Selected stock price target news of the day - September 5th, 2025

By: Matthew Otto

Lululemon Q2 Earnings Beat, Revenue Miss; Guidance Cut Below Estimates

Lululemon Athletica reported second-quarter fiscal 2025 revenue of $2.53 billion, slightly below the consensus estimate of $2.54 billion, but up 7% year-over-year. Earnings per share were $3.10, surpassing analyst expectations of $2.87.

Comparable sales rose 1%, with international revenue up 22% and Americas revenue up 1%, though Americas comparable sales declined 4%. Gross profit increased 5% to $1.5 billion, while gross margin narrowed 110 basis points to 58.5%.

Operating income fell 3% to $523.8 million, with operating margin contracting to 20.7%. Net income for the quarter was $370.9 million, down from $392.9 million in the prior year. The company repurchased 1.1 million shares for $278.5 million and ended the quarter with 784 stores, 14 more than the previous period.

For the third quarter of fiscal 2026, Lululemon expects revenue of $2.47 billion to $2.5 billion, below the $2.56 billion consensus, and earnings per share of $2.18 to $2.23, compared to the $2.9 analyst estimate. For the full year, Lululemon projects revenue between $10.85 billion and $11 billion versus Wall Street’s expectation of $11.2 billion, and earnings per share in the range of $12.77 to $12.97, below the $14.61 consensus.

Analysts Lower Ratings and Reduce Lululemon Price Targets by an Average of 27%

- William Blair analyst Sharon Zackfia downgraded from Outperform to Market Perform.

- Baird analyst Mark Altschwager maintained an Outperform rating yet reduced the price target from $260 to $225.

- Piper Sandler analyst Anna Andreeva kept a Neutral stance but lowered the price target from $200 to $165.

- Oppenheimer analyst Brian Nagel downgraded from Outperform to Perform.

- Evercore ISI analyst Michael Binetti shifted from Outperform to In-Line and the price target from $265 to $180.

- Telsey Advisory Group analyst Dana Telsey moved from Outperform to Market Perform while reducing the price target from $360 to $200.

- Needham analyst Tom Nikic maintained a Buy rating though trimmed the price target from $238 to $192.

- BofA Securities analyst Lorraine Hutchinson downgraded from Buy to Neutral and the price target from $300 to $210.

- BTIG analyst Janine Stichter reiterated a Buy rating but lowered the price target from $375 to $303.

Which Analyst has the best track record to show on LULU?

Analyst Rick Patel (RAYMOND JAMES) currently has the highest performing score on LULU with 16/19 (84.21%) price target fulfillment ratio. His price targets carry an average of $53.34 (14.16%) potential upside. Lululemon Athletica stock price reaches these price targets on average within 147 days.

Broadcom Reports Q3 Results Ahead of Estimates, Raises Revenue Outlook for Q4

Broadcom reported third quarter fiscal 2025 revenue of $15.95 billion, up 22% from $13.07 billion in the same period last year and slightly ahead of the consensus estimate of $15.82 billion. Earnings per diluted share were $1.69, $0.03 above the analyst estimate of $1.66.

Net income totaled $4.14 billion, compared to a loss of $1.88 billion a year earlier. Adjusted net income reached $8.4 billion, up from $6.12 billion. Adjusted EBITDA rose 30% year-over-year to $10.7 billion, representing 67% of revenue. Operating cash flow was $7.17 billion, while capital expenditures were $142 million, resulting in free cash flow of $7.02 billion, or 44% of revenue.

Segment performance showed semiconductor solutions revenue of $9.17 billion, an increase of 26% from $7.27 billion, and infrastructure software revenue of $6.79 billion, up 17% from $5.8 billion. Free cash flow increased 47% from $4.79 billion in the prior year period.

For the fourth quarter, Broadcom provided revenue guidance of approximately $17.4 billion, compared with the consensus estimate of $17 billion, and projected adjusted EBITDA at 67% of revenue.

