Selected stock price target news of the day - September 11th, 2024

By: Matthew Otto

Academy Sports Exceeds Q2 Earnings Expectations Despite Revenue Miss

Academy Sports and Outdoors reported Q2 2024 earnings, posting earnings per share (EPS) of $2.03, just above the analyst estimate of $2.02. Also reported total revenue of $1.55 billion, which came in lower than the consensus estimate of $1.58 billion.

Total sales reached $1.55 billion, down 2.2% compared to the same period last year. Comparable sales were also down by 6.9%, driven primarily by a 7.4% drop in store traffic.

Academy Sports and Outdoors faced several challenges, including economic pressures on its core customer base of young families. Additionally, severe weather events negatively affected operations, with the company estimating these disruptions cost them approximately $16 million in sales.

On the other hand, footwear and outdoor divisions both reported 1% sales growth. Academy Sports’ online sales also grew, accounting for 9.7% of total sales.

Academy Sports and Outdoors revised its full-year sales forecast to between $5.9 billion and $6.07 billion, down 1% to 4% from the previous year.

Analysts Boost Price Targets and Reaffirm Ratings

- Wedbush analyst Seth Basham reiterated an Outperform rating and a $65 price target.

- Truist Securities analyst Joseph Civello kept a Buy rating and raised the price target from $60 to $63.

- Telsey Advisory Group analyst Joseph Feldman continued with an Outperform rating and a $65 price target.

- Evercore ISI analyst Greg Melich increased the price target to $65.

- Loop Capital analyst Anthony Chukumba reaffirmed a Buy rating and a $77 price target.

- Wells Fargo analyst Will Gaertner raised the price target to $61.

Which Analyst has the best track record to show on ASO?

Analyst Christopher Horvers (JPMORGAN) currently has the highest performing score on ASO with 10/10 (100%) price target fulfillment ratio. His price targets carry an average of $4.24 (8.70%) potential upside. Academy Sports and Outdoors stock price reaches these price targets on average within 160 days.

Avid Bioservices Reports Q1 FY2025 Results with Increased Revenue and Record Backlog

Avid Bioservices reported its financial results for the first quarter of fiscal 2025, with revenues reaching $40.2 million. This reflects a 6% increase from $37.7 million in the prior year. Gross profit increased to $5.7 million, with a gross margin of 14%, compared to $4.1 million or an 11% margin in the first quarter of fiscal 2024.

However, net loss widened to $5.5 million, or $0.09 per share, from a net loss of $2.1 million, or $0.03 per share, in the same period last year. Selling, general, and administrative expenses increased by 30%, reaching $8.2 million, driven by higher compensation, benefits, and professional fees.

Operationally, Avid reported $66 million in net new orders during the quarter, bringing its backlog to $219 million, a 16% increase from the same quarter in 2023 and a 13% rise from year-end fiscal 2024.

Analysts Boost Ratings and Price Targets Following Q1 FY2025

- RBC Capital analyst Sean Dodge maintained an Outperform rating and raised the price target from $8 to $12.

- Stephens & Co. analyst Jacob Johnson reiterated an Overweight rating and the price target at $12.

- William Blair analyst Max Smock continued with a Market Perform rating.

Which Analyst has the best track record to show on CDMO?

Analyst Sean Dodge (RBC) currently has the highest performing score on CDMO with 8/12 (66.67%) price target fulfillment ratio. His price targets carry an average of $0.3 (3.90%) potential upside. Avid Bioservices stock price reaches these price targets on average within 32 days.

Apple iPhone 16 Launch: Analysts Weigh In on Incremental Upgrades and Future Prospects

Apple’s recent iPhone 16 launch event, held on Monday, did not generate the excitement many investors had anticipated. Analysts had hoped for significant advancements in Apple’s generative artificial intelligence capabilities, which were expected to drive a major upgrade cycle for the iPhone. However, the event’s focus on new accessories, such as a redesigned Apple Watch and AirPods Pro 2 with basic hearing-aid functionalities, overshadowed the iPhone updates.

Oppenheimer analyst Martin Yang noted that the iPhone 16’s improvements are relatively incremental compared to the major upgrades seen in Apple’s accessories. The most notable change to the iPhone 16 is a new camera control button, while no groundbreaking AI features were introduced.

Yang maintains an Outperform rating for Apple with a $250 price target, suggesting that significant iPhone upgrades may not materialize until next year when Apple Intelligence is more widely available.

Needham analyst Laura Martin also remains optimistic, holding a Buy rating with a $260 price target, but acknowledged that while the iPhone 16 did not introduce major features, Apple’s strategic focus may shift towards more significant advancements later in the year.

