Selected stock price target news of the Week- Jan 31, 2026

By: Mathew Auto

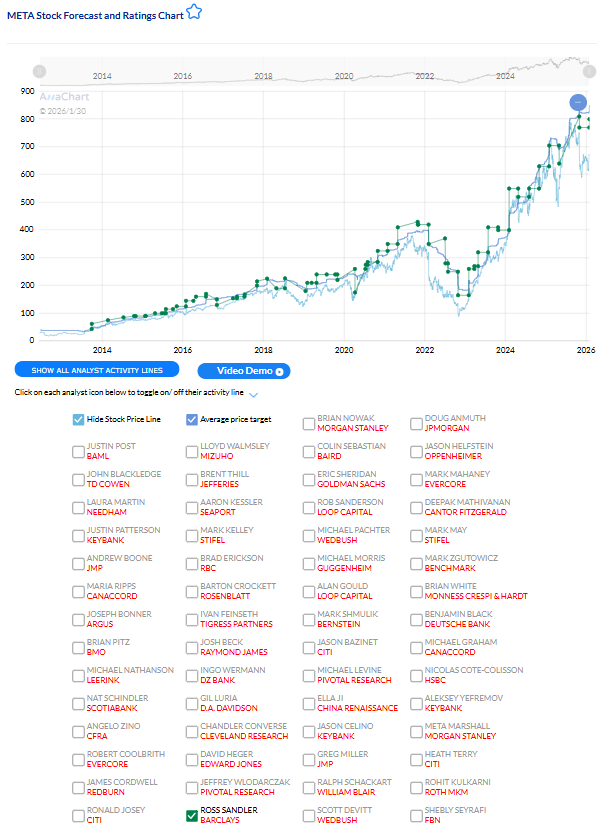

Meta Platforms Earnings Beat Drives Analyst Price-Target Increases

Meta Platforms reported fourth-quarter 2025 revenue of $59.89 billion and diluted earnings per share of $8.88, exceeding analyst expectations of $58.59 billion in revenue and $8.23 per share, according to the company’s earnings release. Revenue increased 24% year over year, driven primarily by advertising performance across the company’s platforms.

During the earnings call, CEO Mark Zuckerberg said the company is seeing “major AI acceleration” across its core products. Meta projected first-quarter 2026 revenue in the range of $53.5 billion to $56.5 billion, above the analyst consensus estimate of $51.41 billion, as reported by MarketWatch.

Advertising accounted for approximately 97% of total quarterly revenue, according to company disclosures. The Wall Street Journal reported that Meta’s AI-driven improvements in ad targeting and measurement have supported advertising monetization, while several technology peers continue to face investor scrutiny over elevated AI-related spending.

Meta said capital expenditures for 2026 are expected to range between $115 billion and $135 billion, compared with $72.2 billion in 2025, reflecting continued investment in AI infrastructure. Following the earnings release, multiple Wall Street analysts raised their price targets.

Following the earnings update, Vivek Arya (BofA Securities) upgraded Texas Instruments from Underperform to Neutral and raised his price target to $235 from $185 following the company’s updated outlook.

Barron’s noted that several semiconductor manufacturers issued guidance indicating changes in demand trends across key end markets. Analysts referenced those industry signals alongside Texas Instruments’ first-quarter outlook in post-earnings research notes when adjusting their price targets and ratings.

Analysts Raise Meta Platforms Price Targets Following Earnings

- Scott Devitt (Wedbush) reiterated an Outperform rating and raised his price target to $900 from $880.

- Ken Gawrelski (Wells Fargo) maintained an Overweight rating and increased his price target to $849 from $754.

- Deepak Mathivanan (Cantor Fitzgerald) kept an Overweight rating while lifting his price target to $860 from $750.

- Youssef Squali (Truist Securities) maintained a Buy rating and raised his price target to $900 from $875.

- Justin Post (BofA Securities) reiterated a Buy rating and increased his price target to $885 from $810.

- Mark Mahaney (Evercore ISI) reiterated an Outperform rating and raised his price target to $900 from $875.

Which Analyst Has the Best Track Record on META?

