Selected stock price target news of the day - January 25th, 2024

By: Matthew Otto

Texas Instruments Fourth Quarter 2023 Earnings: Revenue Declines Amid Sector Challenges

Texas Instruments reported its fourth-quarter earnings for 2023, revealing a total revenue of $4.1 billion, a decrease of 10% and a year-over-year decline of 13%. The company’s analog revenue dropped by 12%, while embedded processing experienced a 10% decline. Notably, the other segment saw a downturn of 25% from the same quarter in the previous year. Industrial and automotive markets accounting for 74% of its revenue for the year, up from 42% in 2013. Industrial revenue stood at 40%, while automotive contributed 34%.

Texas Instrument’s gross profit margin decreased by 650 basis points, attributed to lower revenue, increased manufacturing costs, and reduced factory loading. Operating expenses rose by 4% compared to the previous year, while operating profit saw a 30% decline year-over-year. Net income for the fourth quarter reached $1.4 billion, translating to $1.49 per share, with earnings per share including a $0.03 benefit from unanticipated items.

The company had $1.9 billion cash flow from operations, $1.1 billion in capital expenditures, and $1.2 billion returned to shareholders through dividends. Looking ahead, Texas Instrument projects revenue in the range of $3.45 billion to $3.75 billion for the first quarter of 2024, with earnings per share anticipated to be between $0.96 and $1.16.

Analysts Maintain Varied Ratings and Adjust Price Targets Amid Market Trends

- Barclays analyst Tom O’Malley maintained an Equal-Weight rating and lowered the price target from $160 to $150.

- Morgan Stanley analyst Joseph Moore reiterated an Underweight rating and raised the price target from $138 to $146.

- Susquehanna analyst Christopher Rolland maintained a Positive rating and lowered the price target from $205 to $200.

- Mizuho analyst Vijay Rakesh kept a Neutral rating and lowered the price target from $170 to $164.

- Cantor Fitzgerald analyst C J Muse maintained a Neutral rating and decreased the price target from $180 to $170.

- Truist Securities analyst William Stein kept a Hold rating and decreased the price target from $169 to $168.

- Keybanc analyst John Vinh reiterated an Overweight rating and raised the price target from $180 to $200.

Which Analyst has the best track record to show on TXN?

Analyst Blayne Curtis (BARCLAYS) currently has the highest performing score on TXN with 11/11 (100%) price target fulfillment ratio. His price targets carry an average of $24.5 (17.44%) potential upside. Texas Instrument stock price reaches these price targets on average within 64 days.

Lam Research’s Q4 2023 Performance and Growth Outlook

Lam Research showcased its December 2023 quarterly report, reporting EPS of $7.52, better than the analyst estimate of $7.07. Revenue shows an 8% increase from the previous quarter, reaching $3.76 billion, compared to the consensus estimate of $3.7 billion. Despite a 29% decrease in revenue from the same period a year ago, Lam’s strategic initiatives and operational efficiency were evident in the gross margin performance, reaching 47.6%, slightly above the midpoint of guidance.

Lam had allocated approximately $640 million to open market share repurchases and $264 million in dividends during the December quarter. Lam ended the year with a cash and short-term investments balance of $5.6 billion. Looking forward, the company provided guidance for the March 2024 quarter, anticipating revenue of $3.7 billion with a gross margin of 48%. Furthermore, Lam has undertaken strategic initiatives, including a planned spending increase in R&D for 2024, and anticipates spending $300 million on improvement activities and headcount reductions.

Analysts Bullish: Price Targets Raised Across the Board

- Goldman Sachs analyst Toshiya Hari maintained a Buy rating and raised the price target from $700 to $912.

- Raymond James analyst Srini Pajjuri reiterated an Outperform rating and increased the price target from $850 to $950.

- Barclays analyst Raimo Lenschow maintained an Equal-Weight rating and raised the price target from $750 to $825.

- Needham analyst Charles Shi kept a Buy rating and upgraded the price target from $800 to $900.

- Stifel analyst Brian Chin kept a Buy rating and increased the price target from $850 to $950.

- Citi analyst Atif Malik maintained a Buy rating and raised the price target from $800 to $975.

Which Analyst has the best track record to show on LRCX?

Analyst Tammy Qiu (BERENBERG) currently has the highest performing score on LRCX with 4/4 (100%) price target fulfillment ratio. Her price targets carry an average of $32.07 (4.60%) potential upside. Lam Research stock price reaches these price targets on average within 232 days.

ServiceNow’s Q4 2023: AI Integration Drives Growth

In the fourth quarter of 2023, ServiceNow reported a subscription revenue of $2.365 billion, reflecting a 27% increase compared to the same period in the previous year. Total revenue for the quarter reached $2.437 billion, demonstrating a year-over-year growth of 26%. The company’s adjusted profit per share on a fully diluted basis stood at $3.11, outperforming the Street consensus of $2.78 per share according to FactSet. Notably, ServiceNow achieved a non-GAAP operating margin of 29%, surpassing the company’s own forecast of 27.5%.

