Weekly Updates - Nov 13, 2022

By: Matthew Otto

The sentiment in the market was quite negative as you will from some samples below that have caught attention.

Lyft reported growth in the third quarter of 2022,

With revenue increasing by 22 percent year-over-year and by 6 percent quarter-over-quarter. Net loss for the quarter was $422.2 million, which includes $224.1 million of stock-based compensation and related payroll tax expenses and a $135.7 million impairment charge related to a non-marketable equity investment and other assets. Net loss margin for the quarter was 40.1 percent. Despite the net loss, Lyft’s strong revenue growth indicates that the company is on track to achieve profitability in the near future.

Lyft saw an increase in gross profit and gross profit margin in the third quarter of 2022. This is due to the fact that revenue increased while cost of revenue remained the same. The company’s net income also increased during this time period. This can be attributed to the fact that Lyft’s adjusted net income for Q3 2022 was $36.7 million, which is up from $17.8 million in Q3 2021 and $46.4 million in Q2 2022.Overall, it appears that Lyft is on track to have a successful year financially.

With a reported strong growth in its third quarter contribution, with a year-over-year increase of 15 percent. This was driven by strong ridership growth and continued disciplined management of costs. The company’s contribution margin also expanded to 56.0 percent, which exceeded expectations. Adjusted EBITDA for the quarter was $66.2 million, which also exceeded expectations.

The company outlook for the third quarter of 2022 includes a contribution margin of 55.0 percent and adjusted EBITDA between $55 million and $65 million. These figures were reported during the second quarter of 2022 Financial Results Earnings Call on August 4, 2022. The company’s fourth quarter outlook includes revenue growth of 9-11% quarter-over-quarter and 18-20% year-over-year. Additionally, Adjusted EBITDA is anticipated to be between $80 million and $100 million with a margin of 7% to 9%. Given these forecasted figures, it seems that the company is projected to have a strong finish to the year.

