AnaChart Top Performing Stock Analysts for 2022

By: Joseph Kalish

As we start 2023 AnaChart is releasing its 2022 top stock performing analysts for this year.

Contrary to the press release we can put more context into the why and how.

-

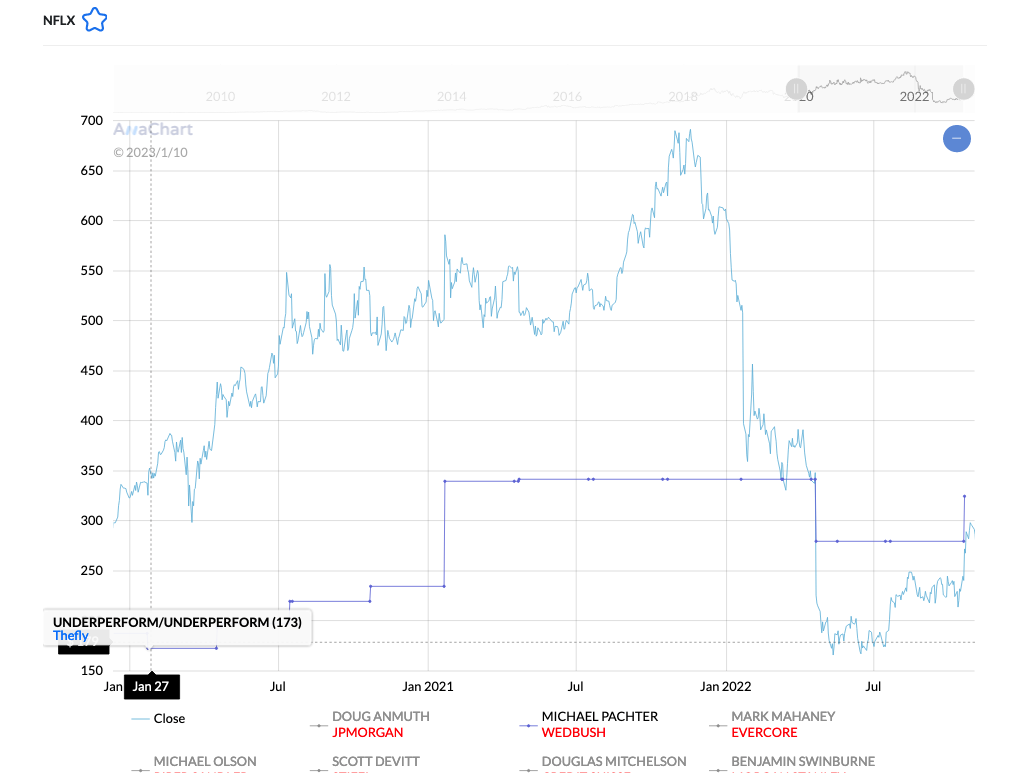

MIchael Pachter, Wedbush, Communication Services.

AnaChart’s stock picker of 2022 for outstanding ability to interpret his valuation in a timely manner with both long and short calls on Netflix (NFLX) . His at making timely valuations with long and short calls has led to over 40% potential upside or downside being realized.

Michael has been short on Netflix for the last three years, he remained bearish even when the stock went up by over a hundred percent, he got ridiculed on forums for his stance but he didn’t waiver and then the stock went down to its originals levels justifying every decision that Michael took. And when NFLX went to 250 Michael became bullish, set a price target over 40% above and predicated that it would get there within less than a year, and it did.

-

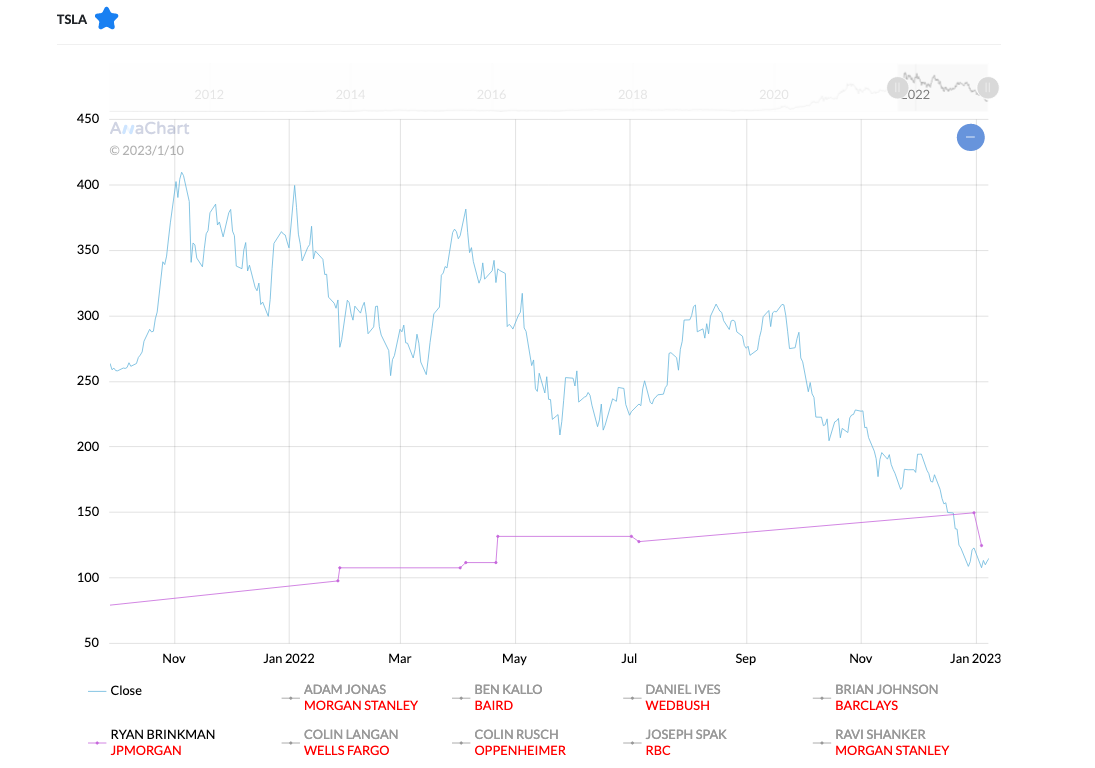

Ryan Brinkman, J.P. Morgan, Consumer Cyclical Tesla (TSLA).

