Weekly Updates - Nov 27, 2022

Selected stock price news highlights of the week

By: Matthew Otto

As this week’s reports continue we see more gloomy perception from high tech while some other industries carry forward a more positive note.

Autodesk

posted quarterly results that met Wall Street expectations but offered a weak outlook for the current quarter.For the quarter ended Oct. 31, Autodesk earned an adjusted $1.70 per share on sales of $1.28 billion. Analysts had been expecting earnings of $1.70 per share on sales of $1.28 billion, according to data from FactSet.

Looking ahead to the fourth quarter, Autodesk said it expects to generate adjusted earnings in the range of $0.93 to $0.95 per share on sales of roughly $1.21 billion. Analysts are currently expecting earnings of $1.14 per share on sales of $1.23 billion, according to FactSet.

For the full year, Autodesk now expects to generate adjusted earnings in the range of $5.48 to $5.50 per share on sales of roughly $4.94 billion. That’s below its previous guidance for earnings in the range of $5.53 to $5.55 per share on sales of around $4.96 billion, and below Wall Street’s current consensus estimates for earnings of $5.55 per share on sales of roughly $4.96 billion, according to FactSet.

Wall Street analysts have been quick to lower their stock forecasts for Autodesk following the company’s announcement of disappointing earnings guidance for the 2022 fiscal year:

Wall Street Action

- Joe Vruwink of Baird has downgraded his price target from $255 to $244, while maintaining his Outperform rating.

- Michael Funk of B of A Securities has lowered his target from $240 to $225 and retained his Neutral rating.

- Tyler Radke of Citigroup has gone even further, slashing his price target from $256 to $230 while still maintaining a Buy rating.

- Matthew Hedberg of RBC Capital has cut his target from $260 to $225 while maintaining an Outperform rating.

- Mizuho’s Matthew Broome has lowered his target from $260 to $210.

- Rosenblatt’s Blair Abernethy has lowered his target from $270 to $235.

- Credit Suisse’s Phil Winslow has lowered his target from $355 to $325.

- Barclays’ Saket Kalia has lowered his target from $275 to $225.

- Oppenheimer’s Ken Wong has lowered his target from $255 to $220.

- Keybanc’s Jason Celino has lowered his target from $264 to $237.

Covid19 hits retail sales

Burlington Stores reported its financial results for the third quarter ended November 26, 2023. net sales for the third quarter of 2023 were $2.04 billion, a decrease of 11% from $2.30 billion in the third quarter of 2022. The decrease was driven by COVID-19-related store closures and reduced customer traffic and mall foot traffic in the quarter. Comparable store sales decreased 10%. Adjusted net income for the third quarter of 2023 was $16.8 million, or $0.26 per diluted share, compared to adjusted net income of $13.7 million, or $0.20 per diluted share, in the third quarter of 2022. Adjusted net income in the third quarter of 2023 excludes $8 million of after-tax charges, or $0.12 per diluted share,

Looking ahead to the fourth quarter of 2023, based on current visibility into comparable store sales trends and other factors, Burlington expects its fourth quarter GAAP earnings per diluted share to be in a range of $0.62 to $0.66 and its fourth quarter adjusted earnings per diluted share to be in a range of $0.70 to $0.74.. Mr Riese concluded, “We are encouraged by the improving sales trends we have seen since August as well as by our progress against each of our Five Pillars strategy.” We expect these positive momentum will continue as we enter the holiday season.”

Wall Street Action

- Goldman Sachs analyst Brooke Roach upgraded his price target on Burlington Stores from $175 to $200 while maintaining a Buy rating. Citing the company’s strong third quarter results, Roach believes that Burlington is well- positioned to continue its growth trajectory.

- Citigroup analyst Paul Lejuez upgraded his price target on the company from $180 to $219 and maintained a Buy rating. Lejuez believes that Burlington’s third quarter results were impressive, and he is optimistic about the company’s future prospects.

- Morgan Stanley analyst Alex Straton upgraded his price target on Burlington from $175 to $219 and assumed an Overweight rating. Straton believes that the company is benefiting from robust consumer demand and is well-positioned to continue its winning streak.

- Credit Suisse analyst Michael Binetti upgraded his price target on Burlington from $165 to $205 while maintaining an Outperform rating. Binetti cites the company’s strong third quarter results as evidence of its solid fundamentals.

- Barclays analyst Adrienne Yih upgraded her price target on Burlington from $164 to $230 and maintained an Overweight rating. Yih believes that the company’s strong performance in the third quarter is a positive sign for its future prospects.

- Telsey Advisory Group analyst Dana Telsey upgraded her price target on Burlington from $200 to $225 while maintaining an Outperform rating. Telsey cited the company’s strong third quarter results as evidence of its solid fundamentals.