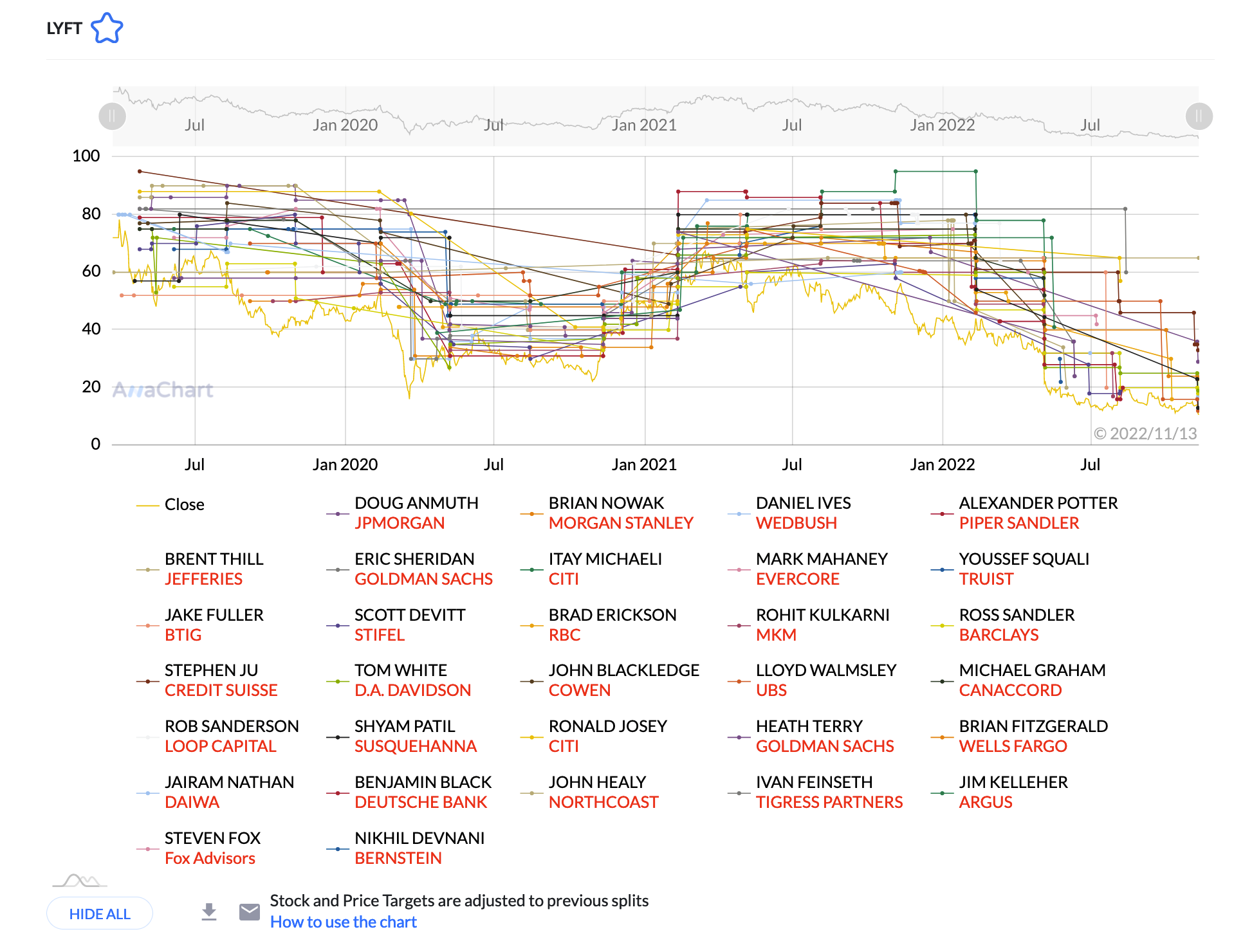

LYFT stock forecast reaction:

- Northcoast John Healy upgraded to a Buy from a Neutral rating.

- Cowen John Blackledge lowered his price target from $42 to $36 while maintaining an Outperform rating.

- Barclays Ross Sandler lowered his price target from $20 to $18 while maintaining an Equal-Weight rating.

- Morgan Stanley Brian Nowak lowered his price target from $24 to $23 while maintaining an Equal-Weight rating.

- Susquehanna Shyam Patil lowered his price target from $23 to $13 while maintaining a Neutral rating.

- Wedbush Daniel Ives lowered his price target from $25 to $17 while maintaining an Outperform rating.

- UBS Lloyd Walmsley lowered his price target from $16 to $12 while maintaining a Neutral rating.

Affirm Holdings

Has issued its quarterly earnings data on Thursday, August 25th. The company reported a loss of $0.65 per share. Affirm had a negative net margin of 45.24% and a negative return on equity of 25.53%. During the same period in the year prior, the business earned a loss of $0.48 per share. The company’s revenue was up 39% on a year-over-year basis. Affirm Holdings provides financial services in the United States and internationally. It operates through two segments, Merchant Solutions and Consumer Products. The company offers point-of-sale financing solutions to retailers; and financing products for consumers, such as installment loans and lines of credit that are denominated in dollars or other currencies through strategic partnerships with retailers or directly to consumers through its website or mobile app, as well as paper checks. As of December 31, 2020, it operated in 2,000 merchant locations throughout the United States and internationally; and had approximately 19 million consumer accounts with loan balances totaling approximately $5 billion outstanding across its ecosystem.

AFRM analyst coverage action:

- Barclays Ramsey El-Assal lowered his price target from $29 to $16 while maintaining an Overweight rating.

- Stephens Vincent Caintic lowered his price target from $18 to $15 while maintaining an Underweight rating.

- Credit Suisse Timothy Chiodo lowered his price target from $27 to $21 while maintaining a Neutral rating.

- Morgan Stanley James Faucette lowered his price target from $53 to $52 while maintaining an Overweight rating.

- RBC Daniel Perlin lowered his price target from $31 to $23 while maintaining an Outperform rating.

- Piper Sandler Kevin Barker lowered his price target from $28 to $22 while maintaining a Neutral rating.

- Deutsche Bank Bryan Keane lowered his price target from $22 to $14 while maintaining a Hold rating.

- JMP Patrick Walravens lowered his price target from $23 to $17 while maintaining a Market Outperform rating.

