Selected stock price target news of the week- Feb 6th, 2026

By: Mathew Auto

Chipotle Earnings Beat Overshadowed by Soft Outlook as Analysts Cut Price Targets

Chipotle Mexican Grill reported fourth-quarter revenue of $2.98 billion and earnings per share of $0.25, exceeding analyst expectations of $2.96 billion in revenue and $0.24 per share, according to the company’s earnings release. Revenue increased 4.9% year over year. Comparable restaurant sales declined 2.5%, driven by a 3.2% decline in transactions, partially offset by a 0.7% increase in average check.

During the earnings call, CEO Scott Boatwright cited a “dynamic consumer backdrop” as the company navigated consumer pressures, according to Yahoo Finance. The company projected full-year 2026 comparable restaurant sales to be approximately flat, below Wall Street expectations of 1.8% growth. Boatwright noted the guidance was “conservative” given consumer trends that “have been really tough to predict.”

Operating margin for the quarter came in at 14.1%, down from 14.6% year over year, while restaurant-level operating margin declined to 23.4% from 24.8%, according to CNBC. The Wall Street Journal reported that traffic to Chipotle restaurants declined for the fourth consecutive quarter, with the company noting particular weakness in the 25- to 35-year-old demographic. Shares declined following the earnings release as investors focused on the cautious outlook and ongoing traffic pressures.

Analysts Adjust Chipotle Price Targets Following Earnings

- Nick Setyan (Mizuho) maintained a Neutral rating and lowered his price target to $37 from $38.

- Brian Harbour (Morgan Stanley) maintained an Overweight rating and lowered his price target to $49 from $50.

- Brian Mullan (Piper Sandler) maintained an Overweight rating and lowered his price target to $44 from $47.

- Zachary Fadem (Wells Fargo) maintained an Overweight rating and lowered his price target to $45 from $50.

- Eric Gonzalez (KeyBanc) maintained an Overweight rating and lowered his price target to $42 from $45.

- Chris O’Cull (Stifel) maintained a Buy rating and lowered his price target to $45 from $50.

- Lauren Silberman (Deutsche Bank) reduced her price target to $48 from $49.

- Sarang Vora (Telsey) lowered his price target to $48 from $50 while maintaining an Outperform rating.

- Andrew Charles (TD Cowen) reiterated a Buy rating and $44 price target.

- Jon Tower (Citi) raised his price target to $49 from $48 while maintaining a Buy rating.

- Christine Cho (Goldman Sachs) reiterated a Buy rating and $46 price target.

- Greg Badishkanian (Wolfe Research) reiterated an Outperform rating and $38 price target.

- Danilo Gargiulo (Bernstein SocGen) reiterated an Outperform rating and $50 price target.

- Logan Reich (RBC Capital) reiterated an Outperform rating and $50 price target.

- Andrew Strelzik (BMO Capital) lowered his price target to $52 from $55.

- Jeffrey Bernstein (Barclays) reduced his price target to $40 from $44.

- Gregory Francfort (Guggenheim) lowered his price target to $36 from $37.

- Dennis Geiger (UBS) reiterated a Buy rating and $45 price target.

- Alton Stump (Loop Capital) reduced his price target to $52.

Which Analyst Has the Best Track Record on CMG?

Among analysts tracked by AnaChart, Nick Setyan (Mizuho) has the best track record on Chipotle, with an 88.89% price-target fulfillment ratio (56/63). His historical price targets have typically been reached within an average of 109 days.

PayPal Earnings Miss and CEO Transition Trigger Analyst Downgrades and Price Target Cuts

PayPal Holdings reported fourth-quarter earnings per share of $1.23, missing analyst expectations of $1.29, while revenue of $8.68 billion fell short of the $8.79 billion consensus estimate, according to StreetInsider and company disclosures. The weaker results highlighted ongoing challenges across PayPal’s branded checkout platform and broader payment processing ecosystem.

Market coverage noted that PayPal continues to face competitive pressure and share losses within its core checkout business. Barron’s reported that the earnings release reinforced concerns surrounding the company’s growth trajectory as fintech competitors expand merchant and consumer offerings. PayPal also issued fiscal 2026 guidance projecting first-quarter earnings per share to decline mid-single digits, with full-year earnings also expected to decline mid-single digits year over year, below prior Wall Street expectations, further weighing on investor sentiment.

The company simultaneously announced leadership changes, appointing former HP Inc. CEO Enrique Lores as Chief Executive Officer and David W. Dorman as Independent Board Chair. Shares declined sharply following the earnings release as investors reacted to the earnings miss, weaker forward outlook, and management transition.

Analysts Adjust PayPal Price Targets Following Earnings

- Harshita Rawat (Bernstein SocGen) maintained an Outperform rating and reduced her price target to $45 from $62.

- Dan Dolev (Mizuho) lowered his price target to $60 from $75, while reiterating an Outperform rating.

- James Friedman (Susquehanna) cut his price target sharply to $63 from $90, maintaining a Positive stance.

- Daniel Perlin (RBC Capital) brought his price target down to $59 from $68, with his Outperform rating left unchanged following leadership updates.

- Jason Kupferberg (Wells Fargo) trimmed his price target to $48 from $67, while keeping an Overweight rating in place.

- Bryan Bergin (TD Cowen) reset his price target to $48 from $65, reiterating a Buy rating.

- Adam Frisch (Evercore ISI) reduced his price target to $40 from $65, maintaining an In Line rating.

- Colin Sebastian (Baird) lowered his price target to $52 from $65, while reiterating an Outperform rating.

- James Faucette (Morgan Stanley) revised his price target downward to $34 from $40, maintaining an Underweight rating.