Winner of the AnaChart Big Short awards for 2022. Through 2019 and into 2022, the analyst’s opinion of Tesla remained unchanged. Last year his forecast was proved correct as Tesla lost over two-thirds of its market value last year, meeting his valuation.

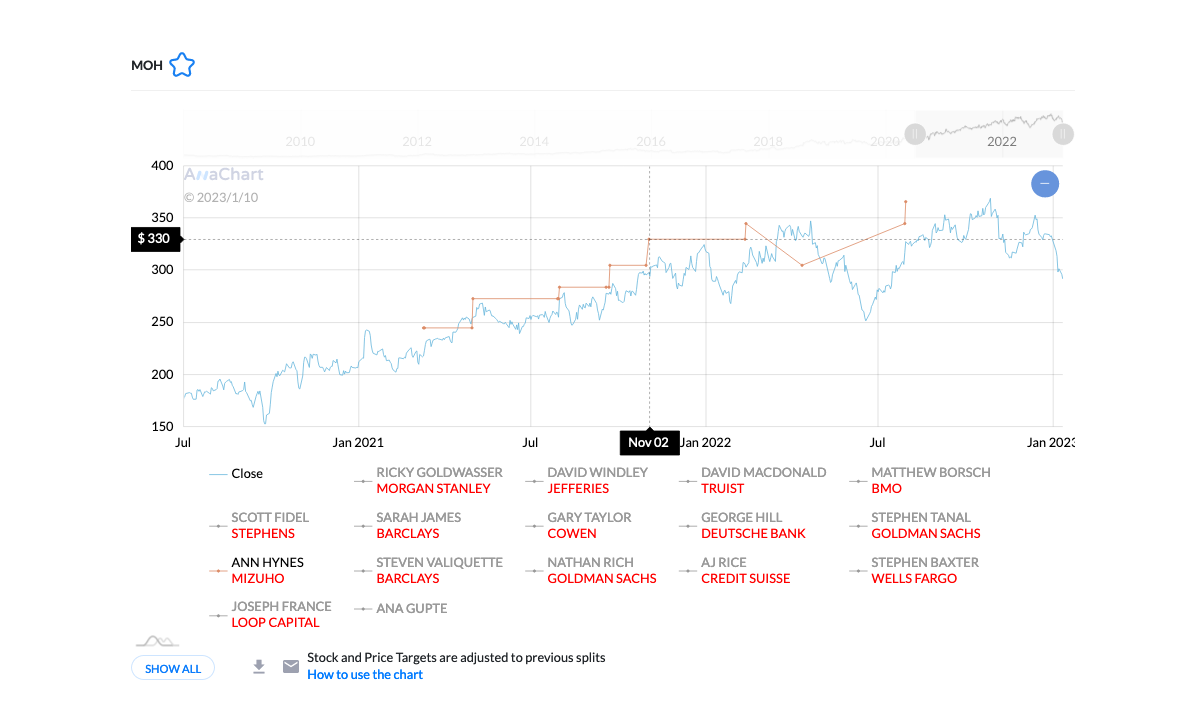

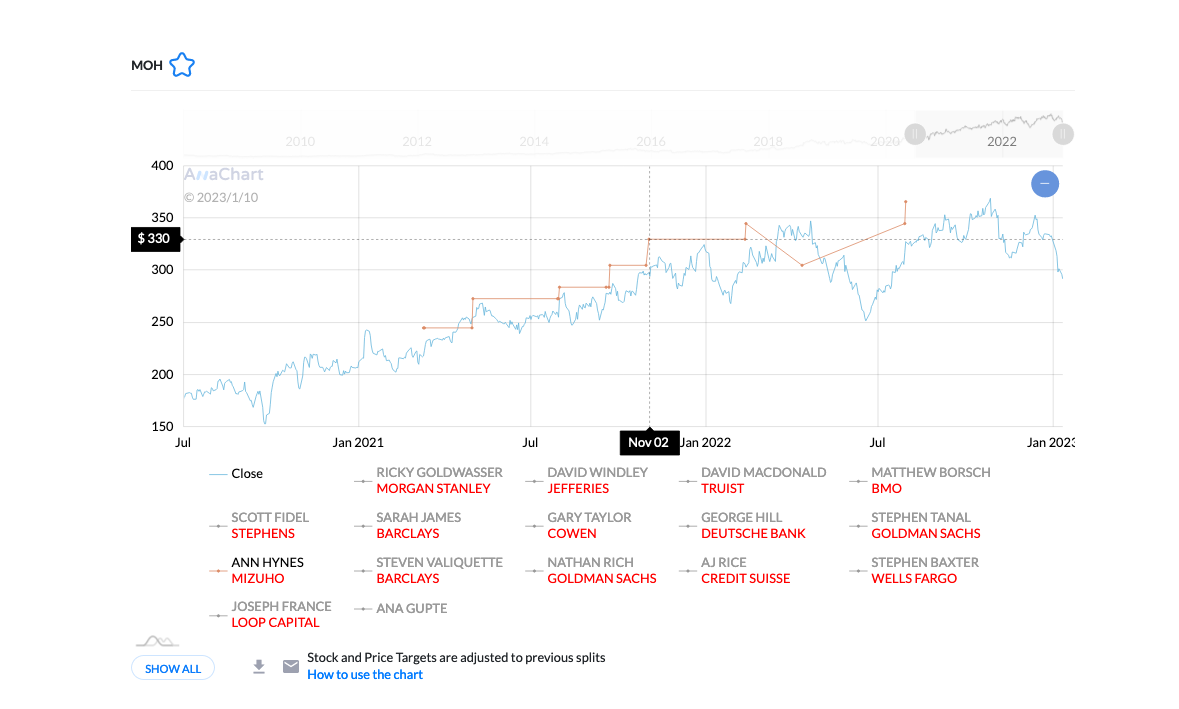

2021 was a good year for Ann on Molina and 2022 was no different and although the stock took a dive at some point, the Mizuho analyst didn’t waiver and her resolve paid off.