EverCommerce

Announced earnings per share of $-0.08 and revenues of $158.1 million. That is an increase of 23.02% in revenues from the year-ago report and is 1.29% lower than consensus estimates set at $160.2 million. EverCommerce provides a suite of cloud-based software solutions that enable businesses to manage their customers, orders, inventory, and payments. The company’s customers include retailers, wholesalers, manufacturers, and distributors. EverCommerce’s platform enables its customers to manage their business operations across multiple channels, including e-commerce, mobile commerce, point-of-sale, and marketplaces. EverCommerce’s products are used by more than 30,000 businesses in over 100 countries. EverCommerce is headquartered in San Francisco, with offices in North America, Europe, Asia Pacific, and South America.

EVCM price target reactions:

- JMP Patrick Walravens lowered his price target from $23 to $17 while maintaining Market an Outperform rating.

- Canaccord Genuity David Hynes lowered his price target from $17 to $12 while maintaining a Buy rating.

- RBC Matthew Hedberg lowered his price target from $13 to $12 while maintaining an Outperform rating.

- Raymond James Brian Peterson lowered his price target from $15 to $11 while maintaining an Outperform rating.

- Barclays Ryan Macwilliams lowered his price target from $17 to $9 while maintaining an Equal-Weight rating.

- Oppenheimer Brian Schwartz lowered his price target from $18 to $14 while maintaining an Outperform rating.

- Piper Sandler Clarke Jeffries lowered his price target from $16 to $11 while maintaining an Overweight rating.

TTWO

Take-Two Interactive Software announced financial results for the second quarter of Fiscal 2023 ended September 30, 2020. Net revenue was $1.05 billion, up 43% from $735 million in the same quarter last year. GAAP net income was $327 million, or $2.70 per diluted share, compared to GAAP net income of $246 million, or $2.01 per diluted share, in the prior year quarter. Non-GAAP net income was $367 million, or $3.02 per diluted share, up 47% from non-GAAP net income of $250 million, or $2.05 per diluted share in the prior year quarter. Net bookings were $1.507 billion in the second quarter of Fiscal 2023, up 49% compared to $1.006 billion in the second quarter of Fiscal 2022.recurrent consumer spending on virtual currency and other items was a record 46% of total net bookings for the second quarter of Fiscal 2023.

Digitally-delivered GAAP net revenue also increased 69% to $1.3 billion, representing 95% of total GAAP net revenue. The largest contributors to GAAP net revenue were NBA 2K22 and NBA 2K23, Grand Theft Auto Online and Grand Theft Auto V, Empires & Puzzles, Rollic’s hyper-casual portfolio, Toon Blast, Red Dead Redemption 2 and Red Dead Online, Words With Friends, and Merge Dragons. Digital delivery channels continued to be the primary growth driver for the company, with all major contributors to GAAP net revenue experiencing double-digit growth.Looking ahead, Take-Two is well positioned for continued success with a robust pipeline of new releases and a strong focus on recurrent consumer spending.

“We posted another consecutive quarter of solid results, with Net Bookings of $1 .5 billion underscoring our ability to launch exciting new games and content updates across our portfolio,” said Strauss Zelnick chairman and CEO of Take-Two stated that they are aiming long – term growth with their potential for the mobile industry , which is expected to reach over $160 billion in gross bookings within the next four years .

” We now expect to deliver Net Bookings of between $ 5 .4 and 5 .5 billion in Fiscal 2023 . Our reduced forecast reflects shifts in our pipeline , fluctuations in FX rates , and a more cautious view of the current macroeconomic backdrop , particularly in mobile .”

TTWO stock price targets in the news:

- DZ Bank Manuel Muhl gave a price target from to $115 upgrading a Hold to a Buy rating.

- BMO Capital Gerrick Johnson lowered his price target from $155 to $120 while maintaining an Outperform rating.

- BAML Securities Omar Dessouky upgrading a Neutral to a Buy rating.

- Cowen’s Doug Creutz lowered his price target from $185 to $147 while maintaining an Outperform rating.

- Stifel Drew Crum lowered his price target from $161 to $130 while maintaining a Buy rating.

- Morgan Stanley Matthew Cost lowered his price target from $190 to $150 while maintaining an Overweight rating.

- Benchmark Mike Hickey lowered his price target from $180 to $139 while maintaining a Buy rating.