- Sanjay Sakhrani (Stifel) cut his price target to $55 from $75, while reiterating a Market Perform rating.

- Saul Martinez (HSBC) downgraded the stock to Hold from Buy and reduced his price target to $47 from $72.

- Joseph Vafi (Canaccord Genuity) moved to a more cautious stance, downgrading PYPL to Hold from Buy and assigning a $42 price target.

- Andrew Boone (Citizens) downgraded the stock to Market Perform from Market Outperform, with no price target provided.

- Dominick Gabriele (Compass Point) upgraded PYPL to Neutral from Sell and set a $51 price target.

- Mayank Tandon (Needham) reiterated a Hold rating following the earnings release, leaving his price target unchanged.

- Christopher Kennedy (William Blair) maintained a Market Perform rating, with no price target issued.

- Matthew Coad (Truist Securities) reiterated a Sell rating and kept his $58 price target unchanged.

Which Analyst Has the Best Track Record on PYPL?

Among analysts tracked by AnaChart, Colin Sebastian (Baird) has the best track record on PayPal, with an 86.11% price-target fulfillment ratio (31/36). His historical price targets have typically been reached within an average of 153 days.

Western Digital Earnings Beat and AI Storage Roadmap Drive Analyst Price Target Increases

Western Digital reported second-quarter fiscal 2026 revenue of $3.0 billion and non-GAAP earnings per share of $2.13, with earnings exceeding analyst expectations of $1.88 per share, according to the company’s earnings release. Revenue increased 25% year over year, driven by strong demand for nearline hard disk drives. The cloud segment represented 89% of total revenue at $2.7 billion, up 28% year over year, according to company disclosures.

During the earnings call, CEO Irving Tan said Western Digital’s performance “reflects our disciplined execution to meet demand in the AI-driven data economy, and the confidence our customers place in our ability to deliver reliable, high-capacity HDDs at scale,” according to the earnings call transcript. The company projected third-quarter fiscal 2026 revenue of approximately $3.2 billion at the midpoint, exceeding Wall Street expectations, according to company disclosures.

Western Digital shares rose following the company’s Innovation Day event in New York, where management outlined a long-term storage technology roadmap. The company introduced a next-generation 40-terabyte hard drive currently undergoing customer qualification testing and unveiled plans to develop 100-terabyte storage drives by 2029, according to company disclosures. Western Digital also announced that its board authorized an additional $4 billion share repurchase program, according to Reuters. Barron’s noted that expanding enterprise data consumption and hyperscale cloud investment tied to artificial intelligence adoption have improved sentiment across storage and semiconductor supply chains.

Analysts Raise Western Digital Price Targets Following Earnings and AI Storage Updates

- James Schneider (Goldman Sachs) raised his price target to $250 from $220, while maintaining a Neutral rating.

- C.J. Muse (Cantor Fitzgerald) lifted his price target to $420 from $325, reiterating an Overweight rating.

- Jim Kelleher (Argus) increased his price target to $300 from $180 and reaffirmed a Buy rating.

- Erik Woodring (Morgan Stanley) raised his price target to $369 from $306, while maintaining an Overweight rating.

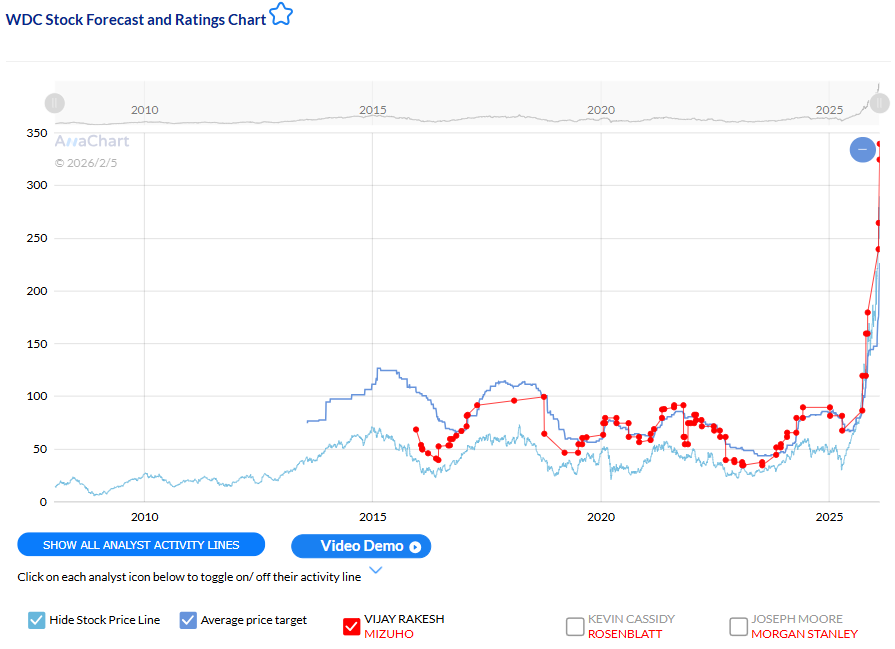

- Vijay Rakesh (Mizuho) boosted his price target to $340 from $260, reiterating an Outperform rating.

- Harlan Sur (JPMorgan) raised his price target to $320 from $250, while maintaining an Overweight rating.

- Tristan Gerra (Baird) lifted his price target to $310 from $260, reiterating an Outperform rating.

- Tom O’Malley (Barclays) increased his price target to $325 from $240, while maintaining an Overweight rating.

Which Analyst Has the Best Track Record on WDC?

Among analysts tracked by AnaChart, Vijay Rakesh (Mizuho) has the current best track record on Western Digital, with a 100% price-target fulfillment ratio (43/43). His historical price targets have typically been reached within an average of 945 days.