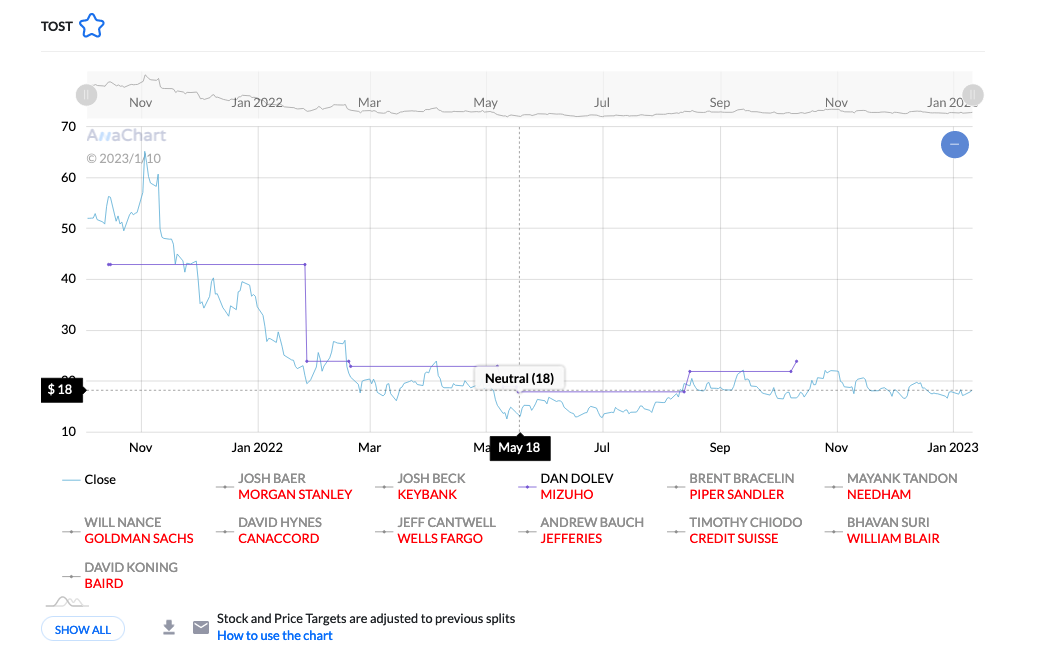

Dolev was bearish on Toast since 2021 with close to 33% in potential downside, his second, third, fourth and fifth price targets were all met and within a few weeks to a few months

-

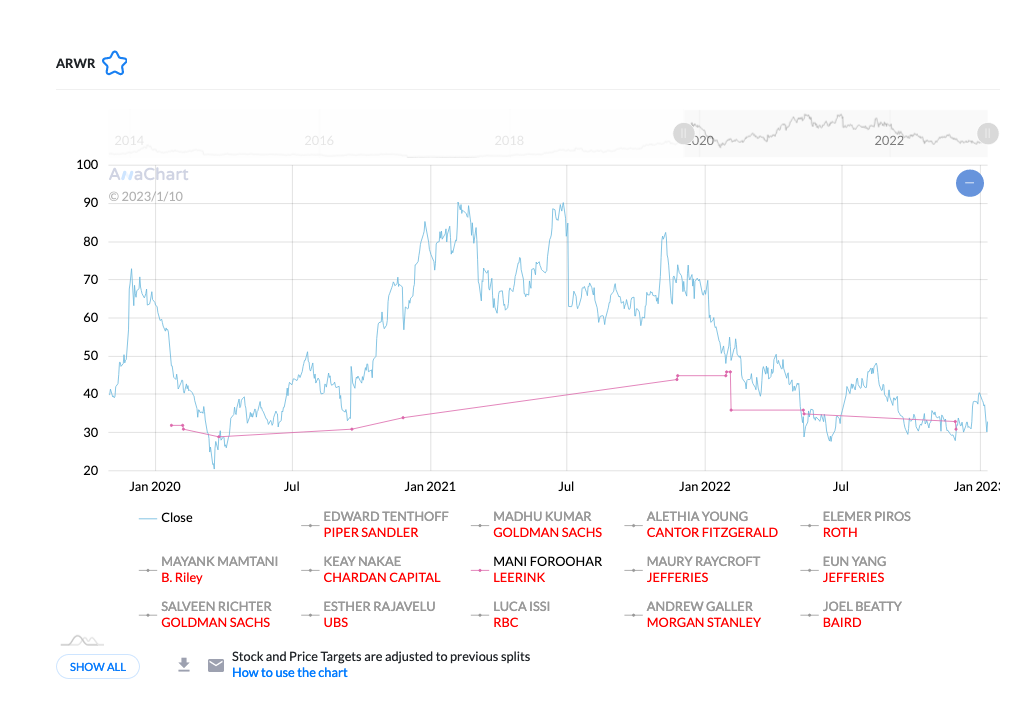

Mani Foroohar, SVB Leerink, Healthcare – Arrowhead Pharmaceuticals (ARWR).

Mani is quite famous for being negative on Moderna, however contrary to, with Arrowhead his bearish forecast was on point with three years stance coming to fruition 50% down in 2022.

