Selected stock price target news of the day - September 9th, 2024

By: Matthew Otto

Samsara Reports Q2 Results, Exceeds EPS and Revenue Estimates, and Raises Q3 Guidance

Samsara reported financial results for the second quarter of fiscal 2025, posting earnings per share (EPS) of $0.05, which was $0.04 higher than the consensus estimate of $0.01. Additionally, Samsara’s quarterly revenue reached $300.2 million, exceeding the analyst estimate of $289.53 million.

Samsara’s annual recurring revenue (ARR) increased 36% year-over-year to $1.26 billion. It also expanded its large customer base, adding 169 customers with more than $100,000 in ARR and 14 customers generating over $1 million in ARR. Gross margin tied its quarterly record at 77%, while the non-GAAP operating margin reached a quarterly record of 6%.

Looking ahead, Samsara expects EPS in the range of $0.03 to $0.04, in line with the consensus estimate of $0.03. It also projects revenue between $309 million and $311 million, slightly higher than the consensus estimate of $308.83 million.

Samsara’s ongoing product innovations, such as the industrial-grade Asset Tag, contributed approximately $1 million in net new annual contract value (ACV) in Q2, and its international expansion remains with 16% of net new ACV coming from overseas markets. For Fiscal Year 2025, total revenue is expected to range between $1.224 billion and $1.228 billion, representing a year-over-year growth of 33% to 34%.

Analysts Raise Targets Following Q2 Earnings and Upbeat Guidance

- JP Morgan analyst Alexei Gogolev maintained a Neutral rating, while raising the price target from $37 to $40.

- Loop Capital analyst Mark Schappel kept a Buy rating and increased the price target from $42 to $46.

- TD Cowen analyst J. Derrick Wood continued with a Buy rating and boosted the price target from $45 to $46.

- Truist Securities analyst Joel Fishbein kept a Hold rating, but lifted the price target from $35 to $40.

- Morgan Stanley analyst Keith Weiss maintained an Equal-Weight rating and raised the price target from $38 to $40.

- Wells Fargo analyst Michael Turrin retained an Overweight rating and adjusted the price target upward from $42 to $46.

- RBC Capital analyst Matthew Hedberg sustained an Outperform rating and increased the price target from $47 to $49.

- Evercore ISI Group analyst Kirk Materne held an In-Line rating, yet raised the price target from $40 to $42.

- Piper Sandler analyst James Fish kept a Neutral rating, while raising the price target from $36 to $40.

Which Analyst has the best track record to show on IOT?

Analyst Matthew Hedberg (RBC) currently has the highest performing score on IOT with 11/15 (73.33%) price target fulfillment ratio. His price targets carry an average of $4.98 (11.31%) potential upside. Samsara stock price reaches these price targets on average within 134days.

UiPath Exceeds Q2 Expectations and Raises FY2025 Guidance Despite Market Decline

UiPath reported its financial results for the second quarter of fiscal 2025 posting earnings per share (EPS) of $0.04, surpassing the analyst estimate of $0.03. Revenue for the quarter reached $316 million, exceeding the consensus forecast of $303.69 million.

UiPath’s annual recurring revenue (ARR) grew by 19% year-over-year to $1.551 billion. The financial results were also bolstered by its cloud-first approach, with over $850 million in cloud ARR. In addition, UiPath’s board approved a $500 million share repurchase program to enhance shareholder value.

Looking ahead, UiPath expects Q3 revenue between $345 million and $350 million, aligning with analyst estimates of $347.2 million. For full fiscal year 2025, UiPath raised its revenue outlook to a range of $1.42 billion to $1.425 billion, compared to the prior consensus estimate of $1.41 billion.

Analyst Ratings Adjusted Following Q2 Results and Revised Guidance

- DA Davidson’s Gil Luria maintained a Neutral rating and increased the price target from $13 to $15.

- TD Cowen’s Bryan Bergin retained a Hold rating, yet lowered the price target from $17 to $16.

- Morgan Stanley’s Keith Weiss initiated coverage with an Equal-Weight rating and a price target of $15.

- RBC Capital’s Matthew Hedberg continued to rate as Sector Perform and a $16 price target.

- Barclays’ Raimo Lenschow kept an Equal-Weight rating and raised the price target from $14 to $15.

- Wells Fargo’s Michael Turrin maintained an Equal-Weight rating and increased the price target from $14 to $15.

- Evercore ISI Group’s Kirk Materne upheld an In-Line rating and raised the price target from $13 to $16.

Which Analyst has the best track record to show on PATH?

Analyst Kirk Materne (EVERCORE) currently has the highest performing score on PATH with 7/9 (77.78%) price target fulfillment ratio. His price targets carry an average of $4.03 (33.67%) potential upside. UiPath stock price reaches these price targets on average within 126 days.

Smartsheet Exceeds Q2 Expectations with Revenue Growth and Updated FY 2025 Guidance

Smartsheet delivered results for the second quarter of fiscal year 2025, with an earnings per share (EPS) of $0.44, surpassing the consensus estimate of $0.29 by $0.15. Revenue for the quarter was $276.4 million, exceeding the consensus estimate of $274.29 million.

