Selected stock price target news of the day - August 1st, 2025

By: Matthew Otto

Amazon Q2 2025: Retail and Cloud Growth Outpace Estimates but Raise AI Concerns

Amazon.com reported second quarter 2025 revenue of $167.7 billion, exceeding the consensus estimate of $162.05 billion and marking a 13% year-over-year increase. Earnings per share (EPS) came in at $1.68, beating analyst expectations by $0.36. Operating income rose to $19.2 billion from $14.7 billion in the same quarter last year, while net income increased to $18.2 billion from $13.5 billion.

Amazon’s North America segment generated $100.1 billion in revenue, up 11%, with operating income rising to $7.5 billion from $5.1 billion. International revenue increased 16% to $36.8 billion, or 11% excluding currency effects, with operating income of $1.5 billion compared to $0.3 billion a year ago.

Amazon Web Services (AWS) posted $30.9 billion in revenue—slightly ahead of expectations—with 17.5% year-over-year growth, but lagged Azure’s 39% and Google Cloud’s 32%. AWS operating income rose to $10.2 billion, although operating margins narrowed to 32.9%, their lowest since Q4 2023. Capital expenditures totaled $31.4 billion in the quarter, contributing to a projected full-year spend of over $118 billion.

Amazon’s third-quarter 2025 guidance projects revenue between $174 billion and $179.5 billion, above the $173.1 billion analyst consensus, implying 10% to 13% growth year-over-year. This includes an anticipated 130 basis point benefit from foreign exchange. Operating income is expected to fall between $15.5 billion and $20.5 billion, compared to $17.4 billion in Q3 2024. Operating cash flow for the trailing twelve months increased 12% to $121.1 billion, while free cash flow declined sharply to $18.2 billion from $53 billion.

Analysts Maintain Positive Ratings Following Q2 Results

- Canaccord Genuity analyst Maria Ripps maintained a Buy rating and the price target at $280.

- Piper Sandler analyst Thomas Champion kept an Overweight rating and raised the price target from $250 to $255.

- WestPark Capital analyst Curtis Shauger reiterated a Buy rating and held the price target steady at $280.

- Telsey Advisory Group analyst Joseph Feldman maintained an Outperform rating while raising the price target from $235 to $265.

- BofA Securities analyst Justin Post continued to rate as a Buy and lifted the price target from $265 to $272.

- Needham analyst Laura Martin reiterated a Buy rating and the price target at $265.

Which Analyst has the best track record to show on AMZN?

Analyst Barton Crockett (ROSENBLATT) currently has the highest performing score on AMZN with 12/14 (85.71%) price target fulfillment ratio. His price targets carry an average of $98.02 (51.59%) potential upside. Amazon.com stock price reaches these price targets on average within 151 days.

Reddit Reports Second Quarter with Revenue Growth and Higher Profitability

Reddit reported financial results for the quarter ended June 30, 2025, highlighted by user growth and better-than-expected financial performance. Daily Active Uniques (DAU) increased 21% year-over-year to 110.4 million, with logged-in DAU rising 17% to 49.3 million and logged-out DAU up 24% to 61.1 million.

Revenue for the quarter reached $500 million, a 78% increase from $281 million in the same period last year and ahead of the $426 million consensus estimate. Advertising revenue accounted for $465 million, up 84%, while other revenue, including data licensing, rose 24% to $35 million. U.S. revenue grew 79% to $409 million, and international revenue rose 71% to $91 million. Global average revenue per user increased to $4.53, compared to analyst expectations of $3.90.

Reddit posted net income of $89 million, reversing a net loss of $10 million in the same quarter last year. Earnings per share were $0.45, $0.26 above the consensus estimate of $0.19. Operating cash flow rose to $111 million, up from $28 million a year earlier. The company also reported adjusted earnings of $167 million, representing 33% of revenue, compared to $40 million in the prior-year quarter.

Looking ahead, Reddit expects third-quarter 2025 revenue between $535 million and $545 million, ahead of the current consensus forecast of $473.1 million. The company also projects adjusted earnings in the range of $185 million to $195 million.

Analysts Raise Price Targets Following Q2 Earnings Outperformance

- Piper Sandler analyst Thomas Champion maintained an Overweight rating and lifted the price target from $150 to $210.

- Morgan Stanley analyst Brian Nowak reiterated an Overweight rating while increasing the price target from $170 to $230.

- BofA Securities analyst Justin Post kept a Neutral rating but raised the price target from $150 to $180.

- Needham analyst Laura Martin continued to rate a Buy rating and boosted the price target from $165 to $215.

Which Analyst has the best track record to show on RDDT?

Analyst Doug Anmuth (JPMORGAN) currently has the highest performing score on RDDT with 6/6 (100%) price target fulfillment ratio. His price targets carry an average of $-19.95 (-9.73%) potential downside. Reddit stock price reaches these price targets on average within 10 days.

Apple Reports June Quarter Results with Strong iPhone and Services Growth

Apple reported better-than-expected financial results for its fiscal third quarter ended June 28, 2025, with revenue of $94.04 billion, exceeding the consensus estimate of $89 billion. Diluted earnings per share (EPS) reached $1.57, beating analyst expectations by $0.15.

iPhone sales led the quarter at $44.58 billion, up from $39.3 billion in the same period last year. Services revenue reached a record $27.42 billion, while Mac and iPad sales totaled $8.05 billion and $6.58 billion, respectively. Net income rose to $23.4 billion from $21.4 billion, and gross margin increased to $43.7 billion.

