Selected stock price target news of the day - October 8th, 2024

By: Matthew Otto

Meta Supports Independent Appeals Centre to Resolve Content Moderation Disputes Under EU Law

Meta Platforms is backing a new independent body, the Appeals Centre Europe, aimed at addressing content moderation disputes on social media platforms. Certified by Ireland’s media regulator, the Dublin-based organization will operate under the EU Digital Services Act (DSA), allowing users to challenge content decisions without going to court.

The Appeals Centre, which is supported by Meta’s Oversight Board Trust, is scheduled to launch by the end of the year. This will initially handle complaints against Facebook, TikTok, and YouTube. More platforms will be included over time as the system develops.

The Appeals Centre’s team of experts will review cases within a 90-day period, ensuring that platform decisions align with their stated content policies. Users will be charged a nominal fee to raise disputes, which will be refunded if the decision is in their favor.

While the organization aims to provide an impartial avenue for dispute resolution, online platforms are not obligated to engage with it, and its rulings will not be legally binding. Funding for the Appeals Centre comes from fees charged to social media companies for each case, alongside a one-time grant from Meta’s Oversight Board Trust. The board will consist of seven non-executive directors.

Analysts Raise Price Targets, Maintaining Positive Ratings

- UBS analyst Lloyd Walmsley maintained a Buy rating and raised the price target from $635 to $690.

- Guggenheim analyst Michael Morris kept a Buy rating and increased the price target from $600 to $665.

- Cantor Fitzgerald analyst Deepak Mathivanan reiterated an Overweight rating and a $660 price target.

- Wells Fargo analyst Ken Gawrelski continued to rate as Overweight and raised the price target from $647 to $652.

Which Analyst has the best track record to show on META?

Analyst Thomas Champion (PIPER SANDLER) currently has the highest performing score on META with 20/22 (90.91%) price target fulfillment ratio. His price targets carry an average of $77.26 (15.52%) potential upside. Meta Platforms stock price reaches these price targets on average within 234 days.

Tradeweb Reports Record Trading Volumes for September and Q3 2024, ADV Up Over 68%

Tradeweb Markets reported trading volumes for September 2024, with total trading reaching $56.1 trillion. Average daily volume (ADV) for the month was $2.63 trillion, a 68.3% increase year-over-year (YoY).

For the third quarter of 2024, Tradeweb saw a total trading volume of $147.5 trillion and an ADV of $2.21 trillion, reflecting a 55.3% YoY growth. Excluding the impact of the Institutional Cash Distributors, LLC (ICD) acquisition, which closed on August 1, 2024, ADV for September was up 50.3% YoY and up 42.7% YoY for the third quarter.

The performance was driven by growth across multiple asset classes. U.S. government bond ADV rose 59.8% YoY to $232.2 billion, and mortgage ADV grew by 32.3% YoY to $240.2 billion. Swaps or swaptions with maturities of one year or more posted an ADV of $576.3 billion, an increase of 73.1% YoY. Total rates derivatives ADV climbed 79.1% YoY to $1.02 trillion. In the credit segment, fully electronic U.S. credit ADV surged 77% YoY to $8.6 billion, with European credit ADV rising 27.9% YoY to $2.7 billion.

Analysts Strong Buy Recommendations with Raised Price Targets

- Piper Sandler analyst Patrick Moley maintained a Neutral rating and raised the price target from $112 to $127.

- Barclays analyst Benjamin Budish maintained an Overweight rating and increased the price target from $125 to $147.

- Raymond James analyst Patrick O’Shaughnessy kept an Outperform rating and raised the price target from $122 to $133.

- BofA Securities analyst Michael Carrier reiterated a Buy rating and raised the price target from $134 to $139.

- Goldman Sachs analyst Alexander Blostein reiterated a Buy rating and increased the price target from $128 to $136.

Which Analyst has the best track record to show on TW?

Analyst Benjamin Budish (BARCLAYS) currently has the highest performing score on TW with 3/3 (100%) price target fulfillment ratio. His price targets carry an average of $18.16 (17.00%) potential upside. Tradeweb Markets stock price reaches these price targets on average within 103 days.

AbbVie Lowers 2024 Profit Forecast Due to Increased Expenses

AbbVie has revised its forecast for 2024 adjusted profit, citing the impact of $82 million in milestone payments and increased research and development expenses associated with recent acquisitions.

