Daily Update - Jan 17, 2023

By: Matthew Otto

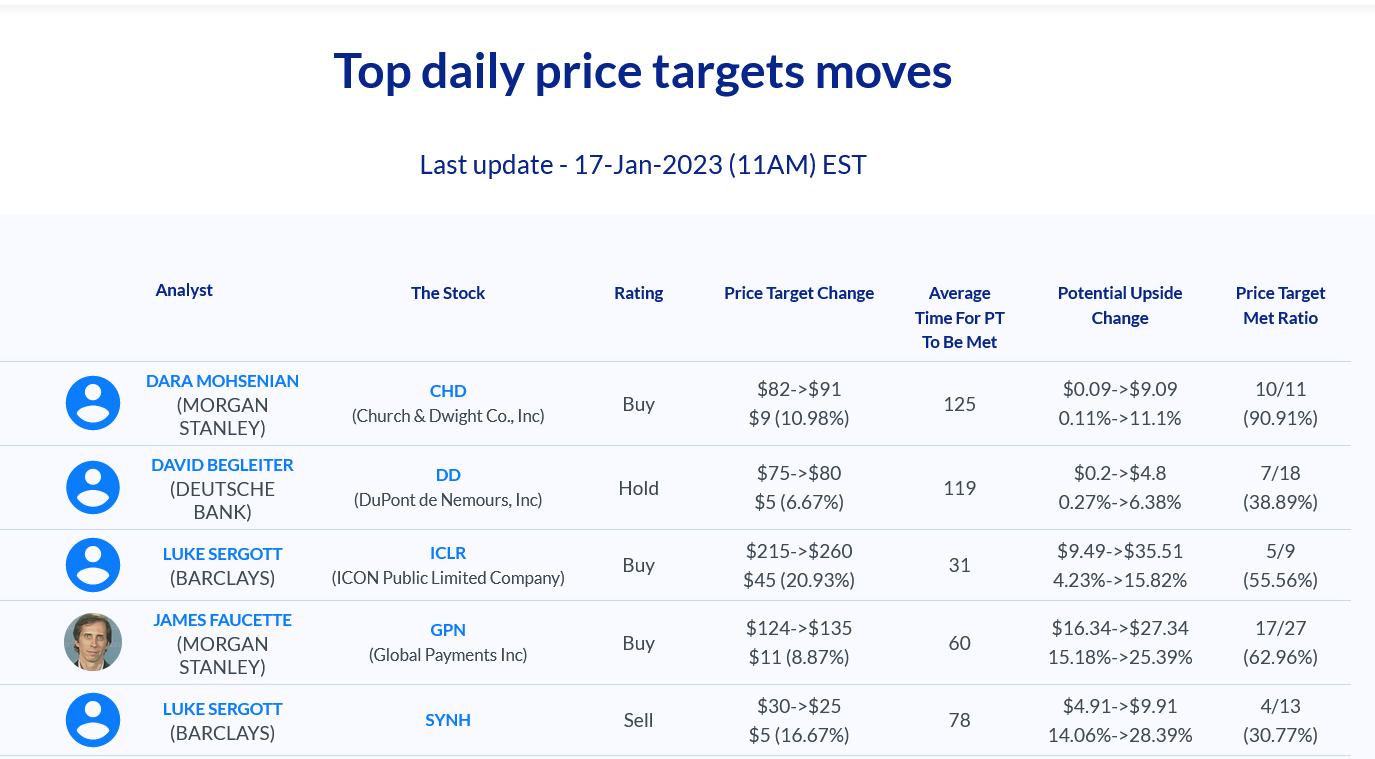

Selected highlights of the day

WEN

The board of directors at Wendy Company made changes to their financial structure, approving a 100% increase in the quarterly dividend to $0.25 per share and authorizing an additional $500 million for repurchasing shares – adding on top of its already existing allowance! with restaurant margins expanding by 300 basis points during Q4 compared to just after entering 2021. With 275 new restaurants across multiple continents opened since this time last year.

- Analyst Jake Bartlett at Truist Securities upped his price target from $27 to $28.

- Lauren Silberman of Credit Suisse raised her outlook from $22 to $24.

- Goldman Sachs’ Jared Garber bumped his price target to $25.

- Deutsche’s Brian Mullan Bank Downgrade his rating from Buy to Hold.

TSLA

The trend with with Tesla continues as the stock saw a sizable alteration in analyst price targets as

- Bank of America Securities’ John Murphy lowered his target from $135 to $130 and maintained Neutral.

- Jefferies’ Philippe Houchois revised his stock forecast from $350 to $180 with a Buy rating.

PFE

- Wells Fargo analyst Mohit Bansal has decreased Pfizer rating from Overweight to Equal-Weight and slashing the price target from $54 to $50.

BIDU

- Jefferies has kept Baidu with a Buy rating while increasing his price target from $217 to $210.

- Goldman Sachs’ analyst Lincoln Kong kept his recommendation as a Buy and lifted the price target to$188 from $186.

C

Despite a strong U.S. labor market, banks have opted for aggressive tightening by central banks as 2023 begins – and B of A Securities analyst Ebrahim Poonawala is keeping Citigroup’s Buy rating at an increased price target of $60 from $52 while Piper Sandler analyst Scott Siefers maintains it with a Neutral up to $51 up from $47.Citigroup similarly bolstered its reserves this year in response, setting them at unprecedented levels nearing the billion mark compared to just one-third that amount last year when CEO Jane Fraser noted 2021 was off to stronger start than expected but warned these conditions may be fleeting moving ahead into the new year.

Church & Dwight

Got positive feedback, as Credit Suisse and Morgan Stanley analysts both upgraded the company’s ratings from Neutral to Outperform and Equal-Weight to Overweight respectively.

- Kaumil Gajrawala of Credit Suisse even increased his price target from $85 to $95.

- Dara Mohsenian at Morgan Stanley raised hers from $82 to $91.

At the recent World Economic Forum in Davos

Matthew Prince, CEO of Cloudflare discussed how generative Artificial Intelligence (AI) can offer a new and innovative way to craft code. With this technology, they are able to quickly answer inquiries from their free-tier customers as well as utilize “really good thought partner” skills for junior programming jobs on its Workers platform.

- Guggenheim’s John Difucci downgraded from Neutral to Sell with his price target at $36.

- Piper Sandler analyst James Fish set a $46 price target.

Netflix

- John Hodulik of UBS has given the streaming giant a Neutral rating with an increased price target of $350.

- Michael Pachter at Wedbush, winner of 2022 AnaChart best stock picker awards, is more bullish with his Outperform assessment and new PT of $400.

- Matthew Thornton from Truist Securities has a hold rating and a $339 price target.

Netflix is reporting earning results this Thursday.

Washington Federal

Has reported a stunning 58% year-over-year growth in earnings for its latest quarter. After factoring out dividends on preferred stock, fully diluted earnings per common share rose an impressive 63%, resulting in net income available to shareholders at $1.16 per share compared to $0.71 last year; significantly bolstering return on assets (15%) and equity (10%).

- DA Davidson analyst Jeff Rulis had the price target raised to $45.

- Piper Sandler’s Matthew Clark maintained his Neutral rating and increased their target from $36 to $37.

WFC

Last week Wells Fargo’s income nosedived 50% year-over-year to $2.86 billion.

- Jefferies Ken Usdin downgrade the bank from Buy to Hold rating while slashed his price target from $49 to $46

- Piper Sandler Scott Siefers to downgrade from Overweight to Neutral while cutting his price target from $50.5 to $47 .