Apple posted its fastest revenue growth since 2021 and issued guidance of “mid to high single digit” growth for the current quarter, exceeding analysts’ forecast of 3.27%. Some analysts, including J.P. Morgan’s Samik Chatterjee, noted that the performance was unexpected, particularly in a quarter when consumers often delay purchases ahead of the annual iPhone refresh expected in September.

Apple recorded an $800 million tariff-related expense in Q3 and expects an additional $1.1 billion impact in Q4.

Analysts Revise Price Targets Amid Mixed Ratings Post-Q3 Results

- Barclays analyst Tim Long maintained an Underweight rating, yet raised the price target from $173 to $180.

- Morgan Stanley analyst Erik Woodring maintained an Overweight rating and lifted the price target from $235 to $240.

- BofA Securities analyst Wamsi Mohan continued to rate a Buy rating and boosted the price target from $235 to $240.

Which Analyst has the best track record to show on AAPL?

Analyst Krish Sankar (TD COWEN) currently has the highest performing score on AAPL with 31/32 (96.88%) price target fulfillment ratio. His price targets carry an average of $69.78 (34%) potential upside. Apple stock price reaches these price targets on average within 193 days.

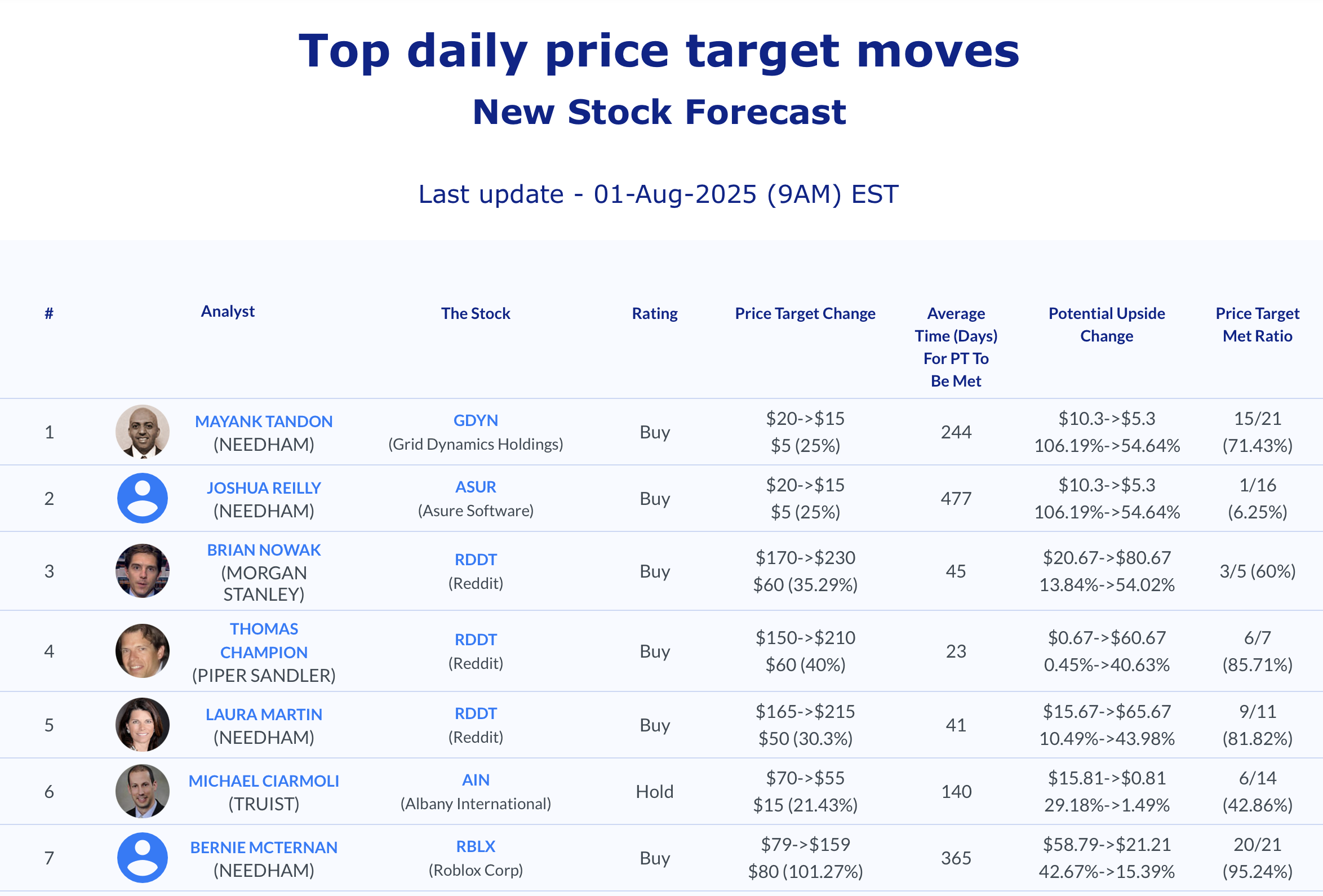

Daily Stock Analysts Top Price Moves Snapshot