Looking ahead to the first quarter of 2024, ServiceNow projects subscription revenue ranging between $2.510 billion and $2.515 billion, representing a year-over-year growth of 24% to 24.5%. For the full year 2024, the company anticipates subscription revenues between $10.555 billion and $10.575 billion, signaling an increase of 21.5% to 22%. ServiceNow’s current remaining performance obligations also experienced growth, reaching $8.6 billion, a 24% increase over the previous year and three percentage points higher than forecast.

Analysts Bullish on Growth Prospects

- BMO Capital’s Keith Bachman maintained an Outperform rating and raised the price target from $630 to $850.

- Goldman Sachs’ Kash Rangan kept a Buy rating and increased the price target from $800 to $910.

- Piper Sandler’s Rob Owens reiterated an Overweight rating and raised the price target from $750 to $830.

- Barclays’ Raimo Lenschow maintained an Overweight rating and upgraded the price target from $870 to $890.

- Needham’s Mike Cikos reiterated a Buy rating and a $900 price target.

- Truist Securities’ Joel Fishbein Jr. reiterated a Hold rating and raised the price target from $700 to $750.

- Jefferies’ Samad Samana kept a Buy rating and increased the price target from $775 to $885.

Which Analyst has the best track record to show on NOW?

Analyst Brad Reback (STIFEL) currently has the highest performing score on NOW with 9/9 (100%) price target fulfillment ratio. His price targets carry an average of $13.54 (1.86%) potential upside. ServiceNow stock price reaches these price targets on average within 141 days.

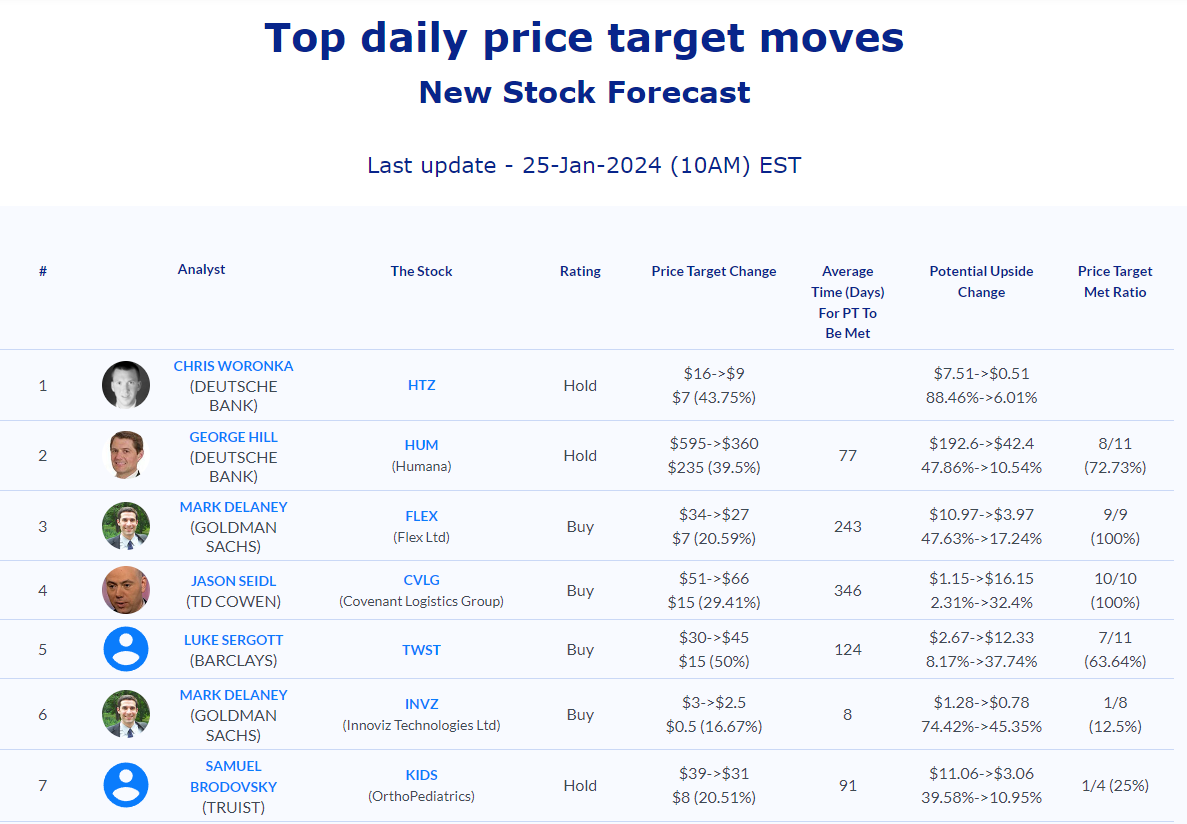

Daily stock Analysts Top Price Moves Snapshot