Annual adjusted profit per share now anticipated in the range of $10.67 to $10.87, down from its earlier forecast of $10.71 to $10.91 per share. This updated guidance falls short of analysts’ expectations, which were pegged at $10.88 per share according to estimates compiled by LSEG.

AbbVie has lowered its forecast for third-quarter adjusted profit per share to between $2.88 and $2.92. A decrease from the previous range of $2.92 to $2.96. The $82 million in expenses incurred during the quarter stemmed from collaborations, licensing agreements, and other asset acquisitions.

Analyst Ratings Maintained and Adjusted Price Targets

- Barclays analyst Carter Gould maintained an Overweight rating and raised the price target from $200 to $212.

- TD Cowen analyst Steve Scala reiterated a Buy rating and increased the price target from $195 to $225.

Which Analyst has the best track record to show on ABBV?

Analyst Carter Gould (BARCLAYS) currently has the highest performing score on ABBV with 13/14 (92.86%) price target fulfillment ratio. His price targets carry an average of $14.84 (8.01%) potential upside. AbbVie stock price reaches these price targets on average within 181 days.

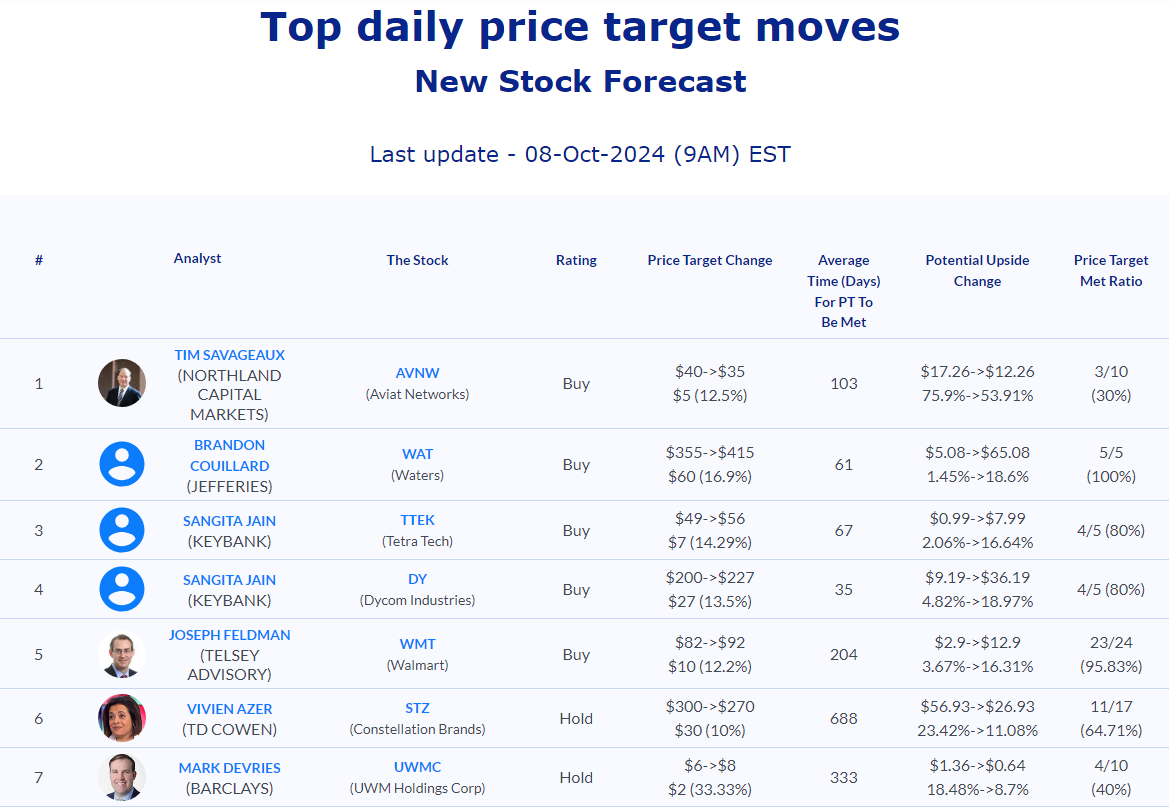

Daily stock Analysts Top Price Moves Snapshot