Selected stock price target news of the day - September 8th, 2025

By: Matthew Otto

ABM Q3 Revenue Tops Estimates While EPS Falls Short

ABM Industries reported third quarter fiscal 2025 revenue of $2.22 billion, an increase of 6.2% year-over-year, compared with the consensus estimate of $2.15 billion. Growth included 5% from organic expansion and 1.2% from acquisitions.

Segment performance was led by Technical Solutions, which rose 19% on higher microgrid volume and acquisitions, and Aviation, which grew 9% amid steady air travel demand. Manufacturing & Distribution increased 8% on new client wins, while Business & Industry and Education each advanced 3%.

Net income rose to $41.8 million, or $0.67 per diluted share, from $4.7 million, or $0.07 per share, a year ago. Adjusted earnings per share were $0.82, down from $0.84 in the prior year and below the analyst estimate of $0.95. Adjusted net income was $51.7 million, compared with $53.6 million last year.

Operating cash flow improved 120.1% to $175 million, while free cash flow rose 134.3% to $150.2 million, compared with $79.5 million and $64.1 million, respectively, a year earlier. Adjusted EBITDA increased 5% to $125.8 million, with the margin steady at 5.9%. Total indebtedness at quarter-end was $1.6 billion, with a leverage ratio of 2.8x and liquidity of $691 million, including $69.3 million in cash.

For the full year, ABM expects earnings to be at the lower end of its $3.65 to $3.8 range, reflecting margin pressure and higher interest costs.

Analyst Ratings on ABM Show Mixed Opinions with 1% Average Price Target Decline

- UBS analyst Joshua Chan maintained a Buy rating and raised the price target from $54 to $55.

- Baird analyst Andrew Wittmann downgraded from Outperform to Neutral while lowering the price target from $56 to $54.

Which Analyst has the best track record to show on ABM?

Analyst Andrew Wittmann (BAIRD) currently has the highest performing score on ABM with 21/23 (91.3%) price target fulfillment ratio. His price targets carry an average of $7.75 (16.06%) potential upside. ABM Industries stock price reaches these price targets on average within 574 days.

Alphabet Hit With EU Antitrust Penalty in Adtech Case

Alphabet, the parent company of Google, has been penalized by the European Commission for alleged anti-competitive practices in the advertising technology sector. Regulators said the company gave undue preference to its own display advertising services, disadvantaging rival providers and publishers across the region.

The Commission has ordered Alphabet to end these practices within 60 days and introduce structural changes in the adtech supply chain. The investigation, launched in 2021, marks the fourth major EU antitrust action against the company.

The penalty totals $3.45 billion, bringing the European Union’s cumulative fines against Alphabet to more than $11.5 billion over the past decade. Previous cases included a $5 billion fine in 2018 linked to the Android operating system, $2.7 billion in 2017 concerning search comparison services, and $1.7 billion in 2019 over online advertising contracts. Alphabet has said it disagrees with the ruling, intends to appeal, and expects to record the charge in its third-quarter 2025 results, according to a U.S. Securities and Exchange Commission filing.

In 2024, Alphabet’s advertising division generated about $237 billion, accounting for 77% of its total revenue. While the fine represents a small portion of annual earnings, EU officials stated the decision underscores long-standing concerns about concentration in the digital advertising market, which represents nearly 80% of all online ad spending in Europe.

Analyst Ratings on Alphabet Show Diverging Views With 17% Average Price Target Increase

- Evercore ISI Group analyst Mark Mahaney maintained an Outperform rating and raised the price target from $240 to $300.

- Phillip Securities analyst Serena Lim Yi Qi downgraded from Buy to Accumulate, while lifting the price target from $235 to $265.

Which Analyst has the best track record to show on GOOGL?

Analyst Alan Gould (LOOP CAPITAL) currently has the highest performing score on GOOGL with 8/9 (88.89%) price target fulfillment ratio. His price targets carry an average of $-4.67 (-2.40%) potential downside. Alphabet stock price reaches these price targets on average within 38 days.

SAIC Reports Q2 FY2026 Results with Lower Revenue but Higher Profitability

Science Applications International Corporation reported second quarter fiscal 2026 revenues of $1.77 billion, a 3% decrease from $1.82 billion in the prior year and below the consensus estimate of $1.87 billion. Earnings per share were $3.63, exceeding analyst expectations of $2.24 by $1.39. Net income rose 57% year over year to $127 million, while operating income increased 4% to $139 million. Operating margin improved to 7.9% from 7.4% a year earlier.

Bookings for the quarter totaled $2.6 billion, resulting in a book-to-bill ratio of 1.5, while year-to-date bookings were $5 billion with a ratio of 1.4. Backlog ended the quarter at approximately $23.2 billion, with $3.6 billion funded. Diluted earnings per share of $2.71 compared with $1.58 a year earlier.

Cash flow from operations was $122 million, down 12% from $138 million in the prior-year quarter, while free cash flow declined to $150 million from $241 million. Capital deployment totaled $130 million, including $106 million in share repurchases and $17 million in dividends.