-

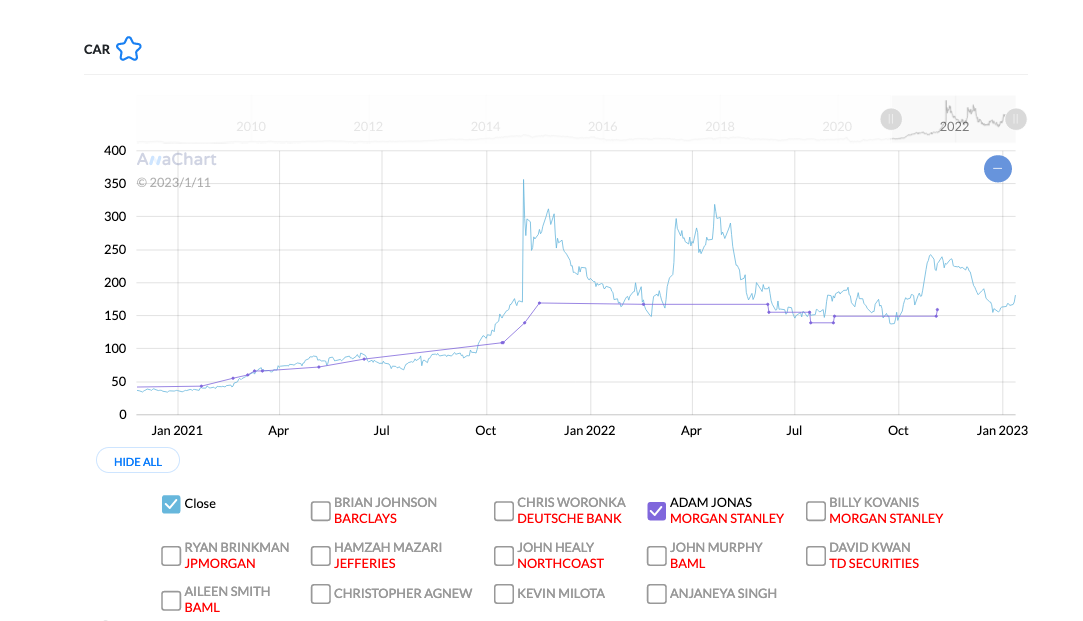

Adam Jonas, Morgan Stanley, Industrials – Avis Budget Group (CAR).

Morgan Stanley analyst Adam has been proven correct three times over the last year with regards to his underweight rating of rental giant stock. Each time it rose significantly for a month before subsiding down again almost exactly to his price targets.

-

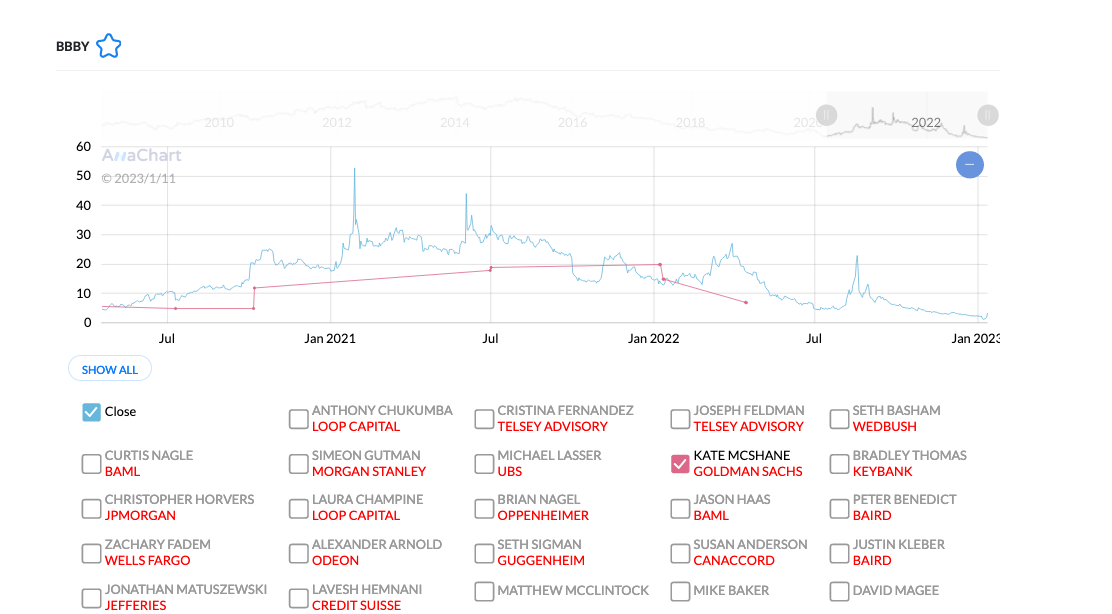

Kate Mcshane, Goldman Sachs, Consumer Cyclical – Bed Bath & Beyond (BBBY).

Kate Mc Shane of Goldman Sachs had a pessimistic outlook for Bed Bath & Beyond stocks in the summer 2020. This vision proved accurate as their stock prices plummeted from 50$ to 14$ by 2021 and continued on a downward trajectory, hitting 7$, exactly as she predicted last year.