DIS

The Walt Disney Company today reported strong earnings for its fourth quarter and fiscal year ended October 1, 2022. Revenues for the quarter and year grew 9% and 23%, respectively, driven by strong growth across all of the company’s businesses. Diluted earnings per share (EPS) from continuing operations for the quarter was comparable to the prior-year quarter at $0.09, while EPS for the full year increased to $1.75 from $1.11 in the prior year. Excluding certain items(1), diluted EPS for the quarter decreased to $0.30 from $0.37 in the prior-year quarter, while EPS for the full year increased to $3.53 from $2.29 in the prior year.

Bob Chapek, Chief Executive Officer of The Walt Disney Company, announced that 2022 was a strong year for the company. He cited some of their best storytelling, record results at their Parks, Experiences and Products segment, and outstanding subscriber growth at their direct-to-consumer (DTC) services. DTC services added nearly 57 million subscriptions this year, for a total of more than 235 million. In the fourth quarter alone, 14.6 million total subscriptions were added, including 12.1 million Disney+ subscribers. Chapek attributes the rapid growth of Disney+ to their strategic decision to invest heavily in content creation and rolling out the service internationally. He expects losses from DTC operations to narrow going forward and anticipates Disney+ will have over 600 million global subscribers by 2024. To continue this momentum, Disney is doubling down on its investment in content and expanding its global footprint with new streaming services like Star and Hulu.

DIS stock price targets in the news:

- Goldman Sachs Brett Feldman lowered his price target from $137 to $118 while maintaining a Buy rating.

- JP Morgan Philip Cusick lowered his price target from $145 to $135 while maintaining an Overweight rating.

- Rosenblatt Barton Crockett lowered his price target from $134 to $120 while maintaining a Buy rating.

- Credit Suisse Douglas Mitchelson lowered his price target from $157 to $126 while maintaining an Outperform rating.

- Barclays Kannan Venkateshwar lowered his price target from $105 to $98 while maintaining an Equal-Weight rating.

- Keybanc Brandon Nispel lowered his price target from $143 to $119 while maintaining an Overweight rating.

IFF

IFF’s third quarter results show that the company is continuing to struggle. Net sales were flat, and EPS was down 8.60%. However, on a currency-neutral basis, sales increased 10%. This was due to strong growth in the Nourish and Pharma Solutions divisions. Adjusted operating EBITDA also grew 3% on a currency-neutral basis. The company attributes this growth to higher prices and productivity gains offsetting lower volumes. IFF is clearly facing some challenges, but it appears that they are making progress in some areas.

IFF announced that it has updated its guidance for the full year of 2022. The company now expects sales to be approximately $12.4 billion to $12.5 billion, down from the previous range of $12.6 billion to $13.0 billion. The change is primarily due to an unfavorable impact from foreign exchange and a more challenging operating environment. IFF still expects to deliver comparable currency neutral sales growth of 9% to 10% for the full year 2022, with comparable currency neutral adjusted operating EBITDA growth to be in line and at the low-end of the Company’s previous 4% to 8% range. Despite the challenges faced this year, IFF remains confident in its ability to deliver strong results and drive shareholder value over the long term.

IFF stock price targets in the news:

- Wells Fargo Michael Sison lowered his price target from $107 to $105 while maintaining an Overweight rating.

- Mizuho Christopher Parkinson lowered his price target from $145 to $116 while maintaining a Neutral rating.

- Credit Suisse John Roberts lowered his price target from $130 to $125 while maintaining an Outperform rating.

- Baird Ghansham Panjabi lowered his price target from $140 to $120 while maintaining an Outperform rating.

- Societe Generale Thomas Swoboda lowered his price target from $170 to $145 while maintaining a Buy rating.

- JP Morgan Jeffrey Zekauskas lowered his price target from $125 to $96 and downgraded from an Overweight to a Neutral rating.

