TipRanks Vs AnaChart

By: Matthew Auto

Preface

Having access to relevant news and information on stock market analysts and their recommendations is important part of educated trades. With over fifty years of history, wall street analysts play a major role with the stock market. They meet management, keep outlook projections honest and their stock forecasts impact the stock market. Some of the analysts calls are needle movers, many of them have a proven track record of stock price predictions.

However, gaining a deeper understanding of an analyst’s performance requires delving beyond surface-level information and examining their individual patterns of success or failure.

Not all analysts offer consistent success across the securities they cover. On average, successful calls range from 10% to 20%, with fluctuations occurring daily.

Relying too heavily on the median of outlets can be misleading. To fully benefit from accurate and evidence-based research, it’s important to have access to a well-researched platform that is solely devoted to stock analyst research. This allows for making sound decisions when navigating unpredictable markets.

What is TipRanks to Wall Street Analysts?

TipRanks is a leading brand for retail investors when searching for stock analysts, specializing in providing investment research tools and services. Its website provides users with access to stock recommendations, financial data, and professional analyst ratings. By analyzing data from various sources including Wall Street analysts, financial bloggers, and news stories, TipRanks’ unique algorithm, which is based on ratings (not price targets) provides a general ranked score for each analyst. TipRanks also generates an overall consensus rating and price target for a particular company. In addition, TipRanks offers several other tools such as a stock screener, portfolio tracker, and news feed to help investors make informed decisions. The platform also provides a premium subscription option that includes additional features and tools.

Why You Should Consider AnaChart as an Alternative to Tipranks

How to spot out a relevant analyst?

When an Institutional analyst covers a stock they commit to provide at a minimum four research reports per year. These reports include various factors regarding that stock depending on the approach the analyst and takes and in the summary of the reports there are two types of recommendation inside:

- The rating for the stock such as buy, hold or sell

- A price target that is what the analysts believes the stock price will reach within a year

TipRanks provides a score between zero and five to all analysts in its database and then ranks them accordingly to give users some context on where they consider the analyst to be in their 8,000 plus database, the score is determined by some mix of statistics and the analysts past stock rating success. For example if an analyst rated a buy on the Apple stock and then within a year the stock indeed went up it would contribute to the analyst rank.

In contrast, AnaChart provides a performance score limited to each single stock with the reasoning that an analyst can excel in one stock more than with others, and that investors want to know the best analysts are per stock, which is a more detailed tool. So for example if an analyst covers 16 stocks he will have one general rank on TipRanks and 16 different performance scores on AnaChart.

The question is what kind of investor are you? Does a general score satisfy your confidence to trade or are you looking for a more detailed answer? Another question is do you rely more on stock ratings or on price targets?

What to Look for In An Alternative to TipRanks

Are you looking for other approaches when looking at stock analysts?

By accessing analysts’ previous price targets, you can determine whether they anticipate or follow (make predictions before the stock price moves or adjust after) and gain valuable insights into their stock-picking reliability.

With AnaChart, you’re able to view previous target prices from each analyst for a more comprehensive overview – something that TipRanks doesn’t offer. Both websites display each analyst ratings (i.e Buy/Hold/Sell) for each analyst. However, AnaChart has the largest set of accessible public stock analyst price targets available anywhere with over 700 hundred thousand recommendations on display showing history of over more than 15 years.

More so, stock price targets are absolute by definition and as such a much better too to measure than stock ratings which are not numerical by nature and as such not reliable to be quantified. This is a major issue to know on which variables you are basing your actions, yo understand exactly how they are based and be able to scrutinize them.

AnaChart has an exclusive feature, it enables visual comparison between two or more analysts and their dynamic with that respective stock. TipRanks only provides a visual display of one analyst at a time.

AnaChart has processed over a million articles and snippets to have the most comprehensive stock price targets displayed anywhere.

How do you know who to trust?

Is TipRanks reliable? Is AnaChart? When you are dealing with over a million articles, mistakes are bound to happen. Both TipRanks and AnaChart gather information from public sources. We are all human, a reporter might misquote a number, name of an analyst or the stock covered, AnaChart has documented over 20,000 errors and contradictions between various financial media publishers that occurred in the last ten years.

Giving investors the ability to scrutinize the data is imperative. Relying on anonymous social media votes of confidence in a platform could be is a nice boost for your confidence but being able to check every detail for yourself and see how a score is calculated is better.

Currently, Tipranks doesn’t display every recommendation that is used to calculate their score that is used to rank an analyst and even if they did, validating hundreds of ratings for a single analyst is near impossible. We don’t suggest any inaccuracies in their calculations, yet the ability to validate information for yourself is always valuable when investing.

On the contrary, because AnaChart ranks per analyst paper stock the resolution is substantially higher and as such is much easier to scrutinize because an analyst will have much less information displayed for one stock than for the stocks in their entire work history.