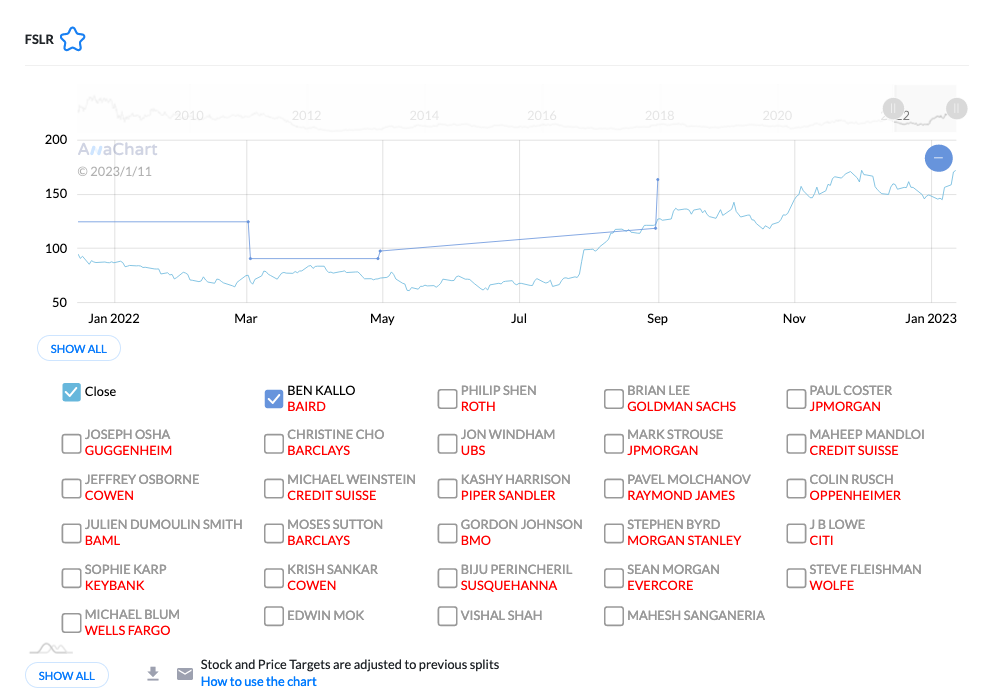

Ben has been almost exclusively positive on First Solar since 2014 and in 2022 this point of view paid off as the stock more than doubled in value. The analyst price targets were consistently met and given well in advance.

-

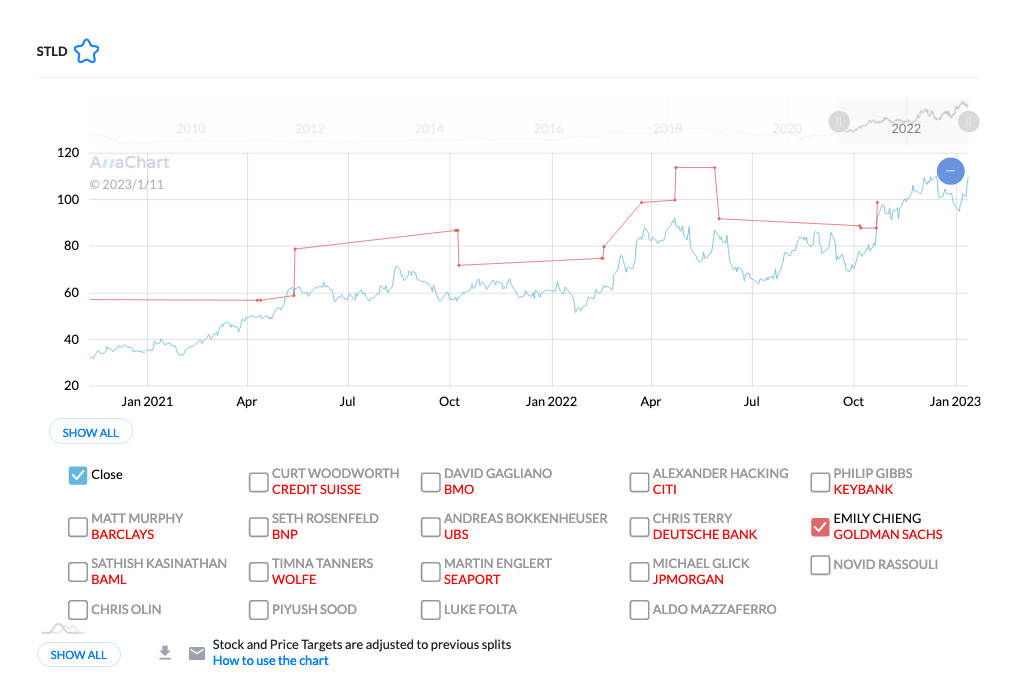

Emily Chieng, Goldman Sachs, Basic Materials – Steel Dynamics (STLD).

The analyst delivered precise price targets ahead of schedule, consistently hitting the mark with her projections as the stock doubled in market share in 2022.

-

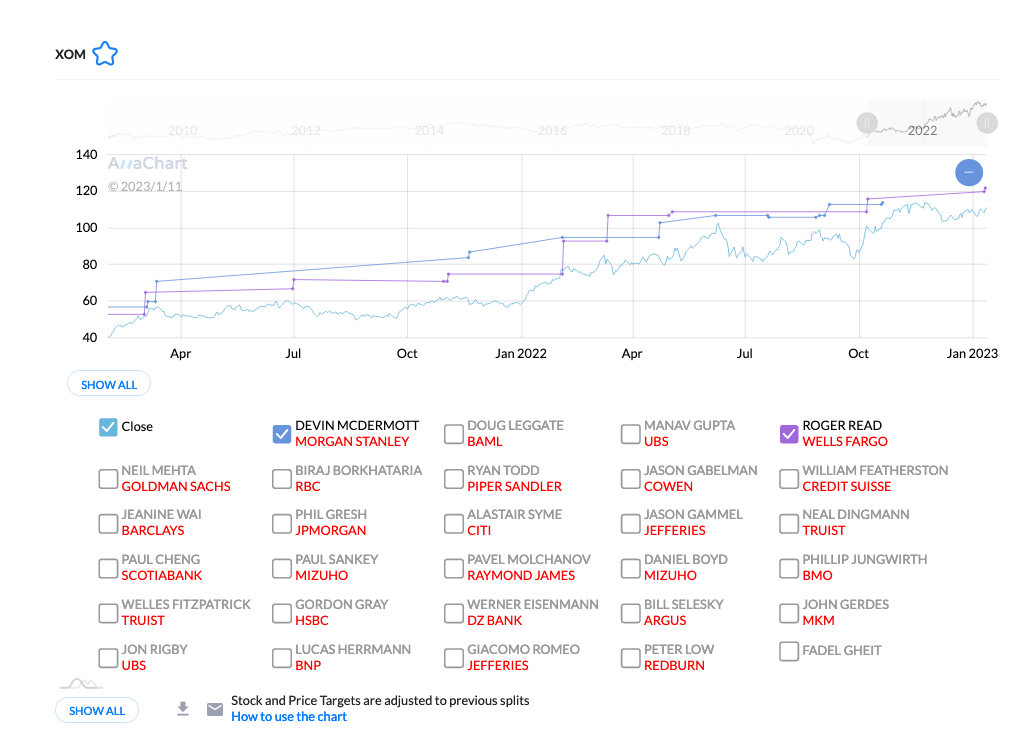

Roger Read, Wells Fargo, Energy – Exxon Mobil (XOM).

