Selected stock price target news of the day - November 4th, 2024

By: Matthew Otto

Amazon Exceeds Q3 Estimates with 11% Revenue Growth, Sets Upbeat Q4 Guidance

Amazon.com announced third-quarter 2024 financial results, reporting an EPS of $1.43, exceeding analysts’ expectations by $0.29, and revenue of $158.9 billion, which surpassed the consensus estimate of $157.25 billion.

Net sales rose 11% from $143.1 billion in Q3 2023, with the North America segment contributing $95.5 billion (up 9%), international sales reaching $35.9 billion (up 12%), and Amazon Web Services (AWS) generating $27.5 billion (up 19%).

Operating income also saw an increase, reaching $17.4 billion compared to $11.2 billion in the same period last year, driven largely by AWS, which posted $10.4 billion in operating income. Amazon’s net income totaled $15.3 billion, translating to $1.43 per diluted share, a marked improvement from $0.94 per share in the third quarter of the prior year.

Looking ahead, Amazon provided fourth-quarter guidance, forecasting revenue between $181.5 billion and $188.5 billion, representing growth of 7% to 11% compared to Q4 2023, though slightly below the consensus estimate of $186.36 billion. This guidance includes an anticipated 10-basis-point unfavorable impact from foreign exchange rates. Operating income is expected to range from $16.0 billion to $20.0 billion, up from $13.2 billion in the fourth quarter of 2023.

Analysts Boost Price Targets Amid Positive Ratings

- Wedbush analyst Scott Devitt maintained an Outperform rating and raised the price target from $225 to $250.

- Bernstein analyst Mark Shmulik reaffirmed an Outperform rating and increased the target from $225 to $235.

- UBS analyst Stephen Ju continued with a Buy rating and lifted the price target from $223 to $230.

- Maxim Group analyst Tom Forte reiterated a Buy rating and raised his target from $251 to $260.

- RBC Capital analyst Brad Erickson upheld an Outperform rating while raising the target from $215 to $225.

- Deutsche Bank analyst Lee Horowitz maintained a Buy rating and adjusted the target upward from $225 to $232.

- BMO Capital analyst Brian Pitz reiterated an Outperform rating with a target increase from $230 to $236.

- Susquehanna analyst Shyam Patil kept a Positive rating and lifted the target from $220 to $230.

- Scotiabank analyst Nat Schindler kept with a Sector Outperform rating and raised the target from $245 to $246.

- Truist Securities analyst Youssef Squali maintained a Buy rating and boosted the target from $265 to $270.

- Benchmark analyst Daniel Kurnos held a Buy rating and raised the price target from $200 to $215.

- Oppenheimer analyst Jason Helfstein reaffirmed an Outperform rating and increased the target from $220 to $230.

Which Analyst has the best track record to show on AMZN?

Analyst Barton Crockett (ROSENBLATT) currently has the highest performing score on AMZN with 9/11 (81.82%) price target fulfillment ratio. His price targets carry an average of $38.07 (19.23%) potential upside. Amazon.com stock price reaches these price targets on average within 133 days.

Booking Holdings Exceeds Q3 Forecasts with $8B Revenue and $83.89 EPS

Booking Holdings reported impressive third-quarter 2024 results, with adjusted earnings per share (EPS) reaching $83.89 — $6.73 above the analyst estimate of $77.16. Generated $8 billion in revenue for the quarter, surpassing the consensus estimate of $7.63 billion and reflecting a 9% year-over-year increase.

Operational metrics also highlighted growth, with total room nights booked increasing by 8% year-over-year to 299 million nights, exceeding Booking’s own projections. Gross travel bookings rose by 9% from the prior year to $43.4 billion, while adjusted EBITDA expanded by 12% to $3.7 billion.

Additionally, Booking Holdings declared a quarterly dividend of $8.75 per share. Booking Holdings also reported a $365 million accrual related to an Italian tax matter, which was excluded from adjusted net income and EBITDA figures.

Analysts Raise Price Targets Following Q3 Results, Maintaining Ratings

- Deutsche Bank analyst Lee Horowitz maintained a Buy rating, while raising the price target from $4,900 to $5,200.

- Goldman Sachs analyst Eric Sheridan kept a Neutral stance, but increased the price target from $3,940 to $4,510.

- RBC Capital analyst Brad Erickson held an Outperform rating and raised the price target from $3,900 to $5,250.

- Susquehanna analyst Shyam Patil maintained a Positive rating and lifted the price target from $4,100 to $5,500.

- Morgan Stanley analyst Brian Nowak retained an Equal-Weight rating, however raised the price target from $4,200 to $4,600.

- JMP Securities analyst John Colantuoni continued to hold a Market Outperform rating and raised the price target from $5,000 to $5,400.

Which Analyst has the best track record to show on BKNG?

Analyst Daniel Kurnos (BENCHMARK) currently has the highest performing score on BKNG with 6/7 (85.71%) price target fulfillment ratio. His price targets carry an average of $323.75 (6.92%) potential upside. Booking Holdings stock price reaches these price targets on average within 129 days.

Estée Lauder’s Q1 Fiscal 2025 Results: EPS Beats Estimates, but Revenue Falls Short

Estée Lauder Companies reported net sales of $3.36 billion for its first quarter reflecting a 4% decline from $3.52 billion in the prior year. Organic net sales decreased by 5%, which negatively impacted the prestige beauty market in mainland China and led to low conversion rates in Asia travel retail and Hong Kong SAR.

