Selected stock price target news of the day - September 22, 2023

By: Matthew Otto

Amazon Prime Video to Introduce Ads in 2024

Amazon has announced its plans to introduce advertising on its Prime Video platform in the U.S., U.K., Germany, and Canada starting in early 2024. However, Amazon is offering an ad-free option for the U.S. Prime members at an additional cost of $2.99 per month, with pricing for other countries yet to be disclosed. The company has also reassured its U.S. Prime members that the overall price of Prime membership will remain unchanged in 2024. For U.S. customers, the cost of Prime Video with advertising will be included in the standard $14.99 monthly Prime membership or the $139 annual subscription, excluding discounts.

Analysts Maintain Positive Outlook with Overweight Ratings

- Wells Fargo analyst Ken Gawrelski maintained an Overweight rating and a $165 price target.

- Morgan Stanley analyst Brian Nowak also reiterated an Overweight rating and a $175 price target.

Analyst Barton Crockett (ROSENBLATT) currently has the highest performing score on AMZN with 5/7 (71.43%) price target fulfillment ratio. His price targets carry an average of $7.41 (6.07%) potential upside. Amazon.com stock price reaches these price targets on average within 43 days.

Microsoft’s Game-Changing AI Copilot Set to Transform Productivity

Microsoft is set to reshape the landscape of productivity tools with the upcoming launch of Microsoft 365 Copilot, an innovative artificial intelligence supplement to its core applications like Word and Excel. Starting from November 1, large corporations will have the opportunity to harness the power of Copilot. This development is a result of Microsoft’s close collaboration with OpenAI, showcasing the company’s commitment to AI-driven innovation. The Copilot feature will not be limited to Microsoft 365 but will also be integrated into other Microsoft products, including Bing, Edge, and Windows 11, starting from September 26.

While Microsoft aims to transform productivity through AI, it faces competition from rivals like Google, which offers a similar AI-driven solution for enterprises. Microsoft acknowledges that the revenue from AI services will see gradual growth as organizations adopt these capabilities, with the real impact expected to materialize in 2025.

Analyst Reiterated Outperform Rating Amid Ongoing Developments

- Wedbush analyst Daniel Ives reiterated an Outperform rating and a $400 Price Target.

Analyst Mark Murphy (JPMORGAN) currently has the highest performing score on MSFT with 25/26 (96.15%) price target fulfillment ratio. His price targets carry an average of $18.89 (12.33%) potential upside. Microsoft stock price reaches these price targets on average within 119 days.

FactSet’s Fiscal Year 2023 Earnings Report: A Year of Growth

FactSet has released its financial results for fiscal year 2023, with annual revenue reaching $2.1 billion. The company met its guidance range of $2.08 billion to $2.1 billion. The adjusted EPS for fiscal year 2023 stood at $14.55, representing an 8.3% increase over the previous year. Excluding the one-time adjustment, the company’s adjusted EPS would have been approximately $15.25, a 13.6% growth that underscores its financial strength.

The company expanded its adjusted operating margin by 230 basis points, reaching 36.2%. This margin expansion not only exceeded its medium-term outlook goal of 36% by the end of fiscal year 2025. FactSet repurchased 264,400 shares for $109.6 million during the fourth quarter, with plans to continue its share repurchase program throughout fiscal year 2024, targeting $250 million in buybacks.

Analysts Offer Differing Views Amid Price Target Adjustments

- BMO Capital analyst Jeffrey Silber maintained a Market Perform rating and raised the price target from $419 to $436.

- Morgan Stanley analyst Toni Kaplan reiterated an Underweight rating but raised the price target from $332 to $352.

- Goldman Sachs analyst George Tong maintained a Sell rating and lowered the price target from $380 to $367.

Analyst Shlomo Rosenbaum (STIFEL) currently has the highest performing score on FDS with 22/22 (100%) price target fulfillment ratio. Her price targets carry an average of $0.93 (3.76%) potential upside. FactSet Research stock price reaches these price targets on average within 137 days.

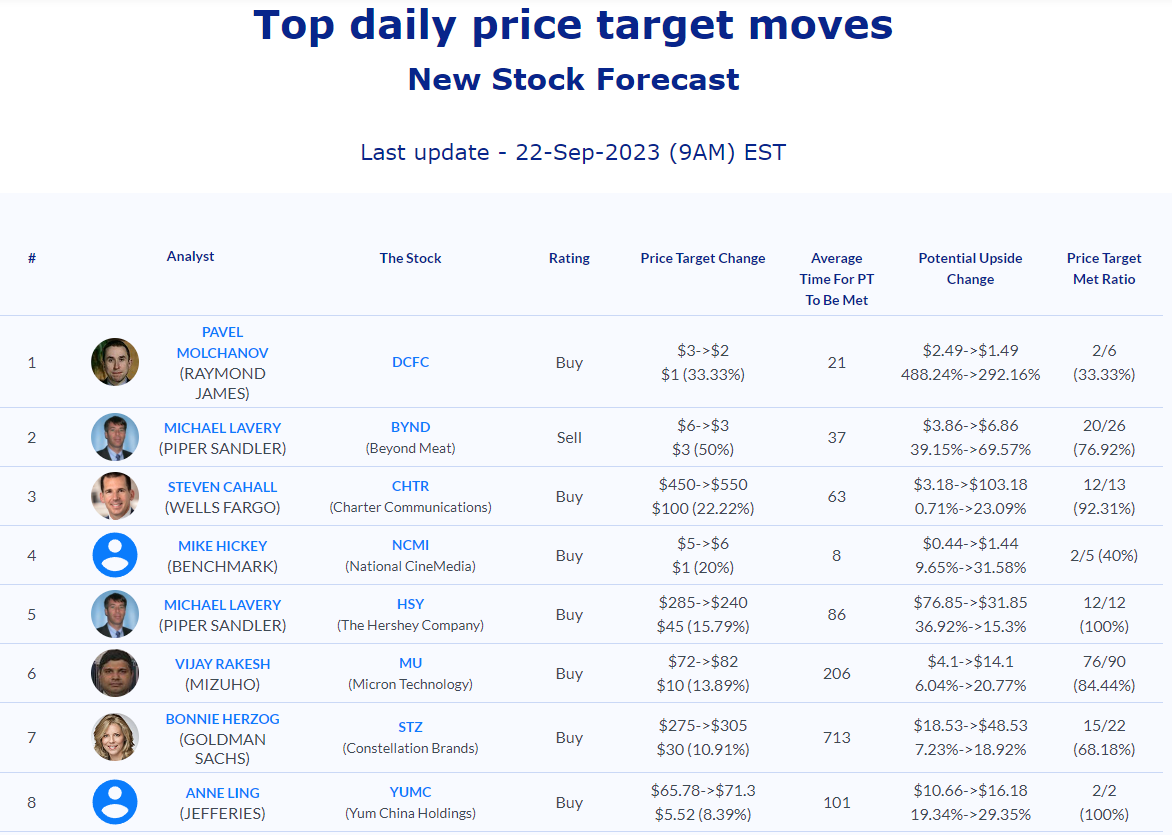

Daily stock Analysts Top Price Moves Snapshot