-

Devin Mcdermott, Morgan Stanley, Energy – Exxon Mobil (XOM).

Both analysts from Wells Fargo and Morgan Stanley consistently surpassed price targets, showcasing their ability to make well-informed projections in a timely fashion for the energy giant that doubled in value. Far from all energy stocks has such growth last year.

-

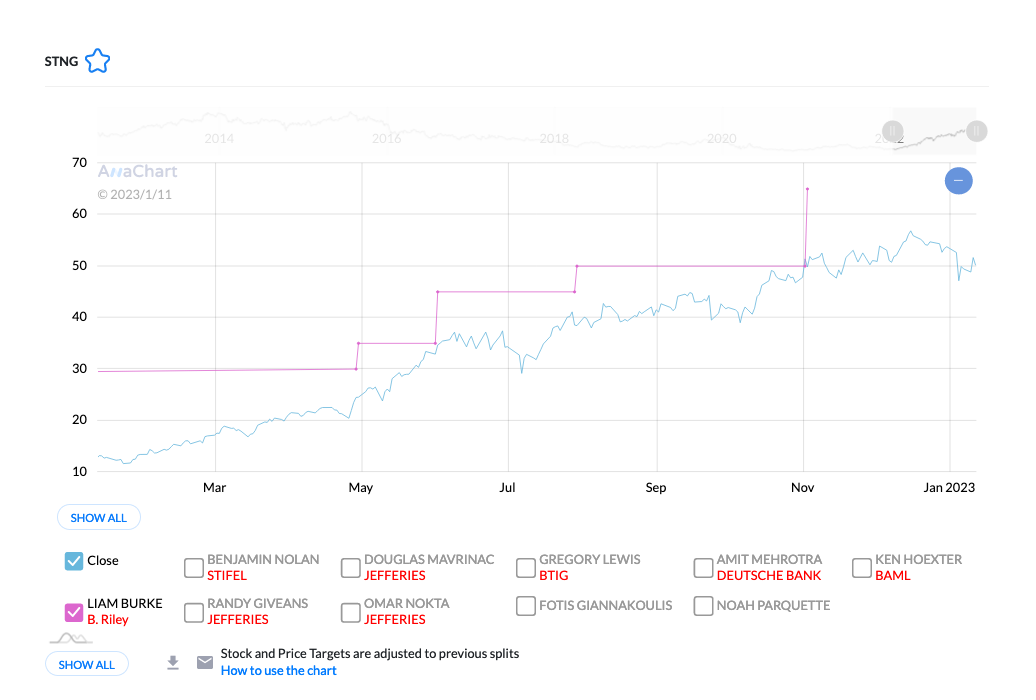

Liam Burke , B. Riley, Energy – Scorpio Tankers (STNG).

Consistent upgrading of the price targets in advance and well knowledge while the stock price rising for 500% from $10 to $over 50.

-

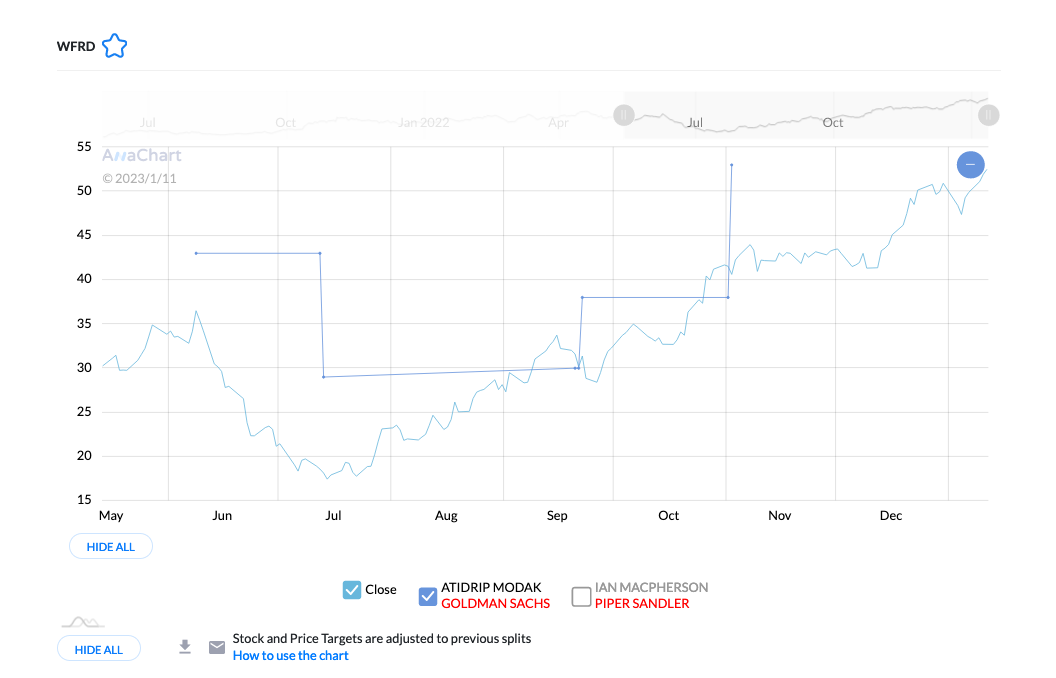

Atidrip Modak, Goldman Sachs, Energy – Weatherford International (WFRD).

