Selected stock price target news of the day - September 25th, 2025

By: Matthew Otto

Uranium Energy Reports Fiscal 2025 Production Ramp-Up and Expansion of U.S. Assets

Uranium Energy filed its annual report for the fiscal year ended July 31, 2025, outlining the transition from development to production. The company reported approximately 130,000 pounds of uranium concentrate (U₃O₈) dried and drummed during the year, supported by operations at the Christensen Ranch ISR Mine and the Irigaray Central Processing Plant in Wyoming. Costs averaged $36.41 per pound, including $27.63 in cash costs.

In the Powder River Basin, two new in-situ recovery (ISR) mine-units were commissioned, while upgrades at the Irigaray plant were initiated to support continuous two-shift operations. Construction of the Burke Hollow ISR Project in South Texas reached 90% completion, with operational start-up targeted for December 2025.

In addition, UEC completed the $175 million acquisition of Rio Tinto’s Sweetwater Complex, which added approximately 175 million pounds of historic uranium resources and 4.1 million pounds of licensed annual production capacity.

Financially, Uranium Energy reported a fiscal year 2025 earnings per share (EPS) loss of ($0.20), missing analyst estimates of ($0.18) by $0.02. Revenue for the year came in at $66.84 million, below consensus expectations of $77.2 million. First-half uranium sales totaled 810,000 pounds at an average realized price of $82.52 per pound, generating $24.5 million in gross profit.

At fiscal year-end, Uranium Energy reported $321 million in cash, inventory, and equities at market value with no debt. Inventory stood at 1,356,000 pounds valued at $96.6 million at market prices, excluding the initial Wyoming production, with an additional 300,000 pounds scheduled for delivery under purchase contracts by December 2025 at $37.05 per pound.

Analyst Ratings on Uranium Energy Mixed as Average Price Target Rises 45%

- HC Wainwright & Co. analyst Heiko F. Ihle maintained a Buy rating and raised the price target from $12.75 to $19.75.

- BMO Capital analyst Alexander Pearce downgraded from Outperform to Market Perform yet raised the price target from $7.75 to $14.

- Goldman Sachs analyst Brian Lee reiterated a Buy rating and a $17 price target.

Which Analyst has the best track record to show on UEC?

Analyst Joe Reagor (ROTH) currently has the highest performing score on UEC with 6/6 (100%) price target fulfillment ratio. His price targets carry an average of $-0.01 (-0.09%) potential downside. Uranium Energy stock price reaches these price targets on average within 186 days.

Freeport Grasberg Mine Accident Leads to Force Majeure and Multi-Year Production Delays

Freeport-McMoRan has declared force majeure at its Grasberg block cave mine in Indonesia following a mud rush incident on September 8 that caused extensive damage to underground infrastructure.

The event trapped workers, with the company confirming two fatalities and five still missing as of September 20. About 800,000 tonnes of wet material entered the mine, impacting multiple service areas, rail systems, electrical installations, and mobile equipment. Operations were suspended the next day to prioritize rescue and recovery efforts.

Grasberg accounts for around 50% of Freeport’s proven and probable reserves and contributes roughly 70% of its projected copper and gold output through 2029, underscoring the scale of the disruption. The company has begun investigating the cause, with findings expected by late 2025, and has notified commercial partners of the force majeure declaration.

The disruption is expected to cut copper output by 250,000 to 260,000 tons in 2025 and by about 270,000 tons in 2026, according to revised estimates. Freeport anticipates a phased restart of unaffected sections of the mine in late 2025, with the Grasberg block cave ramping up gradually in 2026 and full production recovery delayed until 2027. Production in 2026 is projected to be 35% lower than prior forecasts, with output losses weighing on global supply.

Analyst Ratings on Freeport-McMoRan Cut With Average Price Targets Down 17.5%

- JP Morgan analyst Bill Peterson maintained an Overweight rating while lowering the price target from $56 to $46.

- Scotiabank analyst Orest Wowkodaw downgraded from Sector Outperform to Sector Perform and the price target from $55 to $45.

- Raymond James analyst Brian MacArthur lowered the price target from $55 to $46.

Which Analyst has the best track record to show on FCX?

Analyst Orest Wowkodaw (SCOTIABANK) currently has the highest performing score on FCX with 11/21 (52.38%) price target fulfillment ratio. His price targets carry an average of $6.41 (14.06%) potential upside. Freeport-McMoRan stock price reaches these price targets on average within 157 days.

uniQure Reports Positive 36-Month Results for Huntington’s Gene Therapy Candidate AMT-130

uniQure N.V. has released topline data from its pivotal Phase I/II study of AMT-130, a gene therapy candidate for Huntington’s disease. In the high-dose group, AMT-130 slowed disease progression by 75% at 36 months as measured by the composite Unified Huntington’s Disease Rating Scale (cUHDRS) compared with an external control group. Patients receiving treatment showed a mean decline of -0.38 points, versus -1.52 in the control group.

The therapy also slowed functional decline by 60% on the Total Functional Capacity (TFC) scale, with treated patients losing -0.36 points compared to -0.88 for controls. Additional clinical measures suggested slower progression in motor and cognitive function, including an 88% slowing in the Symbol Digit Modalities Test (SDMT), a 113% slowing in the Stroop Word Reading Test (SWRT), and a 59% slowing in the Total Motor Score (TMS). Biomarker analysis also showed cerebrospinal fluid neurofilament light protein (NfL), associated with neurodegeneration, fell by an average of 8.2% below baseline after 36 months.

