Selected stock price target news of the day - July 20, 2023

By Matthew Otto

Netflix Misses on Q2 Revenue

Netflix disappointed Wall Street in the second quarter as its revenue fell short of analyst estimates. Despite exceeding earnings predictions and adding 5.9 million new streaming customers which surpassed Wall Street’s prediction of 1.9 million. (By the end of June, the global subscriber count for Netflix stood at 238.4 million).

Revenue for the quarter witnessed a 2.7% rise from the same period last year, reaching $8.2 billion, although it fell slightly short of the predicted $8.3 billion by analysts. The company forecasts that the revenue for the upcoming third quarter will reach $8.5 billion, while Wall Street’s estimate was slightly higher at $8.7 billion.

The firm announced earnings-per-share of $3.29, diluted for Q2, exceeding the anticipated $2.86 as predicted by analysts polled by Refinitiv.

Netflix’s efforts to find new revenue streams and combat streaming competition through the introduction of an ad-supported tier and a crackdown on password sharing have been ongoing. However, as Netflix approaches market saturation in the United States, it faces challenges in maintaining its growth trajectory.

While the addition of nearly 6 million subscribers outpaced expectations, average revenue per member declined by 3% due to the influx of sign-ups from countries with lower subscription prices. Netflix’s revenue growth projections for the third quarter also fell below Wall Street’s estimates. The ongoing strike by Hollywood actors and writers, which has disrupted film and television productions industry-wide, has affected Netflix as well. However, the company is still raising its 2023 free cash flow estimate to $5 billion and expressing hope for a resolution to the labor tensions.

Mixed Analyst Views on Netflix as Price Targets and Ratings Differ

- Credit Suisse analyst Douglas Mitchelson reiterates a Neutral rating and a $370 price target.

- BofA Securities analyst Jessica Ehrlich maintains a Buy rating and raises her price target from $490 to $525.

- Pivotal Research analyst Jeffrey Wlodarczak remains with a Buy rating and upgrades his price target from $535 to $600.

- Wolfe Research analyst Peter Supino maintains an Outperform rating and raises his price target from $485 to $500.

- Piper Sandler analyst Thomas Champion remains with a Neutral rating and increases his price target from $350 to $440.

- Deutsche Bank analyst Bryan Kraft reiterates a Buy rating and upgrades his price target from $475 to $485.

Analyst Lee Horowitz (DEUTSCHE BANK) currently has the highest performing score on NFLX with a 7/7 (100%) price target fulfillment ratio. His price targets carry an average of $22.89 (6.17%) potential upside. Netflix stock price reaches these price targets on average within 134 days.

Elon Musk Outlines Ambitious AI Goals: Self-Driving and Robots in Factories

Tesla CEO Elon Musk has set new targets for artificial intelligence (AI) products, including self-driving software and the use of humanoid robots in factories. Musk stated that Tesla is in talks with a major automaker to license its full self-driving technology. He believes that the approval of self-driving capabilities by regulators would result in an increase in the value of Tesla vehicles, which he described as potentially “the single biggest step change in history.”

Musk also mentioned the potential deployment of Tesla robots on factory floors as early as next year, although only a small number of robots have been built so far. The move to license Tesla’s technology comes after several failed attempts by others in the industry to develop reliable self-driving software. Musk admitted that he has been overly optimistic in the past about achieving full self-driving, but he believes that Tesla will surpass human driving capabilities by the end of this year.

Analysts Provide Varied Recommendations and Price Targets for Tesla

- Wedbush analyst Daniel Ives reiterates an Outperform rating and a $300 price target.

- Wells Fargo analyst Colin Langan maintains an Equal-Weight rating and a $265 price target.

- Bernstein analyst Toni Sacconaghi reiterates an Underperform rating and a $150 price target.

- Barclays analyst Dan Levy remains with an Equal-Weight rating and a $260 price target.

- Needham analyst Chris Pierce stays with a Hold rating.

Analyst George Galliers (GOLDMAN) currently has the highest performing score on TSLA with 7/8 (87.5%) price target fulfillment ratio. His price targets carry an average of $-4.27 (-4.03%) potential downside. Tesla stock price reaches these price targets on average within 81 days

Philip Morris Reports Strong Q2 2023 Results and Raises Full-Year Forecast

Philip Morris has released its second-quarter and first-half results for 2023. The company reported second-quarter diluted EPS of $1.01 and adjusted diluted EPS of $1.60, showing a currency-neutral growth of 16.9%. For the full year 2023, Philip Morris is aiming for a reported diluted EPS of between $5.36 and $5.45, and an adjusted diluted EPS of $6.13 to $6.22, which would represent a currency-neutral growth of 8.0% to 9.5%.

The report showed that Philip Morris’s second-quarter total cigarette and Heat-Not-Burn (HTU) shipment volume increased by 3.3%. The shipment volume of HTUs grew by 26.6%. Notably, the smoke-free product net revenues rose by 34.1%. The net revenues reached $9.0 billion, marking a 14.5% increase, and smoke-free product net revenues accounted for 35.4% of total net revenues.

