis points, comparable sales increased by 30 basis points. Consumables saw a modest 1% growth, though discretionary categories faced a 5% decline. Services, including vet hospitals and grooming, grew by 10%, contributing to a 3% increase in the overall Services and Other segment.

Gross profit came in at $581 million, down 210 basis points, with a gross margin of 38.1%, lower by 60 basis points year-over-year. Adjusted EBITDA for the quarter was $83.5 million, with an adjusted EBITDA margin of 5.5%. Adjusted earnings per share was negative $0.02, compared to $0.06 in the previous year.

Petco provided guidance for the upcoming third quarter of 2025, forecasting an EPS of ($0.03) to ($0.04), compared to the consensus estimate of ($0.03). Q3 revenue expected to be around $1.5 billion, below the consensus of $1.51 billion. Petco’s liquidity remains robust at $655 million, with free cash flow of $42 million for the quarter.

Analysts Adjust Price Targets Following Q2 2024 Earnings

- Citigroup analyst Steven Zaccone maintained a Neutral rating and raised the price target from $4 to $4.50.

- Goldman Sachs analyst Kate McShane maintained a Buy rating but lowered the price target from $5 to $4.

- RBC Capital analyst Steven Shemesh maintained an Outperform rating and raised the price target from $3 to $3.50.

- Wells Fargo analyst Zachary Fadem reiterated an Equal-Weight rating and increased the price target from $2.75 to $3.

- Wedbush analyst Seth Basham reiterated an Outperform rating and a $5 price target.

Which Analyst has the best track record to show on WOOF?

Analyst Seth Basham (WEDBUSH) currently has the highest performing score on WOOF with 4/12 (33.33%) price target fulfillment ratio. His price targets carry an average of $1.35 (36.99%) potential upside. Petco Health and Wellness stock price reaches these price targets on average within 8 days.

Adobe Reports Strong Q3 Results but Signals Potential Weakness in Q4 Guidance

Adobe reported its third-quarter financial results, achieving revenue of $5.41 billion, exceeding the $5.37 billion forecast. Adjusted earnings per share (EPS) of $4.65, surpassing the $4.53 estimate. This performance reflected an 11% increase in year-over-year revenue, driven primarily by an 11% growth in Adobe’s Digital Media segment, which includes Creative Cloud subscriptions. Adobe reported net income of $1.68 billion, or $3.76 per diluted share, up from $1.40 billion, or $3.05 per share, in the same period last year.

Looking forward, Adobe anticipates fourth-quarter revenue between $5.50 billion and $5.55 billion, below the $5.61 billion forecast, and EPS between $4.63 and $4.68, compared to the $4.67 estimate. Adobe also noted that its subscription revenue for the quarter was $5.18 billion, an 11% increase year-over-year. Adobe’s guidance for net new Digital Media subscriptions was expected to be flat with the $550 million achieved in the August quarter, falling short of the $565 million anticipated by analysts.

Analysts Adjust Targets After Q3 Report and Weaker Q4 Guidance

- Bernstein analyst Mark Moerdler maintained an Outperform rating but reduced the price target from $660 to $644.

- Piper Sandler analyst Brent Bracelin kept an Overweight rating and the price target at $635.

- Citigroup analyst Tyler Radke upheld a Neutral rating and increased the price target from $550 to $621.

- UBS analyst Karl Keirstead lowered the price target to $550.

- Oppenheimer analyst Brian Schwartz reiterated an Outperform rating with a $625 price target.

- HSBC analyst Stephen Bersey maintained a Hold rating and raised the price target from $519 to $536.

Which Analyst has the best track record to show on ADBE?

Analyst Mark Murphy (JPMORGAN) currently has the highest performing score on ADBE with 3/4 (75%) price target fulfillment ratio. His price targets carry an average of $54.69 (10.41%) potential upside. Adobe Systems stock price reaches these price targets on average within 6 days.

Kroger Exceeds Q2 EPS Estimates, Raises Sales Forecast Amid Competitive Landscape and Merger Review

Kroger reported its second-quarter results, with earnings per share (EPS) of $0.93, exceeding the analyst estimate of $0.91. Revenue for the quarter totaled $33.91 billion, below the consensus estimate of $34.08 billion.

Kroger’s identical sales, excluding fuel, grew by 1.2% in the second quarter, supported by a rise in customer metrics such as total and loyal households, and increased visits. Digital sales surged, with delivery solutions up by 17% and pickup up by 10%. Despite facing inflationary pressures and evolving consumer behaviors, Kroger maintained a positive FIFO gross margin rate of 22.6% and saw a 10% increase in their quarterly dividend.

