Selected stock price target news of the day - January 22nd, 2025

By: Matthew Otto

Netflix Achieves Record Fourth-Quarter Performance with Strong Subscriber and Revenue Growth

Netflix added 19 million paid memberships during the quarter, bringing the total to 301.63 million, surpassing Wall Street’s forecast of 290.9 million. Including extra member accounts, Netflix estimates its global audience exceeds 700 million.

Revenue for the quarter grew 16% year-over-year to $10.25 billion, exceeding the anticipated $10.11 billion. Net income nearly doubled from $938 million in the prior year to $1.87 billion, or $4.27 per share, compared to the expected $4.20 per share.

Netflix announced pricing changes for its U.S. streaming plans. The standard plan increased from $15.49 to $17.99 per month, while the premium plan rose from $22.99 to $24.99. The ad-supported tier saw a $1 increase to $7.99 per month.

Similar adjustments were made in Canada, Portugal, and Argentina. Subscribers to the standard plan can add extra members for $8.99 per month, up from $7.99. Netflix reported that ad-supported plans accounted for more than 55% of new sign-ups in applicable regions and grew by 30% quarter-over-quarter.

For 2025, Netflix projects annual revenue between $43.5 billion and $44.5 billion.

Analyst Ratings Reflect Optimism Amid Fourth-Quarter Performance

- BMO Capital analyst Brian Pitz reiterated an Outperform rating and raised the price target from $1,000 to $1,175.

- Baird analyst Vikram Kesavabhotla maintained an Outperform rating while lifting the price target from $875 to $1,200.

- Macquarie analyst Tim Nollen maintained an Outperform rating and increased the price target from $965 to $1,150.

- JP Morgan analyst Doug Anmuth kept an Overweight rating and increased the price target from $1,000 to $1,150.

- Morgan Stanley analyst Benjamin Swinburne kept an Overweight rating but raised the price target from $1,050 to $1,150.

- BofA Securities analyst Jessica Reif Ehrlich reiterated a Buy rating and upgraded the price target from $1,000 to $1,175.

- Pivotal Research analyst Jeffrey Wlodarczak maintained a Buy rating and elevated the price target from $1,100 to $1,250.

- Deutsche Bank analyst Bryan Kraft retained a Hold rating while increasing the price target from $650 to $875.

- Needham analyst Laura Martin maintained a Buy rating and boosted the price target from $800 to $1,150.

- Barclays analyst Kannan Venkateshwar upgraded from Underweight to Equal-Weight and the price target from $715 to $900.

- Canaccord Genuity analyst Maria Ripps upgraded from Hold to Buy and the price target from $940 to $1,150.

Which Analyst has the best track record to show on NFLX?

Analyst David Joyce (SEAPORT) currently has the highest performing score on NFLX with 2/3 (66.67%) price target fulfillment ratio. His price targets carry an average of $112.58 (13.36%) potential upside. Netflix stock price reaches these price targets on average within 40 days.

3M Exceeds Q4 Expectations, Forecasts Profit and Sales Growth for 2025

3M projected organic sales growth of 2% to 3% for 2025, exceeding analysts’ expectations of 1.6%, while forecasting adjusted profit in the range of $7.60 to $7.90 per share.

3M beat fourth-quarter estimates with adjusted earnings per share of $1.68, surpassing analysts’ prediction of $1.66, and reported adjusted revenue of $5.81 billion, exceeding the consensus estimate of $5.78 billion. Total operating expenses for 2024 fell by 44% year-over-year, reflecting the benefits of cost-cutting measures and strategic realignments.

Under CEO Bill Brown, 3M has shifted its focus to driving organic sales growth, which rose 2.1% in the fourth quarter. Key actions included the development of new products, a 12% reduction in office space, and the elimination of over 8,500 jobs.

Analysts Raise Price Targets Following Q4 Results and 2025 Forecast

- BofA Securities analyst Andrew Obin maintained a Buy rating while increasing the price target from $160 to $175.

- Citigroup analyst Andrew Kaplowitz kept a Neutral stance and raised the price target from $142 to $152.

- Barclays analyst Julian Mitchell continued with an Overweight rating and boosted the price target from $161 to $165.

- JP Morgan analyst Stephen Tusa maintained an Overweight rating and revised the price target from $162 to $165.

- Wells Fargo analyst Joe O’Dea upgraded from Equal-Weight to Overweight and the price target from $140 to $170.

Which Analyst has the best track record to show on MMM?

Analyst Andrew Obin (BAML) currently has the highest performing score on MMM with 3/7 (42.86%) price target fulfillment ratio. His price targets carry an average of $32.09 (25.09%) potential upside. 3M stock price reaches these price targets on average within 158 days.

Seagate Exceeds Q2 Expectations, Provides Cautious Q3 Guidance Amid Challenges

Seagate Technology reported fiscal Q2 2025 revenue of $2.33 billion. This exceeded the consensus estimate of $2.32 billion and marked an increase from $1.56 billion in the prior-year period.

