Daily Update - May 4, 2023

Selected stock price target highlights of the day

By Matthew Otto

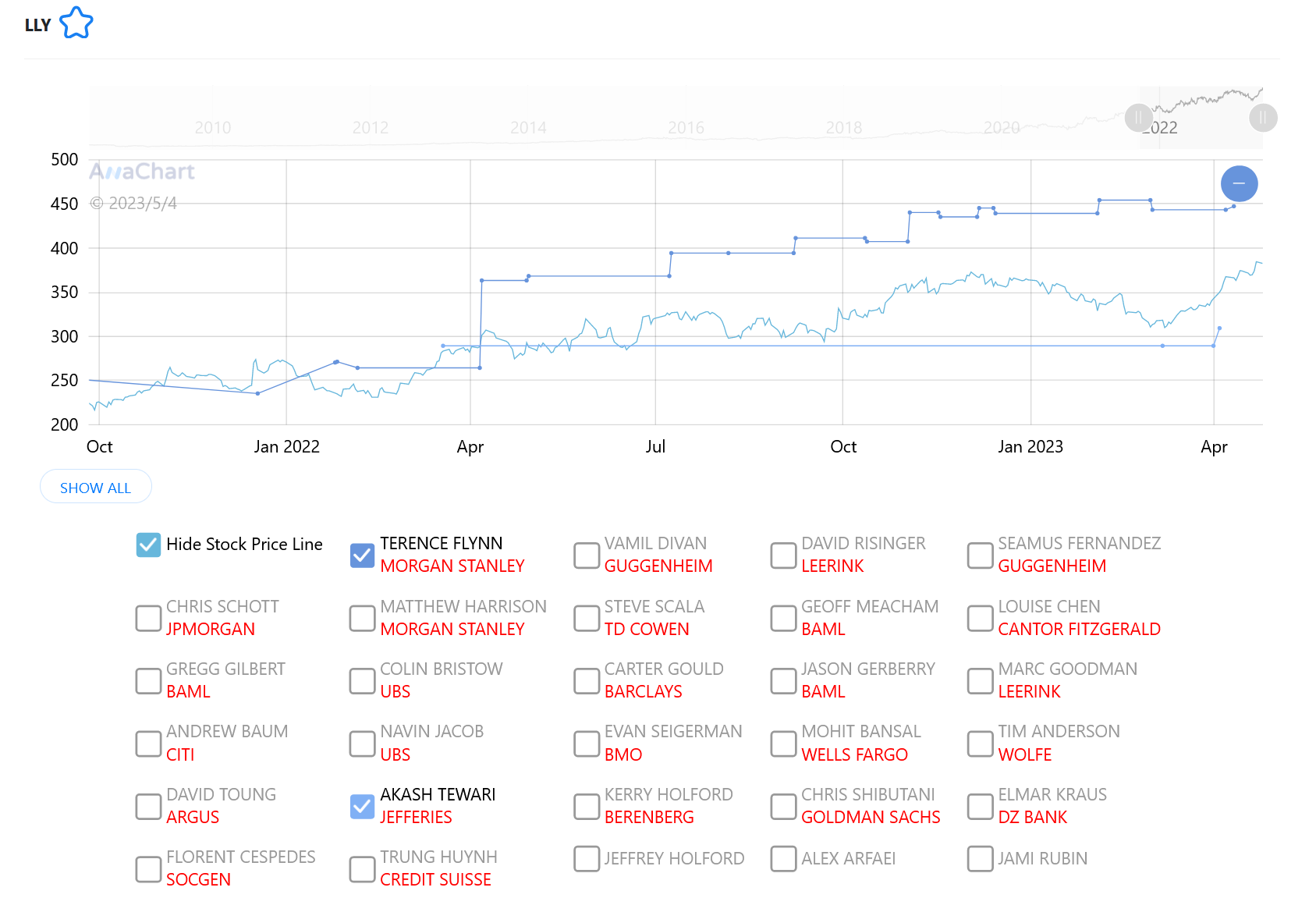

LLY

Eli Lilly announced that their experimental Alzheimer’s drug, donanemab, has shown positive results in a late-stage trial. The drug slowed the progression of Alzheimer’s disease by 35% compared to a placebo in 1,182 people with early-stage disease.

The study evaluated the drug in 552 patients with high levels of tau and found that donanemab slowed progression by 29%. Donanemab is a drug that removes sticky amyloid plaques from the brain, benefiting patients with the fatal disease. The drug will become the third of its class on the market following the approval of two similar medicines, Leqembi and Aduhelm.