Notable awards during the quarter included contracts valued at $928 million with the U.S. Air Force, $728 million with the Treasury Department, $202 million with the U.S. Navy, and a $547 million extension with the Department of State.

Updated fiscal 2026 guidance projects earnings per share of $9.4 to $9.6, above the analyst consensus of $8.92, but revenues are expected in the range of $7.25 billion to $7.33 billion, below the consensus forecast of $7.63 billion. Operating income is expected between $680 million and $690 million, with free cash flow anticipated to exceed $550 million.

JP Morgan Cuts SAIC to Neutral with Price Target Lowered by 18%

- JP Morgan analyst Seth Seifman downgraded from Overweight to Neutral and lowered the price target from $140 to $115.

Which Analyst has the best track record to show on SAIC?

Analyst David Strauss (BARCLAYS) currently has the highest performing score on SAIC with 7/7 (100%) price target fulfillment ratio. His price targets carry an average of $1.48 (1.43%) potential upside. Science Applications International Corporation stock price reaches these price targets on average within 267 days.

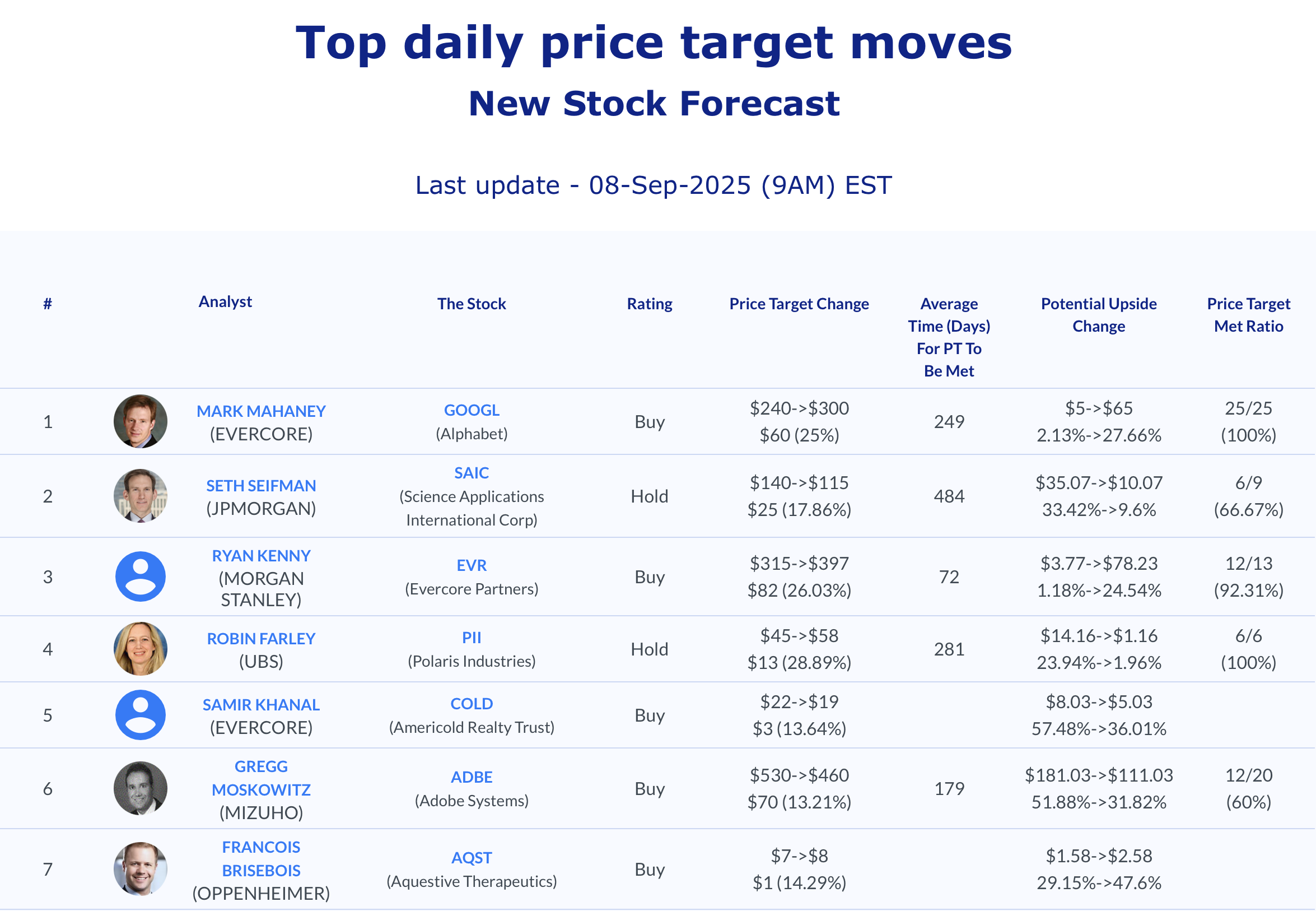

Daily Stock Analysts Top Price Moves Snapshot