Selected stock price target news of the day - November 6th, 2023

By: Matthew Otto

Karuna Therapeutics Reports Q3 Losses Amidst Financial Position

Karuna Therapeutics has reported financial results for the third quarter of 2023, highlighted by a net loss of $119.1 million. The total operating expenses for Q3 reached $136.2 million, compared to $81.1 million for the same period in 2022. Research and development expenses saw an increase, reaching $104 million, attributed to ongoing clinical programs, expanded employee headcount, and higher stock-based compensation. General and administrative expenses also rose to $32.3 million, driven by pre-commercialization efforts and increased personnel costs.

The company’s financial position remains, with cash, cash equivalents, and investment securities totaling $1.3 billion as of September 30, 2023. This increase from $1.1 billion at the end of 2022 was primarily fueled by a follow-on public offering in March, resulting in net proceeds of approximately $437 million. Looking ahead, Karuna Therapeutics anticipates a decrease in research and development expenses in the fourth quarter, with a reaffirmation of the full-year 2023 guidance, expecting total operating expenses to be around $470 million.

Analysts’ Adjustments Reflect Divergent Views on Future Prospects

- RBC Capital analyst Brian Abrahams maintained an Outperform rating and lowered the price target from $235 to $225.

- Goldman Sachs analyst Corinne Jenkins reiterated a Buy rating and adjusted the price target down from $332 to $296.

- Wedbush analyst Laura Chico kept an Outperform rating and raised the price target from $250 to $253.

Which Analyst has the best track record to show on KRTX?

Analyst Mohit Bansal (WELLS FARGO) currently has the highest performing score on KRTX with 3/4 (75%) price target fulfillment ratio. His price targets carry an average of $38.98 (30.07%) potential upside. Karuna Therapeutics stock price reaches these price targets on average within 198 days.

Teleflex Q3 2023, Driven by Revenue Growth and Strategic Acquisition

Teleflex Incorporated reported financial results for the third quarter of 2023. The company’s revenues reached $746.4 million versus the estimate of $733.57 million, marking a year-over-year increase of 8.7% and a 7.4% rise on a constant currency basis. Adjusted earnings per share for the third quarter stood at $3.64, $0.37 better than the analyst estimate of $3.27, reflecting an 11.3% increase compared to the same period last year.

In the America region, revenues reached $428.2 million, demonstrating a 5.5% year-over-year increase. The European, Middle Eastern, and African segment reported $142.7 million in revenues, marking a 4% growth. The Asia region saw revenues of $93.2 million, exhibiting a 17.1% increase year-over-year. Notably, the company’s strategic initiatives included the recent acquisition of Palette Life Sciences for an upfront cash payment of $600 million, contributing to the expansion of Teleflex’s product portfolio. The financial outlook for 2023 has been revised, with Teleflex now anticipating constant currency revenue growth in the range of 6.4% to 6.6%.

Analysts Express Confidence with Upward Adjustments

- Truist Securities analyst Richard Newitter raised the price target to $221.

- Piper Sandler analyst Matt O’Brien increased the price target to $225.

- JMP Securities analyst David Turkaly kept with a Market Outperform and lowered the price target from $315 to $285.

- RBC Capital analyst Shagun Singh maintained an Outperform rating and raised the price target from $218 to $228.

- Stephens & Co. analyst George Sellers reiterated an Overweight rating and a $275 price target.

Which Analyst has the best track record to show on TFX?

Analyst Lawrence Biegelsen (WELLS FARGO) currently has the highest performing score on TFX with 3/3 (100%) price target fulfillment ratio. His price targets carry an average of $8.32 (3.77%) potential upside. Teleflex stock price reaches these price targets on average within 14 days.

Apple Faces Volatility Amid Holiday Quarter Forecast

Apple predicting sales below Wall Street estimates. The company attributed the subdued outlook to weak demand for iPads and wearables, raising concerns about broader holiday demand amid predictions of the slowest rise in sales in years due to inflation. At least 14 analysts subsequently slashed their price targets on Apple, with the median target now at $195, according to LSEG data..