Analyst Ratings Remain Positive as Broadcom Price Targets Rise an Average of 15%

- Evercore ISI Group analyst Mark Lipacis maintained an Outperform rating while increasing the price target from $342 to $370.

- Keybanc analyst John Vinh reiterated an Overweight stance and raised the price target from $330 to $400.

- Piper Sandler analyst Harsh Kumar kept an Overweight rating yet boosted the price target from $315 to $375.

- Benchmark analyst Cody Acree held a Buy rating and moved the price target upward from $315 to $385.

- BofA Securities analyst Vivek Arya continued a Buy rating and lifted the price target from $300 to $400.

- Morgan Stanley analyst Joseph Moore maintained an Overweight rating and increased the price target from $357 to $382.

- JP Morgan analyst Harlan Sur reiterated an Overweight rating and elevated the price target from $325 to $400.

- Deutsche Bank analyst Ross Seymore kept a Buy rating and raised the price target from $300 to $350.

Which Analyst has the best track record to show on AVGO?

Analyst Joseph Moore (MORGAN STANLEY) currently has the highest performing score on AVGO with 10/11 (90.91%) price target fulfillment ratio. His price targets carry an average of $35.38 (11.69%) potential upside. Broadcom stock price reaches these price targets on average within 154 days.

Docusign Reports Revenue Growth and Better-Than-Expected Earnings in Q2

Docusign reported revenue of $800.6 million for the quarter ended July 31, 2025, an increase of 9% compared with the same period last year and above the consensus estimate of $779.78 million.

Subscription revenue rose 9% to $784.4 million, while professional services and other revenue declined 13% to $16.2 million. Billings were $818 million, up 13% year over year, including a roughly 1% positive currency effect. Gross margin was 79.3%, slightly higher than 78.9% in the prior year. Earnings per diluted share came in at $0.92, exceeding the analyst estimate of $0.85 but down from $0.97 a year earlier.

Net income was $63 million, or $0.3 per diluted share, compared with $890 million, or $4.26 per diluted share, in the prior-year quarter. Operating cash flow totaled $246.1 million, up from $220.2 million, while free cash flow was $217.6 million, compared with $197.9 million a year earlier.

For the fiscal year ending January 31, 2026, Docusign expects revenue between $3.19 billion and $3.2 billion, compared with analyst expectations of $3.16 billion, implying growth of around 7% year over year. Subscription revenue is projected between $3.12 billion and $3.13 billion, representing 8% growth, while billings are expected to range from $3.33 billion to $3.36 billion, or 7% higher than the prior year.

For the third quarter ending October 31, 2025, Docusign forecasts revenue between $804 million and $808 million, also up 7% from the prior year, with subscription revenue expected in the range of $786 million to $790 million. Billings for the third quarter are projected between $785 million and $795 million, up 5% from the prior year.

Analyst Ratings on Docusign Show Mixed Outlook with Average Price Target Raised About 6%

- JMP Securities analyst Patrick Walravens reiterated a Market Outperform and a $124 price target.

- Evercore ISI Group analyst Kirk Materne kept an In-Line rating and raised the price target from $90 to $92.

- Baird analyst William Power maintained a Neutral rating while lifting the price target from $85 to $90.

- Piper Sandler analyst Rob Owens stayed at Neutral and moved the price target from $85 to $90.

- BofA Securities analyst Brad Sills maintained a Neutral stance but raised the price target from $85 to $102.

- RBC Capital analyst Rishi Jaluria maintained a Sector Perform rating and increased the price target from $90 to $95.

- JP Morgan analyst Mark Murphy kept a Neutral rating and adjusted the price target from $77 to $80.

- Needham analyst Scott Berg reiterated a Hold rating.

Which Analyst has the best track record to show on DOCU?

Analyst Mark Murphy (JPMORGAN) currently has the highest performing score on DOCU with 7/8 (87.5%) price target fulfillment ratio. His price targets carry an average of $1.72 (2.28%) potential upside. Docusign stock price reaches these price targets on average within 52 days.