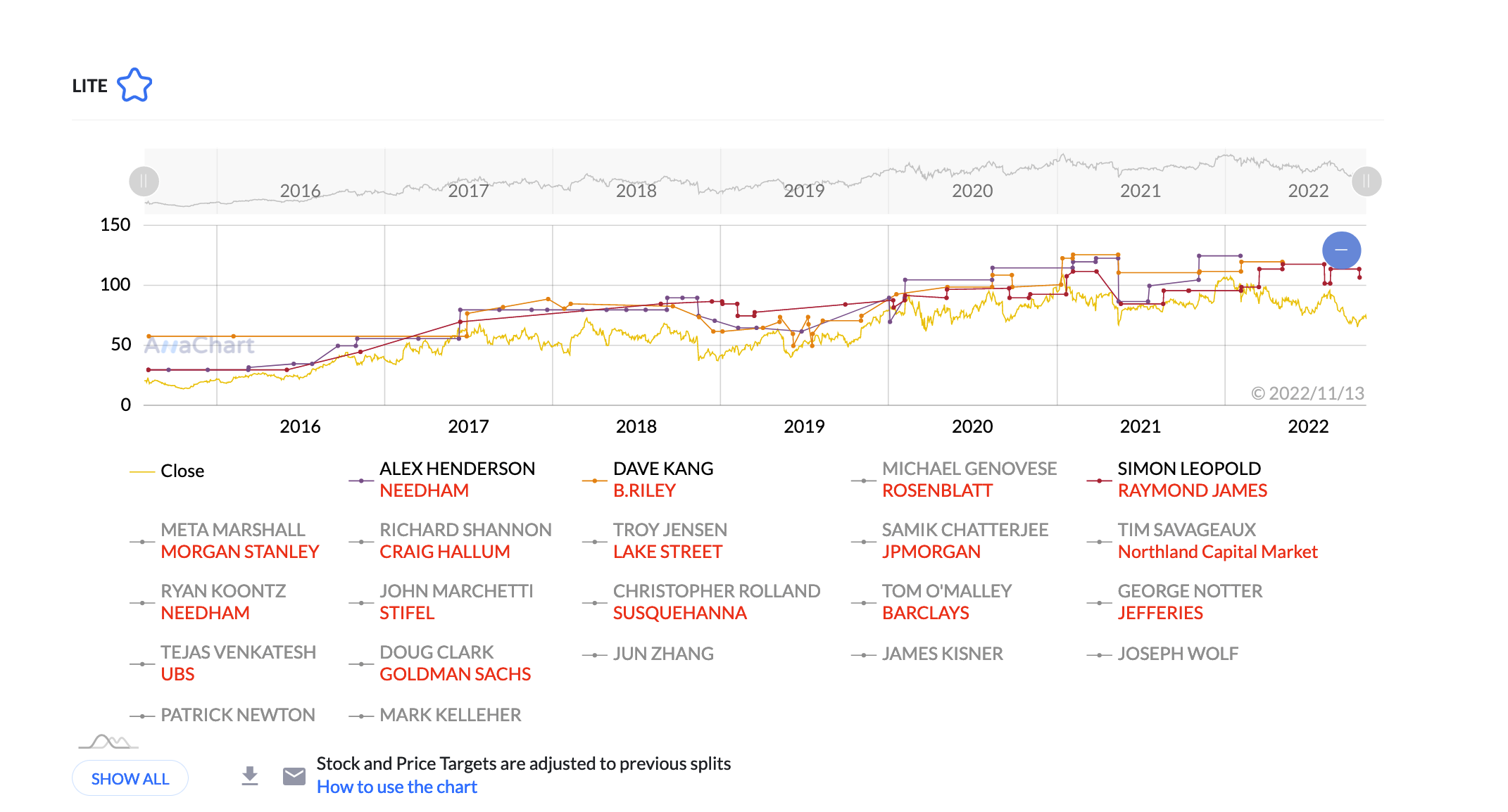

LITE

Lumentum Holdings, a leading manufacturer of optical and photonic products, posted disappointing results for its fiscal first quarter. The company reported a net loss of $400,000, or 1 cent per share. This is a sharp contrast to its net income of $81.5 million, or $1.08 per share, in the year-earlier period. On an adjusted basis, the company earned $1.69 per share, down from $1.79 per share a year before. Analysts were expecting earnings of $1.56 per share. Revenue also fell short of expectations, coming in at $506.8 million compared to the consensus estimate of $503.6 million. For the fiscal second quarter, Lumentum executives anticipate net revenue in the range of $490 million to $520 million along with adjusted earnings per share of $1.20 to $1.45. The FactSet consensus was for revenue of $540 million and earnings per share of $1.61. Shares of Lumentum Holdings fell sharply on the news, trading down more than 10% in after-hours trading.