Lilly said it plans to file for traditional US approval by the end of June, and with regulators from other countries shortly thereafter.

Wall Street Action

- BMO Capital analyst Evan David raised the price target for Eli Lilly to $505,

- Credit Suisse analyst Trung Huynh raised hisprice target $490.00 from $420.00, while maintaining an Outperform rating.

Looking at AnaChart we see Terence Flynn (MORGAN STANLEY), till today, had the street high on Lily at Overweight and a $448 price target while Akash Tewari of Jeffries opposes at a Hold rating and a $310 price target.

HUBS

HubSpot announced its financial results for the first quarter ended March 31, 2023. The company reported total revenue of $501.6 million, up 27% compared to Q1’22, driven by subscription revenue of $489.7 million, up 27% compared to Q1’22. The company also reported an operating loss of ($44.8) million, compared to ($11.2) million in Q1’22, while non-GAAP operating income was $67.7 million, compared to $35.0 million in Q1’22. HubSpot’s net loss was ($38.3) million, or ($0.78), compared to ($9.3) million, or ($0.20) per basic and diluted share in Q1’22.

HubSpot provided its business outlook, with expected total revenue in the range of $503.0 million to $505.0 million for the second quarter of 2023, and total revenue in the range of $2.080 billion to $2.088 billion for full year 2023.

Wall Street Action

- Mizuho analyst Siti Panigrahi upgrades to Buy and increases the price target to $480.

- Needham analyst Joshua Reilly reiterates his Buy rating and maintains the price target at $470.

- Oppenheimer analyst Ken Wong raises the price target from $450 to $490 and continues to rate the stock as Outperform.

- Barclays analyst Ryan Macwilliams updates the price target to $425 and maintains his Equal-Weight rating.

- Piper Sandler analyst Brent Bracelin upgrades HubSpot to Overweight and raises the price target to $482.

- Wolfe Research analyst Alex Zukin maintains his Outperform rating and raises the price target to $485.

- Raymond James analyst Brian Peterson updates the price target to street high at $520 from $500. Stifel analyst Parker Lane increases the price target to $500.

Looking at AnaChart we see that while the stock lost about 60% since November 202, not a single analyst held a bearish position on Hubspot during that period.

QCOM

Qualcomm provided a revenue forecast for the June quarter that fell below expectations. The company cited softening demand for smartphones and a challenging macro environment as the reasons for the lower forecast.

For the March quarter, Qualcomm reported adjusted earnings per share of $2.15, in line with Wall Street estimates, and revenue of $9.3 billion, surpassing analysts’ expectations of $9.1 billion. However, the disappointing guidance for the current quarter, with a revenue range of $8.1 billion to $8.9 billion, below the consensus of $9.1 billion.

The company noted that mobile-phone demand continues to worsen, and there is no sign of a meaningful recovery in China. Global demand for smartphones has been declining, with research firm Canalys reporting a 13% year-over-year drop in first-quarter worldwide shipments. Despite the challenging market conditions,

Wall Street Action

On Monday,

- Bernstein analyst Stacy Rasgon maintained his Outperform rating shares on Monday, citing their low valuation. However, he lowered his price target for the stock to $145 from $155. In his research note, Rasgon noted that smartphones continue to show weakness and that the stock should become more attractive once the market reaches the bottom.

Today,

- Baird analyst Tristan Gerra keeps an Outperform rating and lowers the price target from $150 to $130.

- Barclays analyst Blayne Curtis maintains an Overweight rating and lowers the price target from $150 to $140.

- Mizuho analyst Vijay Rakesh holds a Buy rating and lowers the price target from $150 to $140.

- Deutsche Bank analyst Ross Seymore kept a Buy rating but lowered the price target from $150 to $130.

- Keybanc analyst John Vinh reiterated an Overweight rating yet lowered the price target from $160 to $145.

- UBS analyst Timothy Arcuri lowers the price target to $120.00 from $125.00 while maintaining a Neutral rating.

- Rosenblatt analyst Kevin E. Cassidy lowers the price target to $145 from $150.

- Evercore ISI analyst C.J. Muse lowers the price target to $120 from $130 while keeping an In Line rating.

Looking at AnaChart we see that most analyst that cover Qualcomm have a positive note and some analysts such as Christopher Danely (CITI) have changed their tone to a more positive tone in recent months. The stock has doubled in value in the last two years.

Top price targets action today:

Above is a snapshot of the top daily stock price target moves on AnaChart