Estée Lauder also experienced lower replenishment orders in Asia travel retail, exacerbated by inventory pressure from ongoing retail market deceleration. In terms of earnings, Estée Lauder reported adjusted earnings per share (EPS) of $0.14, which exceeded analyst estimates of $0.09, although revenue fell slightly short of the consensus estimate of $3.37 billion.

Estée Lauder incurred a net loss of $156 million for the quarter, compared to net earnings of $31 million in the prior year, primarily due to $159 million. Additionally, the decline in sales led to a total reported operating loss of $121 million, a decrease from an operating income of $98 million in the previous year.

In light of the complex industry landscape and ongoing uncertainties, Estée Lauder has withdrawn its fiscal 2025 outlook, focusing instead on the upcoming second quarter, which is anticipated to see a further decline in reported and organic net sales between 6% and 8% year-over-year. In response to current market conditions, the company has also reduced its quarterly dividend to $0.35 per share from $0.66.

Analyst Ratings Deteriorate Amid Mixed Q1 Performance

- BofA Securities analyst Bryan Spillane maintained a Neutral rating, yet lowered the price target from $100 to $75.

- TD Cowen analyst Oliver Chen kept a Hold rating, while reducing the price target from $95 to $70.

- RBC Capital analyst Nik Modi retained an Outperform rating; however, decreased the price target from $131 to $100.

- Morgan Stanley analyst Dara Mohsenian maintained an Equal-Weight rating and lowered the price target from $100 to $85.

- Goldman Sachs analyst Jason English continued with a Neutral rating but cut the price target from $100 to $75.

- Canaccord Genuity analyst Susan Anderson held a Hold rating, although lowered the price target from $100 to $75.

- DA Davidson analyst Linda Bolton Weiser kept a Buy rating, yet reduced the price target from $130 to $81.

Which Analyst has the best track record to show on EL?

Analyst Susan Anderson (CANACCORD) currently has the highest performing score on EL with 5/6 (83.33%) price target fulfillment ratio. Her price targets carry an average of $8.42 (12.65%) potential upside. Estée Lauder Companies stock price reaches these price targets on average within 18 days.

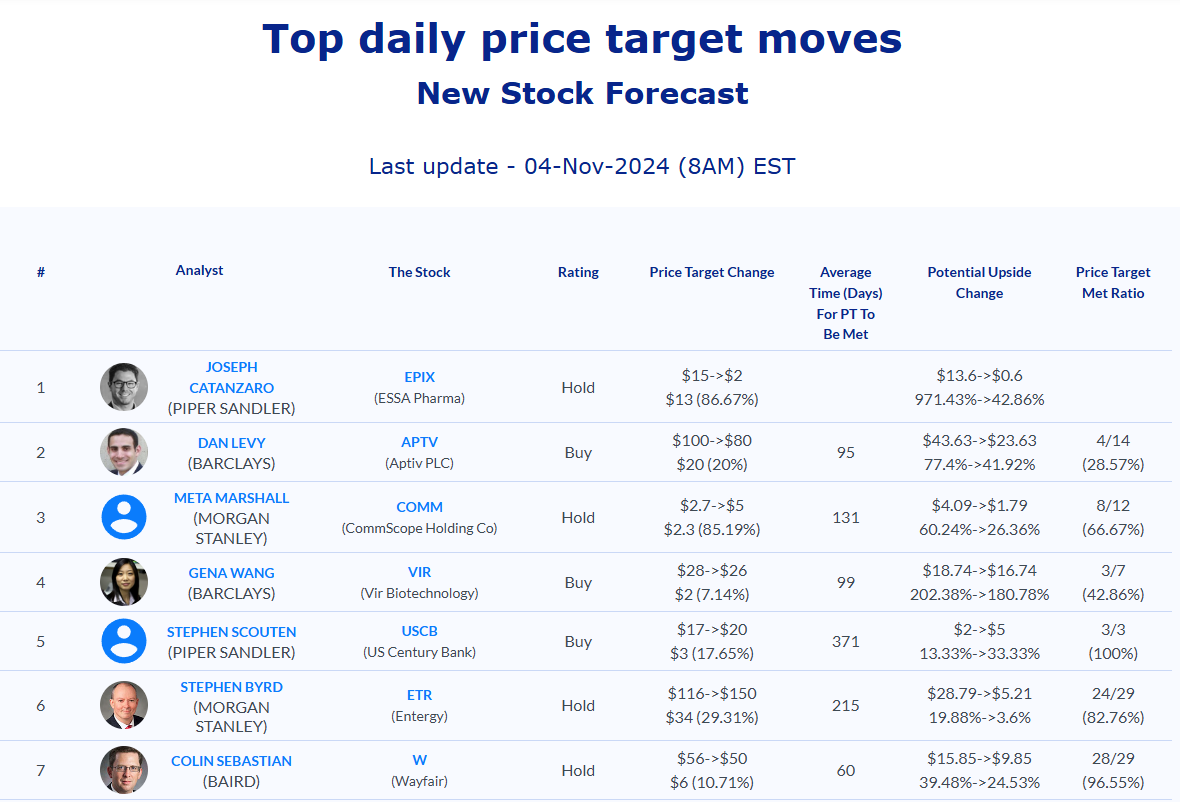

Daily stock Analysts Top Price Moves Snapshot