Why is it important to know where price targets are coming from (part 1)?

May 19 2021

Joseph Kalish

Updated on April 1 2023

Why should I care about stock analyst price targets?

Whether you’re a professional investor or just getting started, analyst price targets can have a major impact on stock prices. Over 300 broker dealers and research firms in the US employ analysts to cover thousands of stocks. However, not all sources are equally influential. Big-name outlets like MarketWatch or Bloomberg typically carry more weight than smaller media publishers. Additionally, well-respected analysts with higher recommendations can attract greater attention from investors and cause significant market movements.

What are price targets and ratings?

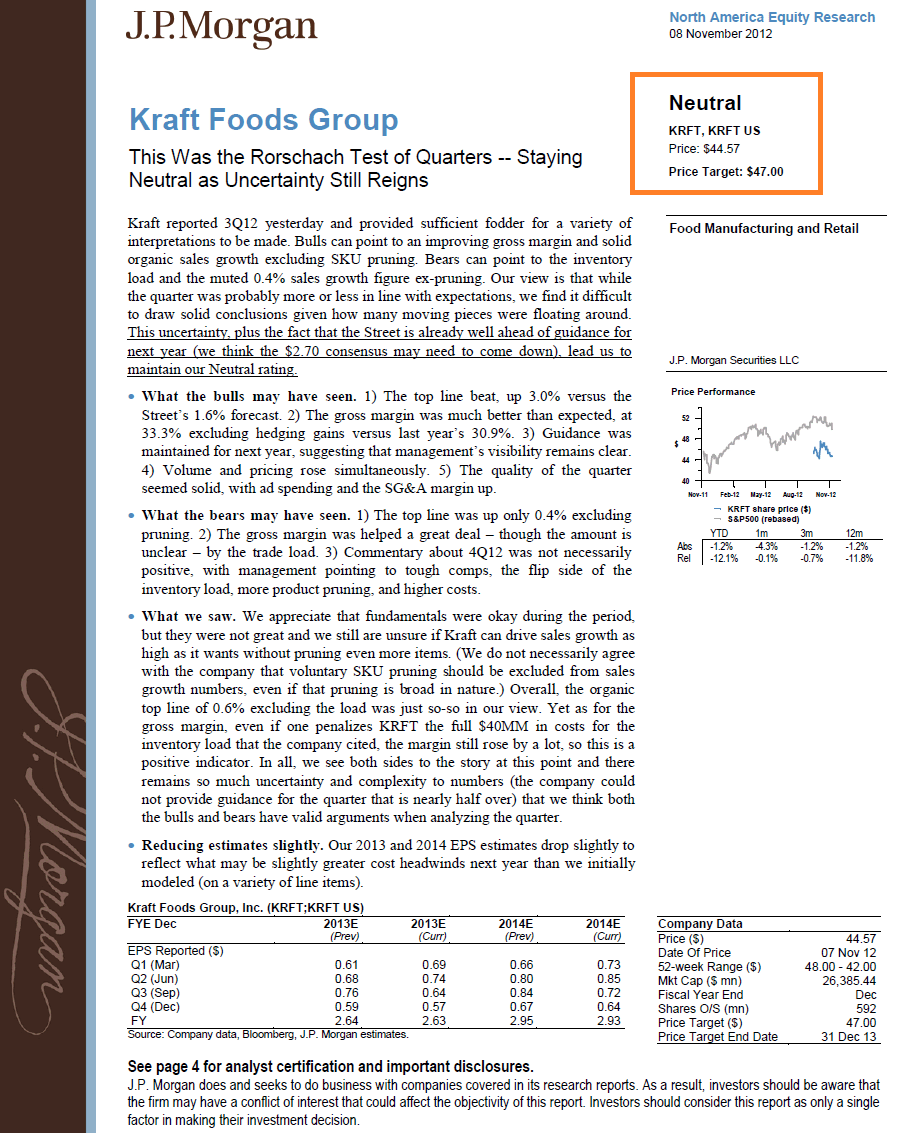

Every analysts that covers a stock produces at a minimum four reports per year. The report is usually six pages long and includes a summary with two conclusions: a rating (Buy/Hold/Sell) and a price target. The price target is an estimated future stock price based on the analyst’s algorithm. For example, a JP Morgan analyst gave Kraft Foods (KRFT) a Neutral rating and a $47 price target.

Picture taken from the CFI website

How can I access these reports?

For the reports themselves you will need access from the firm that produced it or a 3rd party vendor such as Refinitiv. However the media will blast day in day out about the price targets and ratings given and whether you read the report or not it will have an impact on the relevant stock.

