Daily Update - Jan 20, 2023

Selected highlights of the day

By: Matthew Otto

Netflix

Made waves in the fourth quarter of 2023 by adding more subscribers than expected and promoting Greg Peters to co-CEO alongside Ted Sarandos. The impressive subscriber growth helped offset a significant earnings miss – Netflix reported 12 cents per share compared with 45 cents estimated, as well as $7.85 million revenue versus $8 billion forecasted according to Refinitiv survey estimates. Despite this, global paid net subscriptions came out ahead at 7.66 million ads – nearly double expectations from StreetAccount.

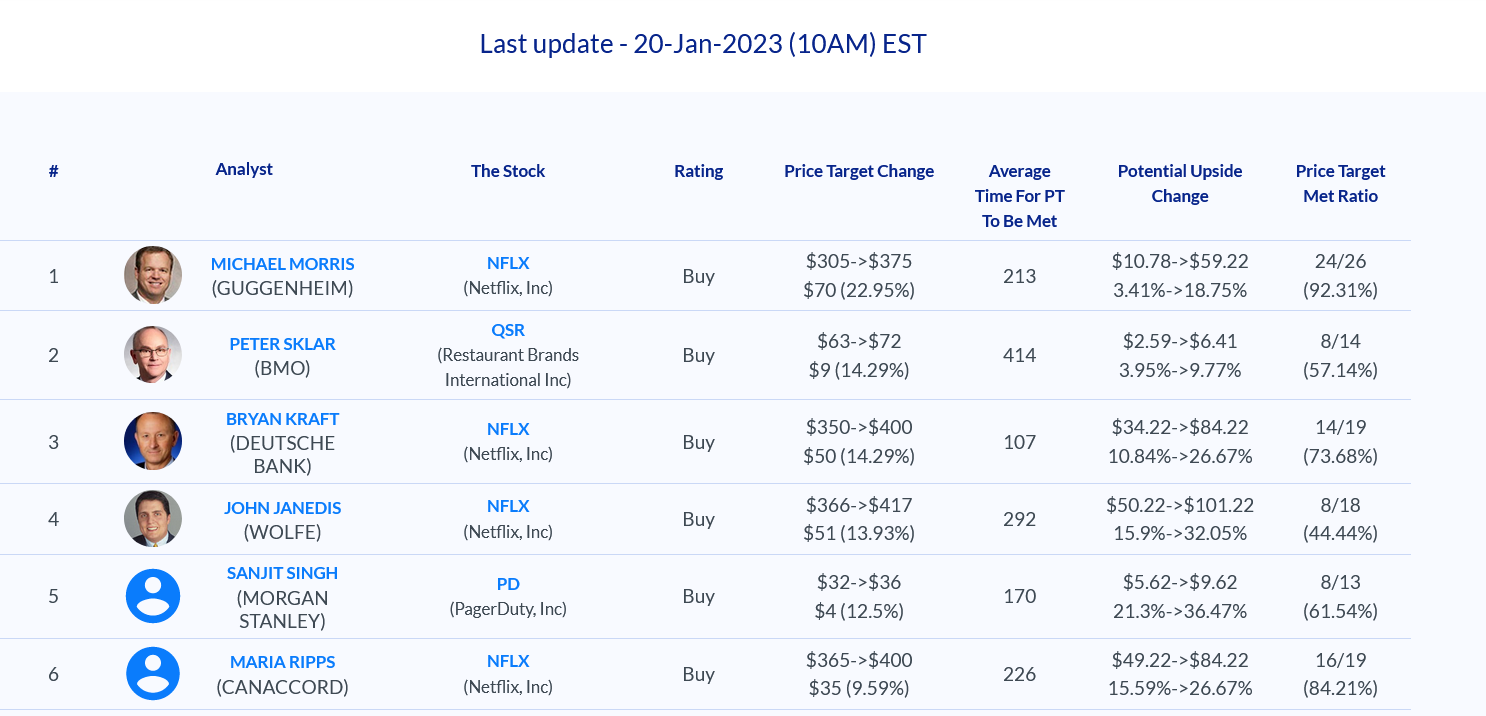

- Maria Ripps from Canaccord Genuity is now with a $400 price target

- Guggenheim analyst Michael Morris sees the stock reaching $375.

