Selected stock price target news of the day - November 27th, 2023

By: Matthew Otto

Lucid Motors Faces Market Headwinds

Lucid Motors is facing a downturn in its market performance, prompting analyst Chris Pierce from Needham to revise the company’s shares from Buy to Hold. Despite Lucid’s technological prowess, highlighted by its Gravity SUV with a 440-mile range, Pierce expresses concerns over demand, particularly in the niche market for luxury vehicles starting at around $80,000. Lucid’s venture into the EV industry as a technology supplier adds complexity, with Pierce questioning its ability to support the current valuation.

In the first three quarters of 2023, Lucid delivered around 4,300 Air Sedans, each priced above $100,000. The company’s emphasis on premium models and technology licensing prompts further scrutiny. Analysts highlight the delicate balance between cutting-edge technology and market demand, emphasizing the need for Lucid to strategically adapt its business model to regain investor confidence.

Analysts Downgrades Lucid Group

- Needham analyst Vikram Bagri downgraded from Buy to Hold.

Which Analyst has the best track record to show on LCID?

Analyst Adam Jonas (MORGAN STANLEY) currently has the highest performing score on LCID with 11/11 (100%) price target fulfillment ratio. His price targets carry an average of $-12.95 (-39.83%) potential downside. Lucid Group stock price reaches these price targets on average within 211 days.

Foot Locker Faces Downgrade and Tough Market Conditions

Foot Locker was downgraded by Citi analyst Paul Lejuez from Neutral to Sell. The downgrade is accompanied by a revised price target of $18, well below the last recorded share price of $23.32. Lejuez points to persistent headwinds that have plagued Foot Locker for months, attributing the decline to a challenging macroeconomic environment and elevated inventory levels.

Citi’s caution is further underscored by the credit card data, revealing a deceleration in the athletic footwear and apparel category from -2% in the second quarter to -6% in the third quarter. Lejuez expresses skepticism about a potential upside surprise, emphasizing the difficulty Foot Locker faces in executing a turnaround, especially given the complex macroeconomic backdrop. Lejuez notes that despite being a major player for Nike, Foot Locker has seen a reduction in product allocation compared to competitors like Dick’s Sporting Goods.

Analyst Downgraded Foot Locker Amid Market Challenges

- Citigroup analyst Paul Lejuez downgraded from Neutral to Sell and set a $18 price target.

Which Analyst has the best track record to show on FL?

Analyst Joseph Feldman (TELSEY ADVISORY) currently has the highest performing score on FL with 16/34 (47.06%) price target fulfillment ratio. His price targets carry an average of $12.93 (31.88%) potential upside. Foot Locker stock price reaches these price targets on average within 370 days.

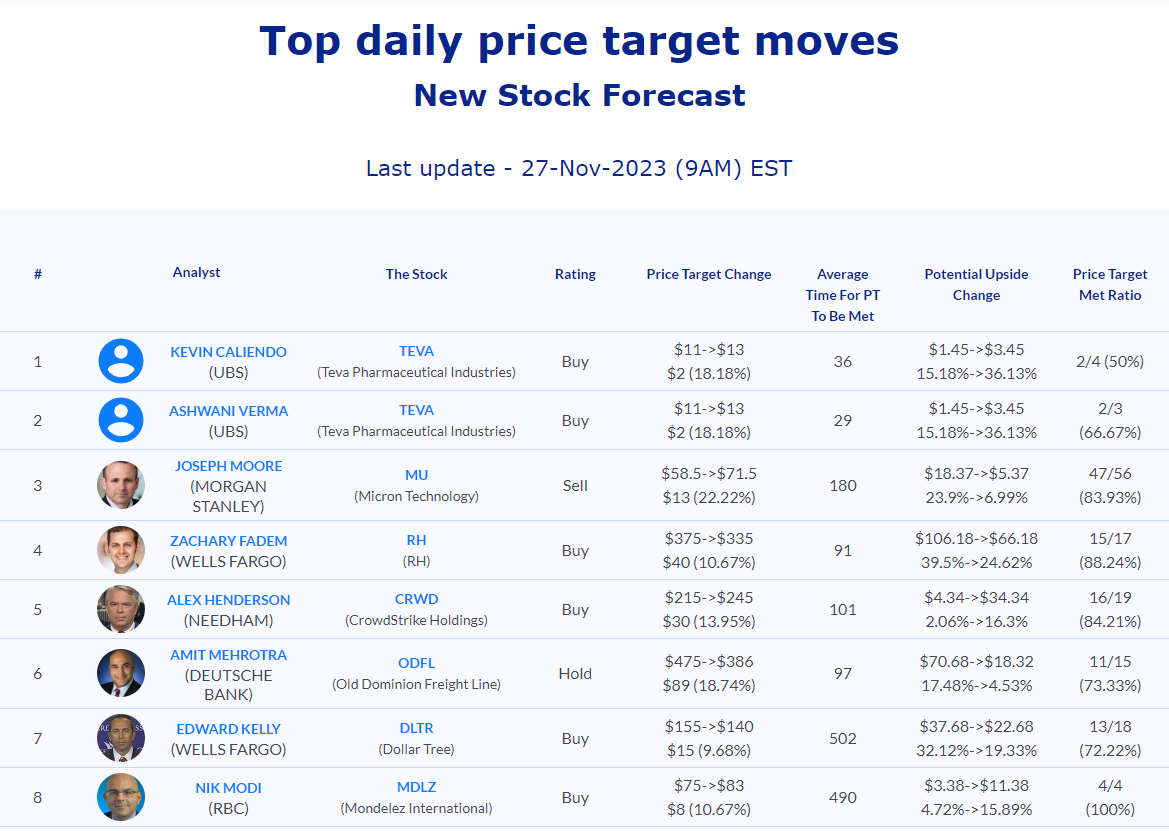

Daily stock Analysts Top Price Moves Snapshot