-

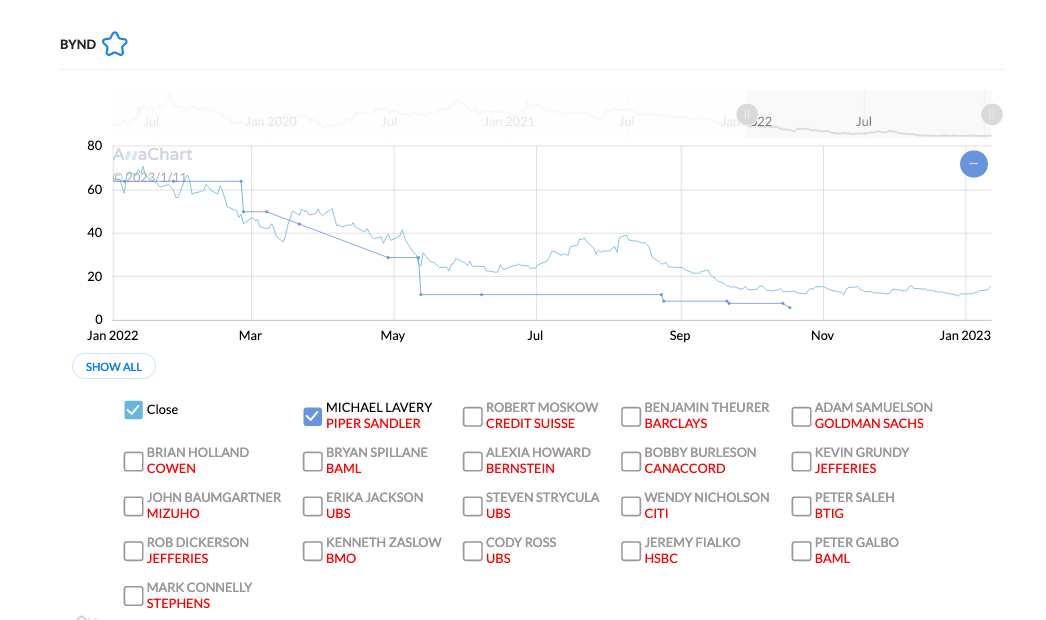

Michael Lavery, Piper Sandler, Consumer Defensive – Beyond Meat (BYND).

-

Joseph Mckay, Wells Fargo, Healthcare – Civitas Resources (CIVI).

-

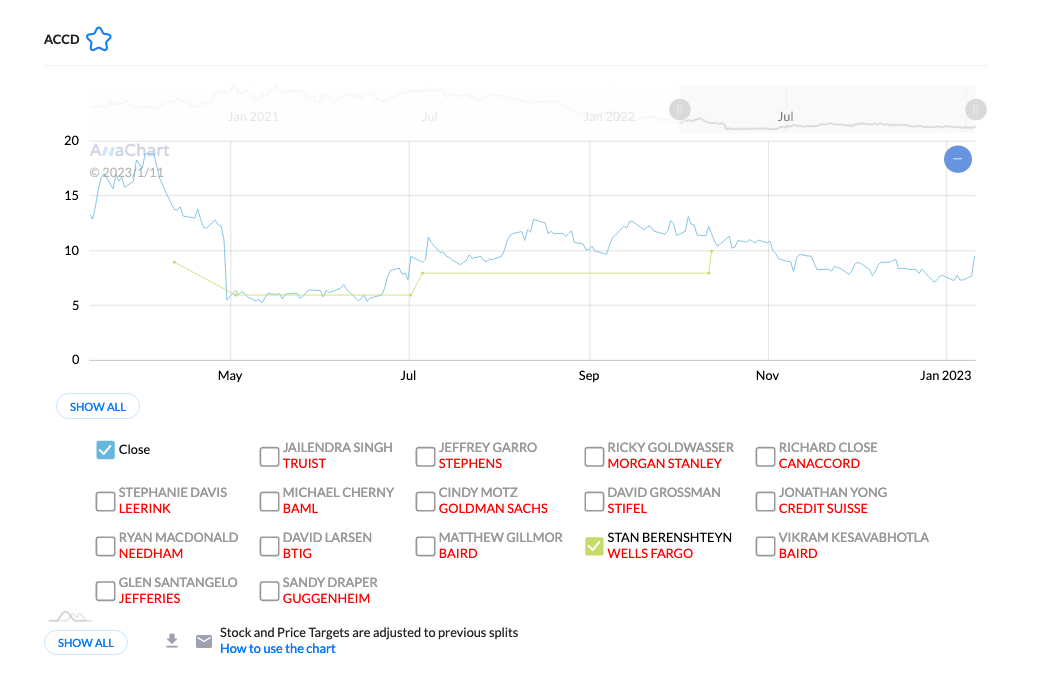

Stan Berenshteyn,Wells Fargo, Energy – Accolade (ACCD).

-

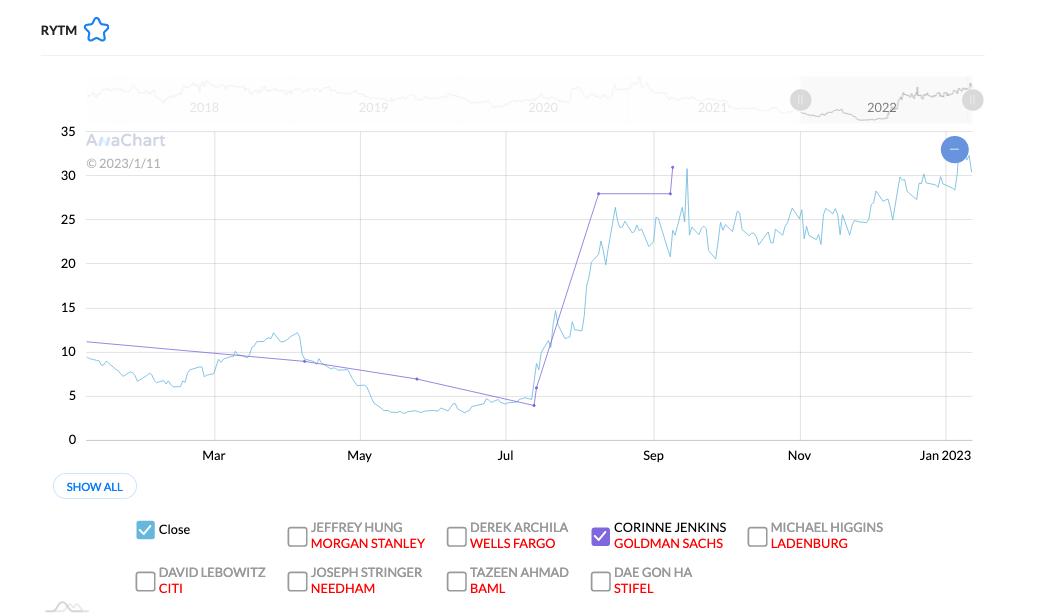

Corinne Jenkins, Goldman Sachs, Healthcare – Rhythm Pharmaceuticals (RYTM).

