Selected stock price target news of the day - June 07, 2023

By Matthew Otto

Hollywood Unrest Continues: WGA Strike Persists Amid New DGA Deal, SAG-AFTRA Braces for Possible Strike

The ongoing strike by the Writers Guild of America (WGA) is causing significant disruptions in the film and television industry. Shows like “Stranger Things,” “A Knight of the Seven Kingdoms: The Hedge Night,” “Thunderbolts,” and “Blade” either halting or postponing production. This strike, which has been in effect since May 2, 2023, follows unsuccessful talks between the WGA and the Alliance of Motion Picture and Television Producers (AMPTP) concerning pay and working conditions.

In a separate development, the Directors Guild of America (DGA) has struck a tentative agreement with the AMPTP, which is set to provide wage and benefit increases, heightened residuals from streaming, and safeguards against artificial intelligence (AI) replacing jobs held by guild members. However, the WGA has stated that the DGA’s agreement will not impact their ongoing strike.

The Screen Actors Guild and the American Federation of Television and Radio Artists are also on the brink of authorizing a potential strike as they commence negotiations with producers. Both the WGA and SAG-AFTRA are seeking protections against the use of AI in their negotiations, alongside pay increases for streamed content.

AI has become a significant issue as both guilds believe their jobs are particularly vulnerable to this emergent technology. The WGA is primarily concerned that production companies will leverage AI to reduce writers’ salaries, while SAG-AFTRA is advocating for the consent and payment of actors whose performances might be replicated by AI technology.

Netflix is directly affected by the strike as she production of the fifth and final season of its popular series “Stranger Things” has been postponed due to the strike

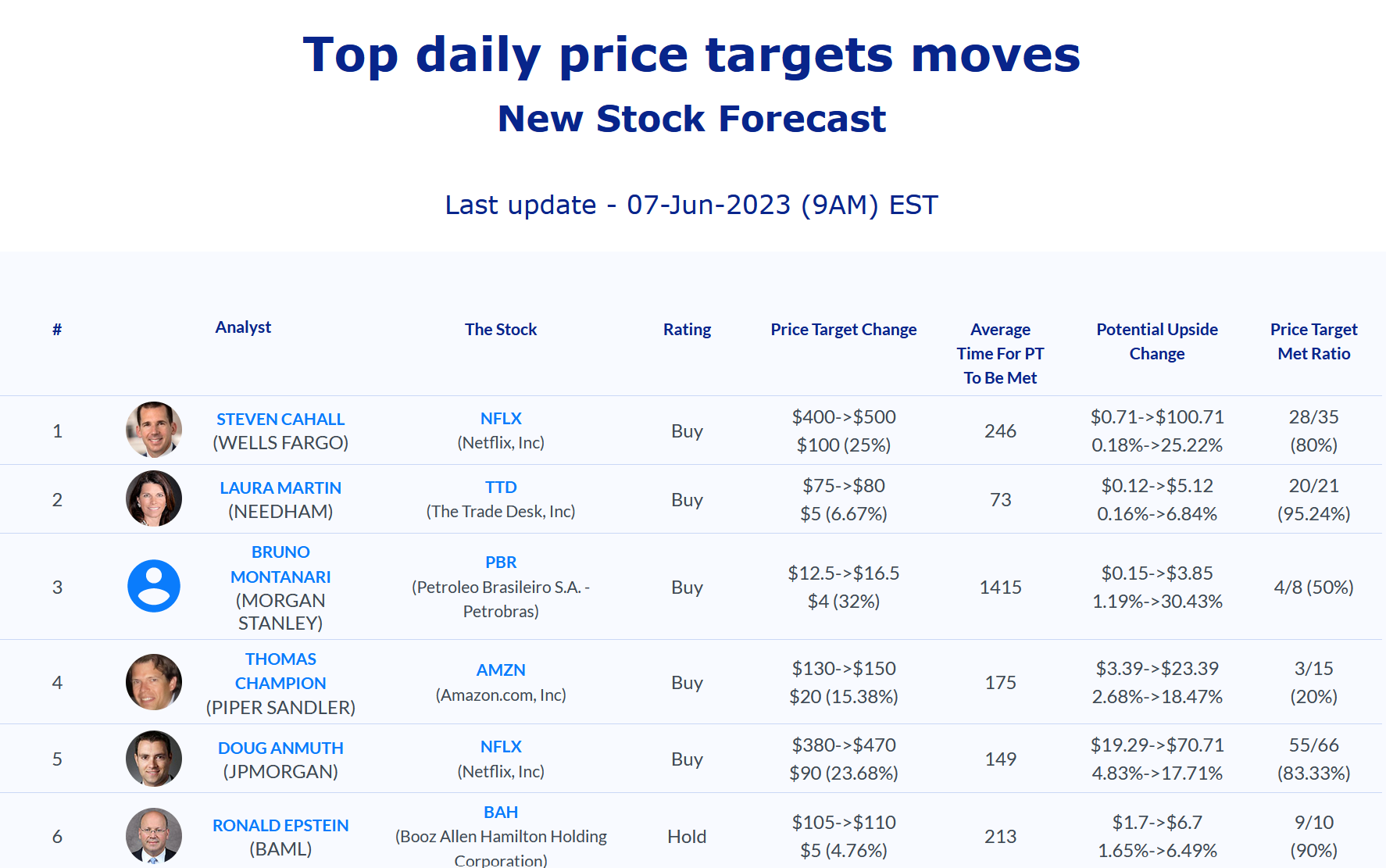

Wells Fargo and JP Morgan raise price targets

- Wells Fargo analyst Steven Cahall maintains an Overweight rating on Netflix, raising the price target from $400 to $500.

