Daily Update - May 5, 2023

Selected stock price target highlights of the day

By Matthew Otto

AAPL

Apple reported earnings of $1.52 per share on revenue of $94.8 billion for the fiscal second quarter, beating analyst expectations of $1.43 per share and $92.9 billion in sales.rticles/apple-earnings-stock-price-2b3d988d?mod=Searchresults&mod=article_inline

The strong performance was mainly due to higher-than-expected sales in the iPhone unit, which generated $51.33 billion in revenue, up 1.5% from the same period last year. Services revenue of $20.91 billion was slightly below estimates, while Mac revenue of $7.17 billion fell short of estimates, and iPad revenue of $6.67 billion met expectations. Wearables, home, and accessories revenue was $8.76 billion, surpassing expectations.

Apple plans to increase its dividend by 4% to 24 cents per share and repurchase up to $90 billion in stock. During the earnings call, Chief Financial Officer Luca Maestri said the company expects revenue growth in the June quarter to be similar to its March performance, which saw a 3% decline, this happened only the for the 3rd time in the past decade

Wall Street Action

- J.P. Morgan analyst Samik Chatterjee rates Apple as Overweight with a price target of $190, Wall Street will be closely observing Apple’s commentary on the current quarter. The FactSet consensus for the June quarter is projecting earnings of $1.21 per share and sales of $84.5 billion. These figures represent the average estimates provided by analysts in the FactSet poll.

- Jefferies’ Andrew Uerkwitz assumes coverage of Apple with a Buy rating and sets a price target of $195.

- Morgan Stanley’s Erik Woodring maintains an Overweight rating on Apple and increases the price target from $180 to $185.

- B of A Securities’ Wamsi Mohan maintains a Neutral rating on Apple and raises the price target from $173 to $176.

- Needham’s Laura Martin maintains a Buy rating on Apple and raises the price target from $170 to $195.

- Atlantic Equities’ James Cordwell maintains an Overweight rating on Apple and raises the price target from $180 to $200.

- Keybanc’s Brandon Nispel maintains an Overweight rating on Apple and raises the price target from $177 to $180.

- Oppenheimer’s Martin Yang raises the price target $195.

- Rosenblatt’s Barton Crockett raises the price target to $198.

- Goldman Sachs’ Michael Ng raises the price target $209.

Looking at AnaChart we have stock analyst Daniel Ives of Wesdbush at street high at $205 and very few bearish analysts such as Toni Sacconaghi of Bernstein and Walter Piecyk of Lightshed as Apple continues to rebound from 2022 lows.

BKNG

Booking Holdings exceeded earnings estimates with adjusted earnings of $11.60 per share on sales of $3.78 billion, beating expectations of $10.57 earnings per share on $3.74 billion in sales. The company’s gross travel bookings grew by 44% YoY to $39.4 billion, a new quarterly record, while revenue increased by 40% to $3.8 billion. However, adjusted EBITDA fell short of expectations, disappointing investors.

Wall Street Action

- Credit Suisse’s Stephen Ju upgrades to Outperform and raises the price target from $2850 to $2950.

- Morgan Stanley’s Brian Nowak raises the price target from $2500 to $2600 while maintaining an Equal-Weight rating.

- JP Morgan’s Doug Anmuth increases the price target from $2850 to $3000 and maintains an Overweight rating.

- Mizuho’s James Lee maintains a Buy rating on and raises the price target from $2670 to $2950.

- Barclays’ Mario Lu raises the price target from $2911 to $2960 while maintaining an Overweight rating.

- Atlantic Equities’ James Cordwell raises the price target to $2900.

Looking at AnaChart we see that the stock has recovered all the losses from 2022 and all analysts carry a positive note on the Booking stock with Tigress Financial analyst Ivan Feinseth having the street high price target at $3,430. Feinseth didn’t capitulate in 2022 and kept his positive forecast as proved to be correct.

EXPE

Expedia Group missed estimates with a loss of 20 cents per share on sales of $2.67 billion, compared to the expected profit of 2 cents per share on $2.66 billion in sales. Despite this, the company saw a 20% YoY increase in total gross bookings to $29.4 billion, with lodging bookings hitting a record of $21.1 billion. CEO Peter Kern attributed the strong travel demand to increasing international travel, major city travel, and the reopening in Asia. Both companies’ earnings highlight the evidence of surging summer travel demand.

The company repurchased $600 million of shares, one of their highest levels ever year-to-date, as they saw the opportunity to continue to buy their equity attractively.

Additional highlights from the first quarter include:

- Total gross bookings of $29.4 billion, a 20% increase from the previous year.

- Record lodging bookings of $21.1 billion.

- Highest ever first-quarter revenue of $2.7 billion, an 18% increase from the previous year.

- B2B revenue of $668 million, a 55% increase from the previous year.