-

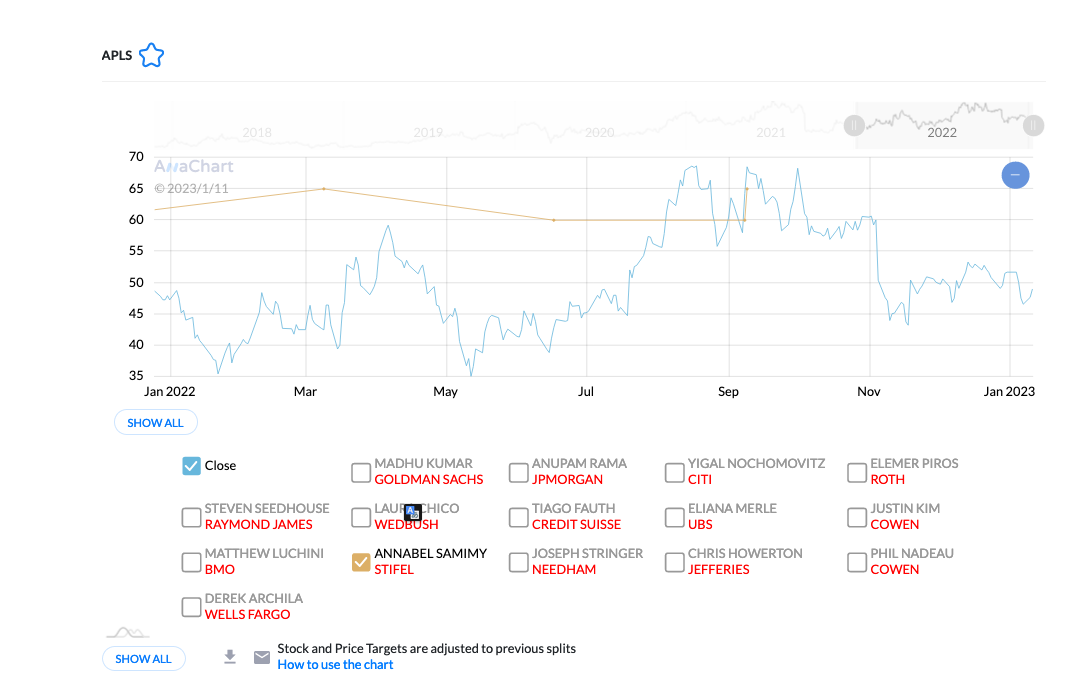

Annabel Samimy, Stifel, Healthcare – Apellis Pharmaceuticals (APLS).

-

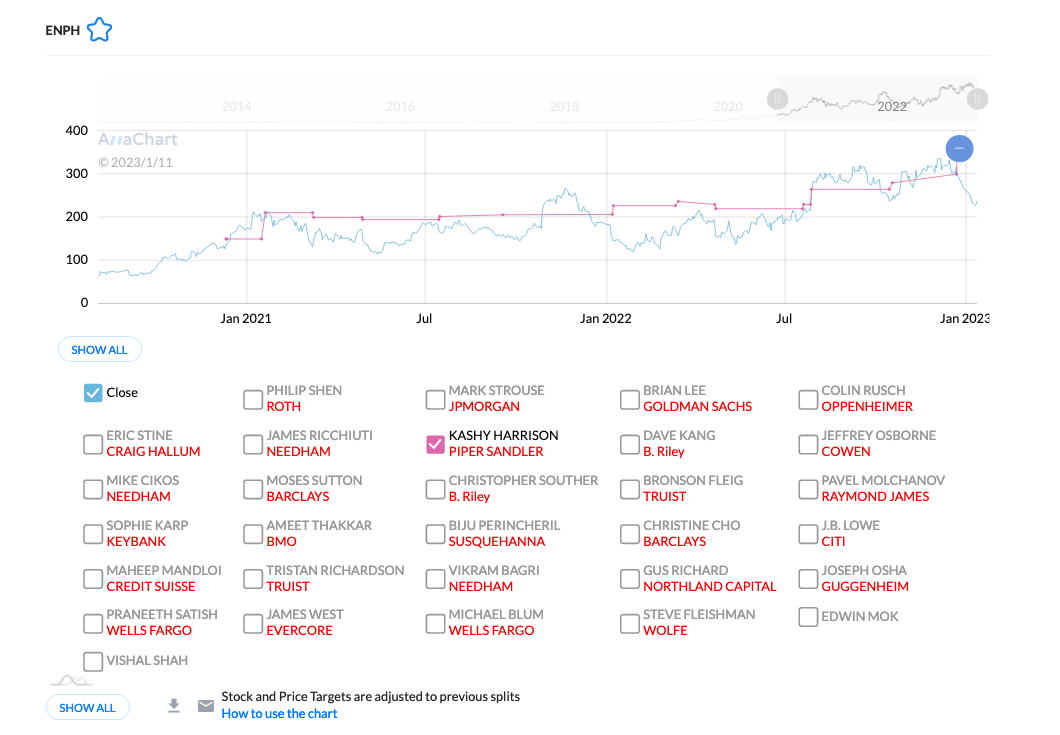

Kashy Harrison, Piper Sandler, Technology – Enphase Energy, Inc. (ENPH).