Lumentum announced that due to a shortage of certain integrated circuit components, the company expects its fiscal 2024 outlook to be lower than previous projections. Lumentum Chief Executive Alan Lowe said that the company’s near-term demand from telecommunications and industrial-lasers companies is still strong, but that the shortages are expected to continue into the next fiscal year. This news comes as a surprise to many, as Lumentum has been one of the few companies immune to the recent trends of slowing down growth and production. However, with this new development, it seems that even Lumentum is not immune to the challenges facing the tech industry today.

Lumentum stock price targets action:

- BAML Securities Vivek Arya lowered his price target from $84 to $62 while upgrading to a Buy from a Neutral rating.

- Morgan Stanley Meta Marshall lowered his price target from $84 to $75 while maintaining an Equal-Weight rating.

- Northland Capital Markets Tim Savageaux lowered his price target from $120 to $65 and downgraded an Outperform to Market Perform rating.

- Rosenblatt Michael Genovese lowered his price target from $125 to $80 while maintaining a Buy rating.

- Raymond James Simon Leopold lowered his price target from $107 to $85 while maintaining an Outperform rating.

- Needham Alex Henderson lowered his price target from $125 to $72 while maintaining a Buy rating.

RIVN

Rivian has released its earnings report for the third quarter of 2022, disclosing a $1.72 billion net loss from operations and revenue of $536 million. The net loss widened compared to the $1.23 billion posted a year earlier, while revenue did not meet analysts’ expectations of $551 million, according to Refinitiv data quoted by Reuters.

The EV startup said it ended the third quarter of 2022 with $13.8 billion in cash, cash equivalents, and restricted cash, which is enough to fund the company’s expansion operations through 2025, according to Rivian CFO Claire McDonough. In a statement released with the earnings report, Rivian CEO RJ Scaringe said the company is “on track” to begin production of its R1T pickup truck and R1S SUV in late 2023. He also said Rivian plans to start delivering vehicles to customers in North America and Europe in 2024. Despite the challenges posed by the pandemic, Scaringe said Rivian is “well positioned” to achieve its long-term goals.

In a recent announcement, the electric vehicle manufacturer stated that it is pushing back the introduction of its smaller R2 platform to 2026. The R2 platform is designed for smaller, more affordable vehicles that likely would include both a pickup and one or more SUVs, according to automotive forecasters. Rivian’s R2 vehicles will be made at a future $5 billion factory in Georgia. In a statement, Rivian said: “We continue to work with the state of Georgia and the Joint Development Authority and expect our R2 platform will launch in 2026. We expect the R2 platform will unlock a global market opportunity for Rivian and are excited about the early development work that is underway.” The news of the delay comes as Rivian prepares to launch its first two vehicles, the R1T pickup and the R1S SUV, later this year. Despite the setback, Rivian remains confident that its R2 platform will appeal to customers looking for an affordable and stylish electric vehicle option.

RIVN price target action

- Mizuho Vijay Rakesh lowered his price target from $65 to $58 while maintaining a Buy rating.

- RBC Joseph Spak lowered his price target from $61 to $50 while maintaining an Outperform rating.

- Wells Fargo Colin Langan lowered his price target from $35 to $32 while maintaining an Equal-Weight rating.

- DA Davidson Michael Shlisky lowered his price target from $27 to $23 while maintaining Underperform rating.

- Wedbush Daniel Ives lowered his price target from $45 to $37 while maintaining an Outperform rating.

- Piper Sandler Alexander Potter lowered his price target from $83 to $63 while maintaining an Overweight rating.

