StockAnalysis.com vs AnaChart

First of all we want to say that we like StockAnalysis.com and use to when checking which stocks have changed their ticker symbol or went defunct.

However stock analysts recommendation is much more complex than that.

AnaChart reads and process every major public media outlet and posts the items for each stock, offering a level of granularity not found in comparable services like StockAnalysis.com who offers no such feature. One of its distinguishing features is its extensive collection of articles and recommendations by Wall Street analysts, accessible to those who subscribe to its advanced package. The difference comes when you wish to dive deeper with your research or validate the accuracy of the reports.

Distinction in Analytical Depth

StockAnalysis.com: It offers a generic ranking of analysts based on limited parameters like success rate and average return. These rankings are broad and don’t offer a way to verify the underlying data. As with most other sites the success rate and average return are based on the analysts previous ratings which are subjective and as not the best tool to quantify an analyst performance unlike price targets.

AnaChart: Conversely, this platform provides nuanced performance scores for analysts specific to individual stocks. This is predicated on the idea that an analyst’s expertise can vary widely depending on the stock in question. For instance, an analyst would have one general rank on StockAnalysis but could have 16 separate performance metrics on AnaChart if they cover 16 different stocks.

Types of Recommendations

Both platforms display stock ratings such as “Buy,” “Hold,” or “Sell.” However, AnaChart also presents the price targets set by analysts. This quantitative metric offers a tangible measure of an analyst’s expectations, which could be critical for some investors.

Information Transparency

AnaChart gives you the tools to scrutinize each analyst’s performance history, including their past price targets. This allows you to assess whether they have historically been prescient or reactionary. Such detailed data can offer valuable insights into an analyst’s reliability.

Visual Tools for Comparison

While StockAnalysis.com only provides textual summaries of analyst actions, AnaChart includes visual representations. These can help you understand, at a glance, how multiple analysts compare to one another over time concerning a specific stock.

Example:

For example let’s take stock analyst Zachary Fadem who covers Consumer Discretionary for Wells Fargo

Here is a screenshot from StockAnalysis.com

As

As you can see there is a summary of ratings counter but no ability to check, you just have to trust that the data is correct and all market conditions (stock going up, down is the same).

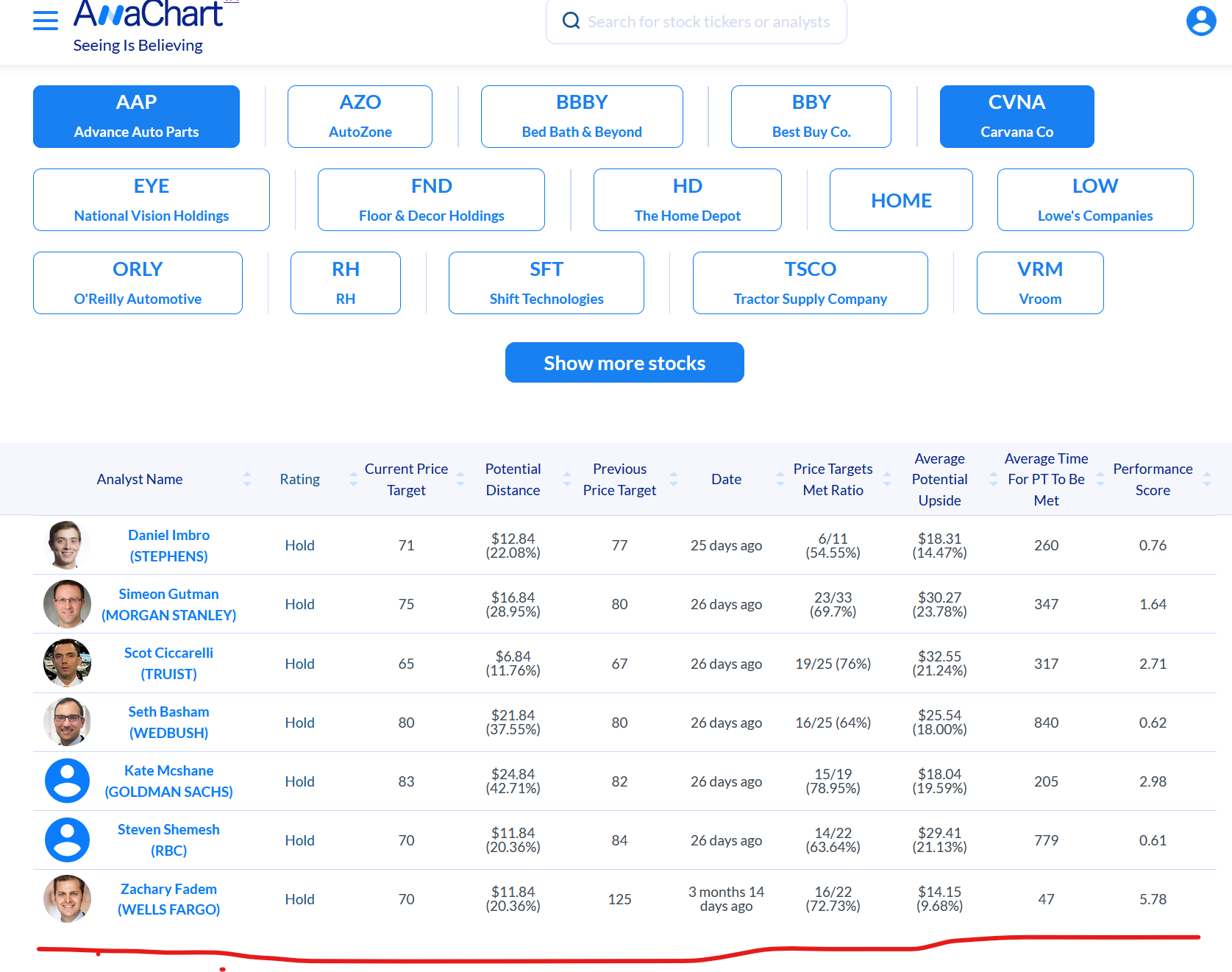

Here for comparison is the first screenshot from AnaChart

As you can see the amount of information is more than double with more statistics related to the analyst’s price target performance.

But there is more, if you scroll down, you can access the chart, select any analyst and focus on their coverage history in details just like in the screenshot below.

As you can see, a picture is worth a thousand words. You see how closely the analyst kept his price target to the stock, and you can touch price target and see which media outlet covered it.

Data Volume

AnaChart boasts an extensive database of over 700,000 public stock analyst price targets and has processed over a million articles. This depth of information surpasses what is generally available on StockAnalysis.com

In summary, AnaChart may be a more fitting choice for investors seeking comprehensive, verifiable data and a more nuanced analysis of stock analysts. The platform addresses various types of investors, whether you prioritize general scores or seek a more detailed, stock-specific evaluation.

For other topics we highly recommend StockAnalysis.com for their vast of amount if information for affordable price.