Kroger’s initiatives, including promotions and a commitment to lower prices by $1 billion post-merger with Albertsons, aim to maintain its edge. The merger remains under antitrust review by the Federal Trade Commission (FTC), which has raised concerns about potential price increases and reduced bargaining power for workers.

For fiscal 2024, Kroger now expects identical sales, excluding fuel, to grow between 0.75% and 1.75%, up from the previous range of 0.25% to 1.75%. Guidance for fiscal 2025 EPS is projected to be between $4.30 and $4.50, compared to the consensus estimate of $4.43.

Analysts Boost Price Targets Following Q2 Report and Positive Outlook

- Evercore ISI Group analyst Michael Montani maintained an Outperform rating and raised the price target from $62 to $63.

- Morgan Stanley analyst Simeon Gutman retained an Equal-Weight rating with an increased price target from $57 to $58.

- Telsey Advisory Group analyst Joseph Feldman continued with an Outperform rating and a price target of $62.

- JPMorgan analyst Ken Goldman raised the price target to $59.

- CFRA upgrades Kroger from Hold to Buy.

- BMO Capital analyst Kelly Bania reiterated an Outperform rating and set the price target at $60.

Which Analyst has the best track record to show on KR?

Analyst Michael Montani (EVERCORE) currently has the highest performing score on KR with 8/10 (80%) price target fulfillment ratio. His price targets carry an average of $9.72 (19.33%) potential upside. Kroger Company stock price reaches these price targets on average within 255 days.

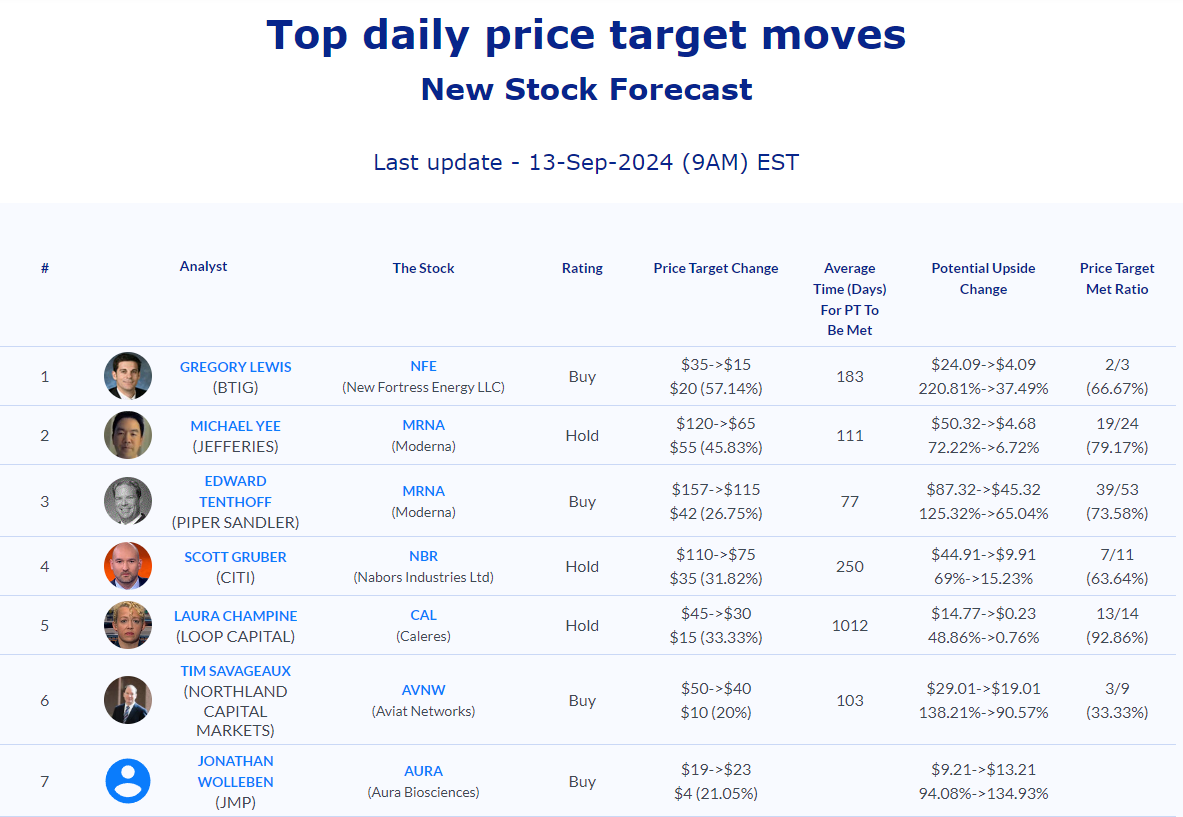

Daily stock Analysts Top Price Moves Snapshot