- JP Morgan analyst Doug Anmuth also keeps his Overweight rating on Netflix, increasing the price target from $380 to $470.

Most analysts are bullish on the Netflix stock however some analysts such as Matthew Harrigan of Benchmark have a sell rating and a price target below the stock price.

Analyst John Blackledge of Cowen has currently the highest performing score on NFLX with 44/49 (89.8%) price target fulfillment ratio. His price targets carry on average an $65.61 (22.61%) potential upside and are fulfilled within average of 74 days.

Novocure’s TTFields Therapy Shows Promising Results in Phase 3 Lung Cancer Trial; Critics Question Standard of Care

Novocure has reported positive results from its Phase 3 LUNAR clinical trial evaluating the use of Tumor Treating Fields (TTFields) therapy, also known as Optune, in conjunction with standard therapies for non-small cell lung cancer (NSCLC). However, the market reaction to the test results was mixed, causing a sharp decline in Novocure’s stock value.

The TTFields therapy, a wearable skin patch that delivers electrical fields to disrupt the rapid division of cancer cells, calimes to extend patients’ overall survival by a median of 3.3 months when added to standard therapies. Patients treated with TTFields alongside immune checkpoint inhibitors, like Merck’s Keytruda or Bristol Myers Squibb’s Opdivo, showed a “profound” benefit, living a median of 7.7 months longer than those treated with checkpoint inhibitors alone.

However, critics argue that Novocure tested Optune in patients who had worsened following chemotherapy, which is no longer the standard of care in lung cancer. Specifically, the scrutiny of progression-free survival, a measure of how long patients live on treatment before their cancer worsens. The use of Optune with standard drugs extended progression-free survival to 4.8 months compared to 4.1 months for standard drugs alone.

Currently, Optune is approved for treating a form of brain cancer. However, approval in NSCLC would significantly expand Novocure’s market. The company plans to submit the LUNAR clinical trial results for publication in a leading, peer-reviewed medical journal and use the data as the basis for a Premarket Approval (PMA) submission to the U.S. Food and Drug Administration in the second half of 2023.

Wall Street Action

- Wedbush analyst David Nierengarten upgraded NovoCure from Underperform to Neutral however lowered the price target from $53 to $46.

- Truist Securities analyst Gregory Fraser reiterated a Buy rating on NovoCure, maintaining a $95 price target.

- HC Wainwright analyst Emily Bodnar also reiterated a Buy rating and a price target at $115

The stock is traded at 25% from its peak value of $221 in 2021.

Analyst Vijay Kumar from Evercore had shown a very prudent stance throughout the last few years with his bearish stance.

Analyst Jessica Fye of JP Morgan has currently the highest performing score on NVCR with 3/3 (100%) price target fulfillment ratio. Her price targets carry on average an $-6.7 (-8.42%)potential downside and are fulfilled within average of 42 days.

Paratek to be Acquired in $462 Million Deal

Paratek Pharmaceuticals is set to be acquired by Gurnet Point Capital and Novo Holdings in a transaction estimated to be approximately $462 million. The pruchase includes the assumption of debt and full payment of a Contingent Value Right (CVR). Oaktree Capital Management will provide $175 million debt financing for the deal.

Gurnet Point and Novo Holdings will buy all outstanding shares of Paratek for $2.15 each in cash, along with a CVR of $0.85 per share, which will be payable when Paratek reaches $320 million in U.S. NUZYRA net sales in any calendar year ending on or before December 31, 2026. The upfront payment offers a premium of 41% over the closing price of Paratek’s as of May 31, 2023.

The transaction, unanimously approved by the Paratek Board of Directors, is expected to close in the third quarter of 2023. After completion, Paratek will become a private company and will no longer be listed on the Nasdaq Global Market.

Wall Street Action

- HC Wainwright & Co.’s analyst Ed Arce has downgraded Paratek Pharmaceuticals from Buy to Neutral and set a price target of $2.15.

- Jefferies’ analyst Suji Jeong has downgraded Paratek Pharmaceuticals from Buy to Hold and lowered the price target from $5 to $2.15.

The stock lost over 90% of its value since its IPO in 2015 with all analysts recommending to buy and carrying potential upside in the process. Currently there are no analysts that gave realistic price targets that were met and as result all analysts have a performance score of zero on the stock.

Daily stock Analysts Top Price Moves Snapshot