- Record net cash provided by operating activities of $3.2 billion and record free cash flow of $2.9 billion.

Wall Street Action

- Credit Suisse’s Stephen Ju maintains an Outperform rating on Expedia Group but lowers the price target from $174 to $172, still has the street high on Expedia.

- DA Davidson’s Tom White lowers the price target from $121 to $109 while maintaining a Neutral rating.

- Mizuho’s James Lee reduces the price target from $120 to $110 but maintains a Neutral rating.

- Barclays’ Mario Lu maintains an Overweight rating but lowers the price target from $117 to $113.

- JPMorgan’s Doug Anmuth lowers the price target to $113.

Looking at AnaChart we see that the stock has not rebounded from its fall of 2022 highs yet all the analysts covering it have a positive note besides Brian Nowak of Morgan Stanley.

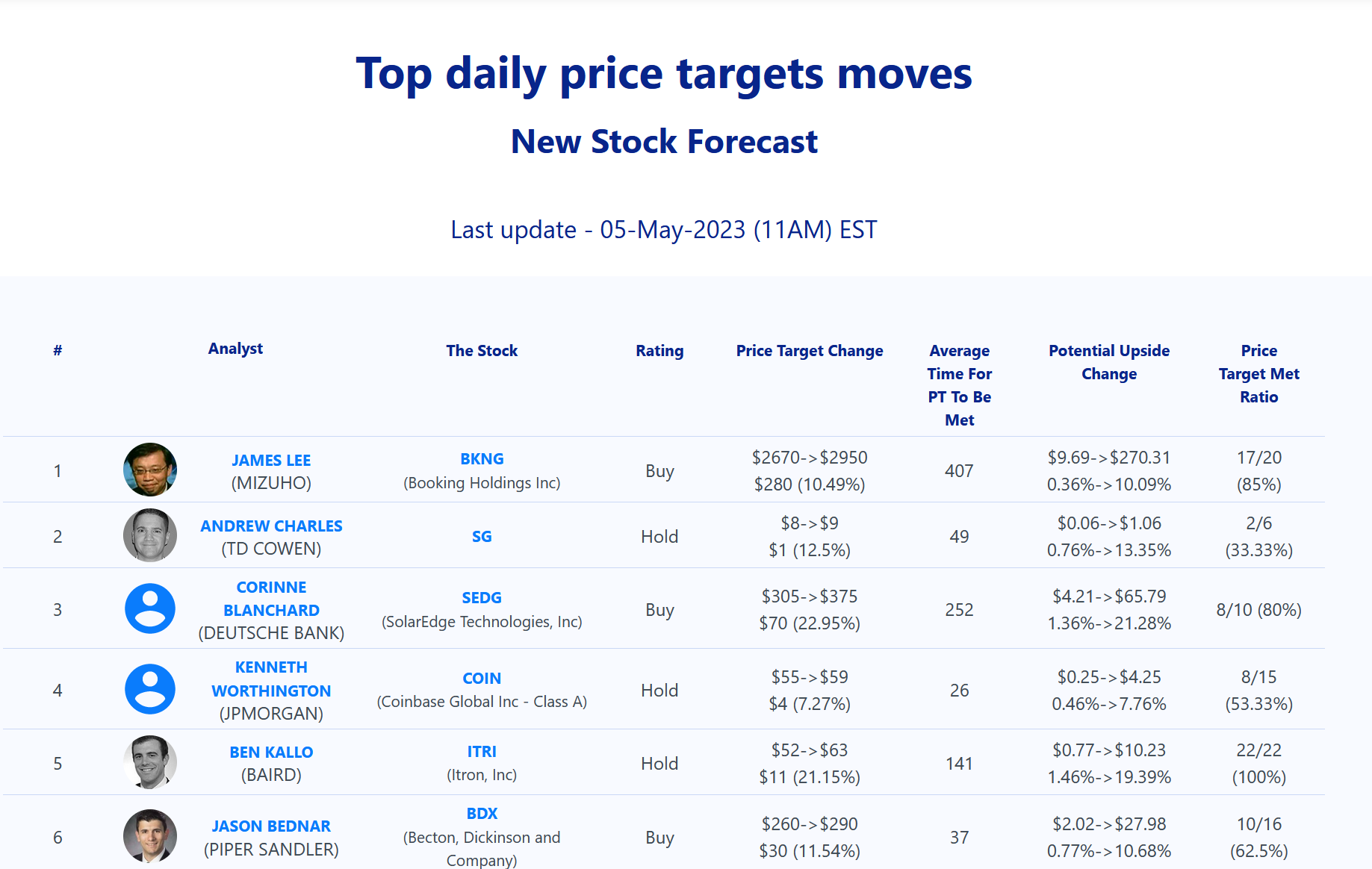

Daily stock Analysts Top Price Moves Snapshot