Why is it important to know where price targets are coming from (part 2)?

May 19 2021

Joseph Kalish

Monitoring the quality of an analyst’s work is challenging;

Relying solely on stock ratings over time fails to provide a comprehensive assessment. A more in-depth examination must be made for accurate results.

For example: Zachary Fadem, who works at Wells Fargo covering Advanced Auto Parts and other stocks the in the consumer cyclical and consumer defensive sectors, is an expert in the field.

Zachary is known for his unwavering opinions – regularly sticking to the same stock ratings. As a result, if that’s all the data available, you are unlikely to be able to rely on the analyst’s insight, as demonstrated in the picture below.

However, knowing the stock price’s history and observing how an analyst foreseen/ responded to certain changes in his target prices can give you great insight into your investment decisions. Compare the two side-by-side for an up close look at these trends!

For example in the GIF below here you can see the success that the analyst had with being able to predict the rise of AAP in 2018 followed by continues correction down in 2019 – 2020 followed by a more hesitant reaction to the stock rise and fall in the last three years.

Missing out on analyst price target adjustments can be a risky game.

Without being aware of sudden shifts, investors may face surprise drops or rises in their portfolio with no warning – and that could spell disaster for any investment strategy.

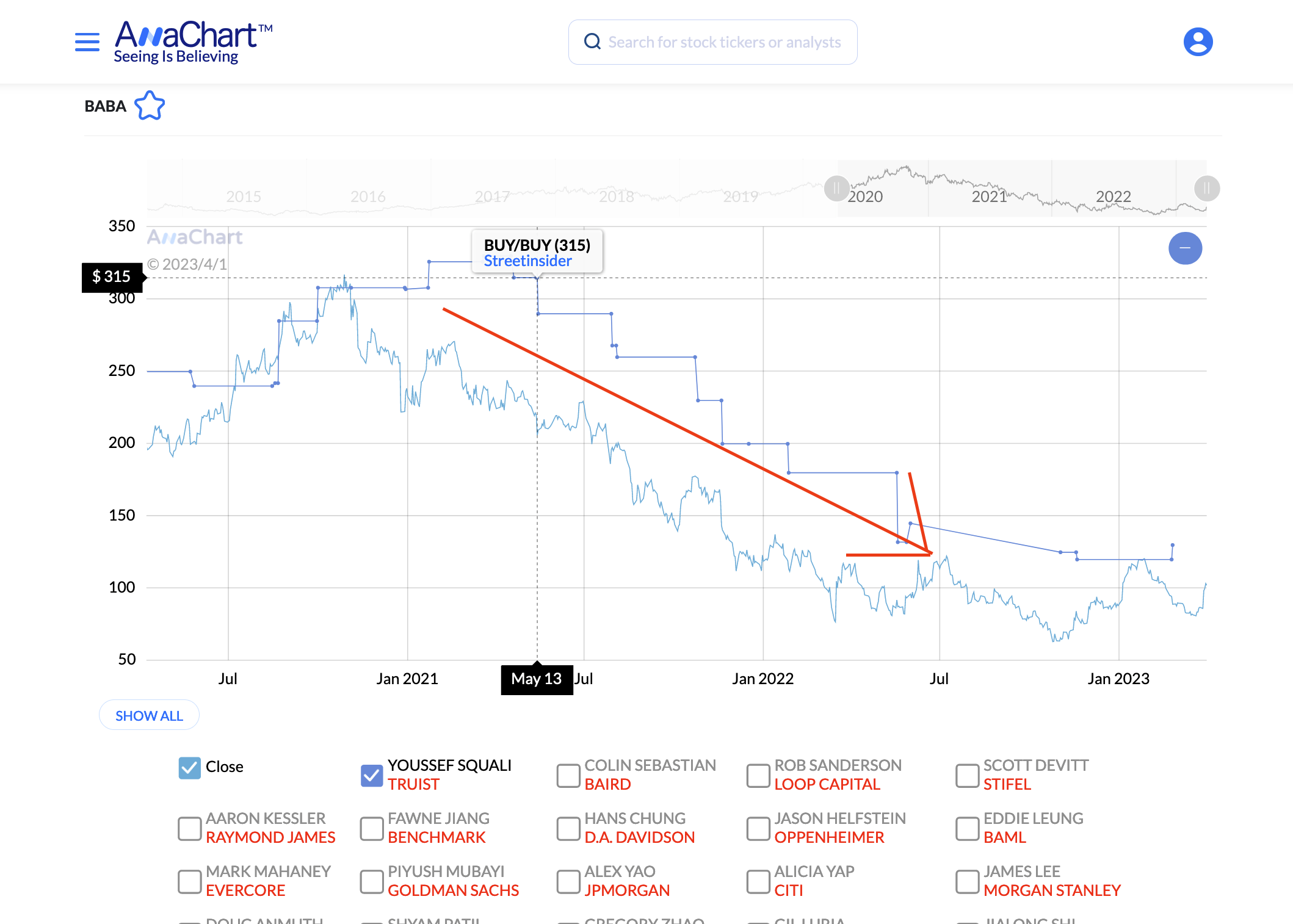

Another example is Truist analyst Youssef Squali who has been covering Ali Baba for the last eight years. During 2021 and 2022 the stock lost two thirds of its market value, the analyst kept his Buy rating for the entire duration but consistently adjust his price target lower.

If you only know the ratings, you may be misled into a false sense of security that the analysts had the situation under control, while in reality, their price target adjustments told a completely different story.

Ultimately, without sufficient insight into analysts’ price targets and historical performance metrics, relying on their advice is a risky proposition.

Without such data points, it’s impossible to accurately gauge the quality or efficacy of analysts’ algorithms. As a result, relying solely on stock ratings fails to provide a comprehensive assessment of an analyst’s work. An in-depth examination is necessary for accurate results.