Huntington’s disease is a rare, inherited neurodegenerative disorder that affects an estimated 75,000 people across the United States, European Union, and United Kingdom, with hundreds of thousands more at risk of inheriting it. The uniQure study included 29 patients, 17 of whom received the high dose of AMT-130, with results compared against a large external dataset of over 900 individuals with the disease.

Analyst Ratings for uniQure Maintained as Price Targets Rise an Average of 128%

- Guggenheim analyst Debjit Chattopadhyay maintained a Buy rating while lifting the price target from $28 to $95.

- Cantor Fitzgerald analyst Kristen Kluska kept an Overweight rating and increased the price target from $47 to $80.

- Chardan Capital analyst Daniil Gataulin reiterated a Buy rating but raised the price target from $35 to $76.

Which Analyst has the best track record to show on QURE?

Analyst Uy Ear (MIZUHO) currently has the highest performing score on QURE with 3/5 (60%) price target fulfillment ratio. His price targets carry an average of $14.22 (90.11%) potential upside. uniQure N.V. stock price reaches these price targets on average within 132 days.

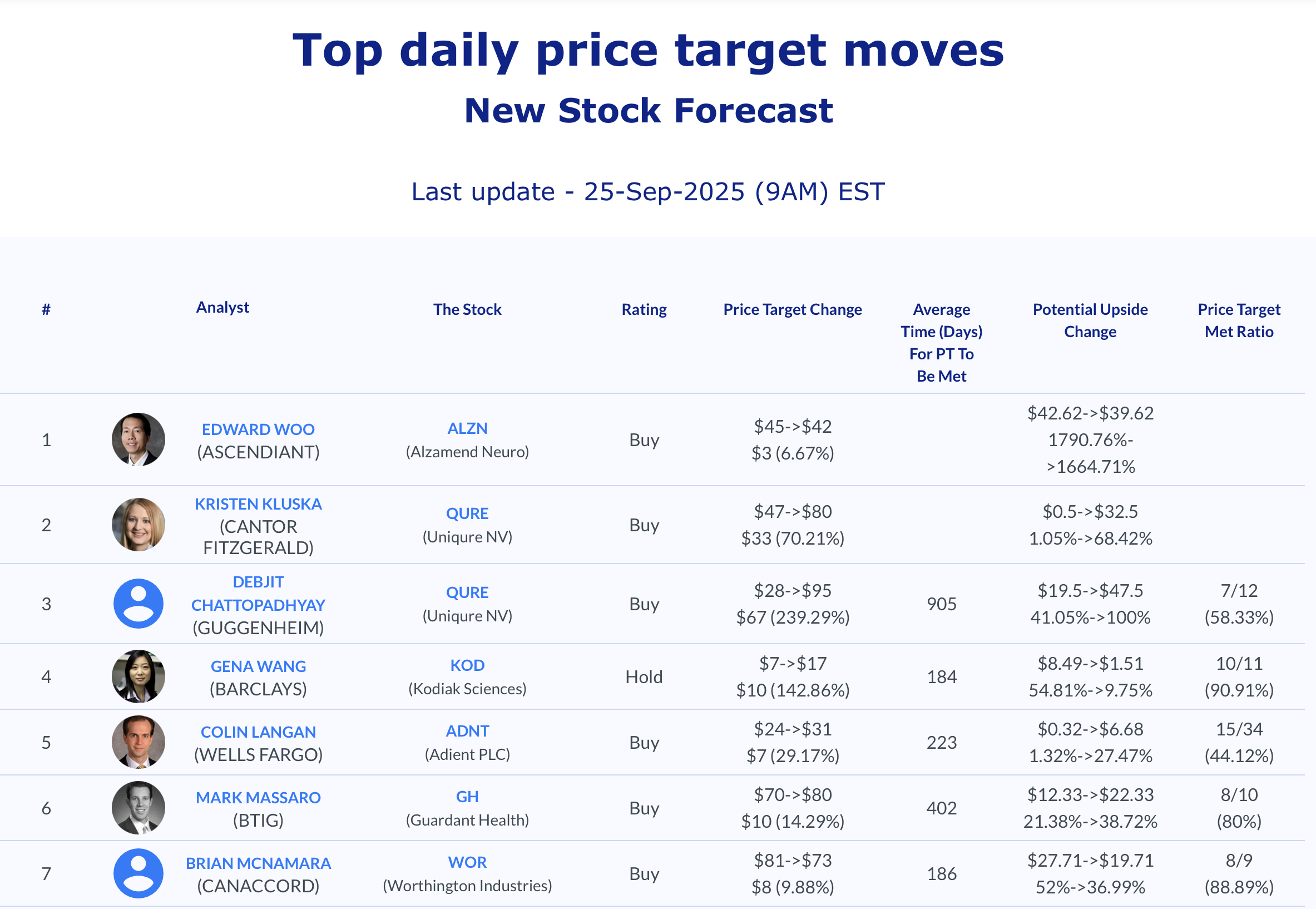

Daily Stock Analysts Top Price Moves Snapshot