Selected stock price target news of the day - September 4th, 2025

By: Matthew Otto

Salesforce Q2 Earnings Exceed Estimates as Outlook Draws Caution

Salesforce reported second-quarter fiscal 2026 earnings of $2.91 per share, $0.13 above the analyst estimate of $2.78. Revenue for the period came in at $10.2 billion, exceeding the consensus estimate of $10.14 billion and rising 10% year-over-year, or 9% in constant currency.

Subscription and support revenue reached $9.7 billion, an 11% annual increase, while remaining performance obligations stood at $29.4 billion, up 11% from the prior year. Net income rose to $1.89 billion, or $1.96 per share, compared with $1.43 billion, or $1.47 per share, a year earlier. Salesforce returned $2.6 billion to shareholders through $2.2 billion in share repurchases and $399 million in dividends and expanded its share buyback authorization by $20 billion, bringing the total to $50 billion.

For the third quarter, Salesforce projected revenue between $10.24 billion and $10.29 billion, with expected earnings per share of $2.84 to $2.86, compared to consensus estimates of $10.29 billion in revenue and $2.85 in earnings. For fiscal 2026, management guided earnings per share in the range of $11.33 to $11.37, ahead of the $11.29 analyst consensus, and revenue between $41.1 billion and $41.3 billion, in line with the $41.2 billion consensus. The company also expects operating cash flow growth of 12% to 13% for the full year.

Analyst Price Targets on Salesforce Cut by 9% on Average

- Keybanc analyst Jackson Ader maintains Salesforce with an Overweight while cutting the price target from $440 to $400.

- Canaccord Genuity analyst David Hynes continues with a Buy but lowers the price target from $350 to $300.

- JP Morgan analyst Mark Murphy maintains an Overweight rating, though he trims the price target from $380 to $365.

- Needham analyst Scott Berg reiterates a Buy and keeps the price target unchanged at $400.

- Piper Sandler analyst Brent Bracelin maintains an Overweight stance, yet reduces the price target from $335 to $315.

Which Analyst has the best track record to show on CRM?

Analyst Gil Luria (D.A. DAVIDSON) currently has the highest performing score on CRM with 10/14 (71.43%) price target fulfillment ratio. His price targets carry an average of $-17.44 (-7.19%) potential downside. Salesforce stock price reaches these price targets on average within 43 days.

GitLab Posts Q2 Growth but Full-Year Revenue Outlook Slightly Trails Consensus

GitLab reported second quarter fiscal 2026 revenue of $236 million, representing a 29% increase from $182.6 million in the same period last year and above the consensus estimate of $226.9 million. Earnings per share were $0.24, surpassing analyst expectations of $0.16.

Gross margin held steady at 88%, while operating margin improved to (8)% from (22)% a year earlier. Operating loss narrowed to $18.4 million from $41 million, and operating income excluding certain adjustments increased to $39.6 million from $18.2 million. Net loss attributable to GitLab was $9.2 million, or $0.06 per share, compared with net income of $12.9 million, or $0.08 per share, last year. Cash flow from operations rose to $49.4 million from $11.7 million, while adjusted free cash flow was $46.5 million compared with $10.8 million.

Customer expansion continued, with accounts generating more than $5,000 in annual recurring revenue rising 11% year-over-year to 10,338, while those above $100,000 grew 25% to 1,344. Remaining performance obligations reached $988.2 million, up 32%, and current RPO rose 31% to $621.6 million.

For fiscal 2026, GitLab projects earnings per share of $0.82 to $0.83, above the consensus of $0.75, and revenue between $936 million and $942 million, compared with analyst expectations of $943 million. For the third quarter, revenue is expected between $238 million and $239 million, with projected diluted EPS of $0.19 to $0.2.

Analyst Ratings Hold Steady as GitLab Price Targets Decline by an Average of 17%

- Raymond James analyst Adam Tindle maintained an Outperform rating but reduced the price target from $60 to $55.

- Truist Securities analyst Joel Fishbein continued a Buy rating and cut the price target from $75 to $55.

- Piper Sandler analyst Rob Owens kept an Overweight stance and lowered the price target from $85 to $70.

- Keybanc analyst Jason Celino maintained an Overweight rating yet trimmed the price target from $60 to $53.

- Canaccord Genuity analyst Kingsley Crane held a Buy rating and decreased the price target from $76 to $70.

- Needham analyst Mike Cikos reiterated a Buy rating and the price target at $55.

- BTIG analyst Gray Powell sustained a Buy rating though reduced the price target from $67 to $57.

Which Analyst has the best track record to show on GTLB?

Analyst Matthew Hedberg (RBC) currently has the highest performing score on GTLB with 17/24 (70.83%) price target fulfillment ratio. His price targets carry an average of $19.41 (45.57%) potential upside. GitLab stock price reaches these price targets on average within 165 days.

C3.ai First Quarter Performance Trails Forecasts with Revenue and EPS Miss

C3.ai reported fiscal first-quarter 2026 revenue of $70.3 million, falling short of the consensus estimate of $94.5 million. Earnings per share came in at a loss of $0.37, compared with analysts’ expectation of a $0.2 loss. Subscription revenue accounted for $60.3 million, or 86% of total revenue, while subscription and prioritized engineering services combined represented $69 million, or 98% of revenue. Gross profit was $26.4 million, reflecting a margin of 38%.