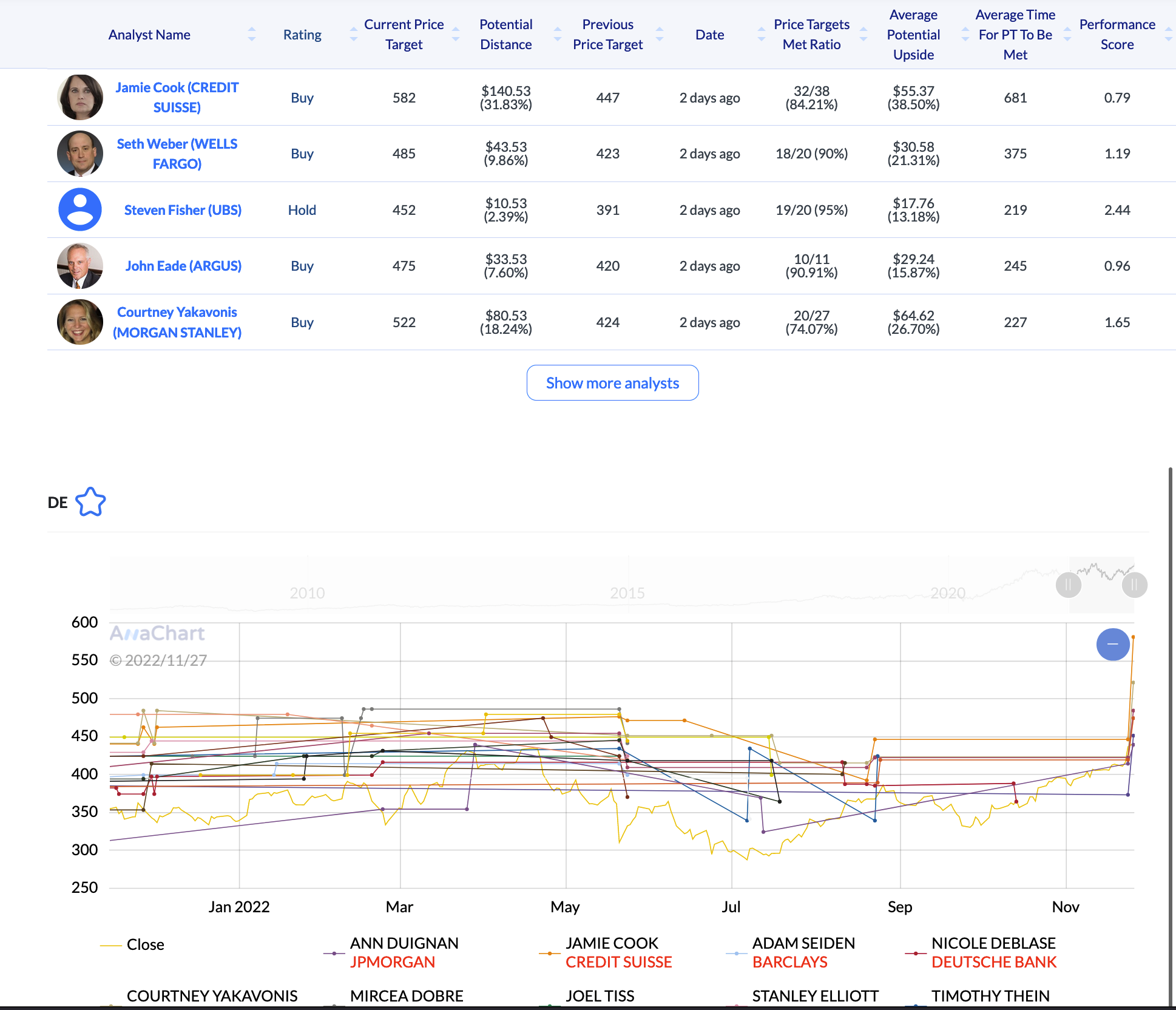

Deere & Company

Has reported strong fiscal fourth-quarter and full-year results for fiscal year 2023. The company’s earnings of $7.44 per share exceeded analyst expectations, and revenue of $14.4 billion was also ahead of expectations. The robust results were driven by continued strong demand for agricultural equipment, which was supported by higher crop prices.

For the full fiscal year, Deere reported net income of $8.1 billion, up from $7.1 billion in fiscal year 2022, and earnings per share of $14.10, up from $11.97 in the prior year. Sales for the full fiscal year were $52.1 billion, up from $42.8 billion in fiscal year 2022.

Looking ahead to fiscal year 2024, Deere expects sales to be flat to slightly down compared to fiscal year 2023 due to the anticipated easing of crop prices. Nevertheless, the company still expects to post strong profitability, thanks to efficient manufacturing and cost controls.

Wall Street Action

- Seth Weber of Wells Fargo has raised his target from $423 to $485.

- Dillon Cumming of Morgan Stanley has increased his target from $424 to $522.

- John Eade of Argus Research has raised his target from $420 to $475.

- Jamie Cook of Credit Suisse has raised her target from $447 to $582.