Among analysts tracked by AnaChart, Ross Sandler (Barclays) holds the strongest historical track record on Meta Platforms, with a 98.18% price-target fulfillment ratio (54/55). His historical price targets have typically been reached within an average of 251 days.

Texas Instruments Q1 Guidance Drives Analyst Price-Target Increases

Texas Instruments Incorporated reported fourth-quarter 2025 revenue of $4.42 billion and diluted earnings per share of $1.27, according to the company’s earnings release. The company issued first-quarter 2026 revenue guidance of $4.32 billion to $4.68 billion, with a midpoint of $4.50 billion, exceeding the analyst consensus estimate of $4.42 billion.

During the earnings call, CEO Haviv Ilan said the company is seeing improved order trends and continued recovery in industrial markets. The first-quarter guidance represents the first sequential quarterly revenue increase the company has projected in 16 years, according to multiple analyst reports.

The Wall Street Journal reported that Texas Instruments said data center demand and industrial market conditions are contributing to its first-quarter expectations. Management commentary noted improved visibility across select end markets during the period, with analog revenue growing 14% year over year in 2025.

Following the earnings update, Vivek Arya (BofA Securities) upgraded Texas Instruments from Underperform to Neutral and raised his price target to $235 from $185, citing the company’s updated outlook and improving demand trends.

Barron’s noted that several semiconductor manufacturers issued guidance indicating changes in demand trends across key end markets.

Texas Instruments Analyst Increase Price Targets Following Earnings

- Timothy Arcuri (UBS) maintained a Buy rating and raised his price target to $260 from $245.

- Cody Acree (Benchmark) maintained a Buy rating and increased his price target to $250 from $220.

- John Vinh (KeyBanc Capital Markets) maintained an Overweight rating and raised his price target to $240 from $220.

- Vivek Arya (BofA Securities) upgraded the stock from Underperform to Neutral and lifted his price target to $235 from $185.

- Harlan Sur (J.P. Morgan) maintained an Overweight rating and increased his price target to $227 from $210.

- William Stein (Truist Securities) maintained a Hold rating and raised his price target to $225 from $195.

Which Analyst Has the Best Track Record on TXN?

Among the analysts tracked by AnaChart, Vijay Rakesh (Mizuho) has the strongest historical track record for Texas Instruments, with a 97.14% price-target fulfillment ratio (34/35). His historical price targets have typically been reached within an average of 240 days

Lam Research Earnings Beat Drives Analyst Price-Target Increases

Lam Research Corporation reported quarterly revenue of $5.34 billion for the period ended December 28, 2025, exceeding analyst expectations of $5.23 billion, according to the company’s earnings release. Non-GAAP diluted earnings per share totaled $1.27, surpassing the consensus estimate of $1.17. Revenue increased 22% year over year.

During the earnings call, CEO Tim Archer said the company expanding product and services portfolio is enabling the market’s transition to smaller, more complex three-dimensional devices and packages.

Lam Research issued guidance for the quarter ending March 29, 2026, projecting revenue of $5.70 billion, plus or minus $300 million, with non-GAAP diluted earnings per share expected at $1.35, plus or minus $0.10. The midpoint of $5.70 billion represents continued sequential growth from the December quarter.

Barron’s reported that several semiconductor manufacturers have pointed to changes in demand conditions across multiple end markets in recent guidance updates.

Analysts Raise Lam Research Price Targets Following Earnings

- Mehdi Hosseini (Susquehanna) maintained a Positive rating and raised his price target to $325 from $250.

- C.J. Muse (Cantor Fitzgerald) maintained an Overweight rating and increased his price target to $320 from $265.

- Harlan Sur (J.P. Morgan) maintained an Overweight rating and raised his price target to $300 from $165.

- Atif Malik (Citigroup) maintained a Buy rating and increased his price target to $300 from $265.

- Charles Shi (Needham) maintained a Buy rating and raised his price target to $300 from $250.

- Joseph Quatrochi (Wells Fargo) maintained an Overweight rating and increased his price target to $290 from $250.

Which Analyst Has the Best Track Record on LRCX?

Among the analysts tracked by AnaChart, Vijay Rakesh (Mizuho) has the strongest historical track record for Lam Research, with a 100% price-target fulfillment ratio (36/36). His historical price targets have typically been reached within an average of 186 days.