Smartsheet’s annual recurring revenue (ARR) stood at $1.093 billion, reflecting a 17% increase year-over-year. Smartsheet saw enterprise growth, with 75 customers expanding their ARR by over $100,000 and three transactions exceeding $1 million. The number of customers with ARR over $1 million grew by 50% to 77, including five government agencies.

Looking ahead, Smartsheet provided guidance for the third quarter of FY 2025, forecasting an EPS range of $0.29 to $0.31, aligning with the consensus of $0.29, and revenue between $282 million and $285 million, slightly below the consensus of $287 million. For the full fiscal year, Smartsheet anticipates an EPS range of $1.36 to $1.39, surpassing the consensus of $1.25, and revenue between $1.116 billion and $1.121 billion, slightly below the consensus of $1.12 billion.

Analysts Upgraded Ratings and Price Targets Following Q2 Report

- Citigroup analyst Tyler Radke maintained a Buy rating and raised the price target from $55 to $63.

- Guggenheim analyst John Difucci continued with a Buy rating and lifted the price target from $60 to $62.

- Canaccord Genuity analyst David Hynes kept a Buy rating and increased the price target from $52 to $60.

- DA Davidson analyst Robert Simmons maintained a Buy rating and the price target steady at $55.

- Truist Securities analyst Terry Tillman remained with a Buy rating and raised the price target from $55 to $60.

- Morgan Stanley analyst Josh Baer maintained an Overweight rating and boosted the price target from $55 to $57.

- RBC Capital analyst Rishi Jaluria continued with a Sector Perform rating and increased the price target from $43 to $51.

- Barclays analyst Ryan Macwilliams maintained an Equal-Weight rating and raised the price target from $45 to $50.

Which Analyst has the best track record to show on SMAR?

Analyst Rishi Jaluria (RBC) currently has the highest performing score on SMAR with 17/19 (89.47%) price target fulfillment ratio. His price targets carry an average of $-1.27 (-2.43%) potential downside. Smartsheet stock price reaches these price targets on average within 19 days.

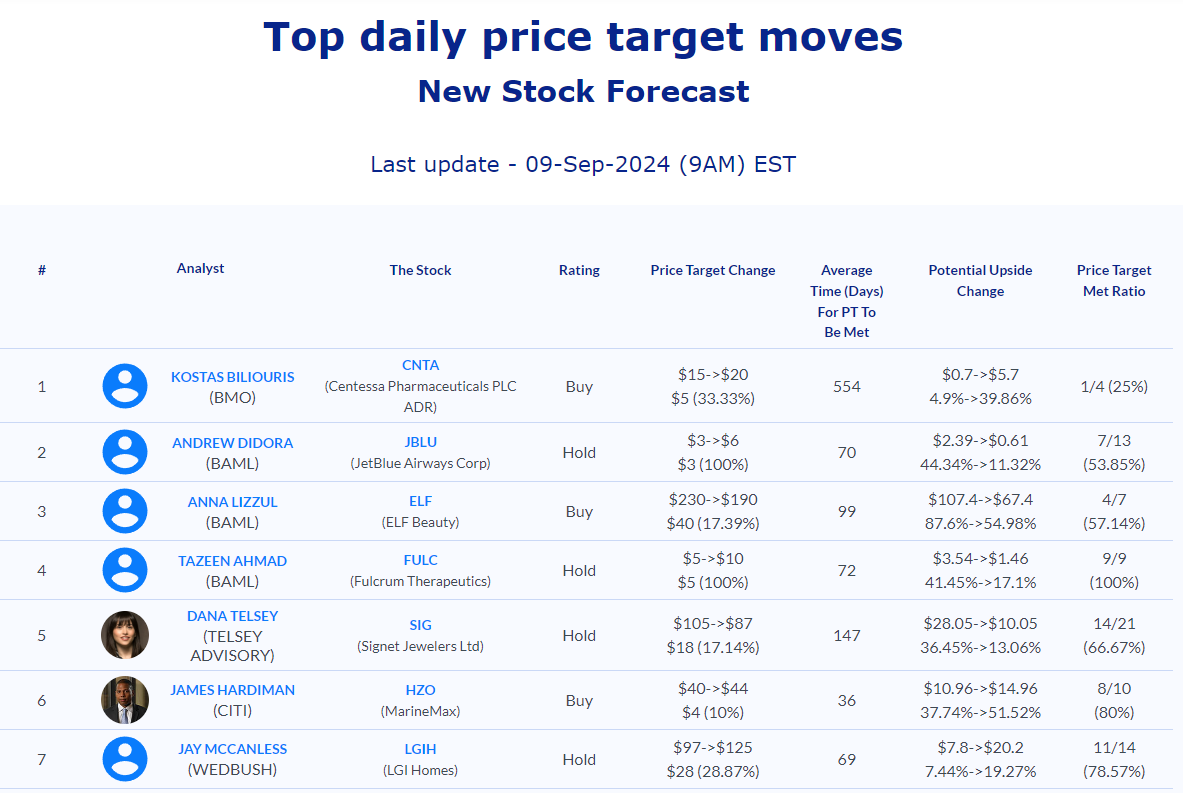

Daily stock Analysts Top Price Moves Snapshot