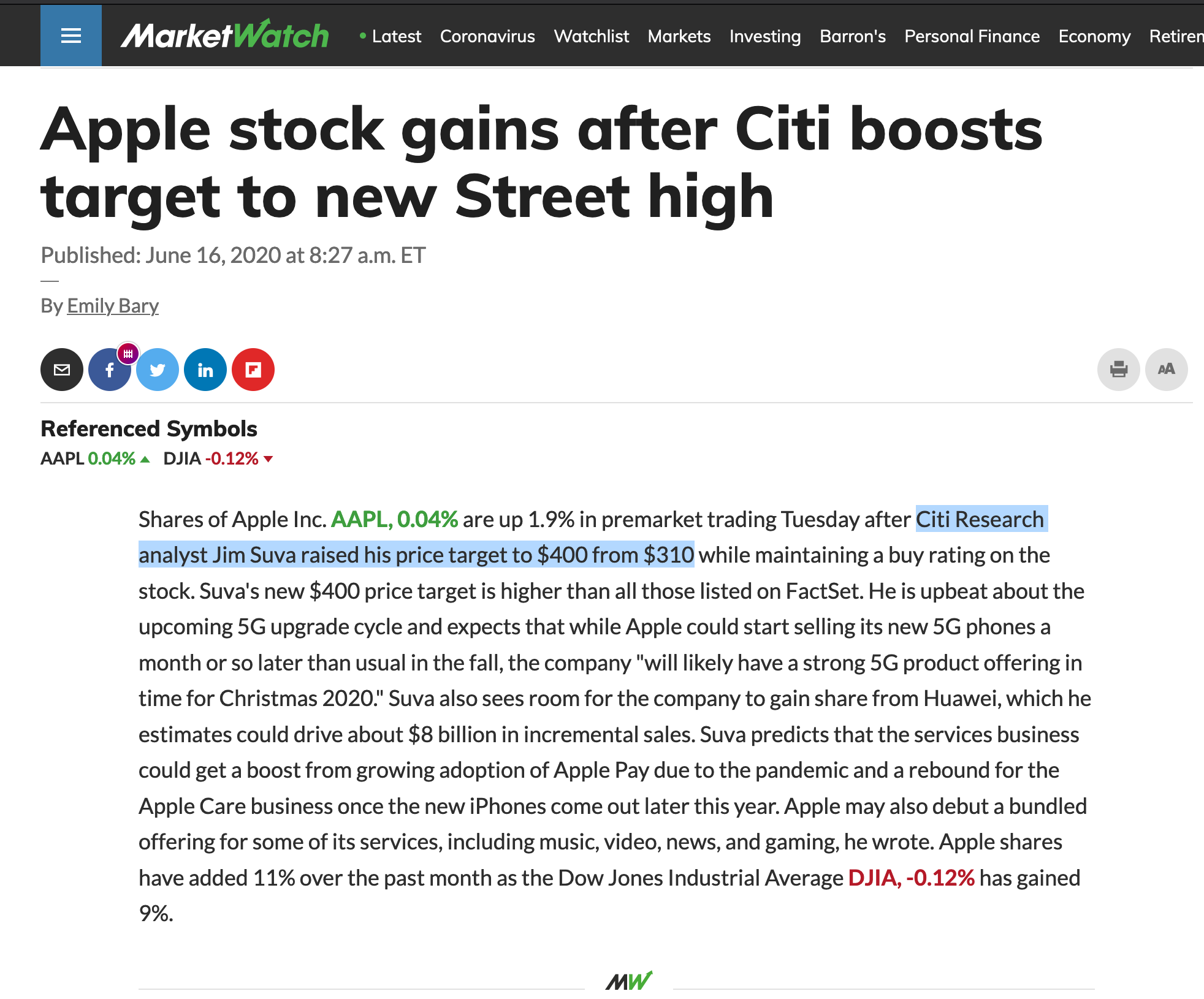

Keeping track of analyst coverage can be difficult – especially when there are headlines with million+ impressions, like the one for Jim Suva and AAPL on MarketWatch.

When it comes to investing in a stock

Not only should you have an understanding of what’s being said about it, but also who is saying it and for how long. Have price targets been prior to or following increases? What was their level of accuracy prior? How updated are their news postings, and from where can this information be accessed? It is critical that these questions are answered before making any investments. Without knowing the track record of an analyst, investors may remain in the dark. Fortunately, there is a platform that can lend clarity to investment decisions: AnaChart. A powerful tool that gives insight into the activity history of each analyst across enables investors to make informed decisions.

*Apple’s stock split in 2020, which was four for every one share, resulted in the adjustment of their price targets in retrospect.

The GIF above shows that For over a decade, Jim Suva has been committed to the stock of Apple. Always expressing his expertise with positive predictions that kept price targets above its current valuation; he was simply adjusting expectations on June 16th 2020 when the stock climbed higher than projected.

Without analyzing prior price targets and how stock prices ultimately performed, investors won’t be able to gauge the accuracy of future forecasts. Knowing what transpired with past predictions can give you better clarity with your stock trends and as result better prepared.

So can I use public information for my stock research?

Analyzing the stock of Apple over the past several years is a great example demonstrating how useful it can be to compare two analysts’ forecasts. Jim Suva from Citi and Lara Martin from Needham both have insightful takes on potential future performance, but Laura’s foresight in consistently raising her price targets ahead of Jim has been particularly impressive – as evidenced by increases for this tech giant between 2019-2022.

This is one example on one stock at one point in time with thousands others at your disposal.