- Matthew Harrigan from Benchmark predicts a price target of$250 but maintains his Sell rating.

- Jason Helfstein of Oppenheimer set a price target of $415 while maintaining an Outperform rating.

- Barton Crockett at Rosenblatt keeps a price target of $343 and a Neutral rating.

- Barclays’ Kannan Venkateshwar set his price target on $250 with Equal-Weight rating.

- William Power over at Baird adjusted to $325 and a Neutral rating.

- Credit Suisse’s Douglas Mitchelson upgraded the target price to $291 while maintaining a Neutral rating.

- JP Morgan analyst Doug Anmuth increased his stock forecast to $390 with an Overweight recommendation.

- Wolfe Research’s Peter Supino raised his price target to $417 with an Outperform rating.

- Evercore ISI Group’s Mark Mahaney revised up his stock prediction from $340 to $400 along with an Outperform rating.

- Jefferies’ Andrew Uerkwitz set a Buy rating alongside a $400 price target.

- Piper Sandler Thomas Champion set a Neutral rating and raised his price target from $270 to $325.

- Morgan Stanley Benjamin Swinburne had a $350 price target coupled With an Equal-Weight rating.

Nordstorm

Is making an update in its fiscal 2022 outlook. Revenue growth expectations have been lowered to the low-end of their 5 to 7 percent range while Earnings before interest and taxes (“EBIT”) margin has also seen a reduction from 4.1 to 4.4 percent down 2.8 – 3 percent range. However, Nordstrom reported a decline in holiday sales and lowered expectations for the rest of their fiscal year. The company announced net sales dropping 3.5% over the nine-week period ending December 31, with Nordstorm’s namesake banner dipping 1.7%. Off-price brand Nordstrom Rack saw an even bigger drop at 7.6%. Forecasts have changed as well, predicting revenue growth to fall on the low end of 5%-7%, while adjusted earnings per share expect to range from $1.50-$1..70 instead of their previous outlooks between $2.-30 and $2-.60.

- Gordon Haskett’s Chuck Grom downgraded his rating from hold to reduce and the the target price from $20 to $13.

- Evercore ISI Group analyst Omar Saad maintaining In-Line with a dropped his price target from$25 to $16.

- BMO Capital’s Simeon Siegel held a Market Perform rating.

- JP Morgan’s Matthew Boss kept an Underweight rating on Nordstrom and a $13 price target.

- Credit Suisse user Michael Binetti maintained a Neutral while slashing and a $17 price target.

- Telsey Advisory group Dana Telsey set a market perform and lowered her stock forecast from $25 to $19.

- Keybanc Noah Zatzkin maintained an Overweight rating although decreasing his price target from $30 to $22.

- Citigroup analyst Paul Lejuez keeps Nordstrom with a Neutral and lowers the stock forecast from $21 to $17.

Allstate

Is facing a downturn in their fourth quarter of 2022 with an estimated net loss between $285 million and $335 million. Despite this, property-liability premiums are on the rise due to increased demand for auto and home insurance; Allstate brand average premium rates have grown 14.4%. Premiums written reached 11.5 billion during Q4 2021 – up 11.4% from last year’s marks.

- Barclays Tracy Benguigui lowered her price target for Allstate from $144 to $126 and assigned an Equal-Weight rating.

- BMO Capital Michael Zaremski meanwhile initiated coverage on the stock with a Market Perform rating & Price Target of $130.

- Yesterday Evercore ISI Group David Motemaden cut his price target for Allstate from $151 to $144.

- Wells Fargo Elyse Greenspan reduced her stock forecast from $107 to $105 and kept an Underweight recommendation.

DK

Analysts at Morgan Stanley and Piper Sandler have recently revised their outlook on Delek US:

- Connor Lynagh of MS kept an Underweight rating but raised his price target from $27 to $29.

- Ryan Todd of PS changed his stance from Overweight to Neutral while scaling back his price target to $32 from $49.

Delek US Holdings DK is investing in its future through targeted capital spending plans. For 2023, total consolidated budget expenditures stand at $350 million; a 19% increase from the midpoint of their 2022 guidance. Of this amount, 58% – or approximately $176 million- will be utilized for maintenance and turnarounds on refining projects while ‘Logistics’ has scheduled roughly 81$ Million towards organic growth across transportation, gathering storage and distribution efforts within the energy sector.