RNG

RingCentral announced financial results for the third quarter of fiscal year 2022. Total revenue increased 23% year over year to $509 million. Subscriptions revenue increased 25% year over year to $483 million. Annualized Exit Monthly Recurring Subscriptions (ARR) increased 25% year over year to $2.05 billion. Mid-market and Enterprise ARR increased 29% year over year to $1.25 billion. GAAP operating margin was (35.9%), compared to (20.1%) in the prior year. Record non-GAAP operating margin was 13.5%, up 300 basis points year over year. Net cash provided by operating activities was $42 million and non-GAAP free cash flow was $21 million. RingCentral continues to invest in innovation and go-to-market initiatives to drive long-term growth and scale. In the third quarter, RingCentral launched its next-generation RingCentral Office®, which features an all new user interface designed for the modern workplace, as well as several new AI-powered features that are designed to improve productivity and efficiency for workers across the globe.

RingCentral reported strong quarterly results, exceeding guidance across key metrics despite a difficult macro environment. This positive performance was driven in part by the company’s continued focus on delivering mission-critical cloud communications solutions to customers. RingCentral’s founder, chairman and CEO Vlad Shmunis noted that the company is well-positioned to capitalize on opportunities in large markets totaling $100 billion. RingCentral’s CFO Sonalee Parekh highlighted the company’s achievements in non-GAAP operating margin, which rose 300 basis points year-over-year to reach 13.5%. These impressive results suggest that RingCentral is well positioned for continued success in the cloud communications space.

RNG price target action

- Mizuho Siti Panigrahi lowered his price target from $80 to $50 while maintaining a Buy rating.

- Wells Fargo Michael Turrin lowered his price target from $100 to $80 while maintaining an Overweight rating.

- Barclays Ryan Macwilliams lowered his price target from $90 to $40 while maintaining an Overweight rating.

- Raymond James Brian Peterson lowered his price target from $90 to $75 while maintaining a Buy rating.

- Piper Sandler James Fish lowered his price target from $59 to $39 while maintaining an Overweight rating.

- Keybanc Thomas Blakey lowered his price target from $59 to $45 while maintaining an Overweight rating.

UPST

Report Total revenue

Of $157 million for the third quarter of 2022, a decrease of 31% from the third quarter of 2021. Total fee revenue was $179 million, a decrease of 15% year-over-year. Bank partners originated 188,519 loans, totaling $1.9 billion, across our platform in the third quarter, down 48% from the same quarter of the prior year. Conversion on rate requests was 10% in the third quarter of 2022, down from 23% in the same quarter of the prior year. Loss from operations was ($58.1) million, down from $28.6 million the prior year. UPST’s performance for the quarter was impacted by lower transaction volume and conversion rates as compared to the prior year.

GAAP

Net loss of $56.2 million for the third quarter of 2022, down from a net income of $29.1 million in the third quarter of 2021. Adjusted net loss was $19.3 million, down from adjusted net income of $57.4 million in the same quarter of the prior year. GAAP diluted earnings per share was ($0.69), and diluted adjusted earnings per share was ($0.24) based on the weighted-average common shares outstanding during the period.

Profit

Was $96.0 million, up 0.1% year-over-year in the third quarter of 2022, with a contribution margin of 54% compared to a 46% contribution margin in the same quarter of the prior year. Adjusted EBITDA was ($14.4) million, down from $59.1 million last year.

Upstart’s financial outlook for the fourth quarter of 2022 includes revenue of $125 to $145 million, with fee-related revenue of $160 million and net interest income of ($25) million. The company expects a contribution margin of 54% and net income of ($87) million, adjusted for certain items. Additionally, Upstart anticipates adjusted EBITDA of ($35) million for the fourth quarter. The company plans to have a basic weighted-average share count of approximately 82.0 million shares and a diluted weighted-average share count of approximately 89.3 million shares outstanding during the quarter.

UPST price target action:

- BAML Securities Nat Schindler price target from to $15 Downgrade a Neutral to Underperform rating.

- Stephens Vincent Caintic lowered his price target from $23 to $12 while maintaining an Underweight rating.

- Goldman Sachs Michael Ng lowered his price target from $14 to $11 while maintaining a Sell rating.

- Morgan Stanley James Faucette lowered his price target from $15 to $11.5 while maintaining an Underweight rating.

- Mizuho Dan Dolev lowered his price target from $17 to $12 while maintaining Underperform rating.

- Piper Sandler Arvind Ramnani lowered his price target from $24 to $14 while maintaining a Neutral rating.