HTU shipment volume growth was fueled by both distributor and wholesaler inventory movements, and IQOS continued to gain momentum. Swedish Match, now a part of Philip Morris International, performed well, particularly in the US market with ZYN nicotine pouch shipment volumes.

Philip Morris has raised its full-year 2023 forecast for organic net revenue growth to a range of 7.5% to 8.5%, and currency-neutral adjusted diluted EPS growth to a range of 8.0% to 9.5%.

Philip Morris Receives Positive Analyst Reviews With Raised Price Targets

- Morgan Stanley analyst Pamela Kaufman reiterates an Overweight rating and a $118 price target.

- Citigroup analyst Simon Hales upgrades from Neutral to Buy and the price target from $109 to $117.

Analyst Pamela Kaufman (MORGAN STANLEY) currently has the highest performing score on PM with 9/20 (45%) price target fulfillment ratio. Her price targets carry an average of $24.08 (32.46%) potential upside. Philip Morris stock price reaches these price targets on average within 684 days

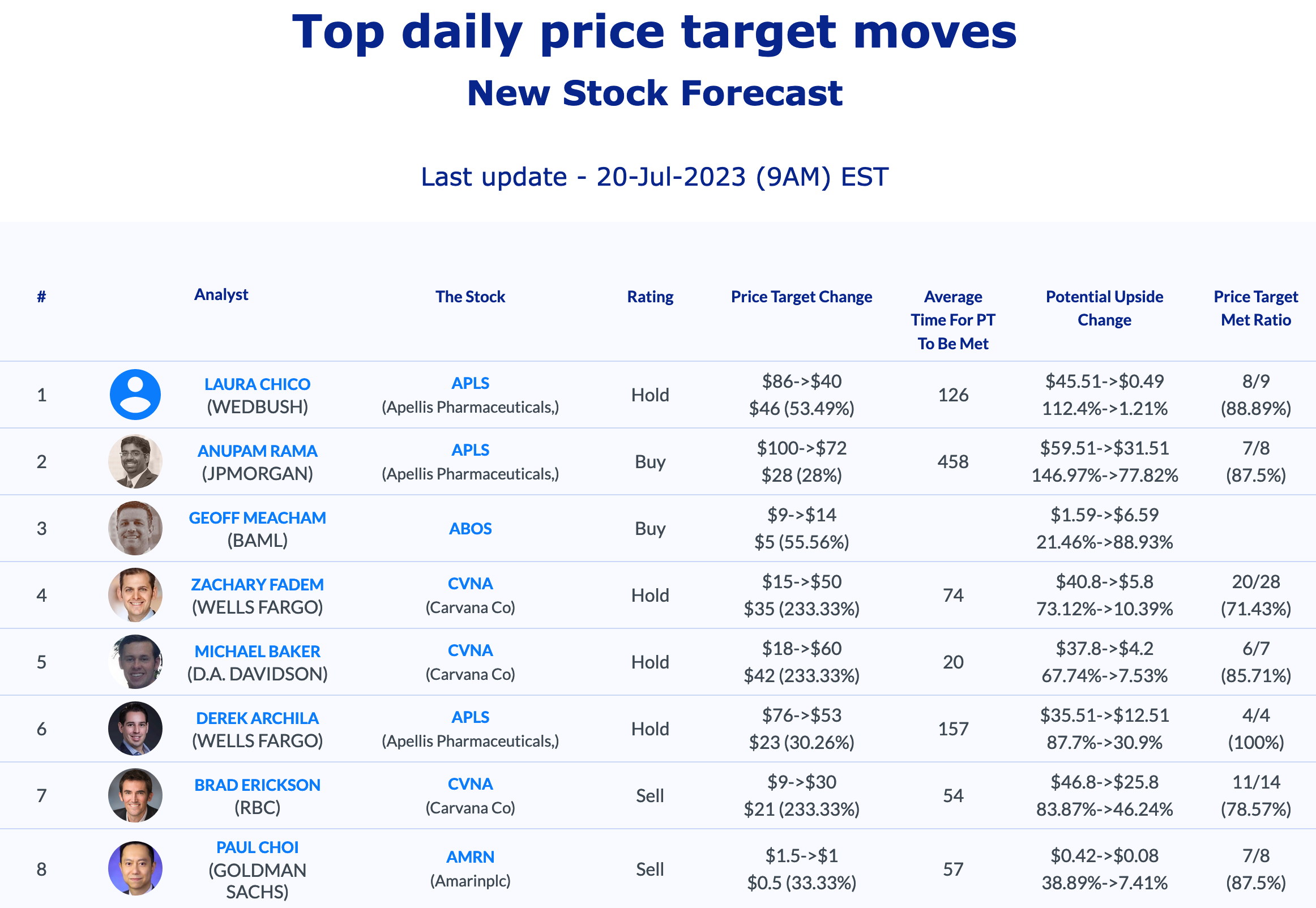

Daily stock Analysts Top Price Moves Snapshot