Melius Research’s Ben Reitzes, who also rates Apple stock as Buy with a $265 price target, believes that the upgrade cycle could accelerate in the coming year with further AI enhancements.

Overall, analysts suggest that while the iPhone 16 did not generate immediate excitement, future developments and broader AI rollouts could positively impact Apple’s stock performance.

Analyst Reflect Cautious Optimism and Mixed Reactions Following iPhone 16 Launch

- JP Morgan analyst Samik Chatterjee maintained an Overweight rating and a price target of $265.

- Oppenheimer analyst Martin Yang continued with an Outperform rating and a price target of $250.

- Piper Sandler analyst Matt Farrell reiterated a Neutral rating and a price target of $225.

- Wedbush analyst Daniel Ives maintained an Outperform rating and raised the price target from $285 to $300.

- BofA Securities analyst Wamsi Mohan kept a Buy rating, along with a price target of $256.

- Needham analyst Laura Martin reiterated a Buy rating and a price target of $260.

Which Analyst has the best track record to show on AAPL?

Analyst Krish Sankar (TD COWEN) currently has the highest performing score on AAPL with 30/31 (96.77%) price target fulfillment ratio. His price targets carry an average of $31.76 (14.55%) potential upside. Apple stock price reaches these price targets on average within 183 days.

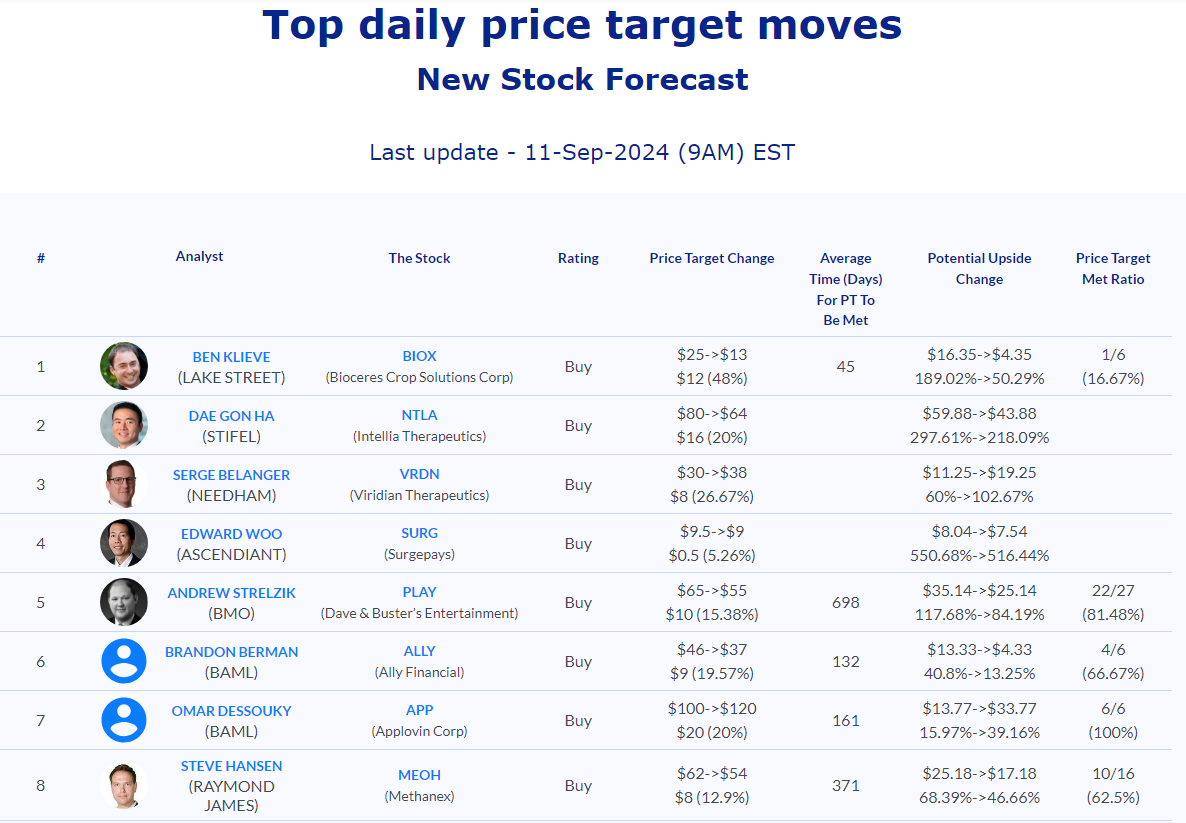

Daily stock Analysts Top Price Moves Snapshot