Bernstein, a brokerage firm, noted that Apple’s revenue growth has stalled in recent quarters, and it appears likely to continue stagnating over the next year. D.A. Davidson analyst Tom Forte expressed skepticism about Apple’s reliance on iPhone sales to drive share value, especially considering management’s flat sales guidance. Despite this, CEO Tim Cook reassured investors that the iPhone 15 models were performing well in China, setting a quarterly sales record for the September quarter. Analysts, including Wedbush Securities’ Dan Ives, found comfort in Cook’s remarks, suggesting that the Street would breathe a sigh of relief regarding Apple’s performance in the Chinese market.

Analyst Perspectives Diverge on Apple’s Future

- Wedbush analyst Daniel Ives reiterated with an Outperform rating and a $240 price target.

- DZ Bank analyst Ingo Wermann lowered the price target to $210.

- Morgan Stanley analyst Erik Woodring maintained an Overweight rating and a $210 price target.

Which Analyst has the best track record to show on AAPL?

Analyst Krish Sankar (COWEN) currently has the highest performing score on AAPL with 26/29 (89.66%) price target fulfillment ratio. His price targets carry an average of $17.79 (20.36%) potential upside. Apple stock price reaches these price targets on average within 112 days.

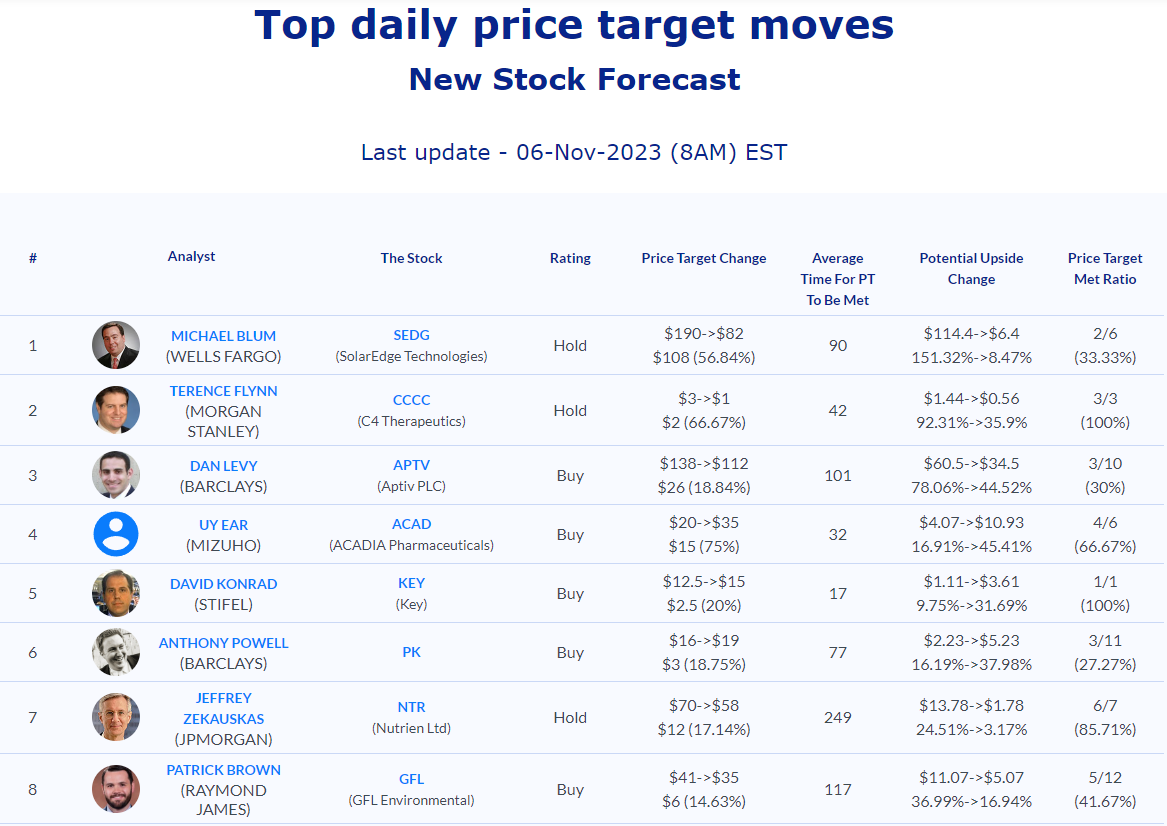

Daily stock Analysts Top Price Moves Snapshot