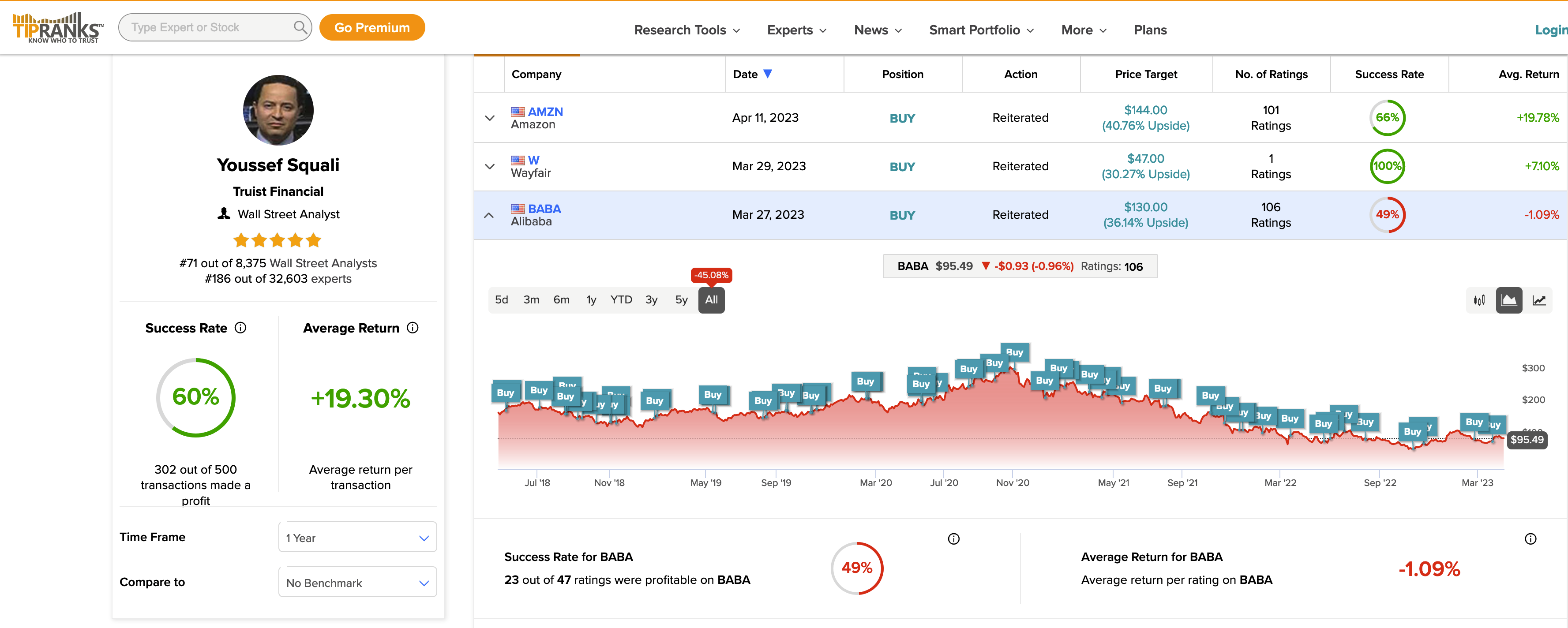

For example take stock analyst Youssef Squali who works at Truist, the first image if from TipRanks of his work history on the AliBaba stock. As you can see his previous/current ratings are posted on the stock price line.

In comparison, this the image from the AliBaba stock on AnaChart in which you can see not only the ratings but the price targets.

As you can see the amount of information displayed is substantially larger on AnaChart.

Cost Effectiveness

Is TipRanks worth it? TipRanks charges $50 per month or $359 per year, while AnaChart charges $20 per month or $200 per year. While TipRanks offers many other features that Anachart doesn’t, such as blogger rankings and risk analysis, if you rely on professional stock analysts, AnaChart’s visual display and with its amount of information is superior to anything on the market.

AnaChart offers a 30 days free trial in which you can cancel anytime without giving any explanation. TipRanks offer a 30 days money back guarantee on its annual package, however you will need to submit a request to have your money back if not satisfied.

What if I don’t want to pay? – TipRanks has a free membership class in which you get to see more information than an unregistered user such as uninterrupted browsing and seeing analysts ratings per stock over time.

AnaChart also has a free program in which you get access to all the 100 NASDAQ stocks showing all current and previous price targets and ratings, however you will not be able to see the links to the media sources that reported the respective stock analysts news. TipRanks doesn’t restrict access to the links on its charts, although capped in time to five years or so and doesn’t show all the links available even in the limited time span.

What is the right platform for you?

Is TipRanks worth the money? Well, that depends what kind of investor are you?

- Do you integrate Wall Street analysts’ recommendations into your investment process?

- How much weight do you place on having research before trading?

- What information do you consider important?

- What level of transparency are you looking for?

- Are you using amateur analysts and bloggers input?

- Do you consider previous stock analyst price targets important?

.

Anachart Benefits

AnaChart was created by stock traders for stock traders, aiming to provide quick, relevant, and reliable information to help investors make informed trading decisions. The platform uses charts, rather than tables, to display data visually, making it easier for users to interpret.