Seagate posted a non-GAAP diluted EPS of $2.03, which was $0.16 above the analyst estimate of $1.87. GAAP diluted EPS came in at $1.55, compared to a GAAP loss of $0.09 in Q2 2024. Gross margin expanded to 34.9% on a GAAP basis and 35.5% on a non-GAAP basis, representing improvements from 23.3% and 23.6%, respectively, in the previous year.

Operating margins also rose, reaching 21.0% on GAAP and 23.1% on non-GAAP, up from 8.0% and 8.2%. Seagate generated $221 million in cash flow from operations, $150 million in free cash flow, and returned $148 million to shareholders via dividends. Cash and cash equivalents totaled $1.2 billion at the end of the quarter.

Looking ahead, Seagate has provided guidance for Q3 2025, expecting revenue of $2.10 billion, below the consensus estimate of $2.20 billion. Non-GAAP diluted EPS is forecasted at $1.70, slightly under the analyst expectation of $1.71.

Analysts Raise Price Targets Following Q2 Results

- BofA Securities analyst Wamsi Mohan maintained a Buy rating and raised the price target from $124 to $130.

- Citigroup analyst Asiya Merchant maintained a Buy rating and increased the price target from $120 to $125.

- Northland Capital Markets analyst Gus Richard reiterated an Outperform rating and raised the price target from $144 to $160.

- Barclays analyst Tom O’Malley kept an Equal-Weight rating and raised the price target from $95 to $105.

- Morgan Stanley analyst Erik Woodring kept an Overweight rating and increased the price target from $129 to $134.

Which Analyst has the best track record to show on STX?

Analyst Toshiya Hari (GOLDMAN SACHS) currently has the highest performing score on STX with 10/11 (90.91%) price target fulfillment ratio. His price targets carry an average of $11.54 (13.19%) potential upside. Seagate Technology stock price reaches these price targets on average within 85 days.

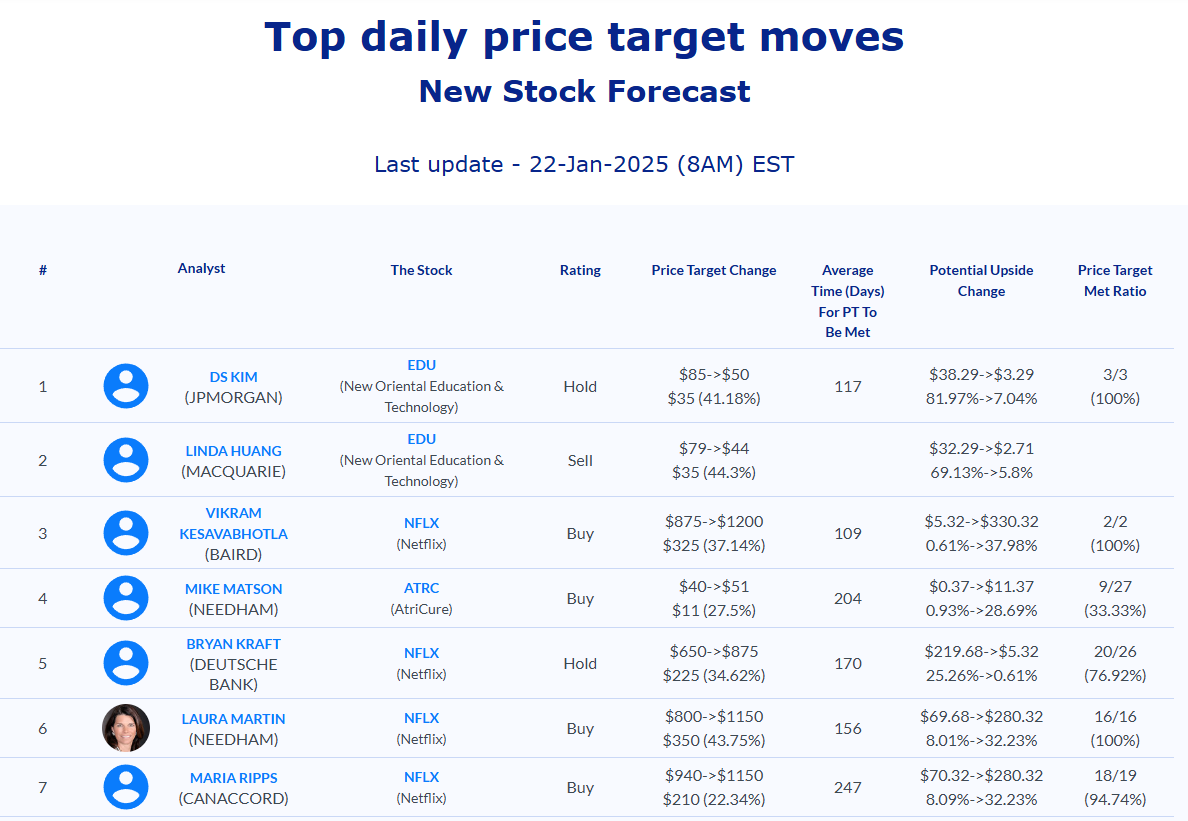

Daily stock Analysts Top Price Moves Snapshot