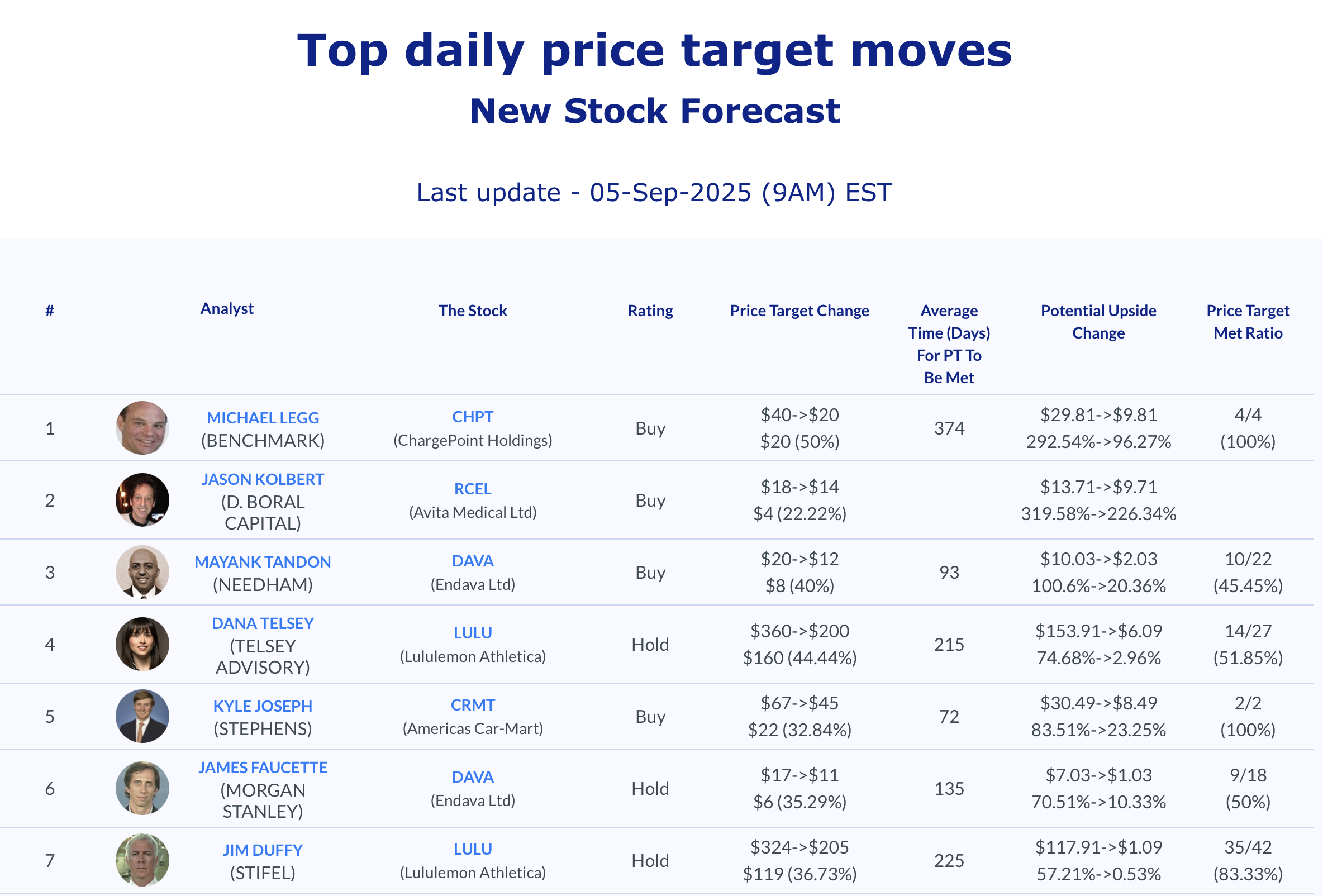

Daily stock Analysts Top Price Moves Snapshot