- Tami Zakaria of JP Morgan has raised her target from $415 to $440,

- Steven Fisher of UBS has raised his target from $374 to $452.

Zoom lowers revenue forecasts due to competition

Despite a pandemic-fueled boom in videoconferencing, Zoom is feeling the squeeze from rivals as it takes longer to close deals and sees its sales forecast for the year lowered. The company reported quarterly revenue and profit that topped analysts’ expectations but gave a tepid forecast for the current quarter. The company is seeing “heightened deal scrutiny for new business,” CEO Eric Yuan said during the earnings call. Rivals aren’t winning the deals Zoom discusses with prospective clients, but they are taking longer to close, said Kelly Steckelberg, the company’s finance chief. The company expects sales this fiscal year of $4.37 billion to $4.38 billion, a slight reduction from its forecast in August and below the $4.4 billion average analyst estimate.

The videoconferencing company said it earned $1.07 per share, adjusted, in the quarter ended Nov. 30, up from 7 cents a year ago. Analysts had expected earnings of 84 cents per share, according to Refinitiv. Revenue rose 169% to $1.10 billion from $410 million a year ago and also beat expectations. Analysts had expected revenue of $1.10 billion, according to Refinitiv. Net income plunged to $48.4 million from $340.3 million in the year-earlier quarter. The company expects sales this fiscal year of $4.37 billion to $4.38 billion, a slight reduction from its forecast in August and below the $4.4 billion average analyst estimate, according to FactSet.

Wall Street Action

- Barclays analyst Ryan Macwilliams downgraded Zoom from “overweight” to “equal weight” and lowered his price target for the stock from $90 to $80. Macwilliams believes that the company’s share price already reflects its strong growth prospects.

- Wells Fargo analyst Michael Turrin downgraded Zoom from “outperform” to “equal weight” and cut his price target for the stock from $95 to $80. Turrin cites increased competition as a key concern for the company going forward.

- Morgan Stanley analyst Meta Marshall downgraded Zoom from “overweight” to “equal weight” and lowered her price target for the stock from $90 to $85. Marshall believes that the company’s current valuation reflects its strong growth prospects.

- MoffettNathanson analyst Sterling Auty downgraded Zoom from “neutral” to “underperform” and slashed his price target for the stock from $85 to $80. Auty is concerned about the company’s ability to continue growing at its current pace in the face of increased competition.

- Mizuho analyst Siti Panigrahi downgraded Zoom from “buy” to “hold” and lowered her price target for the stock from $120 to $100. Panigrahi is concerned about increased competition and potential regulatory headwinds facing the company.

- Deutsche Bank analyst Matthew Niknam downgraded Zoom from “hold” to “sell” and slashed his price target for the stock from $95 to $75. Niknam is concerned about potential regulatory constraints on the company’s business model and increased competition from Microsoft and Cisco.

- Piper Sandler analyst James Fish downgraded Zoom from “neutral” to “underweight” and lowered his price target for the stock from $84 to $77. Fish is concerned about potential regulatory headwinds facing the company as well as increased competition in the market for video conferencing services.

Dell beats on revenue but lowers outlook

Dell Technologies on Thursday reported better-than-expected earnings for its fiscal third quarter, but the company’s sales outlook for the current quarter fell short of Wall Street expectations.

The Round Rock, Texas-based company earned an adjusted $2.30 a share on sales of $24.72 billion in the quarter ended Oct. 28. Analysts polled by FactSet had predicted Dell earnings of $1.60 a share on sales of $24.37 billion. On a year-over-year basis, Dell earnings rose 39% while sales fell 6%.

For the current quarter, Dell expects to earn an adjusted $1.65 a share on sales of $23.5 billion. That’s based on the midpoint of its outlook. Analysts were modeling earnings of $1.63 a share on sales of $24.87 billion in the fiscal fourth quarter. Dell’s guidance would translate to year over year declines of 4% in earnings and 16% in sales. With strong growth in enterprise equipment offset by slumping sales of PCs. The company’s Infrastructure Solutions Group delivered revenue of $9.6 billion, up 12% year over year. Sales of servers and networking gear rose 14% to $5.2 billion, while data storage equipment sales climbed 11% to $4.4 billion. However, Dell’s Client Solutions Group reported a 17% drop in sales to $13.8 billion.

Wall Street Action

- Shannon Cross of Credit Suisse lowers Dell’s price target from $56 to $53, while keeping an Outperform rating.

- Simon Leopold of Raymond James reduces Dell’s price target from $47 to $50, while staying with an Outperform rating.

- Wells Fargo analyst Aaron Rakers cuts Dell’s price target from $58 to $52, while still maintaining an Overweight rating.

- UBS analyst David Vogt revises Dell’s price target downwards from $65 to $60 yet retaining a Buy rating.

- Citigroup analyst Jim Suva downgrades Dell’s price target from $55 to $53 with buy rating.

- Barclays analyst Tim Long lowers Dell’s price target from $49 to $41 with an Equal-Weight rating.