AnaChart is dedicated to transparency, gathering and presenting information from all public sources to save users time and money, while also acknowledging the news media that generated the news.

AnaChart’s performance score is one of its key advantages, as it identifies the best analysts for each stock. The algorithm used for this score is completely transparent, allowing investors to test each step of the process. With Anachart, investors can quickly see which stock analysts performed best for each stock and consistently predicted the stock’s future price movements.

Another benefit of Anachart is its ability to show investors when the top analyst changes their perspective on a stock, rather than just changing their rating. This feature allows investors to know when to pay attention and make informed decisions. Additionally, Anachart provides a detailed view of each analyst’s sentiment towards a stock, both as individuals and as a group, going beyond anonymous aggregated results.

Conclusion

While TipRanks has become a popular choice for investors seeking insights into stock analysts, there are also alternative platforms such as AnaChart that offer competing features and advantages.

By using Anachart as an alternative to TipRanks, investors can access a larger set of accessible public stock analyst price targets and utilize a higher detail approach for analyst performance comparison.

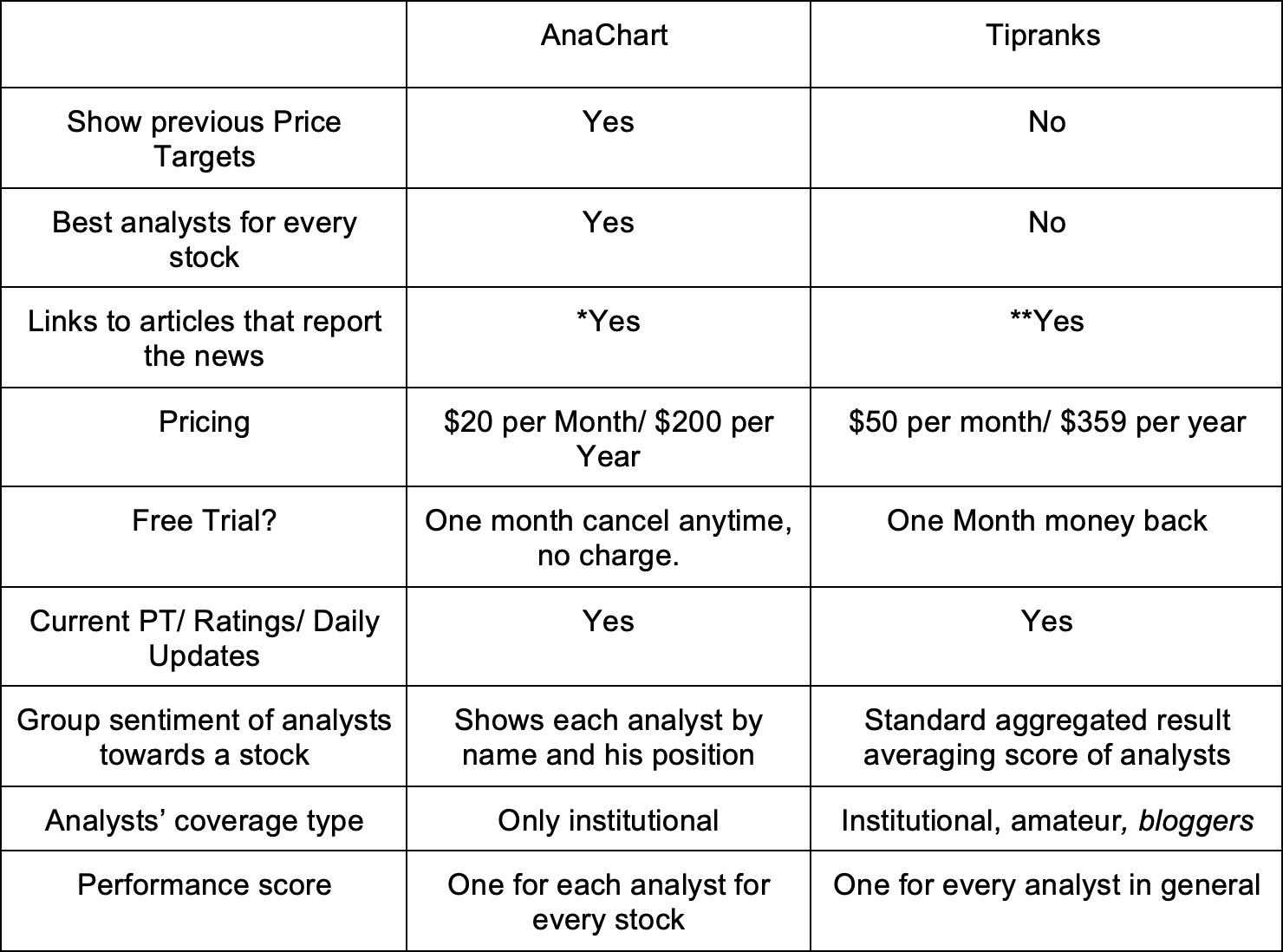

For your convenience we added a TipRanks VS AnaChart Comparison summary table.

*Links are only displayed on the premium membership package

** Partial links are on display