C3.ai closed 46 agreements during the period, including 28 initial production deployments, and ended the quarter with $711.9 million in cash, cash equivalents, and marketable securities.

C3 AI’s partner network contributed 40 agreements in the quarter, with a 54% year-over-year increase in the joint qualified opportunity pipeline. Federal business accounted for 12 agreements, or 28% of total bookings, while nine contracts were signed for generative AI applications, including deployments with Nucor, Koch, and the U.S. Intelligence Community.

Looking ahead, C3.ai projected second-quarter revenue between $72 million and $80 million, well below the consensus estimate of $99.6 million, and a loss from operations in the range of $49.5 million to $57.5 million.

Analysts Lower C3.ai Price Targets by an Average of 28% While Maintaining Mixed Ratings

- UBS analyst Radi Sultan maintained a Neutral rating while lowering the price target from $23 to $16.

- JMP Securities analyst Patrick Walravens kept a Market Outperform rating but trimmed the price target from $30 to $24.

- Keybanc analyst Eric Heath continued an Underweight stance and reduced the price target from $18 to $10.

- Needham analyst Mike Cikos reiterated a Hold rating.

Which Analyst has the best track record to show on AI?

Analyst Gil Luria (D.A. DAVIDSON) currently has the highest performing score on AI with 9/10 (90%) price target fulfillment ratio. His price targets carry an average of $-3.47 (-21.07%) potential downside. C3.ai stock price reaches these price targets on average within 61 days.

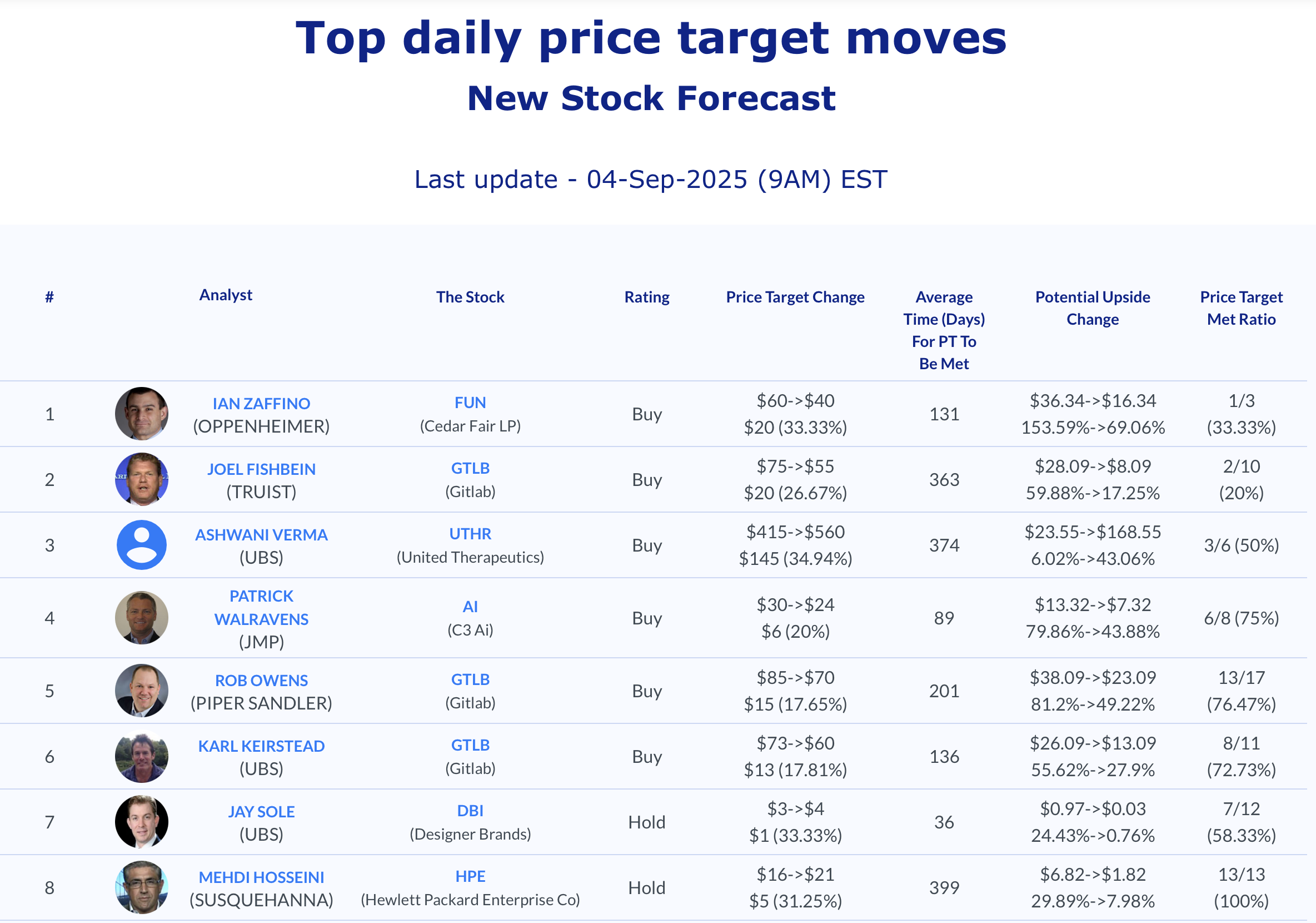

Daily Stock Analysts Top Price Moves Snapshot